Financial statements – subsidiaries

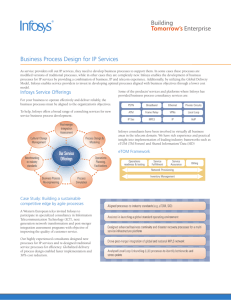

advertisement