State of Advanced Manufacturing: A Canadian Perspective (October

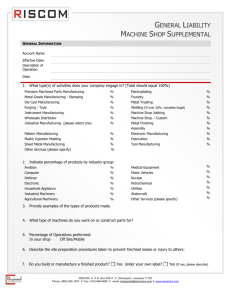

advertisement