1. The Marketing Concept

advertisement

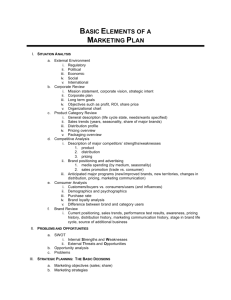

1. The Marketing Concept The marketing concept is the philosophy that firms should analyze the needs of their customers and then make decisions to satisfy those needs, better than the competition. Today most firms have adopted the marketing concept, but this has not always been the case. In 1776 in The Wealth of Nations, Adam Smith wrote that the needs of producers should be considered only with regard to meeting the needs of consumers. While this philosophy is consistent with the marketing concept, it would not be adopted widely until nearly 200 years later. To better understand the marketing concept, it is worthwhile to put it in perspective by reviewing other philosophies that once were predominant. While these alternative concepts prevailed during different historical time frames, they are not restricted to those periods and are still practiced by some firms today. The Production Concept The production concept prevailed from the time of the industrial revolution until the early 1920's. The production concept was the idea that a firm should focus on those products that it could produce most efficiently and that the creation of a supply of low-cost products would in and of itself create the demand for the products. The key questions that a firm would ask before producing a product were: • • Can we produce the product? Can we produce enough of it? At the time, the production concept worked fairly well because the goods that were produced were largely those of basic necessity and there was a relatively high level of unfulfilled demand. Virtually everything that could be produced was sold easily by a sales team whose job it was simply to execute transactions at a price determined by the cost of production. The production concept prevailed into the late 1920's. The Sales Concept By the early 1930's however, mass production had become commonplace, competition had increased, and there was little unfulfilled demand. Around this time, firms began to practice the sales concept (or selling concept), under which companies not only would produce the products, but also would try to convince customers to buy them through advertising and personal selling. Before producing a product, the key questions were: • • Can we sell the product? Can we charge enough for it? The sales concept paid little attention to whether the product actually was needed; the goal simply was to beat the competition to the sale with little regard to customer satisfaction. Marketing was a function that was performed after the product was developed and produced, and many people came to associate marketing with hard selling. Even today, many people use the word "marketing" when they really mean sales. The Marketing Concept After World War II, the variety of products increased and hard selling no longer could be relied upon to generate sales. With increased discretionary income, customers could afford to be selective and buy only those products that precisely met their changing needs, and these needs were not immediately obvious. The key questions became: • • • What do customers want? Can we develop it while they still want it? How can we keep our customers satisfied? In response to these discerning customers, firms began to adopt the marketing concept, which involves: • • • Focusing on customer needs before developing the product Aligning all functions of the company to focus on those needs Realizing a profit by successfully satisfying customer needs over the long-term When firms first began to adopt the marketing concept, they typically set up separate marketing departments whose objective it was to satisfy customer needs. Often these departments were sales departments with expanded responsibilities. While this expanded sales department structure can be found in some companies today, many firms have structured themselves into marketing organizations having a company-wide customer focus. Since the entire organization exists to satisfy customer needs, nobody can neglect a customer issue by declaring it a "marketing problem" - everybody must be concerned with customer satisfaction. The marketing concept relies upon marketing research to define market segments, their size, and their needs. To satisfy those needs, the marketing team makes decisions about the controllable parameters of the marketing mix. 2. The Marketing Process Under the marketing concept, the firm must find a way to discover unfulfilled customer needs and bring to market products that satisfy those needs. The process of doing so can be modeled in a sequence of steps: the situation is analyzed to identify opportunities, the strategy is formulated for a value proposition, tactical decisions are made, the plan is implemented and the results are monitored. The Marketing Process Situation Analysis | V Marketing Strategy | V Marketing Mix Decisions | V Implementation & Control I. Situation Analysis A thorough analysis of the situation in which the firm finds itself serves as the basis for identifying opportunities to satisfy unfulfilled customer needs. In addition to identifying the customer needs, the firm must understand its own capabilities and the environment in which it is operating. The situation analysis thus can be viewed in terms an analysis of the external environment and an internal analysis of the firm itself. The external environment can be described in terms of macro-environmental factors that broadly affect many firms, and micro-environmental factors closely related to the specific situation of the firm. The situation analysis should include past, present, and future aspects. It should include a history outlining how the situation evolved to its present state, and an analysis of trends in order to forecast where it is going. Good forecasting can reduce the chance of spending a year bringing a product to market only to find that the need no longer exists. If the situation analysis reveals gaps between what consumers want and what currently is offered to them, then there may be opportunities to introduce products to better satisfy those consumers. Hence, the situation analysis should yield a summary of problems and opportunities. From this summary, the firm can match its own capabilities with the opportunities in order to satisfy customer needs better than the competition. There are several frameworks that can be used to add structure to the situation analysis: • • • 5 C Analysis - company, customers, competitors, collaborators, climate. Company represents the internal situation; the other four cover aspects of the external situation PEST analysis - for macro-environmental political, economic, societal, and technological factors. A PEST analysis can be used as the "climate" portion of the 5 C framework. SWOT analysis - strengths, weaknesses, opportunities, and threats - for the internal and external situation. A SWOT analysis can be used to condense the situation analysis into a listing of the most relevant problems and opportunities and to assess how well the firm is equipped to deal with them. II. Marketing Strategy Once the best opportunity to satisfy unfulfilled customer needs is identified, a strategic plan for pursuing the opportunity can be developed. Market research will provide specific market information that will permit the firm to select the target market segment and optimally position the offering within that segment. The result is a value proposition to the target market. The marketing strategy then involves: • • • • Segmentation Targeting (target market selection) Positioning the product within the target market Value proposition to the target market III. Marketing Mix Decisions Detailed tactical decisions then are made for the controllable parameters of the marketing mix. The action items include: • • • • Product development - specifying, designing, and producing the first units of the product. Pricing decisions Distribution contracts Promotional campaign development IV. Implementation and Control At this point in the process, the marketing plan has been developed and the product has been launched. Given that few environments are static, the results of the marketing effort should be monitored closely. As the market changes, the marketing mix can be adjusted to accommodate the changes. Often, small changes in consumer wants can addressed by changing the advertising message. As the changes become more significant, a product redesign or an entirely new product may be needed. The marketing process does not end with implementation - continual monitoring and adaptation is needed to fulfill customer needs consistently over the long-term. 3. Situation Analysis In order to profitably satisfy customer needs, the firm first must understand its external and internal situation, including the customer, the market environment, and the firm's own capabilities. Furthermore, it needs to forecast trends in the dynamic environment in which it operates. A useful framework for performing a situation analysis is the 5 C Analysis. The 5C analysis is an environmental scan on five key areas especially applicable to marketing decisions. It covers the internal, the micro-environmental, and the macro-environmental situation. The 5 C analysis is an extension of the 3 C analysis (company, customers, and competitors), to which some marketers added the 4th C of collaborators. The further addition of a macro-environmental analysis (climate) results in a 5 C analysis, some aspects of which are outlined below. Company • • • • • Product line Image in the market Technology and experience Culture Goals Collaborators • • • Distributors Suppliers Alliances Customers • • • • • • • • • • • Market size and growth Market segments Benefits that consumer is seeking, tangible and intangible. Motivation behind purchase; value drivers, benefits vs. costs Decision maker or decision-making unit Retail channel - where does the consumer actually purchase the product? Consumer information sources - where does the customer obtain information about the product? Buying process; e.g. impulse or careful comparison Frequency of purchase, seasonal factors Quantity purchased at a time Trends - how consumer needs and preferences change over time Competitors • • • • • • Actual or potential Direct or indirect Products Positioning Market shares Strengths and weaknesses of competitors Climate (or context) The climate or macro-environmental factors are: • • • • Political & regulatory environment - governmental policies and regulations that affect the market Economic environment - business cycle, inflation rate, interest rates, and other macroeconomic issues Social/Cultural environment - society's trends and fashions Technological environment - new knowledge that makes possible new ways of satisfying needs; the impact of technology on the demand for existing products. The analysis of the these four external "climate" factors often is referred to as a PEST analysis. Information Sources Customer and competitor information specifically oriented toward marketing decisions can be found in market research reports, which provide a market analysis for a particular industry. For foreign markets, country reports can be used as a general information source for the macro-environment. By combining the regional and market analysis with knowledge of the firm's own capabilities and partnerships, the firm can identify and select the more favorable opportunities to provide value to the customer. 4. Market Definition In marketing, the term market refers to the group of consumers or organizations that is interested in the product, has the resources to purchase the product, and is permitted by law and other regulations to acquire the product. The market definition begins with the total population and progressively narrows as shown in the following diagram. Market Definition Conceptual Diagram Beginning with the total population, various terms are used to describe the market based on the level of narrowing: • • Total population Potential market - those in the total population who have interest in acquiring the product. • • • • Available market - those in the potential market who have enough money to buy the product. Qualified available market - those in the available market who legally are permitted to buy the product. Target market - the segment of the qualified available market that the firm has decided to serve (the served market). Penetrated market - those in the target market who have purchased the product. In the above listing, "product" refers to both physical products and services. The size of the market is not necessarily fixed. For example, the size of the available market for a product can be increased by decreasing the product's price, and the size of the qualified available market can be increased through changes in legislation that result in fewer restrictions on who can buy the product. Defining the market is the first step in analyzing it. Since the market is likely to be composed of consumers whose needs differ, market segmentation is useful in order to better understand those needs and to select the groups within the market that the firm will serve. 5. Market Segmentation Market segmentation is the identification of portions of the market that are different from one another. Segmentation allows the firm to better satisfy the needs of its potential customers. The Need for Market Segmentation The marketing concept calls for understanding customers and satisfying their needs better than the competition. But different customers have different needs, and it rarely is possible to satisfy all customers by treating them alike. Mass marketing refers to treatment of the market as a homogenous group and offering the same marketing mix to all customers. Mass marketing allows economies of scale to be realized through mass production, mass distribution, and mass communication. The drawback of mass marketing is that customer needs and preferences differ and the same offering is unlikely to be viewed as optimal by all customers. If firms ignored the differing customer needs, another firm likely would enter the market with a product that serves a specific group, and the incumbent firms would lose those customers. Target marketing on the other hand recognizes the diversity of customers and does not try to please all of them with the same offering. The first step in target marketing is to identify different market segments and their needs. Requirements of Market Segments In addition to having different needs, for segments to be practical they should be evaluated against the following criteria: • • • • • Identifiable: the differentiating attributes of the segments must be measurable so that they can be identified. Accessible: the segments must be reachable through communication and distribution channels. Substantial: the segments should be sufficiently large to justify the resources required to target them. Unique needs: to justify separate offerings, the segments must respond differently to the different marketing mixes. Durable: the segments should be relatively stable to minimize the cost of frequent changes. A good market segmentation will result in segment members that are internally homogenous and externally heterogeneous; that is, as similar as possible within the segment, and as different as possible between segments. Bases for Segmentation in Consumer Markets Consumer markets can be segmented on the following customer characteristics. • • • • Geographic Demographic Psychographic Behavioralistic Geographic Segmentation The following are some examples of geographic variables often used in segmentation. • • • • Region: by continent, country, state, or even neighborhood Size of metropolitan area: segmented according to size of population Population density: often classified as urban, suburban, or rural Climate: according to weather patterns common to certain geographic regions Demographic Segmentation Some demographic segmentation variables include: • • • • Age Gender Family size Family lifecycle • • • • • • • • Generation: baby-boomers, Generation X, etc. Income Occupation Education Ethnicity Nationality Religion Social class Many of these variables have standard categories for their values. For example, family lifecycle often is expressed as bachelor, married with no children (DINKS: Double Income, No Kids), full-nest, empty-nest, or solitary survivor. Some of these categories have several stages, for example, full-nest I, II, or III depending on the age of the children. Psychographic Segmentation Psychographic segmentation groups customers according to their lifestyle. Activities, interests, and opinions (AIO) surveys are one tool for measuring lifestyle. Some psychographic variables include: • • • • • Activities Interests Opinions Attitudes Values Behavioralistic Segmentation Behavioral segmentation is based on actual customer behavior toward products. Some behavioralistic variables include: • • • • • • Benefits sought Usage rate Brand loyalty User status: potential, first-time, regular, etc. Readiness to buy Occasions: holidays and events that stimulate purchases Behavioral segmentation has the advantage of using variables that are closely related to the product itself. It is a fairly direct starting point for market segmentation. Bases for Segmentation in Industrial Markets In contrast to consumers, industrial customers tend to be fewer in number and purchase larger quantities. They evaluate offerings in more detail, and the decision process usually involves more than one person. These characteristics apply to organizations such as manufacturers and service providers, as well as resellers, governments, and institutions. Many of the consumer market segmentation variables can be applied to industrial markets. Industrial markets might be segmented on characteristics such as: • • • Location Company type Behavioral characteristics Location In industrial markets, customer location may be important in some cases. Shipping costs may be a purchase factor for vendor selection for products having a high bulk to value ratio, so distance from the vendor may be critical. In some industries firms tend to cluster together geographically and therefore may have similar needs within a region. Company Type Business customers can be classified according to type as follows: • • • • Company size Industry Decision making unit Purchase Criteria Behavioral Characteristics In industrial markets, patterns of purchase behavior can be a basis for segmentation. Such behavioral characteristics may include: • • • Usage rate Buying status: potential, first-time, regular, etc. Purchase procedure: sealed bids, negotiations, etc. 6. Market Analysis The goal of a market analysis is to determine the attractiveness of a market and to understand its evolving opportunities and threats as they relate to the strengths and weaknesses of the firm. David A. Aaker outlined the following dimensions of a market analysis: • • • • • • • Market size (current and future) Market growth rate Market profitability Industry cost structure Distribution channels Market trends Key success factors Market Size The size of the market can be evaluated based on present sales and on potential sales if the use of the product were expanded. The following are some information sources for determining market size: • • • • government data trade associations financial data from major players customer surveys Market Growth Rate A simple means of forecasting the market growth rate is to extrapolate historical data into the future. While this method may provide a first-order estimate, it does not predict important turning points. A better method is to study growth drivers such as demographic information and sales growth in complementary products. Such drivers serve as leading indicators that are more accurate than simply extrapolating historical data. Important inflection points in the market growth rate sometimes can be predicted by constructing a product diffusion curve. The shape of the curve can be estimated by studying the characteristics of the adoption rate of a similar product in the past. Ultimately, the maturity and decline stages of the product life cycle will be reached. Some leading indicators of the decline phase include price pressure caused by competition, a decrease in brand loyalty, the emergence of substitute products, market saturation, and the lack of growth drivers. Market Profitability While different firms in a market will have different levels of profitability, the average profit potential for a market can be used as a guideline for knowing how difficult it is to make money in the market. Michael Porter devised a useful framework for evaluating the attractiveness of an industry or market. This framework, known as Porter's five forces, identifies five factors that influence the market profitability: • • Buyer power Supplier power • • • Barriers to entry Threat of substitute products Rivalry among firms in the industry Industry Cost Structure The cost structure is important for identifying key factors for success. To this end, Porter's value chain model is useful for determining where value is added and for isolating the costs. The cost structure also is helpful for formulating strategies to develop a competitive advantage. For example, in some environments the experience curve effect can be used to develop a cost advantage over competitors. Distribution Channels The following aspects of the distribution system are useful in a market analysis: • • • Existing distribution channels - can be described by how direct they are to the customer. Trends and emerging channels - new channels can offer the opportunity to develop a competitive advantage. Channel power structure - for example, in the case of a product having little brand equity, retailers have negotiating power over manufacturers and can capture more margin. Market Trends Changes in the market are important because they often are the source of new opportunities and threats. The relevant trends are industry-dependent, but some examples include changes in price sensitivity, demand for variety, and level of emphasis on service and support. Regional trends also may be relevant. Key Success Factors The key success factors are those elements that are necessary in order for the firm to achieve its marketing objectives. A few examples of such factors include: • • • • Access to essential unique resources Ability to achieve economies of scale Access to distribution channels Technological progress It is important to consider that key success factors may change over time, especially as the product progresses through its life cycle. 7. Target Market Selection Target marketing tailors a marketing mix for one or more segments identified by market segmentation. Target marketing contrasts with mass marketing, which offers a single product to the entire market. Two important factors to consider when selecting a target market segment are the attractiveness of the segment and the fit between the segment and the firm's objectives, resources, and capabilities. Attractiveness of a Market Segment The following are some examples of aspects that should be considered when evaluating the attractiveness of a market segment: • • • • • • • • Size of the segment (number of customers and/or number of units) Growth rate of the segment Competition in the segment Brand loyalty of existing customers in the segment Attainable market share given promotional budget and competitors' expenditures Required market share to break even Sales potential for the firm in the segment Expected profit margins in the segment Market research and analysis is instrumental in obtaining this information. For example, buyer intentions, sales force estimates, test marketing, and statistical demand analysis are useful for determining sales potential. The impact of applicable micro-environmental and macro-environmental variables on the market segment should be considered. Note that larger segments are not necessarily the most profitable to target since they likely will have more competition. It may be more profitable to serve one or more smaller segments that have little competition. On the other hand, if the firm can develop a competitive advantage, for example, via patent protection, it may find it profitable to pursue a larger market segment. Suitability of Market Segments to the Firm Market segments also should be evaluated according to how they fit the firm's objectives, resources, and capabilities. Some aspects of fit include: • • • • Whether the firm can offer superior value to the customers in the segment The impact of serving the segment on the firm's image Access to distribution channels required to serve the segment The firm's resources vs. capital investment required to serve the segment The better the firm's fit to a market segment, and the more attractive the market segment, the greater the profit potential to the firm. Target Market Strategies There are several different target-market strategies that may be followed. Targeting strategies usually can be categorized as one of the following: • Single-segment strategy - also known as a concentrated strategy. One market segment (not the entire market) is served with one marketing mix. A singlesegment approach often is the strategy of choice for smaller companies with limited resources. Selective specialization- this is a multiple-segment strategy, also known as a differentiated strategy. Different marketing mixes are offered to different segments. The product itself may or may not be different - in many cases only the promotional message or distribution channels vary. Product specialization- the firm specializes in a particular product and tailors it to different market segments. Market specialization- the firm specializes in serving a particular market segment and offers that segment an array of different products. Full market coverage - the firm attempts to serve the entire market. This coverage can be achieved by means of either a mass market strategy in which a single undifferentiated marketing mix is offered to the entire market, or by a differentiated strategy in which a separate marketing mix is offered to each segment. • • • • The following diagrams show examples of the five market selection patterns given three market segments S1, S2, and S3, and three products P1, P2, and P3. Single Segment Selective Specialization S1 S2 S3 Product Specialization S1 S2 S3 Market Specialization S1 S2 S3 Full Market Coverage S1 S2 S3 S1 S2 S3 P P P P P 1 1 1 1 1 P P P P P 2 2 2 2 2 P P P P P 3 3 3 3 3 A firm that is seeking to enter a market and grow should first target the most attractive segment that matches its capabilities. Once it gains a foothold, it can expand by pursuing a product specialization strategy, tailoring the product for different segments, or by pursuing a market specialization strategy and offering new products to its existing market segment. Another strategy whose use is increasing is individual marketing, in which the marketing mix is tailored on an individual consumer basis. While in the past impractical, individual marketing is becoming more viable thanks to advances in technology. 8. The Product Life Cycle A product's life cycle (PLC) can be divided into several stages characterized by the revenue generated by the product. If a curve is drawn showing product revenue over time, it may take one of many different shapes, an example of which is shown below: Product Life Cycle Curve The life cycle concept may apply to a brand or to a category of product. Its duration may be as short as a few months for a fad item or a century or more for product categories such as the gasoline-powered automobile. Product development is the incubation stage of the product life cycle. There are no sales and the firm prepares to introduce the product. As the product progresses through its life cycle, changes in the marketing mix usually are required in order to adjust to the evolving challenges and opportunities. Introduction Stage When the product is introduced, sales will be low until customers become aware of the product and its benefits. Some firms may announce their product before it is introduced, but such announcements also alert competitors and remove the element of surprise. Advertising costs typically are high during this stage in order to rapidly increase customer awareness of the product and to target the early adopters. During the introductory stage the firm is likely to incur additional costs associated with the initial distribution of the product. These higher costs coupled with a low sales volume usually make the introduction stage a period of negative profits. During the introduction stage, the primary goal is to establish a market and build primary demand for the product class. The following are some of the marketing mix implications of the introduction stage: • • • • Product - one or few products, relatively undifferentiated Price - Generally high, assuming a skim pricing strategy for a high profit margin as the early adopters buy the product and the firm seeks to recoup development costs quickly. In some cases a penetration pricing strategy is used and introductory prices are set low to gain market share rapidly. Distribution - Distribution is selective and scattered as the firm commences implementation of the distribution plan. Promotion - Promotion is aimed at building brand awareness. Samples or trial incentives may be directed toward early adopters. The introductory promotion also is intended to convince potential resellers to carry the product. Growth Stage The growth stage is a period of rapid revenue growth. Sales increase as more customers become aware of the product and its benefits and additional market segments are targeted. Once the product has been proven a success and customers begin asking for it, sales will increase further as more retailers become interested in carrying it. The marketing team may expand the distribution at this point. When competitors enter the market, often during the later part of the growth stage, there may be price competition and/or increased promotional costs in order to convince consumers that the firm's product is better than that of the competition. During the growth stage, the goal is to gain consumer preference and increase sales. The marketing mix may be modified as follows: • • • Product - New product features and packaging options; improvement of product quality. Price - Maintained at a high level if demand is high, or reduced to capture additional customers. Distribution - Distribution becomes more intensive. Trade discounts are minimal if resellers show a strong interest in the product. • Promotion - Increased advertising to build brand preference. Maturity Stage The maturity stage is the most profitable. While sales continue to increase into this stage, they do so at a slower pace. Because brand awareness is strong, advertising expenditures will be reduced. Competition may result in decreased market share and/or prices. The competing products may be very similar at this point, increasing the difficulty of differentiating the product. The firm places effort into encouraging competitors' customers to switch, increasing usage per customer, and converting non-users into customers. Sales promotions may be offered to encourage retailers to give the product more shelf space over competing products. During the maturity stage, the primary goal is to maintain market share and extend the product life cycle. Marketing mix decisions may include: • • • • Product - Modifications are made and features are added in order to differentiate the product from competing products that may have been introduced. Price - Possible price reductions in response to competition while avoiding a price war. Distribution - New distribution channels and incentives to resellers in order to avoid losing shelf space. Promotion - Emphasis on differentiation and building of brand loyalty. Incentives to get competitors' customers to switch. Decline Stage Eventually sales begin to decline as the market becomes saturated, the product becomes technologically obsolete, or customer tastes change. If the product has developed brand loyalty, the profitability may be maintained longer. Unit costs may increase with the declining production volumes and eventually no more profit can be made. During the decline phase, the firm generally has three options: • • • Maintain the product in hopes that competitors will exit. Reduce costs and find new uses for the product. Harvest it, reducing marketing support and coasting along until no more profit can be made. Discontinue the product when no more profit can be made or there is a successor product. The marketing mix may be modified as follows: • Product - The number of products in the product line may be reduced. Rejuvenate surviving products to make them look new again. • • • Price - Prices may be lowered to liquidate inventory of discontinued products. Prices may be maintained for continued products serving a niche market. Distribution - Distribution becomes more selective. Channels that no longer are profitable are phased out. Promotion - Expenditures are lower and aimed at reinforcing the brand image for continued products. Limitations of the Product Life Cycle Concept The term "life cycle" implies a well-defined life cycle as observed in living organisms, but products do not have such a predictable life and the specific life cycle curves followed by different products vary substantially. Consequently, the life cycle concept is not well-suited for the forecasting of product sales. Furthermore, critics have argued that the product life cycle may become self-fulfilling. For example, if sales peak and then decline, managers may conclude that the product is in the decline phase and therefore cut the advertising budget, thus precipitating a further decline. Nonetheless, the product life cycle concept helps marketing managers to plan alternate marketing strategies to address the challenges that their products are likely to face. It also is useful for monitoring sales results over time and comparing them to those of products having a similar life cycle. 9. Brand Equity A brand is a name or symbol used to identify the source of a product. When developing a new product, branding is an important decision. The brand can add significant value when it is well recognized and has positive associations in the mind of the consumer. This concept is referred to as brand equity. What is Brand Equity? Brand equity is an intangible asset that depends on associations made by the consumer. There are at least three perspectives from which to view brand equity: • Financial - One way to measure brand equity is to determine the price premium that a brand commands over a generic product. For example, if consumers are willing to pay $100 more for a branded television over the same unbranded television, this premium provides important information about the value of the brand. However, expenses such as promotional costs must be taken into account when using this method to measure brand equity. • • Brand extensions - A successful brand can be used as a platform to launch related products. The benefits of brand extensions are the leveraging of existing brand awareness thus reducing advertising expenditures, and a lower risk from the perspective of the consumer. Furthermore, appropriate brand extensions can enhance the core brand. However, the value of brand extensions is more difficult to quantify than are direct financial measures of brand equity. Consumer-based - A strong brand increases the consumer's attitude strength toward the product associated with the brand. Attitude strength is built by experience with a product. This importance of actual experience by the customer implies that trial samples are more effective than advertising in the early stages of building a strong brand. The consumer's awareness and associations lead to perceived quality, inferred attributes, and eventually, brand loyalty. Strong brand equity provides the following benefits: • • • Facilitates a more predictable income stream. Increases cash flow by increasing market share, reducing promotional costs, and allowing premium pricing. Brand equity is an asset that can be sold or leased. However, brand equity is not always positive in value. Some brands acquire a bad reputation that results in negative brand equity. Negative brand equity can be measured by surveys in which consumers indicate that a discount is needed to purchase the brand over a generic product. Building and Managing Brand Equity In his 1989 paper, Managing Brand Equity, Peter H. Farquhar outlined the following three stages that are required in order to build a strong brand: 1. Introduction - introduce a quality product with the strategy of using the brand as a platform from which to launch future products. A positive evaluation by the consumer is important. 2. Elaboration - make the brand easy to remember and develop repeat usage. There should be accessible brand attitude, that is, the consumer should easily remember his or her positive evaluation of the brand. 3. Fortification - the brand should carry a consistent image over time to reinforce its place in the consumer's mind and develop a special relationship with the consumer. Brand extensions can further fortify the brand, but only with related products having a perceived fit in the mind of the consumer. Alternative Means to Brand Equity Building brand equity requires a significant effort, and some companies use alternative means of achieving the benefits of a strong brand. For example, brand equity can be borrowed by extending the brand name to a line of products in the same product category or even to other categories. In some cases, especially when there is a perceptual connection between the products, such extensions are successful. In other cases, the extensions are unsuccessful and can dilute the original brand equity. Brand equity also can be "bought" by licensing the use of a strong brand for a new product. As in line extensions by the same company, the success of brand licensing is not guaranteed and must be analyzed carefully for appropriateness. Managing Multiple Brands Different companies have opted for different brand strategies for multiple products. These strategies are: • • • • Single brand identity - a separate brand for each product. For example, in laundry detergents Procter & Gamble offers uniquely positioned brands such as Tide, Cheer, Bold, etc. Umbrella - all products under the same brand. For example, Sony offers many different product categories under its brand. Multi-brand categories - Different brands for different product categories. Campbell Soup Company uses Campbell's for soups, Pepperidge Farm for baked goods, and V8 for juices. Family of names - Different brands having a common name stem. Nestle uses Nescafe, Nesquik, and Nestea for beverages. Brand equity is an important factor in multi-product branding strategies. Protecting Brand Equity The marketing mix should focus on building and protecting brand equity. For example, if the brand is positioned as a premium product, the product quality should be consistent with what consumers expect of the brand, low sale prices should not be used compete, the distribution channels should be consistent with what is expected of a premium brand, and the promotional campaign should build consistent associations. Finally, potentially dilutive extensions that are inconsistent with the consumer's perception of the brand should be avoided. Extensions also should be avoided if the core brand is not yet sufficiently strong. 10. Pricing Strategy One of the four major elements of the marketing mix is price. Pricing is an important strategic issue because it is related to product positioning. Furthermore, pricing affects other marketing mix elements such as product features, channel decisions, and promotion. While there is no single recipe to determine pricing, the following is a general sequence of steps that might be followed for developing the pricing of a new product: 1. Develop marketing strategy - perform marketing analysis, segmentation, targeting, and positioning. 2. Make marketing mix decisions - define the product, distribution, and promotional tactics. 3. Estimate the demand curve - understand how quantity demanded varies with price. 4. Calculate cost - include fixed and variable costs associated with the product. 5. Understand environmental factors - evaluate likely competitor actions, understand legal constraints, etc. 6. Set pricing objectives - for example, profit maximization, revenue maximization, or price stabilization (status quo). 7. Determine pricing - using information collected in the above steps, select a pricing method, develop the pricing structure, and define discounts. These steps are interrelated and are not necessarily performed in the above order. Nonetheless, the above list serves to present a starting framework. Marketing Strategy and the Marketing Mix Before the product is developed, the marketing strategy is formulated, including target market selection and product positioning. There usually is a tradeoff between product quality and price, so price is an important variable in positioning. Because of inherent tradeoffs between marketing mix elements, pricing will depend on other product, distribution, and promotion decisions. Estimate the Demand Curve Because there is a relationship between price and quantity demanded, it is important to understand the impact of pricing on sales by estimating the demand curve for the product. For existing products, experiments can be performed at prices above and below the current price in order to determine the price elasticity of demand. Inelastic demand indicates that price increases might be feasible. Calculate Costs If the firm has decided to launch the product, there likely is at least a basic understanding of the costs involved, otherwise, there might be no profit to be made. The unit cost of the product sets the lower limit of what the firm might charge, and determines the profit margin at higher prices. The total unit cost of a producing a product is composed of the variable cost of producing each additional unit and fixed costs that are incurred regardless of the quantity produced. The pricing policy should consider both types of costs. Environmental Factors Pricing must take into account the competitive and legal environment in which the company operates. From a competitive standpoint, the firm must consider the implications of its pricing on the pricing decisions of competitors. For example, setting the price too low may risk a price war that may not be in the best interest of either side. Setting the price too high may attract a large number of competitors who want to share in the profits. From a legal standpoint, a firm is not free to price its products at any level it chooses. For example, there may be price controls that prohibit pricing a product too high. Pricing it too low may be considered predatory pricing or "dumping" in the case of international trade. Offering a different price for different consumers may violate laws against price discrimination. Finally, collusion with competitors to fix prices at an agreed level is illegal in many countries. Pricing Objectives The firm's pricing objectives must be identified in order to determine the optimal pricing. Common objectives include the following: • • • • • Current profit maximization - seeks to maximize current profit, taking into account revenue and costs. Current profit maximization may not be the best objective if it results in lower long-term profits. Current revenue maximization - seeks to maximize current revenue with no regard to profit margins. The underlying objective often is to maximize long-term profits by increasing market share and lowering costs. Maximize quantity - seeks to maximize the number of units sold or the number of customers served in order to decrease long-term costs as predicted by the experience curve. Maximize profit margin - attempts to maximize the unit profit margin, recognizing that quantities will be low. Quality leadership - use price to signal high quality in an attempt to position the product as the quality leader. • • • Partial cost recovery - an organization that has other revenue sources may seek only partial cost recovery. Survival - in situations such as market decline and overcapacity, the goal may be to select a price that will cover costs and permit the firm to remain in the market. In this case, survival may take a priority over profits, so this objective is considered temporary. Status quo - the firm may seek price stabilization in order to avoid price wars and maintain a moderate but stable level of profit. For new products, the pricing objective often is either to maximize profit margin or to maximize quantity (market share). To meet these objectives, skim pricing and penetration pricing strategies often are employed. Joel Dean discussed these pricing policies in his classic HBR article entitled, Pricing Policies for New Products. Skim pricing attempts to "skim the cream" off the top of the market by setting a high price and selling to those customers who are less price sensitive. Skimming is a strategy used to pursue the objective of profit margin maximization. Skimming is most appropriate when: • • • Demand is expected to be relatively inelastic; that is, the customers are not highly price sensitive. Large cost savings are not expected at high volumes, or it is difficult to predict the cost savings that would be achieved at high volume. The company does not have the resources to finance the large capital expenditures necessary for high volume production with initially low profit margins. Penetration pricing pursues the objective of quantity maximization by means of a low price. It is most appropriate when: • • • • Demand is expected to be highly elastic; that is, customers are price sensitive and the quantity demanded will increase significantly as price declines. Large decreases in cost are expected as cumulative volume increases. The product is of the nature of something that can gain mass appeal fairly quickly. There is a threat of impending competition. As the product lifecycle progresses, there likely will be changes in the demand curve and costs. As such, the pricing policy should be reevaluated over time. The pricing objective depends on many factors including production cost, existence of economies of scale, barriers to entry, product differentiation, rate of product diffusion, the firm's resources, and the product's anticipated price elasticity of demand. Pricing Methods To set the specific price level that achieves their pricing objectives, managers may make use of several pricing methods. These methods include: • • • • Cost-plus pricing - set the price at the production cost plus a certain profit margin. Target return pricing - set the price to achieve a target return-on-investment. Value-based pricing - base the price on the effective value to the customer relative to alternative products. Psychological pricing - base the price on factors such as signals of product quality, popular price points, and what the consumer perceives to be fair. In addition to setting the price level, managers have the opportunity to design innovative pricing models that better meet the needs of both the firm and its customers. For example, software traditionally was purchased as a product in which customers made a one-time payment and then owned a perpetual license to the software. Many software suppliers have changed their pricing to a subscription model in which the customer subscribes for a set period of time, such as one year. Afterwards, the subscription must be renewed or the software no longer will function. This model offers stability to both the supplier and the customer since it reduces the large swings in software investment cycles. Price Discounts The normally quoted price to end users is known as the list price. This price usually is discounted for distribution channel members and some end users. There are several types of discounts, as outlined below. • • • • • • Quantity discount - offered to customers who purchase in large quantities. Cumulative quantity discount - a discount that increases as the cumulative quantity increases. Cumulative discounts may be offered to resellers who purchase large quantities over time but who do not wish to place large individual orders. Seasonal discount - based on the time that the purchase is made and designed to reduce seasonal variation in sales. For example, the travel industry offers much lower off-season rates. Such discounts do not have to be based on time of the year; they also can be based on day of the week or time of the day, such as pricing offered by long distance and wireless service providers. Cash discount - extended to customers who pay their bill before a specified date. Trade discount - a functional discount offered to channel members for performing their roles. For example, a trade discount may be offered to a small retailer who may not purchase in quantity but nonetheless performs the important retail function. Promotional discount - a short-term discounted price offered to stimulate sales.