The neo-liberal experiment in Italy False promises and social

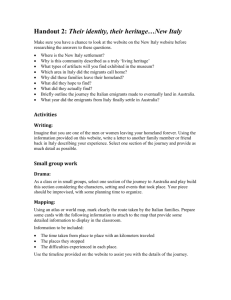

advertisement