TI2012-0457311E5

advertisement

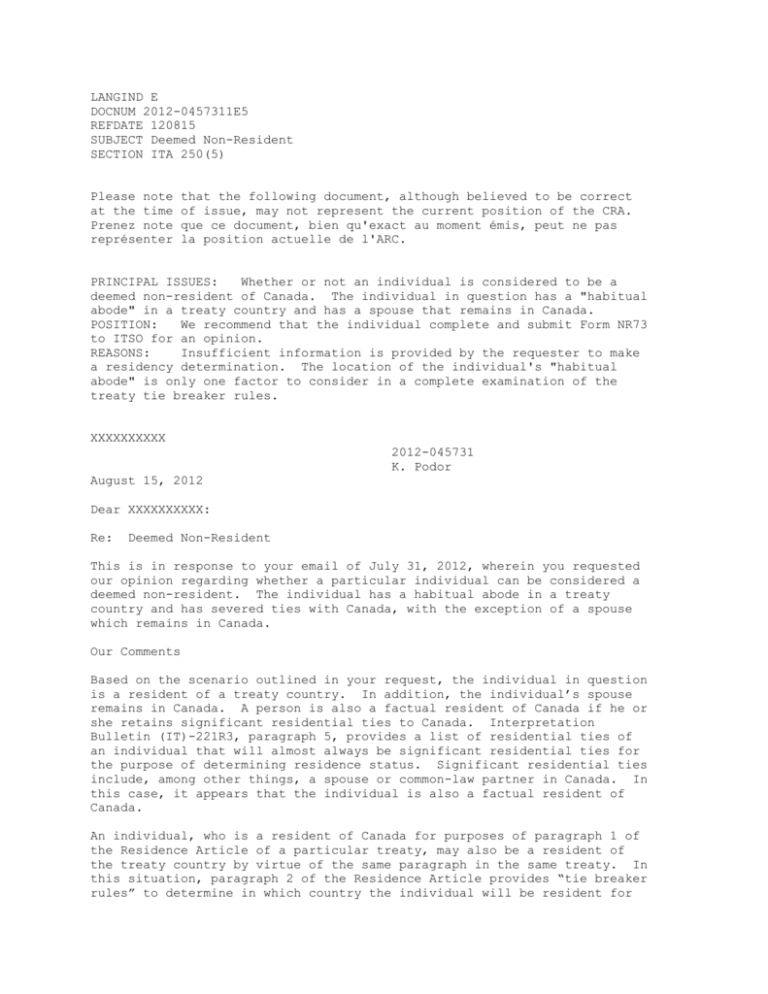

LANGIND E DOCNUM 2012-0457311E5 REFDATE 120815 SUBJECT Deemed Non-Resident SECTION ITA 250(5) Please note at the time Prenez note représenter that the following document, although believed to be correct of issue, may not represent the current position of the CRA. que ce document, bien qu'exact au moment émis, peut ne pas la position actuelle de l'ARC. PRINCIPAL ISSUES: Whether or not an individual is considered to be a deemed non-resident of Canada. The individual in question has a "habitual abode" in a treaty country and has a spouse that remains in Canada. POSITION: We recommend that the individual complete and submit Form NR73 to ITSO for an opinion. REASONS: Insufficient information is provided by the requester to make a residency determination. The location of the individual's "habitual abode" is only one factor to consider in a complete examination of the treaty tie breaker rules. XXXXXXXXXX 2012-045731 K. Podor August 15, 2012 Dear XXXXXXXXXX: Re: Deemed Non-Resident This is in response to your email of July 31, 2012, wherein you requested our opinion regarding whether a particular individual can be considered a deemed non-resident. The individual has a habitual abode in a treaty country and has severed ties with Canada, with the exception of a spouse which remains in Canada. Our Comments Based on the scenario outlined in your request, the individual in question is a resident of a treaty country. In addition, the individual’s spouse remains in Canada. A person is also a factual resident of Canada if he or she retains significant residential ties to Canada. Interpretation Bulletin (IT)-221R3, paragraph 5, provides a list of residential ties of an individual that will almost always be significant residential ties for the purpose of determining residence status. Significant residential ties include, among other things, a spouse or common-law partner in Canada. In this case, it appears that the individual is also a factual resident of Canada. An individual, who is a resident of Canada for purposes of paragraph 1 of the Residence Article of a particular treaty, may also be a resident of the treaty country by virtue of the same paragraph in the same treaty. In this situation, paragraph 2 of the Residence Article provides “tie breaker rules” to determine in which country the individual will be resident for -2purposes of the other provisions of the treaty. If the “tie breaker” rules determine that the individual is a resident of another country for the purposes of the treaty, then subsection 250(5) of the Income Tax Act (the “Act”) will deem the individual to be a non-resident of Canada for purposes of the Act. The requester states that the person in question has a “habitual abode” in the treaty country. Although, the location of an individual’s “habitual abode” is one of several “tie breaker rules”, it is not the only test to consider in determining residency status. A close examination of the facts must be undertaken for each test to determine with which country the individual’s ties are closer. IT-221R3, paragraph 26, provides guidance on the application of the tie breaker rules in determining residency. The treaty tie breaker tests are the location of a permanent home, centre of vital interests, habitual abode, nationality, or an agreement between the competent authorities. The “permanent home” test provides that an individual is a resident, for purposes of the treaty, in a country in which the individual has a permanent home available to him or her. In this case, the individual has a permanent home available in both countries. The individual has a home in the treaty country and his or her spouse lives in Canada in a second permanent home. In this case, the “permanent home” test will not result in a residency determination. Where this is the case, the tie breaker rules refer to the “centre of vital interests” test. The “centre of vital interests” test includes a detailed review of the individual’s personal and economic ties within each country in order to establish which country’s ties are closer to the individual. The Organization for Economic Cooperation and Development (OECD) Model commentary on Article 4, Resident, provides examples of personal and economic factors which include, among other things, the location of family and social relations, occupation, political, cultural or other activities, place of business, the place from which an individual administers his/her property, etc. In this case, the fact that the individual’s spouse and/or family remains in Canada represents a significant personal tie that supports the determination that the individual is a resident of Canada. We have insufficient details to undertake a complete review of all of the factors which must be considered in making a residency determination based on the treaty tie breaker rules. If the individual in question wishes to obtain a non-binding opinion from the Canada Revenue Agency (CRA) regarding his or her residence status, he or she should file Form NR73, Determination of Residency Status (Leaving Canada) with the International Tax Services Office. Form NR73 can be found on the CRA’s website (www.cra-arc.gc.ca) under “Forms and Publications”. Conclusion An individual, that is a factual resident of Canada and a resident of a country with which Canada has a tax treaty, may be considered a deemed non-resident of Canada by virtue of subsection 250(5) of the Act. An individual will become a deemed non-resident if his or her ties with another country become such that, under the relevant tax treaty that Canada has with the other country, the individual would be considered a resident of that other country. This determination follows a detailed examination of the “tie breaker rules” contained in the Residence Article -3of the relevant treaty. The “tie breaker rules” include several tests, one of which is the location of the individual’s “habitual abode”. We recommend that the individual submit a completed Form NR73 to the International Tax Services Office in order to obtain an opinion regarding his or her residence status. We trust these comments are helpful. Lita Krantz, CA Assistant Director International Division/ Division des opérations internationales International Section III Income Tax Rulings Directorate Legislative Policy and Regulatory Affairs Branch