Whitepaper

5-GHz Wireless LAN – Real Opportunity in a Real Market

February 2002

Volume 2.0

1 Wireless LAN Market – Gaining Momentum

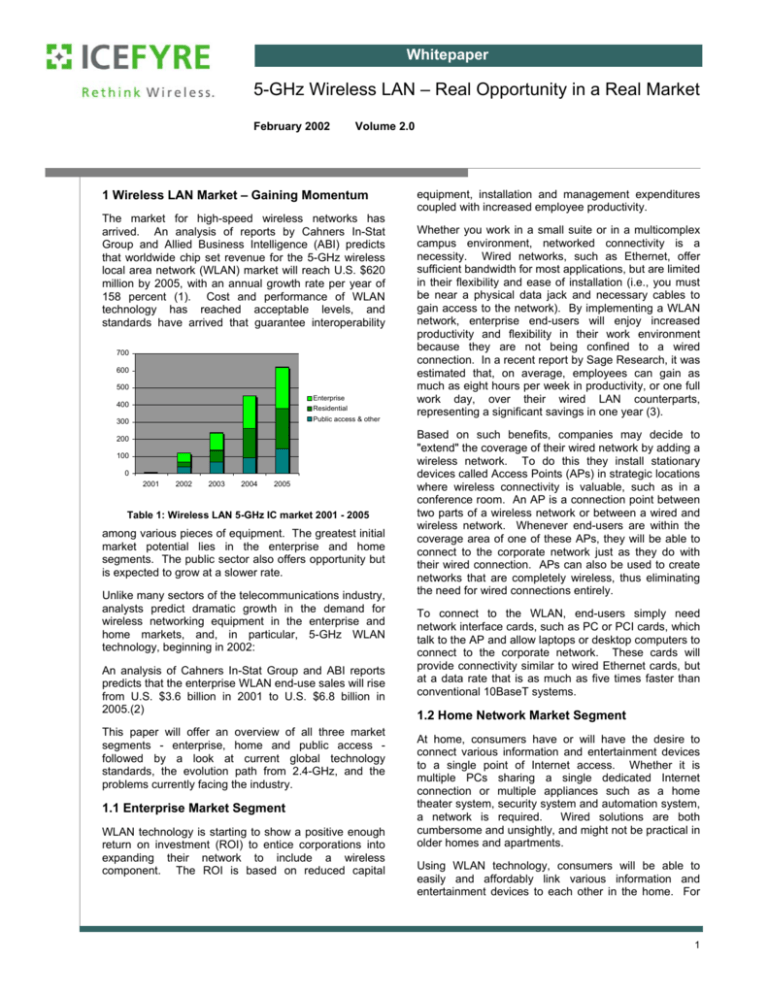

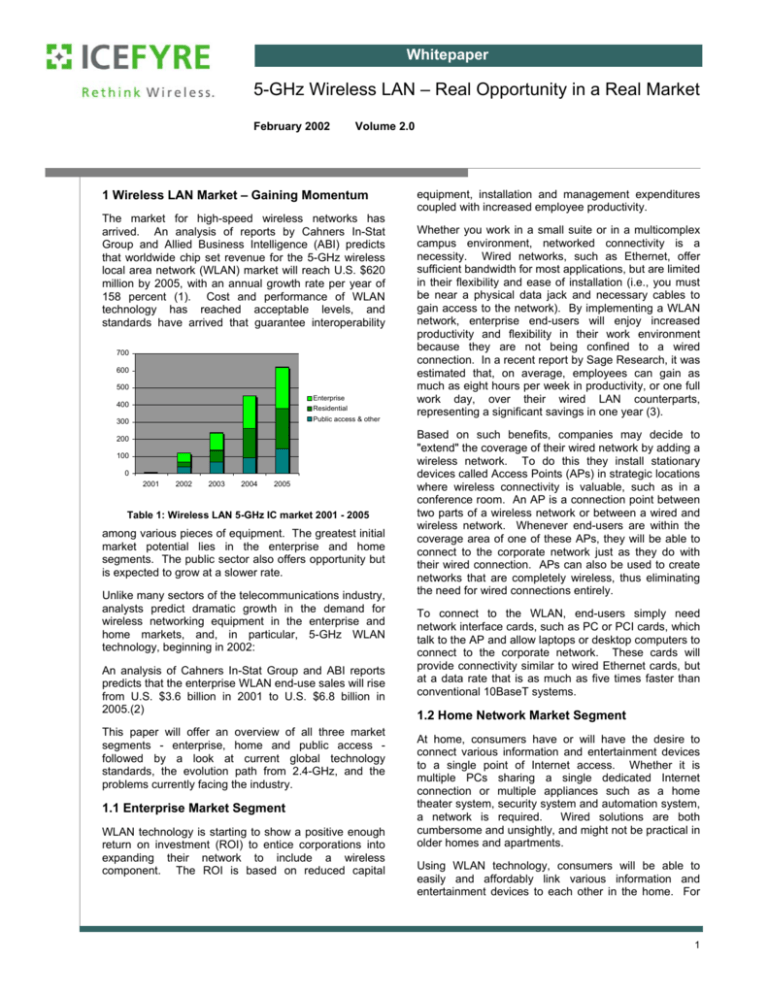

The market for high-speed wireless networks has

arrived. An analysis of reports by Cahners In-Stat

Group and Allied Business Intelligence (ABI) predicts

that worldwide chip set revenue for the 5-GHz wireless

local area network (WLAN) market will reach U.S. $620

million by 2005, with an annual growth rate per year of

158 percent (1). Cost and performance of WLAN

technology has reached acceptable levels, and

standards have arrived that guarantee interoperability

700

600

500

Enterprise

Residential

Public access & other

400

300

200

100

0

2001

2002

2003

2004

2005

Table 1: Wireless LAN 5-GHz IC market 2001 - 2005

among various pieces of equipment. The greatest initial

market potential lies in the enterprise and home

segments. The public sector also offers opportunity but

is expected to grow at a slower rate.

Unlike many sectors of the telecommunications industry,

analysts predict dramatic growth in the demand for

wireless networking equipment in the enterprise and

home markets, and, in particular, 5-GHz WLAN

technology, beginning in 2002:

An analysis of Cahners In-Stat Group and ABI reports

predicts that the enterprise WLAN end-use sales will rise

from U.S. $3.6 billion in 2001 to U.S. $6.8 billion in

2005.(2)

This paper will offer an overview of all three market

segments - enterprise, home and public access followed by a look at current global technology

standards, the evolution path from 2.4-GHz, and the

problems currently facing the industry.

1.1 Enterprise Market Segment

WLAN technology is starting to show a positive enough

return on investment (ROI) to entice corporations into

expanding their network to include a wireless

component. The ROI is based on reduced capital

equipment, installation and management expenditures

coupled with increased employee productivity.

Whether you work in a small suite or in a multicomplex

campus environment, networked connectivity is a

necessity. Wired networks, such as Ethernet, offer

sufficient bandwidth for most applications, but are limited

in their flexibility and ease of installation (i.e., you must

be near a physical data jack and necessary cables to

gain access to the network). By implementing a WLAN

network, enterprise end-users will enjoy increased

productivity and flexibility in their work environment

because they are not being confined to a wired

connection. In a recent report by Sage Research, it was

estimated that, on average, employees can gain as

much as eight hours per week in productivity, or one full

work day, over their wired LAN counterparts,

representing a significant savings in one year (3).

Based on such benefits, companies may decide to

"extend" the coverage of their wired network by adding a

wireless network. To do this they install stationary

devices called Access Points (APs) in strategic locations

where wireless connectivity is valuable, such as in a

conference room. An AP is a connection point between

two parts of a wireless network or between a wired and

wireless network. Whenever end-users are within the

coverage area of one of these APs, they will be able to

connect to the corporate network just as they do with

their wired connection. APs can also be used to create

networks that are completely wireless, thus eliminating

the need for wired connections entirely.

To connect to the WLAN, end-users simply need

network interface cards, such as PC or PCI cards, which

talk to the AP and allow laptops or desktop computers to

connect to the corporate network. These cards will

provide connectivity similar to wired Ethernet cards, but

at a data rate that is as much as five times faster than

conventional 10BaseT systems.

1.2 Home Network Market Segment

At home, consumers have or will have the desire to

connect various information and entertainment devices

to a single point of Internet access. Whether it is

multiple PCs sharing a single dedicated Internet

connection or multiple appliances such as a home

theater system, security system and automation system,

a network is required.

Wired solutions are both

cumbersome and unsightly, and might not be practical in

older homes and apartments.

Using WLAN technology, consumers will be able to

easily and affordably link various information and

entertainment devices to each other in the home. For

1

example, a satellite television receiver on the roof can

connect to the television inside the house via a 5-GHz

WLAN connection. There is no pulling of cables through

new homes or undertaking costly and difficult retrofitting

of older homes. Another example is the capability of a

consumer to review e-mail or search the Web while not

being confined to a study or bedroom with an Ethernet

jack.

Consumers will purchase a gateway or set-top box

through a variety of sales channels including retail

outlets and service providers. The gateway will consist

of a wide area network connection such as DSL, cable

modem, satellite or ISDN, as well as a LAN connection.

There are three primary types of physical connectivity

for the home: existing wiring (telephone and power),

new dedicated cables, or wireless technology. In many

cases, wireless is the most desirable option because it

offers the greatest degree of flexibility and is relatively

cost effective.

Today consumers can purchase wireless network cards

(PC, PCI, etc.) for laptops and desktop PCs based on

the 2.4-GHz 802.11b standard. In addition, makers of

appliances such as telephones (cordless and cellular),

home security systems, home theater equipment,

Internet-enabled refrigerators, and other Internet

appliances will embedhigh-speed wireless technology

into their products to provide connectivity to a gateway

or set-top box.

1.3 Public Area Access Market Segment

Public area access refers to wireless network

connectivity within places such as airports, hotels,

convention centers and subway stations.

Mobile

professionals benefit from an increase in productivity

while away from the office. Service providers or facility

owners install a network of APs within a building, giving

users wireless access to the Internet. The APs are

interconnected via a wired network such as Ethernet,

which in turn connects to the Internet through an edgerouting element. The net result is a sustained wireless

connection to the network as end-users travel between

APs. Devices that have been equipped with wireless

technology, such as mobile phones, personal digital

assistants and laptops, are already available to endusers.

2 5-GHz WLAN - Real Opportunity in a Real

Market

2.1 Technology Standards

A number of technical solutions for high-speed wireless

network markets have been developed throughout the

world,

primarily

in

Europe

(European

Telecommunication Standard Industry - ETSI), Japan

(ARIB) and North America (IEEE).

layers. The only difference lies in 802.11a's Media

Access Control (MAC) layer, which is Ethernet-based.

The HiperLAN2's MAC is similar to Asynchronous

Transfer Mode (ATM), with some additions to support

Ethernet-based applications.

Because HiperLAN2 is based on ATM and IP

technology, it has quality and security functions not yet

available with 802.11a.

Despite these functional

advantages, its more complex and expensive design

makes it a less attractive option. The IEEE 802.11

committee has engaged task groups specifically to meet

European and Japanese technical and market

requirements in areas such as quality of service and

security.

2.2 Evolution to 5-GHz WLAN

There are two primary factors driving the evolution from

2.4 GHz to 5.0 GHz: bandwidth and congestion.

Enterprise customers seeking to implement nextgeneration information technology applications such as

intranet, audio and real-time video applications, as well

as those interested in deploying application service

provider models for the distribution of client software, will

require WLAN solutions offering more bandwidth than is

available with 802.11b.

While the draft 802.11g specification has been touted as

providing performance comparable to 802.11a in the

2.4-GHz band, it is widely believed that it will take

upwards of a year to ratify, and volume production of

802.11g products will not be begin until 2004. In

addition, limitations in key performance areas, such as

network capacity and data throughput in dual mode

802.11g operation may severally limited adoption in the

public and enterprise markets.

In addition, increased congestion in the unlicensed 2.4GHz band, which hosts a variety of wireless applications

including 802.11b WLAN, cordless telephones and

Bluetooth wireless technology as well as home

appliances such as microwaves, is becoming

problematic.

2.3 The Opportunity - High-Volume Production

of 5-GHz WLAN Products

The market for 5-GHz WLAN technology is real, but

challenges remain. OEMs evaluating this space have

suggested that there are three major problems with

current semiconductor solutions.

1. High Power Consumption: OEM customers consider

the power consumption of traditional OFDM modem

solutions to be too high (2.0 watts and higher at 3.3

volts);

The ETSI standard, called HiperLAN2, and the IEEE

802.11a solution use almost identical Orthogonal

Frequency-Division Multiplexing (OFDM) physical

2

2. High Total System Cost: OEM customers consider the

total system bill of material cost of current 802.11a

solutions to be too high;

2 Gemma Paulo Life, Liberty and WLANs: Wireless

Networking Brings Freedom to the Enterprise

November 2001

3. Low System Performance: OEM customers do not

believe that the performance (data rate and range) will

deliver the end-user experience necessary to generate

high demand.

Navin Sabharwal, Wireless LAN Silicon ICs: Market

Dynamics,

Major

Players

and

Technology

Assessments November 2001

These same OEMs have indicated that the silicon

vendor who addresses these issues will make a huge

imp act on the market and will be in a position to lead

the market.

3 Wireless LANs: Improving Productivity and Quality

of Life, Sage Research for Cisco Systems, May 2001

For a more in-depth discussion on the problems facing

this industry, please see the IceFyre whitepaper titled

Achieving Volume Production of 5-GHz WLAN Devices.

For a more in-depth discussion on solutions to these

problems please see the IceFyre whitepaper titled

IceFyre’s 5-GHz OFDM Modem Solution.

3 Summary

The 5-GHz WLAN market is on a growth curve that

provides opportunity to networking equipment and

application OEMs, as well as to component designers

and manufacturers. Driving the market is the end-users'

desire for high-bandwidth network connectivity without

the interference issues of the 2.4-GHz band. There are

some design challenges facing this market, but once

they are solved, the 5-GHz segment is expected to

become the dominant player in WLAN.

References:

1 Gemma Paulo Life, Liberty and WLANs: Wireless

Networking Brings Freedom to the Enterprise

November 2001

Navin Sabharwal, Wireless LAN Silicon ICs: Market

Dynamics,

Major

Players

and

Technology

Assessments November 2001

For additional information regarding IceFyre Semiconductor Corporation

or its products, see www.IceFyre.com

IceFyre Semiconductor Corporation

300–411 Legget Drive | Kanata | Ontario | Canada | K2K 3C9 | Tel: 613.599.3000 | Fax: 613.599.4965

IceFyre Semiconductor Corporation reserves the right to make changes to the product(s) or information contained herein without notice. No liability is assumed

as a result of their use or application. No rights under any patent accompany the sale of any such product(s) or information.

IceFyre and design is a trademark of IceFyre Semiconductor Corporation

All rights reserved

Printed in Canada

© 2002 IceFyre Semiconductor Corporation

February 2002