Qualitative Analyses in the Sales Comparison Approach Revisited

advertisement

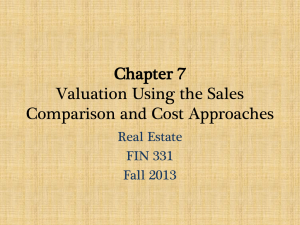

Qualitative Analyses in the Sales Comparison Approach Revisited abstract Most practicing by Gene Rhodes, MAI appraisers agree that when analyzing a group of five or six compa- T rable sales with four or five value-influencing his article is written with the sole intent of further advocating qualitative analyses of comparable sales through an objective ranking system. The qualitative ranking technique has been promoted by such leading valuation thinkers and scholars as Henry Babcock, Gene Dilmore, Richard Ratcliff, James Graaskamp, and others. It was most recently defended by D. Richard Wincott, MAI, in the Fall 2012 issue of The Appraisal Journal. The discussion that follows is that of an ordinary practitioner who has spent many years investigating property sales and trying to answer a single, but most important and complex question: “Why did the property sell for that price?” When appraisers approach the analysis of a comparable sale in that manner, they lay the foundation for developing an objective and sound opinion of the value of the appraised property. This article attempts to assist in developing answers to the question and is written with the intent of guiding field appraisers in their analyses of comparable sales in relation to the appraised property and with the hope that it may help in achieving more reliable results. differences, it is often quite difficult to extract the appropriate adjustments through paired sales analysis. The appraiser’s objective should be to simulate the actions and thought processes of the buyers who acquired the comparable sales. These buyers do not typically have a list of comparable sales on which they make plus and minus adjustments An Attribute Scoring and Analysis System for the observed differ- As indicated above, the subject of this article is qualitative analysis, as opposed to the more traditional and more commonly accepted application of quantitative adjustments. Ultimately, however, the qualitative analyses, as suggested herein, lead to market-supported and convincing quantitative adjustments. While quantitative adjustments are grounded in paired sales analyses, most appraisers recognize that there are almost always multiple value-impacting variables among a typical set of five or six good comparable sales. These multiple differences make it quite difficult, if not impossible, to extract adjustments for each material feature that may have impacted the price paid for the comparable properties. As a result, the appraiser’s adjustments for property characteristics typically stem from either subconscious qualitative analyses or subjective judgment, or a combination of both. The analysis technique discussed herein may adequately be described as an attribute scoring and analysis system. The use of an attribute scoring system was presented by James A. Graaskamp, noted professor and chair of real estate at the University of Wisconsin–Madison, at a national meeting of the Appraisal Institute ences in formulating Qualitative Analyses in the Sales Comparison Approach Revisited a purchase decision. They do, however, go through the process of qualitative analyses. This article attempts to demonstrate how easily qualitative analysis can lead to objective and market-supported quantitative adjustments. The Appraisal Journal, Fall 2014 281 (then the American Institute of Real Estate Appraisers) in 1987. Graaskamp’s ideas and thought processes were most notably set forth in the monograph and demonstration appraisal report titled The Appraisal of 25 N. Pickney: A Demonstration Case for Contemporary Appraisal Methods.1 Graaskamp often used what he termed “price sensitive attributes” in appraisals and research papers.2 Thus, applications of this analytical process are entirely attributable to Graaskamp’s knowledge of real estate and appraisal methodology, especially to his intellect and ability to think beyond commonly accepted techniques. Readers are asked to be open to the premise that new methods or techniques may produce more reliable and convincing results when considering the analytical processes presented herein. The intent of this article is to offer further support of Graaskamp’s valuation methodologies and expand on D. Richard Wincott’s more recent and excellent discussion of this topic in The Appraisal Journal.3 The sales comparison approach in the appraisal process is focused on comparable sales. In the analysis of each of the comparable sales, the central question should be, “Why did this property sell for this particular price? And the extension of this question is: “Given these sale prices and their respective sale conditions and characteristics, what do they indicate as a reasonable selling price/market value for the subject property, considering its conditions and characteristics? To answer these questions, the appraiser must examine aspects inherent in the sale transaction itself and features related to the physical characteristics of the property, including its location. An investigation of each sale transaction may reveal specific conditions that impacted the sale price, regardless of locational and physical characteristics. Such differences in sale and market conditions lead to transactional adjustments. Transactional adjustments include real property rights conveyed, financing terms, conditions of sale, expenditures made immediately after purchase, and market conditions.4 Transactional adjustments are made initially so that the comparable sales and the subject are on an equal basis prior to making adjustments for locational and physical differences. Since transactional adjustments are often quantifiable, this article, which deals with qualitative adjustments, focuses on location and physical characteristics and influences. As The Appraisal of Real Estate states, A major premise of the sales comparison approach is that an opinion of the market value of a property can be supported by studying the market’s reaction to comparable and competitive properties.5 Comparative analysis is the general term used to identify the process in the sales comparison approach in which quantitative and qualitative techniques are applied to comparable sales data to derive a value indication. An appraiser may use both quantitative adjustments and qualitative analysis in comparative analysis.6 The following discussion attempts to illustrate how qualitative analysis can lead to appropriately supported quantitative adjustments, both of which are recognized for use by the Appraisal Institute. Qualitative Analysis Framework To set the framework for this article, think of two jars filled with marbles of value. If each marble has the same value, the value of each jar can be determined by simply counting the number of marbles in the jars. If each marble is worth $1.00 and Jar A contains 50 marbles, it is less valuable than Jar B with 70 marbles. However, if the marbles have a different value based on their colors, Jar A can be more valuable than Jar B if it has a higher ratio of the more expensive colored marbles. Although the analytical process set forth herein can be used equally well when analyzing an improved property, as will be subsequently illustrated, the primary discussion is focused on an appraisal of a vacant parcel of land. With the few exceptions related to contaminated properties and other atypical conditions, every parcel of land has what may be referred to as a base value, just because it is a piece of real estate and some demand exists or it. The level of demand, coupled with available supply, is the primary driver of its base value. Clearly 1. James A. Graaskamp, The Appraisal of 25 N. Pickney: A Demonstration Case for Contemporary Appraisal Methods (Madison, WI: Landmark Research, Inc., 1977), 71–77. 2. These papers are available for review through the University of Wisconsin Digital Collections at http://uwdc.library.wisc.edu/collections/RealEstate /Graaskamp. 3. D. Richard Wincott, “An Alternative Sales Analysis Approach for Vacant Land Valuation,” The Appraisal Journal (Fall 2012): 310–317. 4. Appraisal Institute, The Appraisal of Real Estate, 14th ed. (Chicago: Appraisal Institute, 2013), 392, 405. 5. Ibid., 377. 6. Ibid., 396. 282 The Appraisal Journal, Fall 2014 Qualitative Analyses in the Sales Comparison Approach Revisited with all other things being equal, land prices rise and fall in concert with the pressures stemming from the interrelationships of supply and demand. Land parcels that are reasonably comparable and located in a given market area may have similar base values but sell for significantly different prices because they have observably different locational and physical attributes; these are what Graaskamp referred to as “price sensitive attributes.” The property’s physical attributes of prime importance to the market and the appraiser are its characteristics that may have been most important to the purchasers of the comparable sales and that may, in turn, be most important to a prospective purchaser. For an unimproved parcel of land, the most important physical attributes may be overall location, size, corner influence, topographic characteristics, exposure, the use permissible by zoning, etc. For an improved property, the most important attributes may be quality of construction, age and condition of the improvements, land-to-building ratio, visibility/exposure, overall location, occupancy at the time of sale, etc. In laying the groundwork for an additional understanding of qualitative analysis, follow the thought processes of prospective purchasers who have just been shown five single-family houses that meet their criteria and for which they have been prequalified. Upon returning to the broker’s office, the broker asks the prospective purchasers the expected question: “What do you think of the houses you looked at?” Suppose the responses were something on the order of Property 1 was okay; there were some things we liked and some that we didn’t; it may be worth considering. Property 2 absolutely did not interest us; the room layout and architectural style are not for us. Property 3 we didn’t like it too much; we’d probably put it toward the bottom of the list. Property 4 we thought it was outstanding; we liked everything about it. Property 5 impressed us very much; we liked it a lot, but not quite as much as Property 4. Based on these responses, qualitative ratings for the attribute of purchaser appeal can be assigned, using a ranking of excellent, good, average, fair, and poor: Property 1 Property 2 Property 3 Property 4 Property 5 Average Poor Fair Excellent Good Qualitative Analyses in the Sales Comparison Approach Revisited The five quality ratings of excellent, good, average, fair and poor generally encompass the spectrum of quality ratings most observers would assign to items being examined for relative levels of quality. Within the data set, including the appraised property, the attribute(s) of a property that stands out as being most superior would be rated excellent, and the attribute(s) that stands out as being most inferior would be rated poor. For those property attributes that are rather ordinary, being somewhere near the midpoint between the best and worst on the quality scale, a rating of average would be appropriate. If the attribute is better than average, but does not rise to the level of excellent, it would be rated good. Similarly, if the attribute is below average but does not deserve a rating of poor, it is assigned a quality level of fair. Now consider a simplistic view of two development sites, Parcel A of 50,000 square feet and Parcel B of 40,000 square feet. It is a given that with all other things being equal, Parcel A is more valuable, simply because it has a greater number of productive units in measure of square feet of land area. So, setting aside any differential in value per square foot attributed to the 10,000-square-foot difference in size, and with all other things being equal, if Parcel A recently sold for $500,000, it is reasonable to assume that Parcel B has a value of $400,000 since Parcel A sold at a price of $10.00 per unit (square feet). Now assume that Parcel A and Parcel B are equal in all other features except for location. With all other things being equal, it is reasonable to expect that the site with the superior location will be the more valuable. Consider that the characteristic of location is also comprised of units. Therefore, the site that has the superior location has more units of location than does the inferior site. Both sites have a highest and best use for commercial development. Parcel A is located on a secondary thoroughfare and lies adjacent to existing improvements that are not well maintained, whereas Parcel B is located on a heavily traveled thoroughfare in an area of recent development activity. Thus, since Parcel B has more units of superior location than Parcel A, its value per square foot of land area may reasonably be expected to be higher. In taking this analysis of comparables to extremes, enter Parcels C, D and E, each also having a highest and best use for commercial development. Parcel C is located on a major thoroughfare near the intersection of another major arterial street at the center of business The Appraisal Journal, Fall 2014 283 activity. Parcel D is located on a secondary street in a transitional area between commercial and residential uses. Parcel E is located on an important arterial street and is surrounded by stable, well-maintained commercial developments. On a quality rating or ranking scale of excellent, good, average, fair and poor, Parcel C is rated excellent, Parcel B is rated good, Parcel E is rated average, Parcel A is rated fair, and Parcel D is given a relative rating of poor. This qualitative analysis can be used in developing quantitative adjustments by assigning numerical values to the quality ratings according to the following scale: Excellent50 Good40 Average30 Fair20 Poor10 It is important to note that any range of numbers can be used as long as the spread between the numbers is the same, for example 25, 20, 15, 10, 5, or 100, 80, 60, 40, 20, or 5, 4, 3, 2, 1. Using the quality rating scale, if Parcel A, with a quality rating of fair and a point score of 20, sold for $10.00 per square foot, it also sold for the equivalent of $0.50 per square foot per quality rating score, assuming there were no other elements affecting value. Likewise, if Parcel B, with a quality rating of good and a point score of 40, sold for $15.00 per square foot, it sold for the equivalent of $0.375 per square foot per quality rating score. The average of the two sale prices per square foot per location quality rating score is $0.44 (rounded). Thus, with the recognized limitations of only two sales, and the assumption that there are no other elements affecting the value of the five properties, the data would indicate a value of $22.00 per square foot for Parcel C with quality rating of excellent ($0.44 x 50), $13.20 per square foot for Parcel E with a quality rating of average ($0.44 x 30), and $4.40 per square foot for Parcel D with a quality rating of poor ($0.44 x 10). This analytical process can be applied in everyday appraisal situations where the properties that must be analyzed have multiple attributes that affect value. It has been observed that most appraisers of commercial properties do not typically make more than five adjustments for locational and physical differences. Therefore, the following illustrations use the analysis of five primary attributes, including location. The illustrations are also based on the assumption 284 The Appraisal Journal, Fall 2014 that the cited prices of the comparable sales have been adjusted appropriately for transactional considerations, if necessary. Case Study Analysis of a Lakefront Lot Consider the appraisal of a lakefront lot on a large reservoir within a convenient distance of a major metropolitan area. The primary demand stems from retirement and weekend or recreational users. For a purchaser of a lakefront lot, it is reasonable to assume that the quality of the lake view is a major consideration. Therefore, with all other things being equal, it is reasonable to assume that a lakefront lot with an unobstructed view of the lake and an evening sunset is more valuable than a lot with only a partial view and no opportunities for an over-the-lake sunset or sunrise view. Thus, it may be safely concluded that lake view is an important attribute of lakefront lots. Reservoirs are constructed in areas that are ideally suited for such purposes, much of which is dictated by topographic conditions and availability of feeder creeks and drainage areas. Thus, topographic characteristics around a lake can range from gently sloping to somewhat dramatic slopes. While the lots with the steeper slopes often benefit from adjacent water depth, they usually entail extra development costs for site grading, extended piers, retaining walls, etc. Topographic characteristics have been considered as a price sensitive attribute. The amount of lake frontage is clearly an important attribute. When lake lots are fairly uniform in shape and depth, the sale price per linear foot of lake frontage may be the best unit of comparison. However, due to the irregularities of many shore lines and inconsistent lot sizes, the price per front foot may be inappropriate and unreliable. In those instances, the price per square foot is used and the extent of lake frontage is treated as a price sensitive attribute. As with residential properties in an urban neighborhood, the approach to the property may have a measurable impact on its value. In the case study, some lakefront areas have access via paved roads and pass through restricted subdivisions with attractive, well-maintained homes. At the other extreme are lakefront lots adjacent to subdivisions that originally permitted mobile homes with few, if any, restrictions; many of those mobile home units now are either poorly maintained or are vacant and in need of demolition or removal. Qualitative Analyses in the Sales Comparison Approach Revisited The operators of the lake/reservoir in question allow lakefront home owners to construct private boathouses adjacent to their lots, but the reservoir is not a constant level lake. Therefore, under drought conditions, which are not uncommon at this particular location, the lake level may fall six to seven feet, leaving some home owners with the inability to use their boats. Some lots are known as shallow water lots that are fine when the lake is full, but render boathouses unusable when the level falls three to four feet. Other lots are deep water lots that benefit from steeply declining lake bottoms or adjacency to old creek beds; these lots allow boathouse usage year round, even under most drought conditions. Realtors confirm that water depth adjacent to the lot is an important consideration in the minds of prospective lakefront home owners. Assume the appraisal of a lakefront lot on a reservoir with the conditions described. The appraiser has inspected the property, considered preliminary data on recent sales, and selected and confirmed the sale prices of six properties considered to be most comparable to the subject. Transactional adjustments have been made where necessary. What remains is the analysis of the locational and physical attributes. Following the inspection of the subject and the comparables, the appraiser has concluded that the five primary attributes affecting the sale prices of the comparable sales are quality of lake view, topographic characteristics, lakefront footage, approach, and water depth. Quality of Lake View The appraised property has a lake view that is well above average, effectively covering a range of about 120 degrees, but it does not have a direct over-the-lake view of either the sunset or sunrise. Comparable 1 is located on a promontory, has a lake view that is greater than 180 degrees and has an unobstructed view of the evening sunsets. Comparable 2 has a lake view that spans about 90 degrees and has only a spring and summer view of an over-the-lake sunrise. Comparable 3 is located on a cove that gives it lake frontage and water access, but its view of the open lake, per se, is very limited. Comparable 4 is also located on a cove, but the cove is larger and the view of the lake is slightly better than that of Comparable 3. Comparable 5 has an openwater view of the lake that spans about 100 degrees and Qualitative Analyses in the Sales Comparison Approach Revisited benefits from a variable view of the evening sunset. Comparable 6 is located on a cove that gives it both lake frontage and water access, but looks over a larger finger of the lake, as opposed to the lake itself. After inspecting the subject property and the comparable sales, the following quality ratings, which are relative among the data set, were indicated: Property Quality Rating Score Comparable 1 Excellent 50 Comparable 2 Average 30 Comparable 3 Poor 10 Comparable 4 Fair 20 Comparable 5 Good 40 Comparable 6 Fair 20 Subject Good40 Topographic Characteristics The subject property being appraised has gently sloping topography that should not present any unusual site preparation and construction problems; plus, it contains several mature native trees that add to the appeal of the lot. Comparable 1 has gently sloping features that should not present any construction difficulties, but does not benefit from the advantages of mature native trees. Comparable 2 has rather steep slopes at the building site and extra site work will be required at the time of construction; it has two large oak trees located outside of the building pad site. Comparable 3 has sloping topography but a level, construction-ready building site completed by a prior owner; it also has some native trees. Comparable 4 has gently sloping topography and some mature trees that add to its appeal. Comparable 5 has gently sloping topography but does not have any mature trees. Comparable 6 has rather rough topographic characteristics and only native scrub brush. After inspecting the appraised property and the comparable sales, the following quality ratings, which are relative to the data set, were considered appropriate: Property Quality Rating Score Comparable 1 Average 30 Comparable 2 Fair 20 Comparable 3 Excellent 50 Comparable 4 Good 40 Comparable 5 Average 30 Comparable 6 Poor 10 Subject Good40 The Appraisal Journal, Fall 2014 285 Lakefront Footage The appraised property has 90 feet of frontage on the lake line. The comparable sales have the following approximate linear feet of lake frontage: Comparable 1, 97 feet; Comparable 2, 85 feet; Comparable 3, 105 feet; Comparable 4, 59 feet; Comparable 5, 70 feet; and Comparable 6, 115 feet. The overall range of lake frontages is from a low of 59 feet to a high of 115 feet. The quality ratings for this attribute can be objectively developed by creating a rating scale similar to the following. Lakefront Linear Feet Quality Rating 50–64Poor 65–79Fair 80–94Average 95–109Good 110–124Excellent Thus, the comparable sales and the subject would be rated and scored as follows. Property Quality Rating Score Comparable 1 Good 40 Comparable 2 Average 30 Comparable 3 Good 40 Comparable 4 Poor 10 Comparable 5 Fair 20 Comparable 6 Excellent 50 Subject Average30 Approach The quality of the approaches to the subject property and the comparable sales is quite varied, ranging from Comparable 2 with a rather wide and fully improved access street through an established and well-maintained subdivision of newer to mid-life houses, to Comparable 6 with access via a narrow, asphalt paved but poorly maintained street through an older mobile home subdivision with vacant lots and poorly maintained units. Based upon the inspections of all properties, Comparable 2 is clearly deserving of the highest quality rating of excellent and Comparable 6 is clearly deserving of the lowest quality rating of poor. Access to the subject is through an older mobile home subdivision but the street is wider and has been well maintained. Comparable Sale Nos. 1 and 3 have paved access through traditional subdivisions with limited, but some signs of neglect. Comparable 4, like the subject, has access via a well-maintained street, but through an older and poorly maintained mobile 286 The Appraisal Journal, Fall 2014 home subdivision. Comparable 5 has paved access through mixed-quality residential areas that improve significantly in the vicinity of the property. After inspecting the subject property and the comparable sales, the following quality ratings were considered appropriate: Property Quality Rating Score Comparable 1 Average 30 Comparable 2 Excellent 50 Comparable 3 Average 30 Comparable 4 Fair 20 Comparable 5 Good 40 Comparable 6 Poor 10 Subject Fair20 Water Depth Detailed topographic maps are most helpful in analyzing the water depths at the probable location of a boathouse adjacent to the waterfront of the lot. When the subject lake is full, the water level is at an elevation of 325 feet mean sea level (MSL). To allow for a safety factor, the water depth at the location of the boathouse should be at a minimum of about three feet. Since the typical drought periods have not dropped the lake level by more than seven feet, a minimum water depth of ten feet is required for a reasonable expectation that boat usage will not be affected by normal fluctuations in the water level of the lake. The full-lake water depth at the probable location of a boathouse adjacent to the appraised lot is estimated to be approximately twelve feet. With this depth the subject property would clearly be deserving of the highest quality rating of excellent. Comparable Sale 3 has an approximate water depth of eleven feet and would also be rated excellent. Comparable Sale 5 has a full-lake water depth of only four feet and is clearly deserving of the lowest quality rating of poor. The approximate water depths of the remaining four properties were: Comparable 1, six feet; Comparable 2, five feet; Comparable 4, seven feet; and Comparable 6, nine feet. The quality ratings for the water depth attribute can be objectively developed by creating a rating scale similar to the following. Water Depth (in Feet) Quality Rating 3–4Poor 5–6Fair 7–8Average 9–10Good 11–+ Excellent Qualitative Analyses in the Sales Comparison Approach Revisited Thus, the comparable sales and the subject would be rated and scored as follows. Property Quality Rating Score Comparable 1 Fair 20 Comparable 2 Fair 20 Comparable 3 Excellent 50 Comparable 4 Average 30 Comparable 5 Poor 10 Comparable 6 Good 40 Subject Excellent50 Once the appropriate attributes have been selected and all properties have been analyzed accordingly, an adjustment grid can be created in a form similar to that of Table 1. The transactional adjustments for expenditures made immediately after purchase are excluded as being irrelevant for this property type and data set. The indicated value per square foot of the subject is derived by multiplying the average sale price per square foot per total point score by the subject’s total point score. Prior to any adjustments, the standard deviation of the six sale prices per square foot was 0.54519, and following all adjustments the standard deviation is notably lower at 0.39725. It should be noted that in the above analysis each attribute is of equal importance and carries the same weight, 20% for each of the five attributes. In reality, however, some of the attributes are more significant to the value of the property than others and their respective scores should carry a greater weight. However, while the quality ratings for each attribute may be assigned with a high degree of objectivity, the assignment of proportionate weights to the attributes may be arbitrary and subjective. For example, in the analysis of the above lake lots, Appraiser A might conclude that the most appropriate weights are as follows: quality of lake view - 50%; topographic characteristics - 10%; lakefront feet - 20%; approach 15%, and water depth - 5%. While Appraiser B assigns the same quality ratings and scores, concluding that the appropriate weights should be as follows: lake view - 20%; topographic characteristics - 15%; lakefront feet - 40%; approach - 5%; and water depth 20%. Furthermore, Appraiser C develops the opinion that the following weights are most appropriate: lake view - 35%; topographic characteristics - 5%; lakefront feet - 5%; approach - 50%; and water depth - 5%. The Qualitative Analyses in the Sales Comparison Approach Revisited resulting differences are shown in Table 2 for Appraiser A, Table 3 for Appraiser B, and Table 4 for Appraiser C. In the following procedures the total weighted point scores are divided into the adjusted sale prices per square foot to derive a sale price per square foot per weighted point score for each comparable sale, the average of which is multiplied by the subject’s weighted point score to develop the subject’s indicated value. Since the average of the sale prices per square foot per weighted point score is used to develop the indicated value for the subject, its reliability can be tested by using it as a predictor of the sale price of each comparable sale, which is obtained by multiplying the weighted point score of each respective sale property by the average of the sale prices per square foot per weighted point score. In Table 2 (Appraiser A), the results from this weighting process appear to be somewhat unreliable since only one of the six sales has a predicted price that is within 10% of the actual sale prices and four have a difference that exceeds 15%. In Table 3 (Appraiser B), the standard deviation of the adjusted sale prices per square foot following all adjustments is lower than that of Appraiser A in Table 2, but still higher than the standard deviation derived from the equal weight attributes in Table 1. Additionally, the results appear to be more reliable than those of Appraiser A since three of the sales have predicted prices that are within 10% of the actual sale price and two are within a range of about 12% to 13%. In Table 4 (Appraiser C), the standard deviation of the adjusted sale prices per square foot following all adjustments is materially higher than that of both Appraiser A and Appraiser B, and is significantly higher than the standard deviation derived from the equal weight attributes in Table 1. Additionally, the results appear to be unreliable since one of the predicted prices exceeds the actual sale price by more than 50%, one exceeds its actual sale price by about 46%, one falls short by about 36%, and one falls short by about 15%. Let the Market Select the Attribute Weights As the standard deviations from the previous three analyses indicate, the reliability of the resulting indication of value increases as the standard deviation declines. Since it is somewhat unlikely that the weighting of any single attribute would be greater than 50% and that increments of 5% are reasonable, an electronic spreadsheet can be created with all of the possible combinations of weights for five attributes between 5% The Appraisal Journal, Fall 2014 287 Table 1Comparable Sales Adjustment Grid, Analysis of Lot Sales with Equal Weight Attributes Element Sale 1 Sale 2 Sale 3 Sale 4 Sale 5 Sale 6 Sale price $51,000 $40,000 $58,000 $34,500 $45,000 $55,000 11,520 11,475 14,000 12,000 12,900 14,950 Size (sq. ft.) Sale price per sq. ft. Property rights Adjustment Adjusted sale price Financing terms Adjustment Adjusted sale price Conditions of sale Adjustment Adjusted sale price Subject $4.43 $3.49 $4.14 $2.88 $3.49 $3.68 Fee simple Fee simple Fee simple Fee simple Fee simple Fee simple 0 0 0 0 0 0 $51,000 $40,000 $58,000 $34,500 $45,000 $55,000 Cash Cash Cash Cash Cash Cash 0 0 0 0 0 0 $51,000 $40,000 $58,000 $34,500 $45,000 $55,000 Normal Normal Normal Normal Normal Normal 0 0 0 0 0 0 $51,000 $40,000 $58,000 $34,500 $45,000 $55,000 10/17/12 2/05/13 5/17/13 6/14/13 7/25/13 8/30/13 11,700 Fee simple Cash Market conditions Date of Sale Adjustment Adjusted sale price Adjusted price/sq. ft. Current +5.0% 0.0% 0.0% 0.0% 0.0% 0.0% $53,550 $40,000 $58,000 $34,500 $45,000 $55,000 $4.65 $3.49 $4.14 $2.88 $3.49 $3.68 Excellent Average Poor Fair Good Fair Good 50 30 10 20 40 20 40 Average Fair Excellent Good Average Poor Good Physical attributes Quality of lake view Scores Topographic characteristics Scores 30 20 50 40 30 10 40 Good Average Good Poor Fair Excellent Average Scores 40 30 40 10 20 50 30 Approach Average Excellent Average Fair Good Poor Fair Lakefront feet Scores 30 50 30 20 40 10 20 Water depth Fair Fair Excellent Average Poor Good Excellent Scores 20 20 50 30 10 40 50 170 150 180 120 140 130 180 $0.02735 $0.02327 $0.02300 $0.02400 $0.02493 $0.02831 Total scores Sale price per sq. ft. per total point score Average sale price/sq. ft./point score = Ind. subj. values/sq. ft. = $4.92 $0.02514 $4.19 Indicated value of the subject per sq. ft. = $4.14 $4.32 $4.49 Standard deviation of sale prices per sq. ft. prior to any adjustments = 0.54519 Standard deviation of sale prices per sq. ft. after transactional adjustments = 0.60898 Standard deviation of sale prices per sq. ft. after all adjustments = 0.39725 $5.10 $4.53 $4.53 Note: The indicated value per square foot for each comparable is derived by multiplying the subject’s total point score by the sale price per square foot per total point score of that comparable. The indicated value of the subject is derived by multiplying its total point score by the average sale price per square foot per total point score of the six comparable sales. 288 The Appraisal Journal, Fall 2014 Qualitative Analyses in the Sales Comparison Approach Revisited Table 2Comparable Sales Adjustment Grid with Attribute Weights Selected by Appraiser A Element Sale 1 Sale 2 Sale 3 Sale 4 Sale 5 Transactional adjusted sale price $53,550 $40,000 $58,000 $34,500 $45,000 $55,000 $4.65 $3.49 $4.14 $2.88 $3.49 $3.68 50 30 10 20 40 20 40 25.00 15.00 5.00 10.00 20.00 10.00 20.00 30 20 50 40 30 10 40 3.00 2.00 5.00 4.00 3.00 1.00 4.00 40 30 40 10 20 50 30 8.00 6.00 8.00 2.00 4.00 10.00 6.00 30 50 30 20 40 10 20 4.50 7.50 4.50 3.00 6.00 1.50 3.00 20 20 50 30 10 40 50 Adjusted price/sq. ft. Physical Attributes 50% Topographic characteristics – scores Weights/weighted pt. scores 10% Lakefront feet – scores Weights/weighted pt. scores 20% Approach – scores Weights/weighted pt. scores 15% Water depth – scores Weights/weighted pt. scores Total weighted scores Subject Weights Quality of lake view – scores Weights/weighted pt. scores Sale 6 5% 1.00 1.00 2.50 1.50 0.50 2.00 2.50 100% 41.50 31.50 25.00 20.50 33.50 24.50 35.50 Sale price per sq. ft. per weighted point score $0.11205 $0.11079 $0.16560 $0.14049 $0.10418 $0.15020 Average sale price/sq. ft./point score = $0.13055 Indicated value of the subject per sq. ft. = Adjusted indicated values of subject/sq. ft. = $3.98 $3.93 $5.88 $4.99 $3.70 $5.33 Predicted prices of the comparable sales = $5.42 $4.11 $3.26 $2.68 $4.37 $3.20 16.51% 17.83% −21.17% % Difference of predicted price to actual price = Standard deviation of sale prices per sq. ft. after transactional adjustments = Standard deviation of sale prices per sq. ft. after all adjustments = −7.07% $4.63 $4.63 25.31% −13.08% 0.60898 0.88984 Note: The percentage differences may not correspond precisely to the numbers shown due to lack of rounding in the calculation of the predicted prices. Example, Sale 1 ($5.42 - $4.65)/$4.65 = 16.56%. Table 3Comparable Sales Adjustment Grid with Attribute Weights Selected by Appraiser B Element Sale 1 Sale 2 Sale 3 Sale 4 Sale 5 Transactional adjusted sale price $53,550 $40,000 $58,000 $34,500 $45,000 $55,000 $4.65 $3.49 $4.14 $2.88 Adjusted price/sq. ft. Physical Attributes 50 30 10 20 40 20 40 10.00 6.00 2.00 4.00 8.00 4.00 8.00 30 20 50 40 30 10 40 15% 4.50 3.00 7.50 6.00 4.50 1.50 6.00 40 30 40 10 20 50 30 40% 16.00 12.00 16.00 4.00 8.00 20.00 12.00 30 50 30 20 40 10 20 5% 1.50 2.50 1.50 1.00 2.00 0.50 1.00 20 20 50 30 10 40 50 20% 4.00 4.00 10.00 6.00 2.00 8.00 10.00 36.00 27.50 37.00 21.00 24.50 34.00 37.00 Lakefront feet – scores Weights/weighted pt. scores Approach – scores Weights/weighted pt. scores Water depth – scores Weights/weighted pt. scores Total weighted scores $3.68 20% Topographic characteristics – scores Weights/weighted pt. scores Subject Weights Quality of lake view – scores Weights/weighted pt. scores $3.49 Sale 6 100% Sale price per sq. ft. per weighted point score $0.12917 $0.12691 $0.11189 $0.13714 $0.14245 $0.10824 Average sale price/sq. ft./point score = $0.12597 Adjusted indicated values of subject/sq. ft. = Predicted prices of the comparable sales = % Difference of predicted price to actual price = $4.78 Indicated value of the subject per sq. ft. = $4.70 $4.14 $5.07 $5.27 $4.00 $4.53 $3.46 $4.66 $2.65 $3.09 $4.28 −2.47% −0.74% 12.58% −8.15% −11.57% 16.39% Standard deviation of sale prices per sq. ft. after transactional adjustments = Standard deviation of sale prices per sq. ft. after all adjustments = Qualitative Analyses in the Sales Comparison Approach Revisited $4.66 $4.66 0.60898 0.50191 The Appraisal Journal, Fall 2014 289 Table 4Comparable Sales Adjustment Grid with Attribute Weights Selected by Appraiser C Element Sale 1 Sale 2 Sale 3 Sale 4 Sale 5 Transactional adjusted sale price $53,550 $40,000 $58,000 $34,500 $45,000 $55,000 $4.65 $3.49 $4.14 $2.88 $3.49 $3.68 50 30 10 20 40 20 40 17.50 10.50 3.50 7.00 14.00 7.00 14.00 30 20 50 40 30 10 40 1.50 1.00 2.50 2.00 1.50 0.50 2.00 40 30 40 10 20 50 30 2.00 1.50 2.00 0.50 1.00 2.50 1.50 30 50 30 20 40 10 20 15.00 25.00 15.00 10.00 20.00 5.00 10.00 20 20 50 30 10 40 50 Adjusted price/sq. ft. Physical Attributes 35% Topographic characteristics – scores Weights/weighted pt. scores 5% Lakefront feet – scores Weights/weighted pt. scores 5% Approach – scores Weights/weighted pt. scores 50% Water depth – scores Weights/weighted pt. scores Total weighted scores 5% 1.00 1.00 2.50 1.50 0.50 2.00 2.50 100% 37.00 39.00 25.50 21.00 37.00 17.00 30.00 Sale price per sq. ft. per weighted point score $0.12568 $0.08949 $0.16235 $0.13714 $0.09432 $0.21647 Average sale price/sq. ft./point score = $0.13758 Indicated value of the subject per sq. ft. = Adjusted indicated values of subject/sq. ft. = $3.77 $2.68 $4.87 $4.11 $2.83 $6.49 Predicted prices of the comparable sales = $5.09 $5.37 $3.51 $2.89 $5.09 $2.34 % Difference of predicted price to actual price = 9.47% 53.74% −15.26% Standard deviation of sale prices per sq. ft. after transactional adjustments = Standard deviation of sale prices per sq. ft. after all adjustments = and 50% that add up to a total of 100%. It appears that the total number of possible combinations is 3,238. To illustrate the possibilities, any combination of weights that contains five different numbers can be arranged in 120 different positions, such as (5%, 15%, 20%, 25%, 35%), or (15%, 20%, 25%, 35%, 5%), or (20%, 25%, 35%, 5%, 15%), and on and on for a total of 120 different positions. The same applies to 5%, 10%, 20%, 25%, 40%, etc. With the database created, an electronic spreadsheet can be built that uses each one of the 3,238 different combinations of weights, then calculates the sale price per square foot (or other unit) per weighted point score, and calculates the standard deviation in each iteration. The combination of weights for each of the five attributes that results in the lowest standard deviation in the sale prices per unit per weighted point score is the combination that most closely predicts the actual sale prices of the comparable sales used. If the analysis can predict the actual sale prices of the comparable sales with a reasonable degree of accuracy, it is then fair to conclude that it can produce a reasonably reliable indication of value for the appraised property. By testing the multiple combinations of weights on the selected attributes and quality rating scores 290 Subject Weights Quality of lake view – scores Weights/weighted pt. scores Sale 6 The Appraisal Journal, Fall 2014 0.32% $4.13 $4.13 45.86% −36.44% 0.60898 1.41752 as used in the preceding four tables, the marketindicated weights are: quality of lake view - 35%; topographic characteristics - 15%; lakefront footage - 25%; approach - 5%; and water depth - 20%. The results of the analysis and the indicated value of the subject property are shown in Table 5. With the application of the market-selected weights to each of the five property attributes, the standard deviation of the adjusted sale prices per square foot is a modest 0.06085 and the reliability of the results appears to be quite high since the predicted prices are all within 2% of the actual sale prices. Given its total weighted point score of 38.50, it is indicated that the appraised property is superior to all of the comparable sales. It is noted that if the sale prices per square foot and the weighted point scores are used in a regression analysis, the indicated value of the subject property is approximately $4.80 per square foot, as reflected in Figure 1. The coefficient of determination (R­2) is 0.996387. In lieu of a database with 3,238 combinations of weights that can be tested for the most appropriate fit, appraisers can create a spreadsheet similar to that used in Tables 2, 3, and 4 and first enter the quality Qualitative Analyses in the Sales Comparison Approach Revisited Table 5Comparable Sales Adjustment Grid with Market-Generated Attribute Weights Element Sale 1 Sale 2 Sale 3 Sale 4 Sale 5 Transactional adjusted sale price $53,550 $40,000 $58,000 $34,500 $45,000 $55,000 $4.65 $3.49 $4.14 $2.88 $3.49 $3.68 50 30 10 20 40 20 40 17.50 10.50 3.50 7.00 14.00 7.00 14.00 30 20 50 40 30 10 40 4.50 3.00 7.50 6.00 4.50 1.50 6.00 40 30 40 10 20 50 30 10.00 7.50 10.00 2.50 5.00 12.50 7.50 30 50 30 20 40 10 20 1.50 2.50 1.50 1.00 2.00 0.50 1.00 20 20 50 30 10 40 50 Adjusted price/sq. ft. Physical Attributes 35% Topographic characteristics – scores Weights/weighted pt. scores 15% Lakefront feet – scores Weights/weighted pt. scores 25% Approach – scores Weights/weighted pt. scores 5% Water depth – scores Weights/weighted pt. scores Total weighted scores Subject Weights Quality of lake view – scores Weights/weighted pt. scores Sale 6 20% 4.00 4.00 10.00 6.00 2.00 8.00 10.00 100% 37.50 27.50 32.50 22.50 27.50 29.50 38.50 Sale price per sq. ft. per weighted point score $0.12400 $0.12691 $0.12738 $0.12800 $0.12691 $0.12475 Average sale price/sq. ft./point score = $0.12633 Indicated value of the subject per sq. ft. = Adjusted indicated values of subject/sq. ft. = $4.77 $4.89 $4.90 $4.93 $4.89 $4.80 Predicted prices of the comparable sales = $4.74 $3.47 $4.11 $2.84 $3.47 $3.73 % Difference of predicted price to actual price = 1.88% −0.46% −0.83% −1.30% −0.46% 1.27% Standard deviation of sale prices per sq. ft. after transactional adjustments = 0.60898 Standard deviation of sale prices per sq. ft. after all adjustments = 0.06085 $4.86 $4.86 Figure 1 Lakefront Lot Sales Regression Line with Intercept Sale Prices per Square Foot 5.00 4.50 R2 = 0.9964 4.00 3.50 3.00 2.50 2.00 20.00 25.00 30.00 Weighted Point Scores ratings and respective scores for each attribute. After having done so, the appraiser can select four or five best-thought combinations of weights for the five attributes, and then calculate the standard deviations Qualitative Analyses in the Sales Comparison Approach Revisited 35.00 40.00 of the sale prices per square foot per weighted point score. The combination of weights producing the lowest standard deviation is the one that would develop the best indication of value for the subject property. The Appraisal Journal, Fall 2014 291 Case Study Application of the Attribute Scoring System to an Improved Property The following illustration demonstrates how the attribute scoring system applies equally well to the analysis of an improved property, in this case a strip shopping center, as to a parcel of unimproved land. While the chosen attributes for the comparable sales and the subject are identified, the selections of the quality ratings are somewhat summarized for the sake of brevity. The pertinent information on the comparable sales and the subject are provided in Table 6. This table reflects the sale prices of each property prior to various transactional adjustments required for rent losses and lease-up costs, conditions of sale, and market conditions. In Table 7, the cited sale prices in row 2 were obtained after having made the required transactional adjustments. Table 6Comparable Sale Summary Data for Strip Shopping Center Date of Sale Actual Sale Price Year Built GLA* (sq. ft.) Land/Bldg. Ratio Occupancy 1 Mar 24, 2011 $3,000,000 2000 18,900 5.82 95.0% $158.73 2 Aug 2, 2011 $1,950,000 1996 16,570 5.23 85.0% $117.68 3 Jan 13, 2012 $4,700,000 1998 36,721 4.33 85.0% 4 Feb 23, 2012 $2,200,000 2007 19,692 4.41 5 Dec 12, 2012 $2,813,500 1999 16,718 6 May 6, 2013 $3,675,000 1984 48,290 1997 1995 26,149 17,129 Sale Averages Subj. Current Sale Price/ Stab. GLA EGIM† Stab. OAR‡ Net Income Ratio 7.17 9.10% 65.22% 6.79 9.88% 67.09% $127.99 7.70 8.78% 67.59% 76.0% $111.72 7.14 9.51% 67.86% 4.60 96.0% $168.29 7.54 9.18% 69.23% 3.61 65.7% $76.10 6.62 9.80% 64.91% 4.67 4.59 83.8% 93.6% $126.75 7.16 9.38% 66.98% * Gross leaseable area † Effective gross income multiplier ‡ Overall capitalization rate Table 7 Comparable Sales Adjustment Grid for Improved Property—A Strip Shopping Center Element Sale 1 Transactional adjusted sale price $174.60 $150.86 $135.82 $132.77 $168.29 $82.32 30 20 10 50 10 40 3.00 2.00 1.00 5.00 1.00 4.00 50 40 20 20 30 10 30 20% 10.00 8.00 4.00 4.00 6.00 2.00 6.00 40 30 30 50 30 10 30 20% 8.00 6.00 6.00 10.00 6.00 2.00 6.00 30 20 30 10 20 30 40 15% 4.50 3.00 4.50 1.50 3.00 4.50 6.00 30 30 30 30 40 20 30 35% 10.50 10.50 10.50 10.50 14.00 7.00 10.50 32.50 Quality of construction – scores Weights/weighted pt. scores Subject 30 Exposure/accessibility – scores Weights/weighted pt. scores Sale 6 3.00 Age and condition – scores Weights/weighted pt. scores Sale 5 10% Land-to-building ratios – scores Weights/weighted pt. scores Sale 4 Weights Overall location – scores W eights/weighted pt. scores Sale 3 $3,300,000 $2,499,750 $4,987,500 $2,614,500 $2,813,500 $3,975,000 Adjusted price per sq. ft. Physical Attributes Sale 2 Total weighted scores 100% Sale price per sq. ft. per weighted point score 36.00 30.50 27.00 27.00 34.00 16.50 $4.85000 $4.94623 $5.03037 $4.91741 $4.94971 $4.98909 Average sale price/sq. ft./point score = $4.94714 Adj. indicated values of subject/sq. ft. = $157.63 $160.75 $163.49 $159.82 $160.87 $162.15 Predicted prices comparable sales % Difference of predicted price to actual price = $178.10 $150.89 $133.57 $133.57 $168.20 $81.63 2.00% 0.02% −1.65% 0.60% −0.05% −0.84% Indicated value of the subject per sq. ft. = Standard deviation of sale prices per sq. ft. of GLA after transactional adjustments = Standard deviation of sale prices per sq. ft. of GLA after all adjustments = 292 The Appraisal Journal, Fall 2014 $160.78 $160.78 33.19196 2.00420 Qualitative Analyses in the Sales Comparison Approach Revisited Types of Attributes After inspecting each comparable property and the subject, the appraiser concluded that the most important attributes affecting value were overall location, land-to-building ratio, age and condition, exposure/ accessibility, and quality of construction. Overall Location. Surrounding demographic characteristics and the quality and nature of existing developments in the immediate neighborhood of each property are considered. The most appropriate location quality ratings were as follows: Property Quality Rating Score Comparable 1 Average 30 Comparable 2 Average 30 Comparable 3 Fair 20 Comparable 4 Poor 10 Comparable 5 Excellent 50 Comparable 6 Poor 10 Subject Good40 Land-to-Building Ratios. The land-to-building ratios for the comparable sales and the subject range from a low of 3.61:1 to a high of 5.82:1. The quality ratings for this attribute can be objectively developed by creating a rating scale as follows. Land/Building Ratios Quality Rating 3.5–3.99 Poor 4.0–4.49Fair 4.5–4.99Average 5.0–5.49Good 5.50–5.99 Excellent Thus, the comparable sales and the subject would be rated and scored as follows. Property Quality Rating Score Comparable 1 Excellent 50 Comparable 2 Good 40 Comparable 3 Fair 20 Comparable 4 Fair 20 Comparable 5 Average 30 Comparable 6 Poor 10 Subject Average30 Age and Condition. The dates of construction of the comparable sales ranged from 1984 to 2007, and the average date was 1997; the construction date of the Qualitative Analyses in the Sales Comparison Approach Revisited subject was 1995. The following scale has been used as a guide in the analysis of the aspects of age and condition. Refinements are made, when necessary, based on observed physical condition. Date of Construction 1984–1989 1990–1994 1995–1999 2000–2004 2005–2009 Quality Rating Poor Fair Average Good Excellent Given this scale, the comparable sales and the subject would be rated and scored as follows. Property Quality Rating Score Comparable 1 Good 40 Comparable 2 Average 30 Comparable 3 Average 30 Comparable 4 Excellent 50 Comparable 5 Average 30 Comparable 6 Poor 10 Subject Average30 Exposure/Accessibility. Based on careful observation of the relevant aspects of each comparable and the subject, the following quality ratings for exposure/ accessibility were considered reasonably appropriate. Property Quality Rating Score Comparable 1 Average 30 Comparable 2 Fair 20 Comparable 3 Average 30 Comparable 4 Poor 10 Comparable 5 Fair 20 Comparable 6 Average 30 Subject Good40 Quality of Construction. After on-site inspections of the comparable sales and the subject, the appraiser concluded that the construction quality ratings set forth below were reasonably appropriate. Property Quality Rating Score Comparable 1 Average 30 Comparable 2 Average 30 Comparable 3 Average 30 Comparable 4 Average 30 Comparable 5 Good 40 Comparable 6 Fair 20 Subject Average30 The Appraisal Journal, Fall 2014 293 Given the above analyses of the comparable sales and the subject, and after the attribute weights were tested for the most appropriate fit, the indicated value of the appraised property has been developed in Table 7. With the market-generated attribute weights, the reliability of the resulting indication of value appears to be quite high since all six of the predicted prices are within 5% of the actual sale prices, and the highest difference is only 2%. When a linear regression analysis is performed using the sale prices per square foot and the weighted point scores, the resulting R2 is 0.997708 and the indicated value of the subject is $159.96 per square foot. Conclusions The author of this article is well aware that many fellow appraisers do not advocate the use of qualitative adjustments when analyzing comparable sales, and many review appraisers will not accept appraisals that rely upon qualitative adjustments. But they should reconsider. After all, qualitative comparisons are a reality of the market which the appraiser seeks to simulate. Whole dollar and percentage adjustments for differences are grounded in paired sales analyses. However, there are typically too many differences in the various value-influencing characteristics of a package of five or six comparable sales to reliably extract each adjustment required. Consequently, many of the quantitative adjustments that are used stem from the best-guess estimates of the analyst. It would seem that the most appropriate analysis is one that generally replicates or simulates the actions of buyers and sellers in the market, and that is one of qualitative analysis, rather than positive and negative quantitative adjustments. The objective of analyzing comparable sales is to allow the sales to guide the analyst in forming an opinion of reasonable value for the property being appraised. The sale price of a comparable sale may be viewed as a base value that has been shaped by the interactions of each of the primary attributes with the relative quality level of that attribute. While analysts can objectively rate the quality levels, they cannot objectively select the attribute weights if a weighting of the attributes is to be used. Appraisers can put the marbles in the jars (the quality rating scores), but they cannot assign values to the colors (the weights of each primary attribute). That is done by the market. Appraisers can, however, refine their analysis by testing some of the most reasonable combinations of attribute weights after analyzing the properties in the data set. A final comment is in order. Even if the weighting of the attributes is not used in the analysis and each attribute is allowed to bear an equal weight, the results are likely to be better market-supported, and superior to the application of positive and negative quantitative adjustments since the analyst simulates the interactions of the market and has a better opportunity to develop and assign objective quality ratings during the analysis of the subject property and comparable sales. Gene Rhodes, MAI, received his designation from the American Institute of Real Estate Appraisers in 1975 and served as president of North Texas Chapter 17 in 1987. Rhodes is head of Gene Rhodes & Associates, a commercial real estate appraisal firm based in Addison (Dallas), Texas. Having previously served as an officer with the Henry S. Miller Appraisal Corporation and the Appraisal & Consulting Services Group of Grubb & Ellis Co., Rhodes has appraised a wide range of major commercial, industrial, and multifamily properties throughout Texas. He is a previous contributor to The Appraisal Journal. Rhodes is a state certified general real estate appraiser in Texas, and he received a BBA degree from Texas State University. Contact: gene.rhodes@sbcglobal.net Web Connections Internet resources suggested by the Y. T. and Louise Lee Lum Library Analyze The Market! Qualitative vs. Quantitative http://appraisalnewsonline.typepad.com/appraisal_news_for_real_e/2009/09/analyze-the-market-qualitative-vs -quantitative-.html Qualitative Analysis vs. Quantitative Analysis http://www.waao.org/Meetings/2014/Class_Documents/REVISED_2014_Quant_vs_Qual_Analysis.pdf Qualitative vs. Quantitative Adjustments http://www.bbrec.com/attachments/articles/49/q%20adj.pdf 294 The Appraisal Journal, Fall 2014 Qualitative Analyses in the Sales Comparison Approach Revisited