Building Capacity for the Future

advertisement

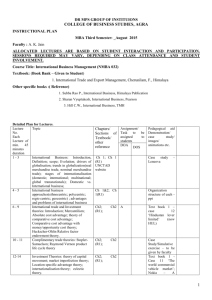

Building Capacity for the Future Capital Hilton August 6-7, 2015 Thursday, August 6 2:00- 5:00 p.m. Registered Programs-Firms Meetings Congressional/Senate & Federal A/B Meetings will be scheduled by CFP Board based on preferences of firms and Registered Programs. Each firm will be assigned a booth(s) to use for meetings held during the 2:00 - 5:00 p.m. window. Each firm will meet with representatives from 6-10 Registered Programs. Exhibits Interactive Career Center Lab *Each attendee will have individualized schedule that will include both exhibit time as well as time with Career Center Lab ------------------------------------------------------------------------------5:15- 6:15 p.m. General Session sponsored by Wiley Presidential Ballroom Registration Criteria, CCI Reports, and Program Sustainability Dr. Charles Chaffin, CFP Board Director of Academic Programs and Initiatives Dr. Chaffin will discuss a variety of initiatives related to CFP Board Registered Programs, including self-assessment data related to registration renewal, Certification Completion Initiative Institutional Reports, and avenues for improving student achievement and program sustainability for all program types and delivery methods. -------------------------------------------------------------------------------------6:15-7:30 p.m. Capital Terrace Reception ------------------------------------------------------------------------------- Friday, August 7 7:00-8:00 a.m. Congressional/ Senate Breakfast 8:00-9:00 a.m. General Session Presidential Ballroom Retention Project Dr. Walt Woerheide, CFP®, The American College Joyce Schnur, CFP®, Kaplan School of Continuing and Professional Education Jason Hovde, CFP®, College for Financial Planning Dr. Charles Chaffin, CFP Board This session will focus on the multi-year retention project between The American College, College for Financial Planning, Kaplan, and CFP Board. This effort has focused upon identifying avenues for improving student completion within the certificate programs at these three institutions. The panel will also present the findings of a study that focused upon students who have not completed their programs with the objective of broader implications to both certificate as well as degree programs. Statler AB Firms Only Session: Ways to Leverage CFP Board’s Partnerships with Registered Programs Dr. John Grable, CFP®, University of Georgia Kathy Oakley, CFP®, Rice University Harry Starn, Jr., CFP®, California Lutheran University Moderated by CFP Board’s Managing Director of Marketing and Corporate Relations, Joseph Maugeri, CFP®, this panel will host the leaders of several Registered Programs and discuss the opportunities firms have to leverage CFP Board’s Registered Programs for high quality talent. ------------------------------------------------------------------------------- 9:15 a.m.-10:00 a.m. General Session Presidential Ballroom Session with CFP Board’s Leadership Rich Rojeck, CFP® / Kevin Keller CFP Board’s CEO, Kevin Keller, and board chair, Rich Rojeck, CFP® will share thoughts on the important partnership between CFP Board and our CFP Board Registered Programs, highlighting opportunities to achieve specific outcomes that will further our shared goals of preparing the next generation of CFP® professionals and establishing financial planning as a recognized profession. ------------------------------------------------------------------------------- 10:15-11:00 a.m. General Session Presidential Ballroom Opportunity in the Marketplace John Loper, CFP®, CFP Board Director of Corporate Relations Jennifer Phillips, Vanguard Matt Ransom, CFP®, Raymond James Jeff Wood, Bank of America Merrill Lynch This panel discussion will involve representatives from several firms, representing various business models present in today’s marketplace. Moderated by John Loper, CFP®, CFP Board’s Director of Corporate Relations, the discussion will center on how the business models differ, as well as the opportunities firms provide to graduates joining the industry. ------------------------------------------------------------------------------11:15-12:00 p.m. General Session Presidential Ballroom Center for Financial Planning ------------------------------------------------------------------------------12:15-1:15p.m. Lunch Congressional/Senate ------------------------------------------------------------------------------1:15-2:00 p.m. Concurrent Sessions CFP® Certification Examination Updates: Job-Task Analysis, Exam Development, and Computer-Based Testing Dr. Isabelle Gonthier, CFP Board Director, Examinations In this presentation, an update on the 2015 Job-Task Analysis (JTA) will be provided, highlighting the process followed to complete the JTA and key outcomes. Information will be presented on the process used to develop new examination content for the CFP® Certification Examination, in light of the changes from the JTA. Key item development principles will be outlined, from item-writing procedures, including examples of different types of items, to item analysis and item banking. Hosting a Financial Planning Career Day Dr. Benjamin Cummings, CFP®, Saint Joseph’s University In January 2015, Saint Joseph’s University and the Financial Planning Association (FPA) Philadelphia Tri-State Area chapter hosted the first Financial Planning Career Day in Philadelphia. Over 50 students and career changers interviewed with nearly 20 firms for both full-time and internship positions. Financial planning students from programs across the region attended to meet with practitioners and to interview for internships and entry-level positions. Students also received career advice about preparing for and entering the profession. Not only do students benefit from a Career Day, hosting a Career Day is also a fantastic way to raise the profile of the financial planning program on campus, generate buzz about financial planning throughout the community, and raise awareness of the financial planning program among firms who are looking for young talent. Many financial planning firms have a small staff and hire infrequently and/or in small numbers. In addition, they are looking for students with specialized knowledge, so traditional campus Career Fairs are not an effective way for them to meet financial planning students. Statler AB Firms Only Session: Best Practices in Career Pathing Scott Allison, CFP®, USAA Mark Craig, Charles Schwab Matt Doran, CFP®, Edward Jones Moderated by John Loper, CFP®, CFP Board’s Director of Corporate Relations, this session will take a closer look at some of the industry’s best practices in career pathing. ------------------------------------------------------------------------------- 2:15-3:00 p.m. Concurrent Sessions FPA Student Program: Building the Foundation for Future Leaders Dr. Martha Alexander, Financial Planning Association Derek Klock, Virginia Tech The future rests with new planners coming into the profession and to those providing resources and programming to help them jump-start and advance in their careers. The Financial Planning Association® (FPA®) is committed to help shape this future. FPA will share ideas on opportunities to prepare the next generation of financial planners through diverse education, relationship building and volunteer opportunities. In addition, Virginia Tech will provide best practices and tips on working with FPA to help your students succeed. Top Ten Tips for Building Capacity in the Financial Planning Profession Dr. Vicki Hampton, CFP®, Texas Tech University This session takes a high-level view the 2015 conference theme, incorporating six items provided to guide paper submissions. Numerous ideas/examples will be detailed regarding: attracting students, retaining students and transitioning students to professionals. Improving your Certification Completion Initiative (CCI) Reports Dr. Kristine Beck, California State University – Northridge Rich Burnes, UCLA Extension Dr. Ruth Lytton, Virginia Tech Stephen Wetzel, CFP® New York University Statler AB Firms Only Session: Best Practices in Recruiting Dr. Lisa Andrews, CFP Board Career Services Manager Shannon Carlson, Financial Finesse Nilesh Parikh, UBS Joseph Maugeri, CFP®, CFP Board’s Managing Director of Marketing and Corporate Relations, will moderate a panel of firms to discuss best practices and tips for recruiting high quality talent. ------------------------------------------------------------------------------- 3:15-4:00 p.m. Concurrent Sessions Assurance of Learning across the Curriculum Dr. Benjamin Cummings, CFP®, Saint Joseph’s University At Saint Joseph’s University, we strive to be the leading educator in financial planning in the Philadelphia area. As Philadelphia’s Jesuit Catholic university, we strive to help our financial planning students prepare to be of service to others and to act with their future clients’ best interest in mind. We hope that our emphasis on cura personalis will translate into a fulfilling career of helping others use their financial resources to support their life’s ambitions. With this end in mind, we want to assure that learning is taking place throughout our financial planning curriculum. As such, we reviewed our financial planning curriculum this year, in order to align our overarching curricular learning objectives to broad learning goals. After identifying our primary learning objectives, we developed a plan to assess these learning objectives across the curriculum, from our introductory class to our capstone course. The primary objective of this approach is to assure student learning, and this approach allows us to assess our curriculum, our courses, and our assessments within our courses to make sure we are accomplishing our broad learning goals. Best Practices in “Personal Finance 101: The Gateway Course to the Profession Andrew Head, CFP® Western Kentucky University Suzanne M. Gradisher, University of Akron To create more CFP® Certificants, there must first be more financial planners. For there to be a greater number of financial planners, there must be more among us who see the wisdom in having greater control over our finances. Certainly, in the absence of national consumer and financial education requirements, higher education curriculum must ideally include a course in general Personal Finance. A primary avenue for industry, as well as program enrollment growth is the ‘Personal Finance 101’ course. It is in this introductory, yet potentially life-altering course that financial planning instructors have the attention of a diverse group of students, many of whom have never once been made aware of the fact that ‘Financial Planner’ is an employable professional advisor, let alone a career choice. In this course fires are lighted for people to take control of their lives. Many times that fire burns bright enough to inspire people to make a career of helping others find that same sense of financial balance. The purpose of this session will be to discuss best practices and executable ideas pertaining to implementation, structure and management of a university-level Personal Finance course. National Association of Personal Financial Advisors (NAPFA) Session “The next generation: what can we do to help?” – Conversations with young Fee-Only Advisors, current students, Fee-Only principals, and Program Directors whom teach the Fee-Only option to their students Dr. Ann Coulson, CFP®, Kansas State University Sue Slowinski, CFP®, NAPFA NAPFA conducted an in-depth survey of early practicing Fee-Only Advisors, degree seeking and CFP® certification seeking students, CFP® Program Directors, and Fee-Only firm owners to find out: How the profession has changed as far as the needs and opportunities to new advisors? What will it take for new graduates to go the Fee-Only route? Are new advisors planning to join an already established firm or start their own firm? What can NAPFA do to help?