Individual Named Insured Endorsement – CA 99 17

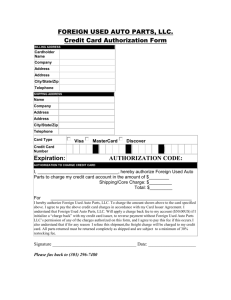

advertisement

Individual Named Insured Endorsement – CA 99 17 By David Thompson, CPCU When a business auto policy (BAP) names an individual as named insured ISO rules 91.B. and 88.A.1 require that the Individual Named Insured (INI) endorsement be added to the policy. There is no premium charge for this endorsement, and once attached to the BAP the INI provides liability and physical damage coverage similar to that found in the personal auto policy (PAP). While INI is non-premium bearing and mandatory, its use may be subject to company underwriting. This article summarizes the coverage provided by the INI endorsement. Eligibility for INI is those risks where an individual is a named insured. In situations where only an individual is the named insured on the BAP it’s appropriate to use INI. Likewise, if an individual and another entity (corporation, partnership, LLC) is also named then the use of INI is still appropriate. The main feature of INI is that it adds PAP type liability and physical damage coverage for the person named, spouse, and resident family members. INI also deletes the “fellow employee” exclusion found in the BAP. While INI is added any time an individual is a named insured, the broader PAP type coverage provided in the endorsement is triggered only when: A private passenger auto is covered by the BAP; or A pick-up or van not used for business purposes is covered by the BAP For example, if the BAP covered 35 dump trucks the broader PAP type coverage would not apply. If there were 35 dump trucks and one private passenger auto owned by the person named in the INI schedule the broader coverage does apply. The “fellow employee” exclusion is always eliminated, regardless of the type vehicle insured. The following changes are provided in the BAP when INI is triggered: Liability coverage: The spouse and resident family members are provided coverage for the following situations, which are similar to coverage provided by the PAP for the use of: 1. Any private passenger type auto owned by the named insured(s); and 2. Any auto not owned by the named insured or resident family member. An example of item #2 would be a spouse or resident child borrowing a neighbor’s car, or renting an auto from a firm such as Hertz or Avis. Note too, that the non-owned auto could include a larger vehicle used for personal purposes, such as the rental of a U-haul box truck to move personal belongings into a new residence. Exclusions under liability coverage include: 1. An auto owned by the person named or any resident family member if the auto is not shown on the BAP. 2. An auto furnished or available for the regular use of the person named or resident family member. 3. An auto used in the car business, such as service or repair of autos. 4. Any non-private passenger type auto (pick-up, van, box truck, etc.) used in business, such as a rented U-haul used for business purposes. Physical damage: For this coverage to apply at least one private passenger auto must be covered for physical damage under the BAP. Coverage applies for a “non-owned auto” which is defined to be a private passenger auto, pick-up, van, or trailer not owned by or furnished or available for the regular use of the person named, spouse, or family member. For example, a rented Avis Ford Mustang would be covered, but a rented U-haul box truck would not. An internal limit of $500 applies for damage to any non-owned auto which is a trailer. Medical payments: The INI does not affect medical payments coverage. If the BAP includes medical payments (it must be added via CA 99 03) and if the named insured is an individual then that individual’s spouse and resident family members are covered while occupying any auto and as a pedestrian if struck by an auto. Uninsured motorist: Like medical payments coverage, uninsured motorist coverage is not affected by INI. If the BAP includes uninsured motorist coverage (it must be added via CA 21 47 for stacked coverage or CA 21 72 for non-stacked) and if the named insured includes an individual then the person named, spouse, and resident family members are provided coverage while occupying any auto or as a pedestrian when struck by an “uninsured motor vehicle.” (Editor’s note: The UM form numbers are Florida specific and will vary by state.) Personal Injury Protection: PIP coverage is not affected by INI. Since the BAP named insured includes the individual then that person, any spouse, and resident family members are provided PIP coverage similar to that provided via a PAP. (Editor’s note: PIP coverage will vary by state.) Other coverage options: There will be situations where INI will not be appropriate, such as when an individual is not a named insured under the BAP. In order to obtain coverage for individuals who have no PAP in the household there are options such as: Drive Other Car Coverage (CA 99 10). For a discussion of this “DOC” endorsement check our on-line Education Library titled “Drive Other Car Coverage”. Named Non-Owner Coverage (PP 03 22): Such policy provides options for liability, medical payments, and uninsured motorist coverage. Each person must be named, including spouses and any resident family members. Note that PIP and physical damage coverage are not provided under this policy. It’s important to completely analyze the customer’s business auto policy and make certain that all employees are properly covered by some auto policy, whether that be a PAP or BAP with or without INI or DOC added. Author: David Thompson 7/10/04