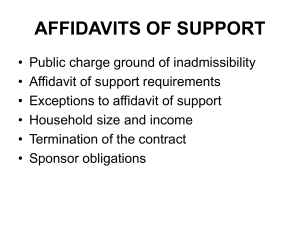

I-864 Overview / Discussion

advertisement

I-864 Overview / Discussion September 30, 2015 Persons Likely to become a Public Charge are Inadmissible, INA § 212(a)(4) Public Charge is defined by DOS and USCIS as “likely to become primarily dependent on the government for subsistence, as demonstrated by either: (1) the receipt of public cash assistance for income maintenance, or (2) institutionalization for long-term care at government expense.” Field Guidance on Deportability and Inadmissibility on Public Charge Grounds, 64 FR 28689 (May 26, 1999); 9 FAM 40.41 N1-2. BUT…these are only factors in the totality of the circumstances. Fact Sheet, USCIS, Public Charge (Oct. 20, 2009) at p.2, published on AILA InfoNet at Doc. No. 09102970; Cable, Albright, DOS 99-State-095509 (May 24, 1999) published on AILA InfoNet at Doc. No. 99052491. See also USCIS, Public Charge Fact Sheet, (Apr. 29, 2011), published on AILA InfoNet at Doc. No. 11050461 [listing benefits if received that are and are not public charge]. Applicants for admission or adjustment of status under a visa number issued under section 203(b) by virtue of a classification petition filed by a relative of the alien are inadmissible unless such relative has executed an affidavit of support described in section 213A. Use Form I-864, I-864EZ, or I-864W. NOTE: USCIS will only accept the 7/2/15 revisions starting October 6, 2015!!! Sponsorship Requirements (1) (2) (3) (4) Petitioner must be USC or LPR; and 18 years or older; and Domiciled in US; and Income 125% above federal poverty guideline In family based cases, the sponsor must be the petitioning family member. NOTE: If the petitioner dies before the intending immigrant obtains his IV or AOS in a family sponsored case, a substitute sponsor, under certain conditions is permitted. 8 C.F.R. §213a.2(c)(2)(iii)(D). For example, if sponsor dies after principal applicant immigrates, but qualified family members will follow to join. Or, if I-30 is reinstated for humanitarian reasons after petitioner dies. Page 1 of 4 Required Documents to Submit with Affidavit of Support (1) Most recent federal tax return + W-2 and/or Schedule C for self-employed (total income from tax return (e.g. 1040 line 22) should match I-864 question 19.a.) (2) Evidence of current employment & salary a. 3 most recent paystubs; and/or b. Letter from employer stating job and rate of pay (3) Continuation page with explanation if any of 3 most recent tax returns not filed (4) Proof of Assets if insufficient income (5) Proof of LPR/USC (if joint sponsor) Income Requirements (1) (2) (3) (4) (5) 125% of federal poverty guideline (see I-864P) 48 Contiguous States (household of 2 = $19,912; add $5,200 for each additional) Residents of Alaska (household of 2 = $24,900; add $6,500 for each additional) Residents of Hawaii (household of 2 = $22,912; add $5,975 for each additional) Sponsors on active military duty are 100% of guideline for Household Size Household size = sponsor, spouse, and children under 18, plus: (1) Any other person claimed as dependent on most recent tax return (2) All persons previously or currently sponsored, if obligation not terminated Assets If current income insufficient, assets may be used. (1) (2) (3) (4) General rule = 5x income required For spouse of intending immigrant = 3x income One way to remember: 5 years to USC vs. 3 years to USC Assets need only make up difference between poverty guideline and actual income Example: Household of 2 in California requires $19,912, but sponsor only has income of $9,912. $10,000 less than required income, so assets of $50,000 required for general sponsor; assets of $30,000 required for petitioner spouse. (5) Show assets with bank statements (6) Valuable real or personal property Example: Deed to petitioner’s house + appraisal (tax assessor valuation) – encumbrance (mortgage statement, etc. indicating loan balance). Do the math for the adjudicator! Simplified I-864EZ Eligibility (only 7 pages!) (1) Petitioner of family member; AND (2) W-2 income; AND (3) Immigrant is the only person immigrating on the underlying visa petition. Page 2 of 4 I-864A Contract Between Sponsor and Household Member (1) Insufficient income alone (2) Include income from household member (e.g. mother, father, sister, spouse) (3) Intending immigrant spouse does not complete I-864A unless he has accompanying children. Question: What if spouse is employed in US? Can you count his/her income? Domicile Requirement The affiant must be domiciled in the US (precludes USCs who are domiciled abroad from sponsoring. Park v. Holder, 572 F.3d 619 (9th Cir. 2009) [husband/petitioner not domiciled in US, so wife was not eligible for AOS]. Domicile = a person’s principal, actual dwelling place. Under DHS guidelines, sponsor domiciled abroad must establish by a preponderance of evidence that she will establish a domicile in the US “on or before the date of the principal intending immigrant’s admission or adjustment of status.” 8 C.F.R. §213a.2(c)(1)(ii)(B). If the sponsor enters the US at the same time as the beneficiary with the intention of establishing her principal residence in the US, the sponsor shall be deemed to have established domicile in the US. Memo, Aytes, USCIS HQRPM 70/21.1.13 at 6 (June 27, 2006) published on AILA InfoNet at Doc. No. 06063013. Sponsors must notify USCIS on Form I-865 within 30 days of any change of address. I-864 Not Required in Certain Cases If I-864 not required, must file an I-864W. (1) (2) (3) (4) (5) (6) Diversity immigrants Special immigrants Self petitioners (e.g. widow/widowers, VAWA) Refugees and asylees Registry (INA §249) Applicants who have already earned 40 quarters of SSA coverage Affidavit is Enforceable Contract The I-864 is now an enforceable contract against the affiant. INA § 213A(a). Sponsor and joint sponsor are jointly and severally liable. Page 3 of 4 Execution of I-864 creates a contract but the obligation begins after the sponsored immigrant acquires LPR status. Enforceable by sponsored person, the local, state, or federal government, or any agency providing a means-tested public benefit until the sponsored immigrant: (1) Naturalizes; (2) Ceases to be an LPR and departs US; (3) Obtains a new grant of AOS in removal proceedings; (4) Earned or credited with 40 qualifying quarters under Title II of SSA (5) Dies. Means-Tested Public Benefits 1. Supplemental Security Income (SSI) 2. Temporary Assistance to Needy Families (TANF) [62 FR 45256, 45284 (Aug. 26, 1997)] 3. Also includes state means-tested benefits. Some Exempt Benefits: 1. Emergency medical care (e.g. emergency Medi-Cal) 2. Short term, noncash in-kind emergency disaster relief 3. National School Lunch program & similar state/local programs 4. Food Stamps 5. Child Nutrition Act of 1966 6. WIC 7. Public assistance for immunizations 8. Medicaid 9. Children’s Health Insurance Program (CHIP) 10. HUD programs are not considered to fall under means-tested public benefits See Fact Sheet, USCIS, Public Charge (Oct. 20, 2009) published on AILA InfoNet at Doc. No 09102970. Continuing Responsibility to Support the Immigrant Congress “clearly intended to permit the sponsored immigrant to sue to enforce the support obligation, if necessary.” 71 FR 35732, 35743 (June 21, 2006). In addition to the US Government or the states to repay any means-tested public benefits, and in addition to any alimony payments, the sponsor or perhaps even the joint sponsor (and the household member who signs the I-864A) may have a continuing responsibility to support the immigrant and family at 125% of the poverty guideline. INA §213A(a)(a)(A). Page 4 of 4