Real Estate and Business Agents Trust Account Handbook

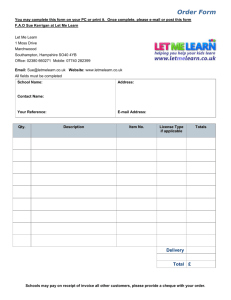

advertisement