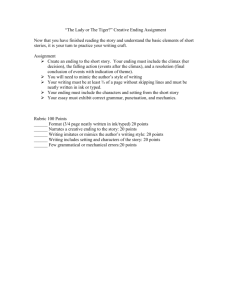

Cost of Goods Manufactured

advertisement

Winn Company Information

Cost of Goods

Manufactured

Problem 2

Information Given

a.

b.

c.

d.

Total fixed overhead is $190,000

PerPer-unit variable manufacturing cost, $25

and there are no other variables

Total current variable manufacturing

costs equal 125 percent of current

conversion cost

The number of units produced is 10,000

Required

Prepare a statement of cost of goods

manufactured for 2001

Creates, produces, and markets games of

strategy

Before an employee is hired, a puzzle of

some sort must be successfully solved

You are applying for a job as an entry level

accountant

Controller wants to evaluate your

analytical skills by testing your knowledge

of basic cost terms and concepts

Information Given for 2001 cont…

cont…

e.

f.

g.

h.

Beginning workwork-inin-process is oneone-half

the cost of ending workwork-inin-process

There are no beginning or ending

inventories for raw materials or finished

goods

The cost of goods sold is $400,000

Variable overhead equals 133 percent of

direct labor costs

Direct materials, beginning balance $

+ Purchases

(8)

Available for Use

(7)

- Direct materials, ending balance

Direct materials used

Direct labor incurred

Factory overhead applied

Current Manufacturing Cost

+Work+Work-inin-process, beginning balance

Total Costs in Process

-WorkWork-inin-process, ending balance

Cost of Goods Manufactured

+Finished goods, beginning balance

Available for Sale

- Finished goods, ending balance

Cost of Goods Sold

0

?

?

0

(5) $

(3)

(4B)

(6)

(9)

(10)

(11)

(2)

?

?

?

?

?

?

?

?

0

(1)

?

0

400,000

1

Direct materials, beginning balance $

+ Purchases

(8)

Available for Use

(7)

- Direct materials, ending balance

Direct materials used

Direct labor incurred

Factory overhead applied

Current Manufacturing Cost

+Work+Work-inin-process, beginning balance

Total Costs in Process

-WorkWork-inin-process, ending balance

Cost of Goods Manufactured

+Finished goods, beginning balance

Available for Sale

- Finished goods, ending balance

Cost of Goods Sold

0

?

?

0

Information Manipulation

(5) $

?

(3)

?

(4B)

?

(6)

?

(9)

?

(10)

?

(11)

?

(2)

400,000

0

(1)

400,000

0

400,000

Information Manipulation cont…

cont…

c.

TV-MFG = 1.25 conversion cost

where conversion cost = DL+FOH

TV-MFG = 1.25 (DL+FOH)

d.

e.

h.

TV-MFG = 1.25DL + 1.25FOH

where FOH = FF-FOH +V+V-FOH

x = 10,000

BWIP = 0.5 EWIP

V-FOH = 1.33 DL

Step 3 continued…

continued…

$250,000 = 1.25 DL + 1.25 (F(F-FOH + VV-FOH)

250,000 = 1.25 DL + 1.25 FF-FOH + 1.25 VV-FOH

250,000 = 1.25 DL + 1.25 FF-FOH + 1.25 VV-FOH

250,000 = 1.25 DL +(1.25)(190,000) +(1.25)(1.33 DL)

250,000 = 1.25 DL + 237,500 + 1.6625 DL

250,000 - 237,500 = 1.25 DL + 1.6625 DL

12,500 = 2.9125 DL

DL = 12500 / 2.9125

DL = 4291.8465 ≈ 4292

a.

b.

TFFOH = $190,000

TV-MFG = $25 x

where x = 10,000 (d)

TV-MFG = ($25)(10,000) = $250,000

where TV-MFG = DM + DL + VV-FOH

Step 3

TV-MFG = 1.25 conversion cost

(c)

TV-MFG = 1.25 DL +1.25 FOH

where TV-MFG = $250,000

(b)

FOH = FF-FOH + VV-FOH

where F(a)

F-FOH = $190,000

V-FOH = 1.33 DL

(h)

Direct materials, beginning balance $

+ Purchases

(8)

Available for Use

(7)

- Direct materials, ending balance

Direct materials used

Direct labor incurred

Factory overhead applied

Current Manufacturing Cost

+Work+Work-inin-process, beginning balance

Total Costs in Process

-WorkWork-inin-process, ending balance

Cost of Goods Manufactured

+Finished goods, beginning balance

Available for Sale

- Finished goods, ending balance

Cost of Goods Sold

0

?

?

0

(5) $

?

(3)

4,292

(4B)

?

(6)

?

(9)

?

(10)

?

(11)

?

(2) 400,000

0

(1) 400,000

0

400,000

2

Step 4

Step 4B

V-FOH = 1.33 DL

where DL = 4292

V-FOH = (1.33)(4292)

V-FOH ≈ 5708

Not on Statement

Direct materials, beginning balance $

+ Purchases

(8)

Available for Use

(7)

- Direct materials, ending balance

Direct materials used

Direct labor incurred

Factory overhead applied

Current Manufacturing Cost

+Work+Work-inin-process, beginning balance

Total Costs in Process

-WorkWork-inin-process, ending balance

Cost of Goods Manufactured

+Finished goods, beginning balance

Available for Sale

- Finished goods, ending balance

Cost of Goods Sold

(h)

TFOH = FF-FOH + VV-FOH

where FF-FOH = $190,000

V-FOH = $ 5,708

TFOH = $190,000 + $5,708

TFOH = $195,708

$195,708

(a)

4A

4A

0

?

?

0

Step 5

(5) $

?

(3)

4,292

(4B) 195,708

(6)

?

(9)

?

(10)

?

(11)

?

(2) 400,000

0

(1) 400,000

0

400,000

Direct materials, beginning balance $

0

+ Purchases

(8) 240,000

Available for Use

(7) 240,000

- Direct materials, ending balance

0

Direct materials used

(5) $240,000

Direct labor incurred

(3)

4,292

Factory overhead applied

(4B) 195,708

Current Manufacturing Cost

(6) 440,000

+Work(9)

?

+Work-inin-process, beginning balance

Total Costs in Process

(10)

?

-Work(11)

?

Work-inin-process, ending balance

Cost of Goods Manufactured

(2) 400,000

+Finished goods, beginning balance

0

Available for Sale

(1) 400,000

- Finished goods, ending balance

0

Cost of Goods Sold

400,000

TV-MFG = DM + DL + VV-FOH

where TV-MFG = 250,000

DL = 4292

V-FOH = 5708

3

4A

$250,000 = DM + 4292 +5708

DM = 240,000

Steps 9 And 11

BWIP = 0.5 EWIP

{∴

let BWIP = x

EWIP = 2x

Nothing Possible

MFG +BWIP – EWIP = CGM

where MFG = 440,000

440,000 + x – 2x = 400,000

440,000 - 400,000=2x – x

40,000 = x ⇒ BWIP

3

Direct materials, beginning balance $

0

+ Purchases

(8) 240,000

Available for Use

(7) 240,000

- Direct materials, ending balance

0

Direct materials used

(5) $240,000

Direct labor incurred

(3)

4,292

Factory overhead applied

(4B) 195,708

Current Manufacturing Cost

(6) 440,000

+Work(9) 40,000

+Work-inin-process, beginning balance

Total Costs in Process

(10) 480,000

-Work(11) 80,000

Work-inin-process, ending balance

Cost of Goods Manufactured

(2) 400,000

+Finished goods, beginning balance

0

Available for Sale

(1) 400,000

- Finished goods, ending balance

0

Cost of Goods Sold

400,000

Direct materials, beginning balance $

0

+ Purchases

(8) 240,000

Available for Use

(7) 240,000

- Direct materials, ending balance

0

Direct materials used

(5) $240,000

Direct labor incurred

(3)

4,292

Factory overhead applied

(4B) 195,708

Current Manufacturing Cost

(6) 440,000

+Work(9) 40,000

+Work-inin-process, beginning balance

Total Costs in Process

(10) 480,000

-Work(11) 80,000

Work-inin-process, ending balance

Cost of Goods Manufactured

(2) 400,000

+Finished goods, beginning balance

0

Available for Sale

(1) 400,000

- Finished goods, ending balance

0

Cost of Goods Sold

400,000

4