weekly economic update

advertisement

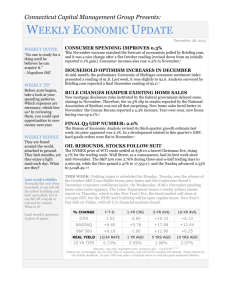

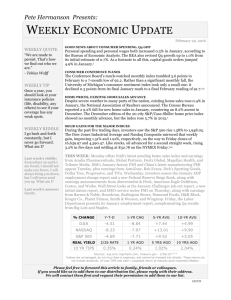

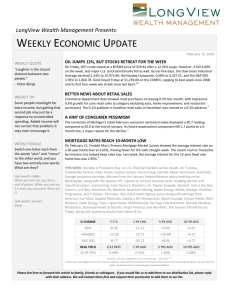

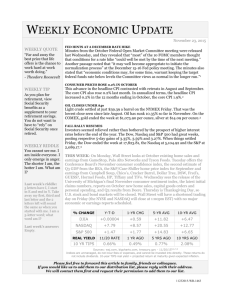

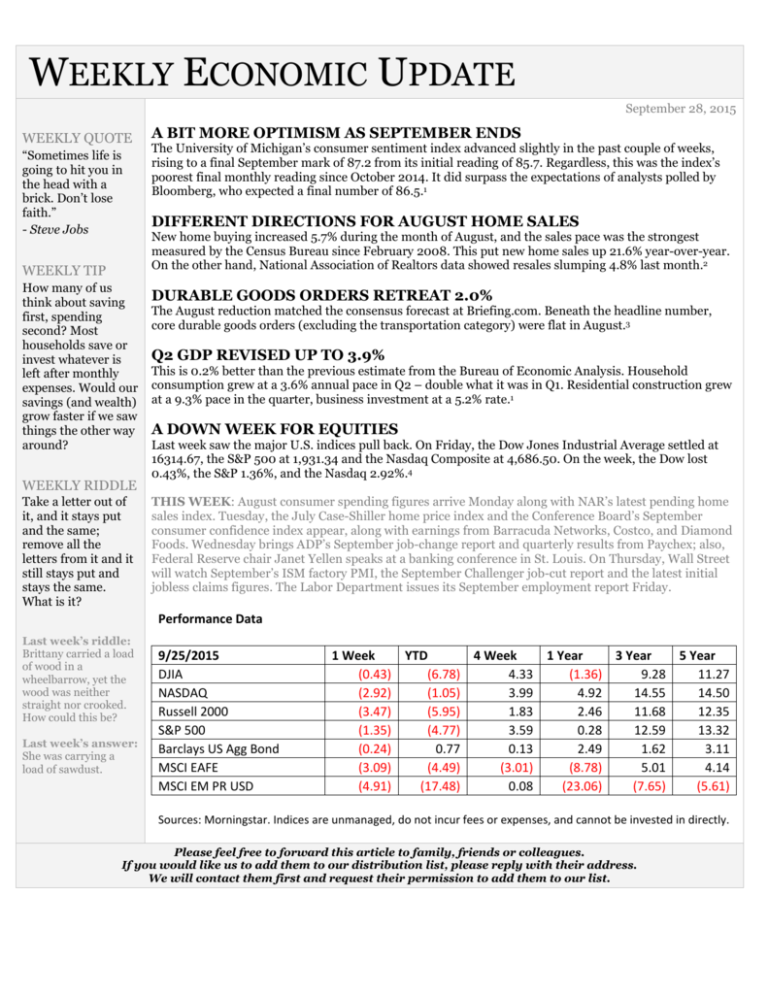

WEEKLY ECONOMIC UPDATE September 28, 2015 WEEKLY QUOTE A BIT MORE OPTIMISM AS SEPTEMBER ENDS “Sometimes life is going to hit you in the head with a brick. Don’t lose faith.” - Steve Jobs DIFFERENT DIRECTIONS FOR AUGUST HOME SALES WEEKLY TIP How many of us think about saving first, spending second? Most households save or invest whatever is left after monthly expenses. Would our savings (and wealth) grow faster if we saw things the other way around? WEEKLY RIDDLE Take a letter out of it, and it stays put and the same; remove all the letters from it and it still stays put and stays the same. What is it? The University of Michigan’s consumer sentiment index advanced slightly in the past couple of weeks, rising to a final September mark of 87.2 from its initial reading of 85.7. Regardless, this was the index’s poorest final monthly reading since October 2014. It did surpass the expectations of analysts polled by Bloomberg, who expected a final number of 86.5.1 New home buying increased 5.7% during the month of August, and the sales pace was the strongest measured by the Census Bureau since February 2008. This put new home sales up 21.6% year-over-year. On the other hand, National Association of Realtors data showed resales slumping 4.8% last month.2 DURABLE GOODS ORDERS RETREAT 2.0% The August reduction matched the consensus forecast at Briefing.com. Beneath the headline number, core durable goods orders (excluding the transportation category) were flat in August.3 Q2 GDP REVISED UP TO 3.9% This is 0.2% better than the previous estimate from the Bureau of Economic Analysis. Household consumption grew at a 3.6% annual pace in Q2 – double what it was in Q1. Residential construction grew at a 9.3% pace in the quarter, business investment at a 5.2% rate.1 A DOWN WEEK FOR EQUITIES Last week saw the major U.S. indices pull back. On Friday, the Dow Jones Industrial Average settled at 16314.67, the S&P 500 at 1,931.34 and the Nasdaq Composite at 4,686.50. On the week, the Dow lost 0.43%, the S&P 1.36%, and the Nasdaq 2.92%.4 THIS WEEK: August consumer spending figures arrive Monday along with NAR’s latest pending home sales index. Tuesday, the July Case-Shiller home price index and the Conference Board’s September consumer confidence index appear, along with earnings from Barracuda Networks, Costco, and Diamond Foods. Wednesday brings ADP’s September job-change report and quarterly results from Paychex; also, Federal Reserve chair Janet Yellen speaks at a banking conference in St. Louis. On Thursday, Wall Street will watch September’s ISM factory PMI, the September Challenger job-cut report and the latest initial jobless claims figures. The Labor Department issues its September employment report Friday. Performance Data Last week’s riddle: Brittany carried a load of wood in a wheelbarrow, yet the wood was neither straight nor crooked. How could this be? Last week’s answer: She was carrying a load of sawdust. 9/25/2015 DJIA NASDAQ Russell 2000 S&P 500 Barclays US Agg Bond MSCI EAFE MSCI EM PR USD 1 Week YTD 4 Week 1 Year 3 Year 5 Year (0.43) (6.78) 4.33 (1.36) 9.28 11.27 (2.92) (1.05) 3.99 4.92 14.55 14.50 (3.47) (5.95) 1.83 2.46 11.68 12.35 (1.35) (4.77) 3.59 0.28 12.59 13.32 (0.24) 0.77 0.13 2.49 1.62 3.11 (3.09) (4.49) (3.01) (8.78) 5.01 4.14 (4.91) (17.48) 0.08 (23.06) (7.65) (5.61) Sources: Morningstar. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Please feel free to forward this article to family, friends or colleagues. If you would like us to add them to our distribution list, please reply with their address. We will contact them first and request their permission to add them to our list. Best Regards, Dan Sipe and Thomas Lee Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. * To unsubscribe from the Weekly Commentary please reply to this e-mail with “Unsubscribe” in the subject line, write us at paula.vincent@raymondjames.com <mailto:paula.vincent@raymondjames.com>, or mail your request to Lee Sipe & Associates, 15245 Shady Grove Rd. #240 Rockville, MD 20850, Attn: Paula Vincent Daniel J. Sipe and Thomas P. Lee Financial Planners/Lee Sipe & Associates Independent Firm 15245 Shady Grove Rd. # 240 / Rockville, MD 20850 Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC Phone: (301) 216-1111 Fax: (301) 216-1160 dan.sipe@raymondjames.com We do not accept market orders via e-mail. Orders received from all other medium (i.e. facsimile, telephone answering service, etc.) must be confirmed by calling our office. This is a confidential communication belonging to Lee, Sipe and Associates, Inc. and Raymond James Financial Services, Inc. If you have received this message in error, please notify us immediately. Raymond James Financial Services does not accept orders and/or instructions regarding your account by e-mail, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. E-mail sent through the Internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all e-mail. Any information provided in this e-mail has been prepared from sources believed to be reliable, but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in e-mail. This e-mail is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer. Representative Disclosure This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. Citations. 1 - bloomberg.com/news/articles/2015-09-25/economy-in-u-s-picked-up-on-consumer-spending-construction [9/25/15] 2 - housingwire.com/articles/35142-new-home-sales-climb-57-in-august [9/24/15] 3 - briefing.com/investor/calendars/economic/2015/09/21-25 [9/25/15] 4 - markets.on.nytimes.com/research/markets/usmarkets/usmarkets.asp [9/25/15] 5 - markets.wsj.com/us [9/25/15] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F25%2F14&x=0&y=0 [9/25/15] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F25%2F14&x=0&y=0 [9/25/15] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F25%2F14&x=0&y=0 [9/25/15] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F24%2F10&x=0&y=0 [9/25/15] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F24%2F10&x=0&y=0 [9/25/15] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F24%2F10&x=0&y=0 [9/25/15] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F26%2F05&x=0&y=0 [9/25/15] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F26%2F05&x=0&y=0 [9/25/15] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F26%2F05&x=0&y=0 [9/25/15] 7 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/25/15] 8 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/25/15]