(VAT) - FAQS - Jammu & Kashmir Commercial Taxes Department

advertisement

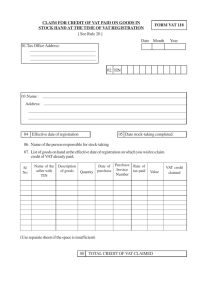

GOVERNMENT OF J&K COMMERCIAL TAXES DEPARTMENT Though the Value Added Tax (VAT) regime is a much simple , transparent , trader and customer friendly system of taxation but all the same it is very novel too for the people, it is therefore, but natural that the trading community in particular and the consumers in general need answers to their queries about this new tax regime. The Department of Commercial Taxes, Government of J&K has accordingly attempted answers to some of the Frequently Asked Questions (FAQs) on VAT as below: VALUE ADDED TAX (VAT) - FAQS. Defining VAT Q1. What is VAT? A: VAT is the abbreviated form of Value Added Tax. V = Value A = Added T = Tax Each Commodity passes through several stages of production and distribution. Value at the final stage is the sum of value created/added at each of these stages. Under VAT value added at each stage of production and distribution is taxed. VAT is essentially a Multi-point System of taxation. Q2. What is VALUE ADDED? A: Value added is the difference between a dealer’s Sales and Purchases. Value Added = Value of Output - Value of Purchased Inputs. Q3. Is VAT popular? A: VAT is immensely popular throughout the world. VAT system is presently in operation in more than 135 Countries and covers nearly 85% of the World’s population. Q4. Is VAT system in operation in our neighbouring Countries? A: Yes. It is operational in . Pakistan, Bangladesh, Nepal, Srilanka and China). Q5. Who Pays VAT ? A: Only dealers above the taxable limit have a tax liability under VAT. Q6. What is the taxable limit in J&K? A: Under The Jammu and Kashmir Value Added Tax Act, 2005 taxable limit means in relation to a dealer who: (a) Imports for sale or use in manufacturing or processing any goods into the State on his own behalf or on behalf of his Principal NIL (b) manufactures or produces any goods for sale or is engaged in any business other than the business specified in (a) above Rs.7.50 lacs Q7. Who Registers under VAT? A: All dealers above the taxable limit have to register under VAT. Q8. What will the taxable limit include? A: The taxable limit includes gross turnover of sales or purchases. Q9. What is included in the gross turnover to determine the liability to pay tax? A: The turnover of all sales or purchases as the case may be shall be taken, whether such sales or purchases are taxable or not and the turnover shall include all sales or purchases as the case may be, made by a dealer on his own account and also on behalf of principals whether disclosed or not. Q10. How does VAT work? A: VAT works on the principle of Input Tax, Output Tax and Input Tax Credit. Q11. What is Input tax? A: Tax paid by a Registered dealer to another Registered dealer for goods purchased is the Input Tax. Q12. What is Output Tax? A: The tax charged by a Registered dealer for the sale of goods is the Output Tax. Q13. What is Input tax credit? A: The set-off which a dealer gets for the taxes paid on purchases made within the State is the Input Tax Credit. Q14. What is the eligibility for Input Tax Credit? A: Facility of INPUT TAX CREDIT is available for tax paid on goods purchased within J&K by a registered dealer having a TIN (Tax Payer Identification Number) from another registered dealer also having a TIN. Q15. Are inter-state purchases eligible for Input Tax Credit ? A: No, Inter-State Purchases are not eligible for Input Tax Credit. Q16. What is Net Tax payable under VAT? A: The net tax payable under VAT is: Output Tax - Input Tax Q17. How is VAT liability calculated? A: VAT liability is calculated by deducting Input Tax Credit from Tax collected by a dealer during a tax period. Q18. What is a tax period under the J&K VAT Act? A: The Tax period under The Jammu and Kashmir Value Added Tax Act, 2005 is a quarter which means that the returns have to be filed on a quarterly basis. Q19: What happens to the excess Input Tax Credit ? A: If the Input Tax Credit of a Registered dealer exceeds the tax collected during a tax period the excess Input Tax Credit will be carried over to the next tax Period/s. Q20: What about refund of excess Input Tax Credit ? A: The Input Tax Credit will be carried up to the end of the next financial year beyond which the excess unadjusted Input Tax Credit, if any, will be eligible for refund. Q21. Which dealers are eligible for turnover tax registration ? A: Dealers who are neither MANUFACTURERS nor IMPORTERS nor EXPORTERS and whose GROSS ANNUAL TUROVER OF SALES is between Rupees 7.50 lacs and Rupees 20 lacs , have the option to register for TURNOVER TAX and pay tax @ 1% of their taxable turnover. Q22. Can a dealer registered under turnover tax claim the benefit of Input Tax Credit ? A: No, the facility of Input Tax Credit is not available to a dealer registered under turnover tax. Q23. Can a dealer registered under turnover tax issue a tax invoice? A: No, a dealer registered under turnover tax can’t issue a tax invoice. Q24. When shall a VAT invoice be issued? A: A dealer having a TIN (Taxpayer Identification Number) when selling goods to another dealer having a TIN shall issue a VAT INVOICE. Q25. When shall a retail invoice be issued? A: If a dealer having a TIN (Tax Payer Identification Number) sells goods to a dealer who does not have a TIN or is registered as a dealer under Turnover Tax or as a Casual Trader or is an unregistered dealer or is a customer, the dealer shall issue a RETAIL INVOICE. Q26. On what kind of invoice is Input Tax Credit available? A: Input Tax Credit is available only on VAT invoice(original) and no Input Tax Credit is available on a retail invoice. Q27. Can a dealer registered under turnover tax charge tax from the consumers? A: No, a dealer registered under turnover tax can’t charge any tax from the consumers. Q28. What is Voluntary registration ? A: Any dealer, whose gross turnover of sales during a year exceeds Rs. one lac, may notwithstanding that he is not liable to pay tax, apply for voluntary registration. Q29. Is the mode of assessments different under VAT system? A: Yes, there is a mechanism of self–assessment under VAT whereby the dealers assess their own tax liability and pay the tax due as per the returns filed by them on a quarterly basis. Q30. Who gets the facility of self-assessment? A: The facility of self-assessment is available to all registered dealers irrespective of their turnover. Q31. Shall the department issue any notices for assessment? A: No, the department shall not issue any notices for assessment, if the dealers file their returns in time and also pay the tax due in time. Q32. Will all the returns filed by dealers be picked up for audit? A: No, a transparent criteria has been evolved under which a small percentage of cases shall be picked up for tax audit/ audit assessment. Q33 When shall the department take action against a dealer? A: The department shall take action only when there is compelling evidence of tax evasion or tax avoidance against a dealer. Q33. Is there any surcharge under VAT? A: No, there is no provision for surcharge under VAT. Q34. How is VAT consumer friendly? A: Because of the mechanism of Input Tax Credit where the dealer gets a set-off for the taxes paid earlier within the State, such taxes are not treated as part of the cost thus there is no CASCADING i.e,. Tax on Tax . This ensures that the price of commodities does not increase under VAT . Q35. Is it mandatory for a dealer having a TIN to issue a VAT or a retail invoice? A: Yes, it is mandatory for all registered dealers having a TIN to issue a VAT invoice/ a retail invoice, as the case may be . Q36. What happens if a dealer having a TIN fails to issue a VAT invoice or a retail invoice, as the case may be? A: If a dealer having a TIN fails to issue a VAT invoice or a retail invoice, as the case may be, shall be liable to a penalty equal to ten times of the tax payable on each such default or Rs. 10,000 whichever is higher. Q37. What happens if a person purchases goods from a dealer (having a TIN) without an invoice? A: If a person purchases goods from a dealer having a TIN without an invoice, he shall be liable to penalty equal to double the amount of tax leviable on such goods. Q38. Is the depiction of price of commodity and component of tax separately on the VAT/retail invoice mandatory? A: Yes, it is mandatory to depict the price of commodity and component of tax separately on the VAT/retail invoice. Q39. What are the different tax rate slabs under VAT? A: The tax rate slabs under VAT are: 0%, 1%, 4% and 12.5% Q40. Which commodities have been kept out of VAT ? A: Aviation Turbine Fuel, Diesel, Liquor, Lottery tickets, Natural Gas, Petrol and Resin have been kept outside VAT. Q41. What is the status of services under VAT in J&K? A: The services have been kept outside the purview of VAT in J&K and are taxed under The Jammu & Kashmir General Sales Tax Act, 1962. Q42. Is there a provision of tax deduction at source under The Jammu and Kashmir Value Added Tax Act, 2005 ? A: No, The Jammu and Kashmir Value Added Tax Act, 2005 does not have any provision for tax deduction at source and the same continues to be governed under The Jammu & Kashmir General Sales Tax Act, 1962 . Q43. What is the benefit for exporters under VAT? A: If any goods are exported outside the territory of India, the sales of such goods are ZERO RATED (which means that no tax is charged on such sales and credit for Input Tax paid in the State is allowable ) and the dealer is entitled to the refund of the Input Tax paid in the State. Q44. If I need a registration, in what Form VAT need I to apply? A: Every dealer other than a Casual Trader liable to be registered (including voluntary registration) shall submit an application in Form VAT-01 to the Jurisdictional Registering Authority. The application for registration by a casual trader shall , however be, in Form VAT-02. Q45. What is the period of validity of a dealer’s registration certificate? A: Every certificate of registration other than the certificate of registration of a Casual Trader is valid for a period of five years from the date of issue and, in case of dealers already registered under The Jammu & Kashmir General Sales Tax Act, 1962 the validity of five years shall commence from the date a fresh registration is granted to them. However in case of a Casual Trader the certificate of registration shall be valid only for the period as recorded in his certificate of registration. Q46. Within what time period has a registered dealer to apply to the Jurisdictional Registering Authority for carrying out any amendment in his registration certificate? A: The time period prescribed is 30 days. Q47. Within what time period shall the Jurisdictional Registering Authority amend the certificate of registration ? A: It shall be done within 20 days of the receipt of the application for amendment . Q48. Is it mandatory for a registered dealer to display the certificate of registration? A: Yes, it is mandatory on the part of every registered dealer to display the certificate of registration at a prominent place at his main place of business and certified copies are to be displayed at the additional place of business, if any. If any registered dealer fails to do so he shall be liable to a penalty of Rs.5,000. Q49. What happens to a dealer who was required to get himself registered but has failed to do so? A: A dealer who was required to get himself registered but has failed to do so shall be liable to a penalty of Rs. 5,000 besides the concerned Assessing Authority shall assess to the best of his judgement the amount of tax due from the dealer. Q50. What happens to a turnover tax dealer whose turnover exceeds Rs. 20 lacs? A: As soon as the turnover of a dealer registered under turnover tax exceeds Rs. 20 lacs, he shall at once bring it the notice of the concerned Assessing Authority and apply for a TIN. Q51. What is the procedure for filing of returns? A: Every registered dealer other than a casual trader shall submit a quarterly return (Form VAT-11 by a VAT dealer or a voluntary registration dealer and Form VAT –12 by a dealer liable to turnover tax) containing particulars of sales and purchases accompanied by proof of full payment of any tax due, to the Jurisdictional Assessing Authority within one month from the expiry of each tax period. Every casual trader shall furnish to the Jurisdictional Assessing Authority a quarterly return in Form VAT-13 along with proof of full payment of tax due within one month after the expiry of the quarter. Every dealer other than a Casual trader liable to pay tax under the Act shall also furnish an annual return. Such return shall be filed in Form VAT 11-A by a VAT dealer or a voluntary registration dealer, and in Form VAT 12-A by a turnover tax dealer within 120 days from the expiry of that year. A trading account shall accompany every such return. Every VAT dealer shall also furnish alongwith annual return and trading account a list of VAT invoice books used during the year mentioning therein the total number of VAT invoices issued out of each VAT invoice book so used.