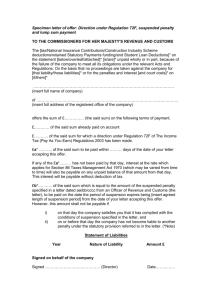

Notes for Guidance – Taxes Consolidation Act 1997 – Finance Act

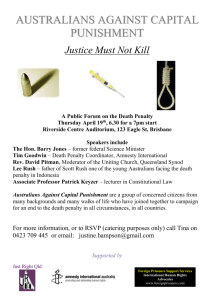

advertisement