Approaches to the Management of Business Strategy

Strategic Management of Business

Today’s business management is highly competitive. Simple methods and approaches on budget – oriented planning or forecast based planning are not enough for an organization particularly large organization to survive and develop. There is a need for strategic business management for assessment of the business environment, formulation of strategies, its implementation, evaluation of progress and taking adjustments to stay healthy in business.

The first vital approach to the management of business strategy is the strategic planning process covering the corporation’s mission and objectives, environmental scanning, strategy formulation/implementation, and evaluation and control. Basically speaking strategic management or business strategy has two approaches: (1) The Industrial Organization Approach and (2) The Sociological Approach. The Industrial Organization Approach adheres on economic theory referring to issues like competitive rivalry, resource allocation, economies of scale assumptions – bounded rationality, self-disciplined behavior, and profit maximization.

Sociological Approach primarily deals with human interactions assumptions such as bounded rationality, satisfying behavior, and profit sub-optimality. (Quickmba.com, 2004)

1

Business strategies can also be classed into two categories based on its area of concentration, one category has its concentration focused on efficiency and the other category’s concentration is focused on effectiveness. Abe divided into another category. One category is for those whose concentration points mainly to efficiency and the other is for those that concentrate mainly on effectiveness . Efficiency means the right way of doing things while effectiveness means doing the right things. And an ideal strategy is a kind that blends both efficiency and effectiveness for there would be no point in acting efficiently if the desired effect is not achieved.

Approaches to the management of business strategy can be classified as bottom-up, topdown, or collaborative processes. The bottom-up approach is usually accomplished through a capital budgeting process. Proposals that come from employees and submitted to their managers and funneled up further to the upper level of the organization are being assessed by means of financial criteria like return on investment and cost-benefit analysis. The approved proposal will be the base for new strategy. A new strategy will be simply formulated and developed doing away from grand strategic design or strategic architect. So far the most common approach is the top-down wherein the overall direction of the organization comes from its highest level or the

CEO maybe with a possible assistance coming from strategic planning team.

Recent development in strategic management of business can be seen from organizations that are experimenting on collaborative strategic planning approaches that give due consideration to the inherently emergent characteristic of strategic decisions. For most large corporations strategy is of several levels. There exists the strategy hierarchy with strategic management as its highest level. This is so because strategic management in its very nature applies to all parts of the organizations. All directions come from the highest level to the corporate values, culture, goals and missions. Under this very big corporate approach are functional or business unit strategies. The functional strategies cover marketing strategies. Under marketing strategies are the following sub strategies: (1) new product development, (2) human resource, (3) financial, (4) legal, and (5) information technology management. It is focused on plans in a short term and medium term basis. The domain of functional strategies covers the functional responsibility of its department. And in turn each functional department performs its respective task in meeting overall corporate objectives. But this kind of strategy seems for many companies to be an inefficient approach to organize functions and activities. For some companies they have been

adopting the strategic business unit approach. This is an approach in business wherein a particular unit is a semi-independent unit within the organization. A specific unit (SBU) is commonly responsible for its own operations like budgeting, product decisions, hiring, price setting and developing of its business strategies in line with the broader corporate strategies.

The lowest level under hierarchal strategy is the operational. It has a narrow focus dealing with everyday operational activities. It performs under a specified budget. It can not make its own budget nor make an adjustment. However, operational level seems to complicate activities. As such, some organizations are reverting to simpler strategic structure. This structure is being made simpler through information technology. Because with strategic divisions the processes of sharing information and creation of common goals are being obstructed unlike with the knowledge management systems through the use of information communication technology. (en.wikipedia.org, 2005)

2

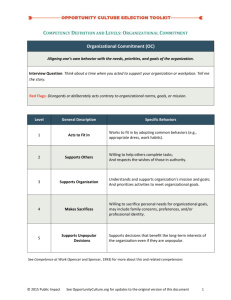

Following are other models of approaches to strategic management : (Quickmba.com

1999-2004)

3

: Nowadays most firms are considering Competitive Strategy as the basis for much modern business strategy. Competitive strategy is tantamount to competitive advantage. When a certain firm achieves rate of profits that is ahead of others then the said firm is considered as having sustainable competitive advantage over other firms in the same industry. Generally speaking the common goal of all business strategies is to attain and maintain sustainable competitive advantage. According to Michael Porter’s theory there are two basic types of competitive advantage: the cost and the differentiation. Cost advantage happens when a firm provides the product or services that are similar to its rivals but at a much lower cost.

Differentiation advantage happens when a firm provides product or services that exceed the quality of competing products. Therefore, competitive advantage prods the firm to provide

superior value for the customer and superior profits for its business. These advantages are also called as positional advantage because they determine the rank or position of a particular firm in the industry as a leader in either cost or differentiation. The competitive advantage inevitably leads to creation of superior value output through the firm’s utilization of its resources and capabilities. Below is a diagram that combines the resource – based positioning views of concept on competitive advantage:

A Model of Competitive Advantage

4

Resources

Distinctive

Competencies

Cost Advantage/

Differentiation

Advantage

Value

Creation

Capabilities

In terms of resources and capabilities an organization ought to have superior resources and capabilities than those of its rivals. For without this superiority the business rivals can easily copy what the firm is doing. Resources pertain to the firms assets that are used in the creation of cost or differentiation advantage. Examples of resources are the patents and trademarks, proprietary knowledge, installed customer base, reputation of the firm and brand equity.

Capabilities pertain to the ability of the firm to effectively utilize its resources. Example of which is the capability of the firm to bring a certain product or service to market faster than its business rivals. The resources and capabilities of the firm pave the way for its distinctive competencies. These competencies in turn lead to innovation, efficiency, quality, and customer responsiveness for the creation of a cost advantage (lower cost structure) or a differentiation advantage. And it is up to the firm to achieve competitive advantage through its choice between low cost and differentiation. This process is a vital factor in the firm’s competitive strategy.

Another options presented to a firm are the broadness or narrowness of a market segment to target. In this concept, Porter formulated a matrix using cost advantage, differentiation advantage, and a broad or narrow focus as a mark in setting up generic strategies for the firm’s pursuit and creation of competitive advantage.

In Porter's Generic Strategies the basic factor in determining the profitability of a firm is the attractiveness of the industry where it operates and the secondary determinant is the firm’s position in the said industry. A firm that is occupying leading position can achieve superior returns even in an industry that may have below – average profitability. Another theory of

Michael Porter contends that a firm’s strengths are classified into cost advantage and differentiation. And when these strengths are applied in a scope (broader or barrow), what result are the three-generic strategies – (1) cost leadership, (2) differentiation and (3) focus. These are generic strategies for the reason that they are independent from either firm or industry.

Target Scope

Porter's Generic Strategies

5

Advantage

Low Cost Product Uniqueness

Broad (Industry Wide)

Narrow (Market Segment)

Cost Leadership Strategy

Focus Strategy (Low Cost)

Differentiation Strategy

Focus Strategy

(Differentiation)

Under the Cost Leadership Strategy the firm has to be a low cost producer of a product or service with certain level of quality in an industry. To gain market share, the firm has to sell its product or service either at an average prices in order to gain higher profit than its competitors or below the average price in the industry. This enables a firm to maintain some degree of profitability in the event of a price war while the competition suffers loss. And when the industry matures and there is the decline in the prices the firm can still produce cheaper products.

This means that the firm is capable to remain profitable at longer period of time compared to others. Cost leadership generally aims for a broad market place. Firms that usually succeed in cost leadership possess the internal strengths like access to the required capital, skill in product design and efficient manufacturing, expertise in manufacturing process engineering, and efficient distribution channel. Under differentiation strategy the firm has to develop a product or service with unique attributes to be valued by customers as better than or different from the products of the competitors. The unique attributes of the product or services can prompt the firm to charge premium price for it. Firms that usually succeed in differentiation possess the following internal strengths: (1) have access to leading scientific research, (2) have skillful and creative product

development team, (3) have strong sales team, and (4) have a reputation for higher quality and innovation. Under focus strategy the firm has to concentrate on a narrow segment to attain either cost or differentiation advantage. A firm employing focus strategy may benefit from a high degree of customer loyalty. The very same loyalty will serve as barrier for other firms to directly compete. Firms following focus strategy have lower volumes as such have lesser bargaining power with its suppliers. A combination of generic strategies is not advisable because these are not necessarily compatible with one another. If a firm chose to attain advantage through all of these generic strategies failure or loss may result from it.

For what reasons, and to what extent, do the experiences of Marks & Spencer bear out the validity of any of these models?

Marks & Spencer was founded on 1884 as a market stall by Marks. It became Marks &

Spencer in 1894 as a partnership with Spencer. From that humble beginning Marks & Spencer became leader in the industry. And for more than half a century M & Spencer was the epitome of enlightened capitalism. It dominated the British high streets and provided shoppers with quality and value clothing unrivalled by competitors. It was one of Britain’s largest high profile retailers selling variety of goods and services such as clothes, food, furniture and loan services.

But its glory has started to crumble when it profits began to fall since 1998. M & S has been facing their worst times ever. Their problems began at the start of financial year April 1999.

They suffered almost from financial ruins. Since the event of its failure, M & S has been taking more than several attempts to recover their losses. Extensive studies and researches have been conducted to find out the root causes so as to come up with appropriate strategies for development. Most of the studies started with the company’s profile. Below is an analysis of

the company’s profile and the validity of one strategic management models to Marks & Spencer’ experiences.

Marks & Spencer’s organization culture is characterized as a reflection of “taken-forgranted fashion” that is an attitude shared by members of the organization. The beliefs and basic assumptions operate unconsciously among the members and also exist at the organizational level. The assumptions and taken for granted fashion have taken its roots from the basis of the organization’s success. During the 80's Marks & Spencer experienced a massive growth of interest in culture and symbolism in organizations. The culture and symbolism that pertain to meaning and imagery are used to emphasize the ‘softer’ character of the organization. M & S pattern of action within the organization is treated in view of meanings and symbol rather than as a ‘hard’ structure of the business system. They depended too much in the image of M & S that they have overlooked the other side of the coin. `The explanation of why people act as they do may lie not in a combination of "objective" and "subjective" factors, but in a network of meanings which constitute a "world taken for granted" (Schutz, 1964)

6

. the participants. Indeed,

"objective" factors, such as technology and market structure, are literally meaningful only in terms of the sense that is attached to them by those who are concerned and the end to which they are related... Organisations do not react to their environment, their members do. People act in terms of their own and not the observer's definition of the situation ' (Silverman's, 1970)

7

A key for sustainability of all organization is to change and evolve continuously to match with its environment out side its window in which it operates. Until the late 1990s M&S have been very successful. It worked to achieve this esteem by applying a structured formula to all its operations and maintained it by establishing a set of fundamental principles, which were held as core to the organization and used in all of its business activities since its birth. Their paradigm help them in

the past but the same paradigm didn’t worked in the present and they went through a strategic drift. Mark & Spencer’s corporate culture from its foundation to its fall in the late 1990s is described as follows: M&S always depended on the British suppliers overlooking the impact of this system to its financial costs. They had a traditional way of having specialist buyers through an operation being performed from the central buying office from where it was distributed to stores overlooking its effect on time factor. M & S stores used to have identical layout, design, and training among others. Store managers are not in the liberty to deviate from the specifications. Moreover, there existed severe restrictions on the ways by which store managers relate with the local customers. And lastly, Marks & Spencer was not interested to cater to current fashion and trends. The firms failure in terms of its culture is best expressed by Richard

Greenbury, M & S chief executive from 1991 , “ I think that the simple answer is that we followed absolutely and totally the principles of the business with which I was embued…. I was the business with the aid of my colleagues based upon the very long-standing, and proven ways of running it”. (Johnson & Scholes, 2001).

8

Marks & Spencer as a whole had adhered to these commitments since the time when Simon Marks founded the M & S up to all other succeeding chief executives.

Therefore the firm in its monotonous ways and adherence to hierarchal level strategies and a static outdated system of doing business experienced loss of customer’s satisfaction – that is any organization’s key to success. As such inevitable downfall followed. Many analysts saw that M & S had remained too long with their traditional risk-aversive formula. M & S had ignored the dynamism of the market place. Marks & Spencer’s concluded that the role of Marks

& Spencer’s organizational culture has been a failure in fostering dynamic organization that led

to the fall of M & Sin the late 1990s. This culture has brought huge inequality between the organizations paradigm and their operating environment.

Today M & S is trying its best to keep up with time (the factor that they ignored before) in order to recover their position in the industry. New strategic approaches are being implemented to hasten the recovery.

The Validity of Porter’s Strategic Business Approach to the Experiences of Marks & Spencer:

Analyzing the environment - Five Forces Analysis

The Porter’s five forces generic strategies

9 aid the business to contrast a competitive environment. Five forces looks at five key areas namely the threat of entry, the power of buyers, the power of suppliers, the threat of substitutes, and competitive rivalry.

The threat of entry: The threat of entry looks out in terms of differentiation for M & S to the customers’ loyalty that can discourage potential entrants. M & S has a long time developed focus that has served as an entry barrier. As such, it is unlikely for Mark & Spencer to have new entrant in its area. M & S is an expert in this field.

The power of buyers: Marks & Spencer showed and practiced preference in using British suppliers alone. M & S became dependent on its suppliers. It experienced less power to negotiate because of few close alternatives.

The power of suppliers: Marks & Spencer’s patronage of British suppliers made them reliant over giving enough power of the suppliers over M & S.

The threat of substitutes: Substitution can reduce demand for a particular ‘class’ of products when customers switch to the alternatives. The alternatives came from Tesco and Sensbury as they acted on providing added value foods. These alternatives provided threat to M & S.

Competitive Rivalry: Under competitive rivalry, Marks & Spencer really faced threat as other companies entered the industry with the same quality goods but with affordable price and up-todate fashion. This is the area where M & S failed the most. The firm was unable to fight the current of competition.

The use of Competitive Strategy Model and Value Chain for Marks & Spencer’s

Competitive Advantage Recovery

10

“The value chain describes the activities within and around the organization which together creat a product or service” (Johnson and Scholes, 2002)

11

Marks & Spencer should give emphasis on the delivery of goods to its customers in the best possible way. This is a very significant way to improve profitability and to foster competitive advantage in the market place. In this instance, clients have to receive the product that they purchase in satisfying ways such as delivering an up-to-date, fashionable high quality garment to the customer accompanied by an affordable competitive price. There is a need for

Marks & Spencer to improve its procedures on its inbound logistics, operations, suppliers, store designing, layout and many more. Their warehouses should be made clear of old stocks to give way to new up-to-dated stocks. The packaging of their products should also be given due considerations. It is recommended for M & S to consider purchasing supplies from overseas to save cost so as to provide customer product at less price. There is also a need for M & S to redesign their store in ways that give space, convenience, and comfort to customers while they

are browsing, fitting and shopping. Moreover, it is recommended for M & S to employ the use of information technology system to facilitate smooth and fast running services to its suppliers and costumers. Apparently, Marks & Spencer are already taking steps on the same way. It is to be expected that following this model M & S will regain its competitive advantage one of these days.

Endnotes:

1 Quick MBA Knowledge to Power Your Business 1999 – 2004, Strategic Management , [Online], 4/12/05,

Available at: http://www.quickmba.com/strategy

2 Wikipedia the Free Encyclopedia 2005, Strategic Management, [Online], 4/12/05, Available at: http://en.wikipedia.org/wiki/Strategic_management#General_Approaches

3

Quick MBA Knowledge to Power Your Business 1999 – 2004, Competitive Advantage , [Online], 4/12/05, http://www.quickmba.com/strategy/competitive-advantage/

4

Ibid.

5 Quick MBA Knowledge to Power Your Business 1999 – 2004 Poerter’s Generic Strategies , [Online], 4/12/05,

Available at: http ://www.quickmba.com/strategy/generic.shtml

6

Schutz 1964, Phenomenology, [Online], 4/12/05, Available at: http://plato.stanford.edu/entries/schutz/

7

Dutta A. The Marks And Spencer Case, [Online], 4/12/05, Available at: http://www.angelfire.com/trek/arpan_dutta/ms.html

8 Johnson & Scholes 2001 Strategic Management, Exploring Corporate Strategy 5 th Edition.

9

Quick MBA Knowledge to Power Your Business 1999 – 2004 Poerter’s Generic Strategies , [Online], 4/12/05,

Available at: http ://www.quickmba.com/strategy/generic.shtml

10

Quick MBA Knowledge to Power Your Business 1999 – 2004 The Vaue Chain, [Online], 4/12/05, Available at: http://www.quickmba.com/strategy/value-chain/

11 Johnson & Scholes 2002 Strategic Management, Exploring Corporate Strategy Text & Cases 6 th Edition.