Faculty of Economics & Management Sciences

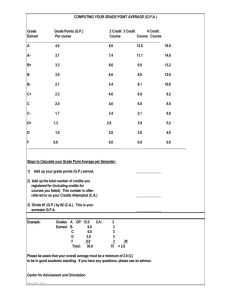

advertisement