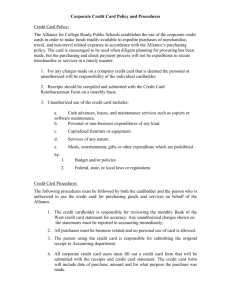

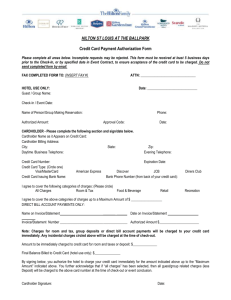

American Express Card Acceptance Addendum to

advertisement