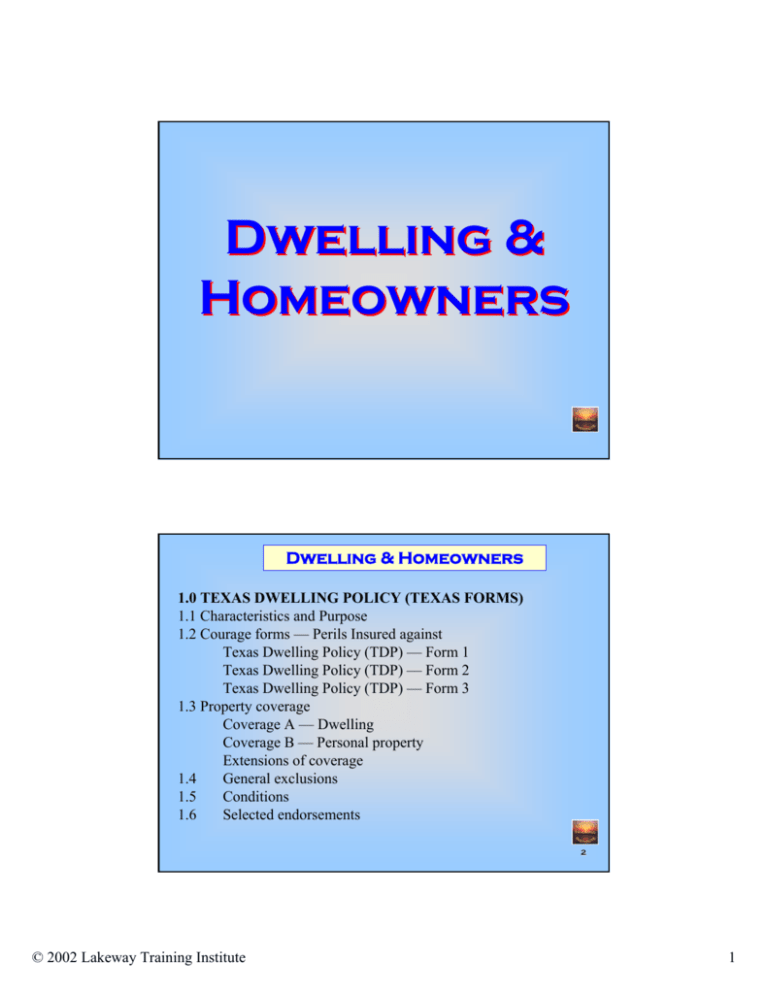

Dwelling & Homeowners Dwelling & Homeowners

advertisement