MANEGERIAL ECONOMICS UNIT4 Managerial Economics UNIT

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

UNIT-4

National Income – Concepts and Measurement

Meaning of National Income:

National income is the total market value of all final goods and services produced in an economy including net factor income from abroad during an accounting year. In order to avoid double counting of the goods and services in the national income, only final goods are taken into consideration and for calculating Net National Income, the Wear N’ Tear and depreciation charges are deducted from Gross National Income. National income also refers to the aggregate of factor income earned by the normal residents of a nation during a given period (say a year) as a result of their productive services.

According to Prof. Pigou,

“National income or dividend is that part of the objective income of the community including, of course, income derived from abroad which can be measured in money.”

According to Prof. Pigou “ only those goods and services should be included (double counting being avoided) that are transacted is a specific year in exchange of money.”

Pigou’s definition is precise, convenient, elastic and workable because it does away with the difficulty of measuring the national income inherent in Marshall’s definition.

Gross National Product (G.N.P.)

Gross National Product is defined as the total market value of all final goods and services produced in a year. It is a measure of the current output of economic activity in the country.

There are three different methods to measure GDP:

I.

The Product Method: In this method, the value of all goods and services produced in different industries during the year is added up. This is also known as the Value

Added Method to GDP or GDP at Factor Cost by Industry of Origin. The following items are included in India in this: agriculture and allied services; mining; manufacturing; construction; electricity; gas and water supply; transport; communication and trade; banking and insurance; real estate and ownership of dwellings and business services; and public administration and Defence and other services (or government services).

II.

The Income Method: The people of country who produce GDP during a year receive income from their work. Thus GDP by income method is the sum of all factor income: Wages and Salary (compensation of employees)+ Rent + Interest + Profit

III.

Expenditure Method: This method focuses on goods and services produced within the country during one year. GDP by expenditure method includes: i.

Consumer expenditure on services and durable and non-durable goods (C), ii.

Investment in fixed capital such as residential and non-residential building, machinery and inventories (I), iii.

Government expenditure on final goods and services (G), iv.

Export of goods

Managerial Economics UNIT-2 By: Mayank Pandey

1

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

Net National Product (N.N.P.)

Net National Product

= Gross National Product - Depreciation

OR

Net National Income

At Market Price

National Income or Net National Income at Factor Cost: profits.

NNI at factor cost = NNI at MP + Subsidies – Indirect Taxes government earned

Personal Income:

Personal Income = National – Social Security contributions –corporate income

Taxes – Undistributed Corporate Profits + Transfer Payment

Disposable Income:

Disposable Income = Personal Income – Personal Taxes

Disposable income shows the purchasing power of the households.

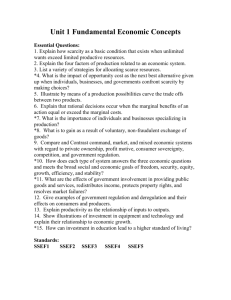

Concepts Summarized: The following chart summarizes the various concepts of national income.

GNP

Expenditure

Approach

Personal

Consumption

Expenditure

GNP

Income

Approach

Wages

Rent

Interest

Dividends

Managerial Economics

NNP

National

Product

Wages

Rent

Interest

Dividends

NI

National

Income

Wages

Rent

Interest

Dividends

UNIT-2

PI

Personal

Income

Wages

Rent

Interest

Dividends

DI

Disposable

Income

Consumption

By: Mayank Pandey

2

Government

Purchases

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

Income of the unincorporated business

Corporate

Income Taxes

Income of the unincorporated business

Corporate

Income Taxes

Income of the unincorporated business

Corporate

Income Taxes

Income of the unincorporated business

Subsides

Transfer

Payments

Saving

Gross Private

Domestic

Investment

Net Foreign

Investment

Social Security contributions

Undistributed

Corporate profits

Social Security contributions

Undistributed

Corporate profits

Indirect Business Indirect Business

Taxes Taxes

Depreciation

Govt’s Surpluses

Social Security contributions

Undistributed

Corporate profits

Subsidies

National Income at Current Prices and National Income at Constant Prices

While estimating national income goods and services produced are multiple by their prices.

Thus,

NI =

PG

(Here, NI =national income,

= sum total, P =price, G = Goods and services)

Conversion of Monetary National Income into Real National Income

Or

Derivation of Real National Income:

By Estimating National Income at some fixed prices :

Real National income or Material income at constant prices

=

National Income at Current Prices

Current Price Index Number

Example: if in 1981, national is Rs. 100 crores, and in 2001 it is Rs.200 crores at the current prices and if price index rises from 100 to 200 within this period, then national income at current prices can be converted into national income at constant prices (at 1981 prices) as under:

Real national income in the year 1981 =

Real National Income in the year 2001 =

200

400

X 100 = 50

Managerial Economics UNIT-2 By: Mayank Pandey

3

Personal

Taxes

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

By using a G.N.P. Deflator:

GNP deflator =

Current Year Price Index

Base Year Price Index

Suppose the current year (2001) price index is 220 while the base year (1981) price index

220 number is 200, then the GNP deflator is

200x

= 22/20=11/10=1.1

In order to obtain the real national income or national income of constant prices we divide the nominal GNP of national income at current prices with the GNP deflator.

Private income

Private income is the income of the private sector obtained from any sources, productive of otherwise, and the retained income of the corporations.

Private Income includes income from domestic product accruing to the private sector, transfer earning, undistributed profits and net factor income from abroad.

Private income = Income from Domestic Product Accruing to the Private Sector + Net

Factor Income from Abroad + Net Transfer Payments from the Government + Transfer

Payments from the Rest of the World + Interest on National Debt.

Per Capita Income

Per capita income of a country usually refer to the average earnings or income of an individual in a particular year in that country. It denotes the income received by an individual in a certain year in a country. Per capita income is expressed at current prices.

Per Capita Income (2012) =

National Income in 2012

Population in 2012

MEASUREMENT OF NATIONAL INCOME

There are three methods of measurement of national income:

1.

Product Method of Value Added Method.

2.

Income Method.

3.

Expenditure Method.

On the basis of these methods, national income so calculated would be identical i.e. gross national product, gross national income and gross national expenditure is identical.

GNP=GNI=GNE

PRODUCT METHOD OF VALUE ADDED METHOD

This is also known as the ‘Inventory Method’ or ‘Commodity Service Method’. This method approaches national income from the output side.

INCOME METHOD

Managerial Economics UNIT-2 By: Mayank Pandey

4

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

This method approaches national income from the distribution side. In other words, this method measure the national income after it has been distributed and appears as income earned of received by individuals of the country. Thus, according to this method, nation income is obtained by summing up of the incomes of all individuals in the country.

Following the income approach, national income can be measured by aggregating the annual flows of factor earnings generated by the production of the final output, say good I (Pi Qi) is also reflected in the sum of the corresponding factor incomes generated, i.e., P i

Q i

= R i

+ W i

+

I i

+ P i

.

Where R i

, W i

, I i

, P i

denotes flow of rent, wages, interest, and profits generated by the production of good i. it follows, therefore, that national income can be measured as the sum of annual flow of different types of factor incomes in the economy.

In this approach, payments for factor, viz., wages, salaries, rents, interest and profits are directly aggregated together to obtain estimates of value added.

EXPENDITURE MEETHOD

This method arrives at national income by adding up all the expenditure made on goods and services during a year. Income can be spent either on consumer goods or investment goods.

Thus, we can get national income by summing up all consumption expenditure and investment expenditure made by all individuals as well as the government of a country during a year. Hence, the gross national product is found by adding up the following.

(a) Personal Consumption Expenditure: What private individual spend on consumer goods and services.

(b) Gross Domestic Private Investment: What private businesses spend on replacement, renewals, and new investment.

(c) Net Foreign Investment: What the foreign countries spend on the goods and services of the national economy over the above what this economy spends on the output of the foreign countries, i.e., export minus imports.

(d) Government Purchases: What the government spends on the purchase of goods and services, i.e., government purchases.

NATIONAL INCOME AS A MEASURE OF ECONOMIC WELFARE

Gross National product (GNP) is not a satisfactory measure of economic welfare because the quantitative estimates of national income do not include certain production activities and services which definitely affect the overall welfare of the people. Some of these factors not taken into consideration in computing GNP are as follows:

1.

Leisure

2.

Quality of Life

3.

Non-market Transactions

4.

Structure of Production

5.

Availability of Essential Consumer Goods

Managerial Economics UNIT-2 By: Mayank Pandey

5

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

6.

Externalities

DIFFICULTIES IN THE CALCULATION OF NATIONAL INCOME

Although all methods are used almost in all countries to calculate national income, yet the calculation is a complex affair and is beset with conceptual and statistical difficulties.

Kuznets mentions the following difficulties:

1.

Difficulty of Defining the Nation

2.

Non-marketing Services

3.

Inapplicability of any one Method

4.

Which Stage to Choose

5.

Paucity of Statistics

6.

How to Avoid Double Counting

7.

Identification of Transfer Payments

8.

Self-consumption Production

9.

Multiple Occupations

10.

Incorrect Statistics

IMPORTANCE OF NATIONAL INCOME STUDIES

The growing importance of national income studies in recent years is due to the following reasons:

1.

Rate of Economic Growth

2.

Economic Welfare of the People

3.

Knowledge of the Distribution of National Income

4.

Economy’s Structure

5.

Standard of Living Comparison

6.

Economic policy

7.

Economic Planning

8.

Distribution of Grants-in –aid

9.

Relative Role of Public and Private Sectors

10.

Defence and Development

Inflation-

Meaning and Definition

The word inflation is derived from the Latin “Inflare” and means to increase or to balloon.

In economics , inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services.

Types of Inflation:

The following are the types of inflation:

Managerial Economics UNIT-2 By: Mayank Pandey

6

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

1Hyperinflation: An extremely high rate of inflation is known as hyperinflation. It is a state of galloping inflation. N. Gregory Mankiw has defined Hyperinflation as

“inflation that exceeds 50% per month, which is just over 1% over per day.

2Suppressed Inflation: Suppressed inflation is a situation where deliberate policies are pursued to prevent price rises in the present, but it is only a temporary suppression of inflation.

Deflation: this means a fall in prices, the opposite of inflation.

Disinflation: It refers to the slowing of the rate of inflation, that is, prices are still rising, but at a slower rate than before. It implies the process of bringing down prices moderately from their previous higher level.

3Reflation: It is a term used to denote inflation after a period of deflation, meaning inflation designed to restore prices to a previous level.

4Crawling Inflation: Crawling inflation is where inflation is low and which moves up and down slowly.

Based on its cases or sources, we can identify three kinds of inflation a.

Administered Pricing b.

Demand Pull Inflation c.

Cost Pull Inflation

Administered Pricing: Inflation caused by the revision of prices by the government.

Demand Pull Inflation: Demand-pull inflation arises when aggregate demand outpaces aggregate supply in an economy.

Cost Pull Inflation: This is because of rise in costs. Cost-push inflation or supply-shock inflation is a type of inflation caused by large increases in the cost of important goods or services where no suitable alternative is available.

General Causes of Inflation in India

Following are the main causes of inflation in India:

1.

Supply Constraints

2.

Demand Accelerators

Following are the main supply constraints because of which prices rise in India:

1.

Fluctuation in Agricultural Output

2.

Hoarding of Essential Goods

3.

Low growth of Industrial Sector

4.

Increment in Administered Prices

5.

Restriction on Imports

The various factors that have accelerated demand thus have resulted in the increase in prices are:

1.

Growth of Population

2.

Increment in Income and Employment

3.

Urbanization

Monetary and fiscal factors have also contributed to price rise in the India as they work as demand accelerations. The following are important reasons in this respect:

Managerial Economics UNIT-2 By: Mayank Pandey

7

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

1.

Rising Level of Government Spending

2.

Deficit Financing

Measurement of Inflation/Price Indices in India

Inflation is measure through various price indices. The following price indices used in India to measure inflation:

1.

GDP Deflator.

2.

Consumer Price Indices.

3.

Wholesale Price Index.

GDP Deflation: It is the broadest measure of the price level. Gross Domestic Product (GDP) deflator is the index of the average price for the goods and services produced in the economy.

It includes the price of all finished goods

Consumer Price Indices (CPI): The consumer price Indices (CPI) measure the price of a selection of goods purchased by a ‘typical consumer’

In India we have three such CPIs:

(i) CPI for Industrial Workers (CPI-W).

(ii) CPI for urban non-manual employees (CPI-UNME).

(iii)CPI for agriculture laborers (CPI-AL).

Whole Price Index: It measures the change in price of a selection of goods at wholesale (i.e., typically prior to sales taxes). It includes the prices of raw materials and semi-finished goods, as well as of imported tangible goods, besides the prices of tangible goods included in the

GDP, if they are transacted at the wholesale level. It excludes the prices of services.

Impact of Inflation

Inflation influences and touches the life of every individual and corporate entity. Hence, inflation influences the decisions affects our lives in the following ways:

1.

Indirect Tex

2.

Shoe Leather Costs

3.

Menu costs

4.

Variability in Relative Prices

5.

Negative Impact on Export

6.

Change in Yardstick

7.

Tax Anomaly

8.

Redistribution

9.

Reduction in Investment and Saving

10.

Vicious Circle of Inflation

Impact of Inflation on Different Groups

Managerial Economics UNIT-2 By: Mayank Pandey

8

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

1.

Loan Agreements/Future Contract/Future payment

2.

Producers and Traders

3.

Fixed Income Group

4.

Investors

Measures to Control Inflation

Monetary Policy: Inflation can be controlled by controlling the supply of money in the economy. The central bank, through its monetary policy, can control inflation to a certain extent. Through various measures like CRR, SLR, Bank Rate, Open Market Operations,

Moral Suasion (for details see chapter of Monetary Policy), etc. the Central bank can increase or decrease the supply of currency in the economy and thus control inflation to some extent.

Price Controls

This vicious circle can be understood from the following equation

Deflation Reduction in Demand

Low

Production

Unemploymen

Vicious Circle of Deflation

Results in widespread Unemployment t

(Diagram-1 Showing Vicious Circle)

Inflation

This can be understood from the following diagram:

Demand

Production

Savings

Managerial Economics UNIT-2

Employment

By: Mayank Pandey

9

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

(Diagram-2 Showing Impact of Mild Inflation)

So thus see that mild inflation is better than no inflation at all. This is true especially for a country which is in the take off stage of development.

Business Cycles

Meaning and Definition

The term business cycle for trades cycle refers to the fluctuations in reconnecting activity that occur in as more or less regular time sequence in all capitalist society

According to Prof. Haberler:

“The business cycle in the general sense may be defined as an alternation in the periods of prosperity and depression of good and bad trade.”

CHARACTERISTICS OF BUSINESS CYCLE

Business Cycle possesses the following characteristics:

1.

Cyclical fluctuations are wave-like movements.

2.

Fluctuations are recurrent in nature.

3.

They are non periodic or irregular.

4.

They occur in such aggregate variables as output, income, employment and prices.

5.

These variables move at about the same time in same direction but at different rate.

6.

The durable goods industries experience relatively wide fluctuations in output and employment and small fluctuation in price. On the other hand non-durable industries experience relatively wide fluctuation in price and small fluctuation in output and employment.

7.

Business cycles are not seasonal fluctuations such as upswings in retail trade during

Diwali or Christmas.

8.

Trade cycles are not secular trends such as long run growth or decline in economic activity.

9.

Upswing and downswings are cumulative in their effects.

PHASES OF THE BUSINESS CYCLE

According to Prof. Schumpeter a trade cycle will have four phases:

1.

Expansion or Boom

2.

Recession

3.

Depression or Trough or Contraction

Managerial Economics UNIT-2 By: Mayank Pandey

10

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

4.

Recovery

Expansion or Boom

This phase of trade cycle represent the best stage of prosperity. In this stage hectic economic activities go on and factors of production are put to optimum use. The main characteristics of this phase are as under: i.

Income or production is the maximum. On account of the interaction of multiplier and accelerator, increase in income is many times more than that of increase in investment. ii.

The economy reaches full employment by removing unemployment. Beyond the stage of full employment, the economy experiences over full employment and hence rise prices and wages. iii.

Prices rise and wages rate are very high. iv.

Traders and industrialists earn huge profits. v.

There is expansion in bank credit. vi.

There is expansion in consumption expenditure, consequently demand also increases. vii.

Rate of interest also rises. However, the rise in rate of interest is less than the rise in rate of profit.

Recession

Under the phase of prosperity, the entrepreneurs make investment in certain ventures which do not prove to be profitable. The main features of this phase are: i.

There is fall in income, employment and output.

ii.

Prices and wages begin to fall.

iii.

Since profits fall, there is no new borrowing despite fall in the rate of interest.

iv.

There is contraction of bank credit.

v.

Fall investment sets in motion the reverse action of the multiplier. Consequently, income falls many times more than the decline in investment.

vi.

Demand of the consumers for various goods also falls. vii.

There is sharp decline in the stock of the goods.

viii.

There is a feeling of doubt and fear among the people.

Depression or Contraction

Managerial Economics UNIT-2 By: Mayank Pandey

11

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

Once the process of recession starts it becomes almost difficult to stop the trend. Salient features of this phase are as follows: i.

Level of output and income is low. ii.

Unemployment increases. iii.

Wages, interest, prices and other costs decline. iv.

Volume of profit falls sharply. Hence despite fall in rate of interest, inducement to invest is very low. v.

Cash reserves with the banks pile up and demand for credit falls. vi.

Old and worn-out machines are not replaced. Hence demand for capital goods falls. vii.

Demand for consumer goods falls. viii.

There is an all-round decline in investment causing reverse action of multiplier and accelerator. ix.

People grow pessimist and it affects economy adversely.

Recovery

During the phase of depression the entrepreneurs do not even replace machine and other capital goods. The main features of recovery are as follows: i.

Replacement investment results into increase in income and output. ii.

Employment increases. iii.

Demand for consumption and production goods rises. iv.

Prices begin to rise and there are more profits. v.

Costs increase relatively less. vi.

Investment increases. vii.

Demand for bank loans and advances increases. viii.

Pessimism gives place to optimism.

Features

Features of Different Phases of Business Cycle

Phase-I Phase-II Phase-III

Expansion or

Boom

Recession Depression

1.

Employment Increase

Increases

Suddenly falls

Falls

Very Low

Falls very low

Phase-IV

Recovery

Slowly Rises

Slowly Rises

Managerial Economics UNIT-2 By: Mayank Pandey

12

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

2.

Output

3.

4.

5.

6.

Wages

Prices

Interest

Bank Credit

Rise

Rise

High

Expands

Rises

Large

Optimism

Fall

Fall Sharply

Begins to fall

Suddenly falls

Falls

Fall

Doubt and

Fear

Fall very low

Fall very low

Very low

Falls low

Falls very low

Fall very low

Pessimism

Begin to Rise

Begins to Rise

Begins to Rise

Begins to

Expand

Begins to Rise

Begins to Rise

Optimism

7.

Cost of

Production

8.

Stocks

9.

Feelings

Features

Employment

Phase-I

Expansion or

Boom

Increase

Phase-II

Recession

Suddenly falls

Phase-III

Depression

Very Low

Phase-IV

Recovery

Slowly Rises

Output

Wages

Prices

Interest

Bank Credit

Cost of

Production

Increases

Rise

Rise

High

Expands

Rises

Falls

Fall

Fall Sharply

Begins to fall

Suddenly falls

Falls

Falls very low

Fall very low

Fall very low

Very low

Falls low

Falls very low

Slowly Rises

Begin to Rise

Begins to Rise

Begins to Rise

Begins to Expand

Begins to Rise

Stocks Large

Optimism Feelings

Causes of Business Cycle

Fall

Doubt and Fear

Fall very low

Pessimism

Begins to Rise

Optimism

Economists have given various causes of business cycles. Some attributes them to monetary and non-monetary factors while others to psychological factors. Samuelson attributes business cycles to external and internal factors.

External Factors

Managerial Economics UNIT-2 By: Mayank Pandey

13

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES MBA SEMESTER 1

MANEGERIAL ECONOMICS UNIT4

The external factors emphasize the causes of business cycles in the fluctuations of something outside of the economic system. Such external factors are:

sunspots,

wars,

revolutions,

political events,

gold discoveries,

growth rate of population,

migrations, discoveries of new land and resources,

Scientific and technological discoveries and innovations.

These outside factors change the level of national income by affecting either the investment or consumption component of aggregate demand.

Internal Factors

The internal factors related to mechanisms within the economic system itself which will give rise to self generating business cycles, so that every expansion will breed recession and contraction, and every contraction will in turn breed revival and expansion, in the regular, repeating, never-ending chain. Internal factors divided into monetary and non-monetary which we explain as follows: i.

Bank Credit iv.

Competition ii.

Over-Saving or Under

Consumption v.

Psychological Causes vi.

Innovations iii.

Over Investment

MINIMIZING EFFECTS OF BUSINESS CYCLES

The methods employed by businessmen to avoid or minimize the ill-effects of the business cycle fall into two general categories:

I.

Preventive Measures

The various preventive measures are given below:

1.

Conserving assets during expansion, avoiding undue increase in plant and equipment, and in dividends.

2.

Managing plant in such a way as to-

(a) Avoid decrease in unit production;

(b) Avoid increase in unit overheads; and

(c) Maintain satisfactory labour conditions and steady employment throughout the year.

3.

Avoiding excessive inventories of raw materials, materials in process, and finished products.

4.

Avoiding purchase commitments in excess of financial resources.

5.

Avoiding excessive sales which result in cancellations.

6.

Employing a flexible credit standard which may be tightened during expansion and relaxed during contraction.

Managerial Economics UNIT-2 By: Mayank Pandey

14

September

2013

IENGINEERS- CONSULTANTS LECTURE NOTES SERIES

MANEGERIAL ECONOMICS UNIT4

II. Relief Measures

MBA SEMESTER 1

Of the various measures employed to mitigate the effect of contraction, the following are worth mentioning:

1.

Quick liquidation of inventories.

2.

Reduction of costs of manufacture, both direct and indirect.

3.

Improvement of quality to enhance demand.

4.

Adoption of selling methods based on accurate analysis of the new situation.

5.

Development of plant and organization for future business.

6.

Part-time operation.

7.

Utilization of profits gained in good times for payments to out-of-work employees.

8.

Launching new merchandise lines during slack periods. Plans for these new lines are perfected before the contraction arrives, so that the plant is ready to begin production at once when the occasion calls for it. Such a policy is particularly appropriate for a concern manufacturing novelties.

9.

Transference of employees from on department to another during contraction. If such a versatile labour force has been secured. Some of the worst effects of contraction on the manufacturing firm can be avoided during depression. Such a move not only benefits the firm concerned but also hastens recovery as a whole through the maintenance of purchasing power among the working population.

Managerial Economics UNIT-2 By: Mayank Pandey

15