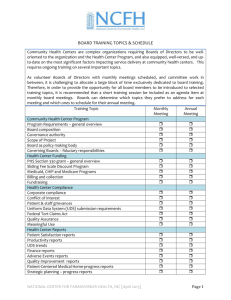

Board and Top Management: Changes over the Decades

advertisement