Request for Arbitration

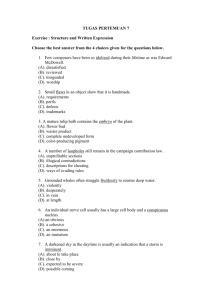

advertisement