Nivea- Building Brands Building Business

Business

2000

S I X T H e d i t i o n

BUILDING BRANDS,

BUILDING BUSINESS

An unforgettable quote from George Orwell’s "Animal Farm" informed us that "All animals are equal but some are more equal than others".

One could be forgiven for thinking that in recent times a similar quote could be applied to stakeholders in business organisations.This might read "All stakeholders are equal but some, consumers, are more equal than others". Even if it were true few would complain about it.

The majority of modern business philosophies like TQM and World

Class Manufacturing are without doubt consumer oriented. But there are few areas as consumer driven as marketing.This holds true from the multi-billion trans-national operations down to a threeemployee indigenous firm. When a company ‘thinks global and act local’, it makes its marketing strategy customer-driven. When the consumer becomes your main focus, rewards will follow.

Beiersdorf

One company that have benefited enormously from having adopted such a consumer driven marketing strategy is Beiersdorf. The year

2000 was its most successful in its 120-year history. German in origin, the company’s products are sold in nearly every country in the world with over 70% of sales outside Germany.The Group now has sales in excess of 4.2 billion.

The Beiersdorf Group policy has been to "open up new countries and new product categories". This is key to Beiersdorf’s expansion strategy strengthening its position through synergistic acquisitions or inorganic growth . An example of this type of this synergistic expansion was Beiersdorf ’s acquisition of the plaster brand

Elastoplast, the market leader in the majority of countries including the United Kingdom and Ireland. This resulted in synergies, along with the business know-how of the acquired company, positioning

Beiersdorf as a global leader in this market. However it is

Beiersdorf’s achievement of continuously high sales growth and the organic growth of their brands that will be the main focus of this study. In particular it will chart the introduction of two products from its NIVEA brand on the Irish market and the marketing strategy behind their launch.

Business

2000 s i x t h e d i t i o n

The Nivea Experience

Over the last number of years Beiersdorf has pursued a strategy of investing in a small number of strong consumer brands.The success of this policy has seen one of its stalwart brands, NIVEA, reach worldwide sales of over 2 billion in 2000, four times its 1990 level. In Europe there has been a continuous rise in consumer spending. NIVEA has been active in tapping into this and seeking ways of increasing its market share.

NIVEA could be regarded as market leader in terms of its marketing policy. This means it continuously and proactively attempts to anticipate and satisfy the needs of the consumer before its competitors. To do this

NIVEA must concentrate on every aspect of the product life cycle

(PLC) . It must invest in research and be ready to exploit gaps in the market with new and innovative solutions.

NIVEA has expanded its position as the world’s greatest skincare brand mainly through organic growth. It is not surprising therefore that NIVEA pays special attention to the Irish market particularly as it remains the fastest growing economy in Europe.

NIVEA has been in Ireland since 1922. During that time NIVEA products have enjoyed substantial consumer acceptance . So much so that

NIVEA is the number 1 skincare brand in the Republic of Ireland with

21.7% market share (Source: AC Nielsen, April/May 2002).

Through its many and varied market research techniques, NIVEA identified Ireland as a mature and fast moving market with strong growth fuelled by increasing demand for skin friendly products with clear consumer benefits.

NIVEA and Product Development

Before any NIVEA product reaches the shelves of Irish retailers there are a number of stages of development.

Internationally:

1. Idea Generation

Research and Development.

This is where the NIVEA Research and

Development Depar tment try to source new ideas for possible products. Beforehand, they may undertake a SWOT analysis or a capability analysis, which can help to identify where the company has a strong or unique ability. The new ideas may be generated amongst key workers or as the result of intrapreneurial initiatives from within the workforce. They may emer ge as a result of market research or from feedback from retailers and consumers. Often they may be products currently in the NIVEA product portfolio that have already been launched in a different part of the world, and are deemed suitable for introduction to other markets, with perhaps modifications to suit local markets.

2. Product Screening

Not all the ideas suggested will be suitable for launch. It may be that the time is not yet right or simply that the product is either impractical or uneconomical to produce.

3. Concept Development

The task now facing NIVEA is to take the idea(s) and match it to the needs of the potential NIVEA consumer. As we will see, NIVEA has accumulated quality data on the personal care needs of the Irish male.The

challenge is to produce products that are attractive to that segment in particular.

4. Feasibility Study

It is essential to then assess the commercial feasibility in terms of production costs, potential profitability, market support, investment, etc.The main steps would be:

◗ The scientists try and match the ingredients to the demands of the consumer.

◗ The production department assesses whether the company has sufficient production capacity or whether it needs to expand existing factories, build new plants, merge or take-over a competitor or even subcontract out the new product range.

◗ The cost accountants monitor costs and try to assess the possible profits from the new products(s).

◗ The marketing department devises new packaging, as well as a broad communications strategy, that will attract the targeted market.

5. Prototype Development

If the reaction from the feasibility studies is positive, then NIVEA will authorise the development of a small amount of the new product(s).

Whether or not this will be the product and packaging that will be eventually launched on the market will depend on the reaction to

NIVEA’s test marketing.

www.business2000.ie

6. Test Marketing

Even though NIVEA has devoted substantial amounts of time and resources to the new product, it could stand to lose huge amounts if the market reacts badly once the product is launched.Therefore it is vital that

NIVEA engage in test marketing before mass-production begins. Essentially, market researchers observe and discuss with the consumer their response to the "test" product and bring back the results to NIVEA executives. If feedback strongly suggests that changes be made to either product or packaging the company acts appropriately.

7. Launch

Assuming the reaction to the test marketing is positive and that there is indeed a niche in the market for the new product, the marketing team then decide to launch the product into their own local market and devise a financial plan and communications strategy.

New Product Launch

Confidentiality

The introduction of any new product into a market is a delicate combination of professionalism and secrecy. The marketing teams within

NIVEA, (responsible for the launch) will then devise a detailed marketing plan encompassing TV, Radio, Outdoor, Press and various other below the line activities (Direct Marketing, Sampling, promotion packs, etc.). Because of the amount of money spent on developing and producing the product it is absolutely vital that the product is launched without the details being leaked either in the media or especially to NIVEA’s many competitors in the skin care and personal care market.

In general it makes financial sense for NIVEA in Ireland to launch products that are in the UK market first. NIVEA gains from the economies of scale that such a strategy generates. Economies of scale derive when the average unit cost of producing a product decrease as the volume of production increases. Ireland usually prepares a parallel launch because much of Britain’s advertising media is already available in Ireland and the main feasibility work is done in the UK.

More and more Irish consumers are exposed to terrestrial British TV stations like ITV and Channel 4 and in recent years the numbers tuning into Sky TV and other satellite channels has grown enormously. It is a similar story with the UK print media. NIVEA’s Irish market benefits from

"overspill" from UK activity.

So why therefore did NIVEA decide to launch two of their products

NIVEA Deodorant and NIVEA Bath Care in Ireland without having first introduced it onto the UK market?

The Irish Dimension

The marketing concept places a high degree of importance on ascertaining what exactly customers want by way of new products and from existing products. It must then strive to produce these goods and services profitably and more efficiently than its competitors.

It made financial sense for NIVEA Ireland to launch these products in the

Irish market because there was an obvious gap for quality shower and deodorant products and NIVEA could offer this along with a long and trusted heritage in skincare. The financial rewards of launching in Ireland could more than compensate for the traditional economies of scale from a prior launch in UK. More surprising however was the research conclusions about the characteristics of the Irish market. Beiersdorf Ireland recognised a gap in the Irish market and capitalised on it.

The male personal care market has grown hugely in recent years with product sales world wide now in excess of $3.5 billion. While this is still comparatively modest compared to women’s personal care sales NIVEA had recognised the potential for development especially in Ireland. Growth possibilities existed because the male personal care market was less saturated than the female one and research had shown that men were now taking a much more open approach to personal grooming.

What faced NIVEA in Ireland was a deodorant market with a total market value of 29.21 million and 21% year on year growth. In the shower sector the total market value was 15.367 million with more than 25% year on year growth. Both were fast moving markets with buoyant growth levels.

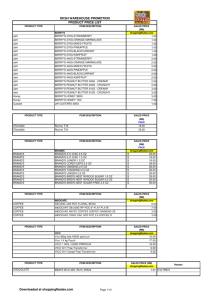

The table below demonstrates some of the trends that were emerging in the Irish market and the manner that NIVEA Deodorant and NIVEA Bath

Care responded to those trends.

CONSUMER TRENDS

No longer willing to suffer skin irritation from harsh formulations

Importance of fragrance

Men are demanding more effective products but are now aware of the need to look after their skin

NIVEA’S RESPONSE

NIVEA Deodorant is alcohol and preservative free and enriched with Allantoin

Gentle fresh scent whether masculine or feminine

Men accept NIVEA and acknowledge its reputation for quality, care and reliability

From the above trends it is quite obvious that

◗ Consumers are no longer willing to suffer skin irritation from harsh formulations. With its unique skincaring heritage NIVEA Deodorant can dominate and grow this market.

◗ Despite the fact that men sweat more than women they are 13% less likely to use a deodorant daily. Men nonetheless, according to research, deem perspiration as less of an issue but have strong demand for a reassuring product in attractive packaging. NIVEA has already established a direct communication platform with men through NIVEA for Men.They apply this strategy to the deodorant market.

Conclusion

NIVEA’s enterprising and innovative approach to the Irish market has been already reaped dividends. Whether or not their competitors will follow suit remains to be seen. One thing is for sure

- the traditional approach to launching products can never again be assumed to be the only way.

While every effor t has been made to ensure the accuracy of information contained in this case study, no liability shall attach to either The Irish Times Ltd. or Woodgrange Technologies Ltd. for any errors or omissions in this case study.

Business

2000 s i x t h e d i t i o n

tasks and activities

1.

Describe the various stages involved in the development process of a new product using NIVEA Deodorant or any product of your choice as an example.

2.

Distinguish between the terms marketing concept and marketing strategy.

3.

Define the terms

◗ Brainstorming

◗ Intrapreneurship

◗ SWOT analysis

◗ Organic growth

◗ World class manufacturing

◗ Economies of scale

4.

In terms of marketing define the following terms

◗ Desk Research

◗ Field Research

◗ Market research

5.

From your reading of the above study

◗ Describe the method traditionally used by companies like NIVEA to launch their new products in the UK and

Ireland.

◗ Outline the reasons why NIVEA chose to launch NIVEA

Deodorant in Ireland before introducing the product in the UK?

◗ Explain with relevant examples the product mix operated by NIVEA.

6.

The Beiersdorf Group has a policy of "opening up new countries and new product categories". This is key to

Beiersdorf ’s expansion strategy. Using the following matrix where would you place NIVEA Deodorant?

Existing

PRODUCT

New

MARKET

Existing

Elastoplast - existing product is developed within a market to maintain market share.

???

New

???

www.nivea.com

www.business2000.ie