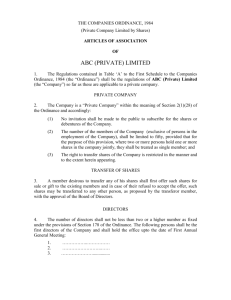

gibraltar companies ordinance

advertisement