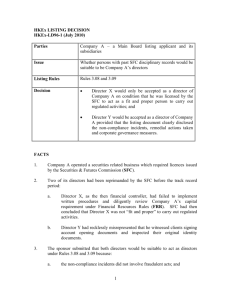

consultation paper

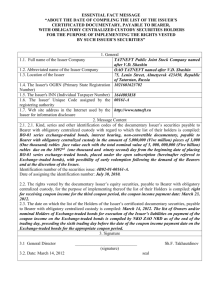

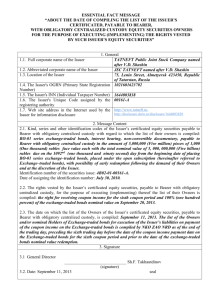

advertisement