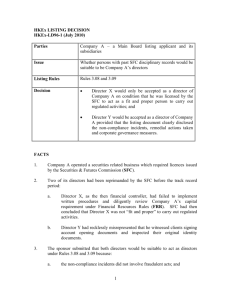

consultation paper

advertisement