ACC 441 - Shaw University

advertisement

SHAW UNIVERSITY

Department of Business & Public Administration

ACC 441- 50 -Advanced Accounting I

Instructor: Bernard F. Bugg

Phone:

(919) 546-8352

Office:

Tupper 101

E- mail Address: bbugg@shawu.edu

Hours:

MW-1:30-5:30 & TTH 12-1; Meeting Time:

MW–5:45 pm

TTH- 3:45-4:45, or by appt.

Required Text[s]

Fischer, Paul M., Taylor, William J., Cheng, Rica H. (10th Edition). Advanced Accounting

Program Mission Statement

The mission of the Business Administration major reflects the mission of both the Department and the University, which

is to provide a liberal arts education and to prepare the student to function effectively in the world of work as well as in

graduate and professional schools. The sequence of courses leading to the major in Business Administration with

concentration in Accounting is designed not only to sharpen the professional skills of the students but also to enhance

their ability to think clearly and critically, to analyze, synthesize and evaluate, acquire and understanding of self, and to

develop a commitment to ethics and values.

Program Goals

1. Providing students with a liberal arts education in Business Administration that upon graduation will: (a) prepare

them for employment in government and industries, (b) prepare them to continue graduate or professional studies.

2. Helping students develop their analytical, cognitive, oral and writing skills, as well as to develop an awareness of

an commitment to values.

3. Increasing the number of students concentrating in Accounting.

4. Strengthening the Accounting Concentration Program with specific emphasis on computer application.

5. Starting the process of getting the Business Administration program accredited.

6. Encouraging the professional development and teaching effectiveness of the departmental faculty

7. Implementing and strengthening necessary administrative processes.

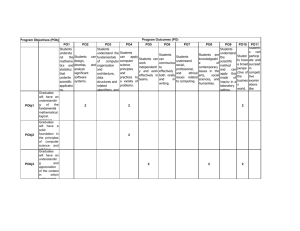

Program Learning Outcomes (PLO)

The proposed accounting concentration program outcomes are:

1. Accounting graduates demonstrate the ability to understand operations of a profit or not-for-profit entity and to

effectively apply professional knowledge to financial statement preparation, analysis and related decision-making.

2. Accounting graduates demonstrate the ability to effectively apply professional knowledge to individual and

business tax return preparation, analysis and related decision-making.

3. Accounting graduates demonstrate the ability to effectively apply professional knowledge to internal managerial

report preparation, analysis and related decision-making.

4. Accounting graduates demonstrate the ability to effectively apply professional knowledge to understand the audit

process, including fraud deterrence, detection and investigation, and to research related decision making issues.

5. Accounting graduates are able to apply critical thinking skills in solving accounting problems.

6. Accounting graduates have an understanding of the legal, ethical and regulatory environment of business and the

strategic role of accounting.

7. Accounting graduates demonstrate the ability to effectively use oral and written communication in the context of

accounting related matters.

8. Accounting graduates are prepared for careers in the accounting profession, professional certification and

graduate studies in the accounting field.

Course Description/Prerequisites

This course is designed to provide the most innovative and comprehensive insight of advanced financial accounting topics

on the market today. Strong pedagogical elements are incorporated throughout this course. Focus is on advanced

application of accounting pronouncements, relating to Not-For-Profit Accounting, Multinational Accounting and

Accounting for Partnerships. This is a 3 credit hour course and the prerequisite is ACCT 342.

1

Student Learning Outcomes (SLO)

Student Learning Outcomes: Upon course

completion, students will be able to:

Assessment of Student

Learning Outcomes

(Assessment Tools)

Linkage to Program

Learning

Outcomes to, r supports

the stated SLO).

1

1F. Acquire an understanding of Accounting for Business

Combinations and related standards and applications.

Exam Questions, Research

Papers

1G. Prepare and analyze consolidated financial

statements and research related issues

1H.Acquire an understanding of international accounting

standards, issues, and practices.

5A. Demonstrate effective use of critical thinking skills,

oral and written communications skills related to

financial accounting matters.

6A.Acquire an understanding of the basic legal, ethical

and regulatory issues related to financial accounting.

Exam Questions, Research

Papers

Exam Questions, Research

Papers

Exam Questions, Research

Papers

1

Exam Questions,

Research Paper

6

7B. Demonstrate effective use of oral and written

communications skills related to financial accounting

matters.

8A. Pursue graduate studies, professional

certifications, and careers in financial accounting.

Exam Questions,

Research Paper, PPT

Presentation

Follow-up Surveys, and

Recommendation Letters.

7

1

5

8

Classroom Policies

Students are responsible for attending class on time and adhering to the University’s Class Attendance Policy. The

Attendance Policy is printed in the Shaw University Undergraduate Catalogue and shall be enforced. Each student is

allowed as many unexcused absences per semester as the class meets per week. Cheating ( includes plagiarism) will not

be tolerated {ZERO TOLERANCE]. If caught, student(s) will receive a zero. Exams/Quizzes must be taken when

scheduled. Make-ups will only be given in event of emergency. If final exam is missed due to emergency, an incomplete

will be given and make-up exam will be administered during following term. Grading Criteria is discussed below.

Student Classroom Decorum Expectations:

To enhance the learning atmosphere of the classroom, students are expected to dress and behave in a fashion conducive to

learning in the classroom. More specifically, students will refrain from disruptive classroom behavior (i. e., talking to

classmates, disrespectful responses to teacher instructions; swearing; wearing clothes that impede academic learning

such as but not limited to, wearing body-revealing clothing and excessively baggy pants; hats/caps, and/or headdress.

Students will turn off telephones prior to entering the classroom. Students who exhibit the behaviors described above, or

similar behaviors will be immediately dismissed from class at the third documented offense. The student will be readmitted

to class only following a decision by the department chair. The student may appeal the decision of the department chair to

the Dean of the College offering the course, and, subsequently, to the Office of the Vice President for Academic Affairs,

and then to the President of Shaw University. The decision of the President will be final. Failure to follow the procedures

herein outlined will result in termination of the appeal, and revert to the decision of the department chair.

Each behavior construed by the teacher/professor as noncontributive to learning will be recorded, properly documented, and

appropriately reported to the student and to the chair of the academic department offering the course. The report will be in written

form with a copy provided to both the student and the department chair. The faculty member should retain a copy for his/her own

records. Additional student behavior codes may be found in Student Affairs.

Grading Criteria:

The overall assessment for this course is based upon the following components:

WEIGHT

ASSESSMENT

POINTS

10%

Attendance and Homework

50

2

20%

Unit Quizzes/Exams

100

50%

Midterm/Final Exams

250

20%

Research Project

100

100%

TOTALS

500

Grade Scale:

The grading scale based upon total points earned is as follows:

POINTS

EARNED

GRADE

450 – 500

A

400 - 449

B

350 - 399

C

300 - 349

D

Below 300

F

Topical Course Outline

Week#

Topic Description

1

Introduction/Overview

2

Business Combinations – The Environment

3

Exam #1

4-5

Consolidated Statements – Date of Acquisition

6-7

Consolidated Statements – Subsequent to Acquisition

8

Exam #2

9-11

Inter Company Transactions – Merchandising, Plant Assets and Notes

12

Business Combinations – Overview/Summary

13-14

International Accounting Issues

15

Final Exam Review, Research Paper ** due

16

Final Exam

Homework_______________

TBA

TBA

TBA

TBA

TBA

TBA

TBA

** Research Paper involves an analysis of the annual report of a governmental agency/ not-for-profit organization or a

related recent accounting fraud scandal in the governmental or not-for-profit sector. Research paper should be at least 5

typed pages + cited references. Research paper on annual report should include following:

-Brief summary of organization

-Brief summary of Management and Discussion Analysis

-Comparative vertical/horizontal/trend/ratio analysis

-Brief summary of interesting footnotes focusing on concepts discussed in class

-Cited references

Research paper on fraud scandal should include the summary of case and background, the Accounting

and ethical issues involved, the lessons learned from fraud scandal and cited references.

Grading rubric for oral and written presentations of term project is summarized at the end of this syllabus. In addition, the

online search tool EBSCO Host and other LRC resources can be accessed through the university’s library

website at http://www.shawu.edu/Academics/James_Cheek_Learning_Resource_Center.aspx

3

Written Communication Rubric

Oral Communication Rubric

4

Oral Communication Rubric (Continued)

5