Economics 301: Macroeconomics

advertisement

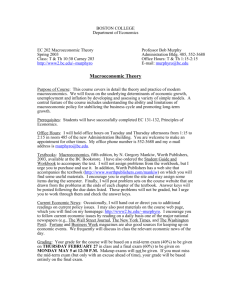

Economics 303: Macroeconomics Prof. A. Villamil: avillami@uiuc.edu, 331 Wohlers Hall, 244-6330 Office hours: 9:30-10:00 Tuesday and Thursday, Tuesday 12-1 Fall 2004 Course Objectives. The purpose of this course is to introduce you to current theoretical and policy problems in macroeconomics. We will address the following questions: 1. What determines an economy’s “standard of living” and growth path? 2. What is “the business cycle” (i.e., fluctuations and co-movements in consumption, investment, employment, output, interest rates, inflation, etc.)? 3. What can/should a government do when an economy experiences macroeconomic fluctuations? 4. What are the effects of monetary policy, fiscal policy, trade policy, and exchange rate policy? Course Requirements and Evaluation Procedure. Your course grade will be determined by your performance on two mid-term examinations and a comprehensive final examination. In addition, there will be homework to assist you in mastering the material. The homework will also be used to determine final course grades for scores that fall “on the margin.” The exam dates are: Mid-term Exam I: October 7 (30 points) Mid-term Exam II: November 18 (30 points) Final Exam: Wednesday, December 15, 8 – 11 am, regular room (40 points) Note: Requests for re-graded exams must be handed in no later than one week after the exam is returned. Note: The deadline to drop an undergraduate class without a grade of “W” is October 15, 2004. Text & Readings: N. Gregory Mankiw, Macroeconomics, 5th edition, 2003, Worth Publishing. Some additional readings are listed below. Others readings related to current policy will be assigned in class (e.g., from the New York Times). You will find the course more enjoyable if you use Mankiw’s website at http://www.worthpublishers.com/mankiw and read a newspaper to follow current events, e.g. the New York Times at http://www.nytimes.com CourseWebsite: I will post course material at http://compass.uiuc.edu Please follow the login instructions. Other Issues. If you have any problems with the course, please see me as soon as possible. Tentative Schedule Session 1: August 26. Overview, introduction and growth facts: What Determines the Wealth of Nations? READ: Parente and Prescott, “Changes in the Wealth of Nations,” FRB of Minneapolis Quarterly Review (1993), at: http://research.mpls.frb.fed.us/research/economists/ecp.html Session 2: August 31. Measures of Macro Performance READ: Mankiw chapters 1, 2, 6 Session 3: September 2. Measures of Macro Performance continued: “jobless recovery” READ: Schreft and Singh, at: http://www.kc.frb.org/publicat/econrev/er03q2.htm#jobless Session 4: September 7. National Income & Micro Review READ: Mankiw chapter 3 Session 5: September 9. National Income & Micro Review continued READ: Mankiw chapter 3 and the Appendix Session 6: September 14. Growth Model and the “Golden Rule” READ: Mankiw chapter 7 and the Lecture Note on Economic Growth Session 7: September 16. Population Growth and Technological Progress READ: Mankiw chapter 7 and the Lecture Note on Economic Growth Session 8: September 21. Technological Progress, Accounting, Policy and Endogenous Growth READ: Mankiw chapter 8 and the Lecture Note on Economic Growth Session 9: September 23. Homework review, problem session, and policy discussion Session 10. September 28. Policy Applications: Growth in Asia and recent crises READ: “Asia: A Billion Consumers,” The Economist, 10/30/93, 1-22 Session 11: September 30. “Long-term” Growth (Money and Inflation) READ: Mankiw chapter 4 Session 12: October 5. Review and Problem Session Session 13: October 7. Exam I Session 14: October 12. International Trade READ: “The Miracle of Trade,” The Economist, 1/27/96 (posted on compass) Session 15: October 14. The Open Economy READ: Mankiw chapter 5 Session 16: October 19. The Linear Keynesian Model: the Keynesian Cross READ: Mankiw chapters 9, 10, and 11 Session 17: October 21. The Linear Keynesian Model (simple IS-LM and AS-AD Closed Model) READ: Mankiw chapters 9, 10, and 11 Session 18: October 26. Effects of Monetary Policy over time on gdp, inflation, & interest rates Session 19: October 28. Effects of Fiscal Policy & P shocks over time on gdp, inflation, & interest rates Session 20: November 2. The Linear Mundell-Fleming Model: Flexible exchange rates READ: Mankiw chapter 12 Session 21: November 4. The Linear Mundell-Fleming Model: Fixed exchange rates READ: Mankiw chapter 12 Session 22: November 9. Policy Application: TBA READ: TBA Session 23: November 11. Business Cycles READ: Mankiw chapter 19 Session 24: November 16, Review and policy discussion Session 25: November 18. Exam II Thanksgiving Break: No Class Nov. 23 or 25 Session 26: November 30. Business Cycles READ: Mankiw chapter 19 Session 27: December 2. Business Cycles continued READ: Mankiw chapter 19 Session 28: December 7. Money Demand and the Money Supply Process READ: Mankiw chapter 18 and Lecture Note Session 29: December 9: Policy Debates, Review and Summary READ: Mankiw Epilogue: What We Know, What We Don’t Session 30: Final Exam. Wednesday, December 15, 8-11 AM (regular room)