Consumer Sentiment, the Economy, and the New Media

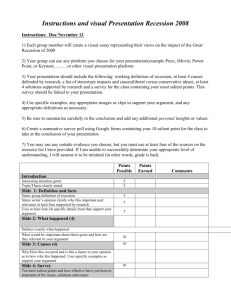

advertisement