Study Guide Ch 10

advertisement

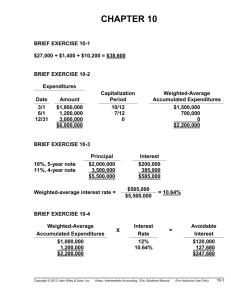

BRIEF EXERCISES Brief Exercise 10–1 Capitalized cost of the machine: Purchase price Freight Installation Testing Total cost $35,000 1,500 3,000 2,000 $41,500 Note: Personal property taxes on the machine for the period after acquisition are not part of acquisition cost. They are expensed in the period incurred. Brief Exercise 10–2 Capitalized cost of land: Purchase price Broker’s commission Title insurance Miscellaneous closing costs Demolition of old building Total cost $600,000 30,000 3,000 6,000 18,000 $657,000 All of the expenditures, including the costs to demolish the old building, are included in the initial cost of the land. Solutions Manual, Vol.1, Chapter 10 © The McGraw-Hill Companies, Inc., 2013 10–7 Brief Exercise 10–3 Cost of land and building: Purchase price Broker’s commission Title insurance Miscellaneous closing costs Total cost $600,000 30,000 3,000 6,000 $639,000 The total must be allocated to the land and building based on their relative fair values: Percent of Total Fair Value Asset Land Building Fair Value $420,000 280,000 $700,000 60% 40 100% Initial Valuation (Percent x $639,000) $383,400 255,600 $639,000 Brief Exercise 10–4 Cost of silver mine: Acquisition, exploration, and development Restoration costs † $5,600,000 429,675 † $6,029,675 $500,000 x 20% = $100,000 550,000 x 45% = 247,500 650,000 x 35% = 227,500 $575,000 x .74726* = $429,675 *Present value of $1, n = 5, i = 6% (from Table 2) © The McGraw-Hill Companies, Inc., 2013 10–8 Intermediate Accounting, 7/e Brief Exercise 10–5 After one year, the liability will increase to $455,456. ($429,675† + ($429,675 x 6%) = $455,456) † $500,000 x 20% = $100,000 550,000 x 45% = 247,500 650,000 x 35% = 227,500 $575,000 x .74726* = $429,675 *Present value of $1, n = 5, i = 6% (from Table 2) Actual restoration costs Less: Asset retirement liability Loss on retirement $596,000 (575,000) $ (21,000) Brief Exercise 10–6 Calculation of goodwill: Consideration exchanged Less fair value of net assets: Book value of assets Plus: Excess of fair value over book value of intangible assets Goodwill $14,000,000 $8,300,000 2,500,000 (10,800,000) $ 3,200,000 Brief Exercise 10–7 The initial value of machinery and note will be the present value of the note payment: PV = $60,000 (.85734* ) = $51,440 * Present value of $1: n = 2, i = 8% (from Table 2) Interest expense for July 1 to December 31, 2011: $51,440 x 8% x 6/12 = $2,058 Solutions Manual, Vol.1, Chapter 10 © The McGraw-Hill Companies, Inc., 2013 10–9 Brief Exercise 10–8 The cost of the patent equals the fair value of the stock given in exchange: 50,000 x $22 = $1,100,000 Brief Exercise 10–9 Average PP&E for 2013 = ($740,000 + 940,000) ÷ 2 = $840,000 Net sales ÷ Average PP&E = Fixed-asset turnover ratio ÷ $840,000 = 3.25 ? Average PP&E x Fixed-asset turnover ratio = Net sales x 3.25 = $2,730,000 $840,000 Brief Exercise 10–10 Proceeds Less book value: Gain on sale of equipment $16,000 $80,000 (71,000) 9,000 $ 7,000 Journal entry (not required): Cash ................................................................................. Accumulated depreciation (account balance) .................... Gain (difference) ............................................................ Equipment (account balance) .......................................... © The McGraw-Hill Companies, Inc., 2013 10–10 16,000 71,000 7,000 80,000 Intermediate Accounting, 7/e Brief Exercise 10–11 Pickup trucks = Fair value of machinery plus cash paid $17,000 + 8,000 = $25,000 Loss on exchange = $20,000 (book value) – 17,000 (fair value) = $3,000 Journal entry (not required): Pickup trucks (determined above) ..................................... Accumulated depreciation (account balance) .................... Loss (difference) ............................................................... Cash ........................................................................... Machinery (account balance) .......................................... 25,000 45,000 3,000 8,000 65,000 Brief Exercise 10–12 Pickup trucks = Fair value of machinery plus cash paid $24,000 + 8,000 = $32,000 Gain on exchange = $24,000 (fair value) – 20,000 (book value) = $4,000 Journal entry (not required): Pickup trucks (determined above) ..................................... Accumulated depreciation (account balance) .................... Cash ........................................................................... Gain (difference) ........................................................... Machinery (account balance) .......................................... Solutions Manual, Vol.1, Chapter 10 32,000 45,000 8,000 4,000 65,000 © The McGraw-Hill Companies, Inc., 2013 10–11 Brief Exercise 10–13 Pickup trucks = Book value of machinery plus cash paid $20,000 + 8,000 = $28,000 No gain is recognized in this situation. Journal entry (not required): Pickup trucks (determined above) ...................................... Accumulated depreciation (account balance) .................... Cash ............................................................................ Machinery (account balance) .......................................... © The McGraw-Hill Companies, Inc., 2013 10–12 28,000 45,000 8,000 65,000 Intermediate Accounting, 7/e Brief Exercise 10–14 Average accumulated expenditures: January 1 March 31 June 30 $500,000 x 600,000 x 400,000 x 600,000 x October 30 12/12 9/12 6/12 2/12 = $ 500,000 = = = 450,000 200,000 100,000 $1,250,000 Interest capitalized: $1,250,000 – 700,000 $ 550,000 x 7% = $49,000 x 6.75%* = 37,125 $ 86,125 = Interest capitalized * Weighted-average rate of all other debt: $3,000,000 5,000,000 $8,000,000 x 8% = $240,000 x 6% = 300,000 $540,000 $540,000 = 6.75% weighted average $8,000,000 Solutions Manual, Vol.1, Chapter 10 © The McGraw-Hill Companies, Inc., 2013 10–13 Brief Exercise 10–15 Average accumulated expenditures: January 1, 2013 March 31, 2013 June 30, 2013 $500,000 x 600,000 x 400,000 x 600,000 x October 30, 2013 12/12 9/12 6/12 2/12 = $ 500,000 = = = 450,000 200,000 100,000 $1,250,000 Interest capitalized: $1,250,000 x 6.77%* = $84,625 * Weighted-average rate of all other debt: $ 700,000 3,000,000 5,000,000 $8,700,000 x 7% = $ 49,000 x 8% = 240,000 x 6% = 300,000 $589,000 $589,000 = 6.77% weighted average $8,700,000 Brief Exercise 10–16 Research and development: Salaries Depreciation on R & D facilities and equipment Utilities and other direct costs Payment to another company Total R & D expense $220,000 125,000 66,000 120,000 $531,000 Note: The patent filing and related legal costs and the costs of adapting the product to a particular customer’s needs are not included as research and development expense. © The McGraw-Hill Companies, Inc., 2013 10–14 Intermediate Accounting, 7/e