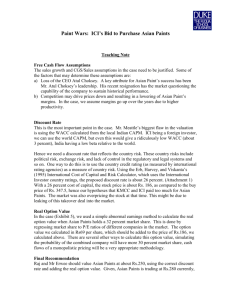

Asian Paints Annual Report - Retail Environments Insights Center

advertisement