promoter disputes - Business Standard

advertisement

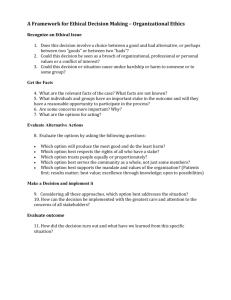

PROMOTER DISPUTES Zandu Pharmaceutical Works 2008 EMAMI RANA KAPOOR vs MADHU KAPUR Yes Bank 2013 The tussle between the promoters’ of private sector lender YES Bank over board level appointment spilled over at its annual general meeting on Saturday as the crucial resolutions to induct three board members were opposed by several shareholders. Madhu Ashok Kapur – the widow of YES Bank’s late co-founder Ashok Kapur — and her two children had moved the Bombay High Court requesting a stay on the AGM. Rana Kapoor had tried to resolve the issue before the court hearing and had sent a letter to Madhu Kapur on June 6 assuring that their rights will be protected but cited certain regulatory issues which could pose a challenge for the appointment of Shagun Kapur Gogia on the bank’s board. ATUL OTHER CHOKSEY vs PROMOTERS Asian Paints Shaw Wallace 1984 VIJAY MALLYA MANU vs CHHABRIA 1997 vs PARIKHS Agarwal family promoted Emami bought a 24 per cent stake of Vaidya family in Zandu Pharmaceutical Works in May 2008 taking its total holding to 27.5 per cent and announced open offer for additional 20 per cent stake. This made another promoter family group of Zandu Parikhs who owned a 20 per cent stake upset. Parikhs refused to share the management control and termed the takeover hostile. Parikhs went to the Company Law Board (CLB), saying they had the first right of refusal on the Vaidyas' stake sale. The case dragged for a few months. In between SEBI cleared Emami’s open offer. The offer was initially made at ~6,315 a share. Then Parikhs entered into talks for settlement and finally agreed to sell their stake at ~15,000 a share following that Emami raised the open offer price to ~16,500 and got the management control. Champaklal Choksey with three of his friends namely, S C Dani, C N Choksey and Abhay Vakil started Asian Paints in 1942. In July 1997, Atul Choksey and his father Champaklal Choksey sold their 8 per cent stake in Asian Paints because of their differences with copromoters. On July 31, 1997, three per cent of the total stake of Choksey's was bought by Morgan Stanley while five per cent was purchased by Capital International. On the same day Champaklal Choksey passed away. It began in 1984, when a then unknown Chhabria made a hostile bid for liquor major Shaw Wallace (SWC). Mallya claimed the bid was actually made jointly by an offshore firm in which he was a partner. Chhabria disputed that and eventually gained ownership of SWC. A legal battle raged for years in Hong Kong. It wasn’t until March 2005 that the battle came to an end with Mallya finally acquiring a controlling interest in SWC from the Chhabria family, three years after Manu Chhabria died at 56. On Augutst 1, 1997 Capital International and Morgan Stanley said that they would not have bought the shares if they knew that Atul Choksey (then CEO) was planning to exit. The impression the buying parties got was that Choksey was speaking on the behalf of all the promoters and the share belonged to all the four promoter families. The two FIIs backed out on the the deal on August 7, 1997. Atul Choksey then sold it to ICI in August 1997. Britannia Late 1980s WADIA vs PILLAI Nusli Wadia’s battle to acquire Britannia Industries, then owned by US giant RJR Nabisco Inc, made the headlines in the late 1980s. Wadia first met the Nabisco brass through a friend, NRI cashew trader K. Rajan Pillai. But Nabisco changed its mind about selling to Wadia and appointed Pillai as Britannia chairman. This turned the two friends into foes. Soon Pillai acquired Britannia and partnered with French food company, Danone SA. French company later fell out with Pillai, accusing him of fraud, and tied up with Wadia. After a bitter boardroom battle, Pillai was ousted and Wadia eventually took over Britannia in the early 1990s.