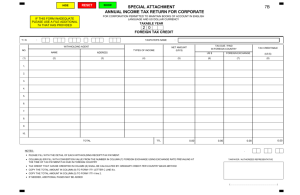

2014 media profile - DANNY DARUSSALAM Tax Center

advertisement

InsideTax MEDIA TREN PERPAJAKAN 2014 MEDIA PROFILE prologue InsideTax Magazine publication could not be separated from our awareness of the presence of asymmetric information problems that happen in around the taxation area in Indonesia. Asymmetric information in this context refers to the imbalance mastery of information among stakeholders in taxation area. In macro level, the impact of asymmetric information seen from the lack effectiveness of tax policy, the high rate of tax evasion, and also can lead toward corruption. In micro level, asymmetric information can lead to a different interpretation of the tax regulation, high rates of tax disputes, and also create high compliance costs. Therefore, InsideTax Magazine comes to provide enlightenment and education about domestic and international taxation trends to the public. We are aware asymmetric information in taxation could not be eliminated entirely, and yet we are convinced that InsideTax Magazine as a media can play a major role in reducing asymmetric information in taxation area. 2 vision Become the leading media in conveying the latest developments on domestic and international taxation. 99 first ISSUed in september 2007 99 acknowledge as the best quality tax magazine, compared to others 99 published by danny darussalam tax center 99 presents critical views, current developments, progressive ideas, and in-depth practical analysis about taxation 3 our competitive advantages d rk an etwo on is n g stron ositi Our ctable p by any e p e s g re d d luding owle c ackn older, in usiness h b stake horities, ell as t w u s a a x , ans. ta lists a i mici c e e d a sp c a ersity univ Our te of m am cons ists ulti profe ssio -talente stron nals wh d o g back grou educatio have nd, s nal on ha supp handlin rp analy sis g iss orted ue and b resea y reliabl s, e rch o f taxa data, tion. Our contributors are those who have a deep understanding of both domestic and international taxation. favorite contents 20% 19% 17% 15% 14% 15% Enrich our reader’s insight by giving a brief discussion about taxation issues from various disciplines. in-depth analysis case law tax regulation update tax newsflash profile interview others *based on readers survey, March 2014 We are not only deliver tax news, but also guide you through our insight. our team InsideTax Magazine is issued by the Division of Research and Training DANNY DARUSSALAM Tax Center (DDTC). DDTC is an independent tax consultant who has specialized in transfer pricing, international taxation, tax compliance and litigation services as well as tax research and knowledge development. DDTC staffed by specialists, experts and professionals in various disciplines. As a research and knowledge-based organization, we also strengthened by a rich and diverse range of taxation literature and database in our library. DDTC has library with more than 1,500 journals and books to ensure that our team have unlimited access to share our knowledge through sophisticated contents. Moreover, our team is given many scholarships abroad by DDTC to attend many various courses and training by various educational institutions. We believe that as an institution of research and science-based, we have continued to increase our ability to educate and enlight the best solution and analysis in order to support our role in media. 5 2014 MEDIA PROFILE our contents 1. Inside Headline: Contains the main article reviewed in depth by the editorial team. 2. Inside Article: • Review: Contains a brief review of the taxation issues in Indonesia and is accompanied by concept analysis and how it’s applied. • Court: Contains a review of the tax court decision on case law. • Regulation: Contains an update of Indonesian tax regulations. • Reportase: Contains some tax news articles report that covered directly by the editorial team. 3. Inside Profile: Contains a report on the results of interview with figures who understand taxation issues. 4. Inside Solution: Contains problem solving of some tax cases which is often faced by taxpayer and provide some tips and strategies. 5. Inside Library: Contains a book review from DDTC’s library collections. 6. Inside Newsflash: Contains domestic and international tax news which accompanied by a brief review. 7. Inside Event: Contains various events coverage and information about taxes. 8. Inside Storiette: Contains a fiction short story about taxes. 9. Inside Intermezzo: Cartoons, lifestyle, quiz, etc. 10.Inside Enlightenment: Contains infographics and taxation scheme arranged with attractive design that making easier for our readers to digest various of tax database and information. 65% our readers demand more intense publishing 26% 14% 5% 6 weekly biweekly *based on readers survey, March 2014 2014 MEDIA PROFILE monthly bimonthly 60-80 PAGES insidePROFILE insideprofile T anggal 6 Mei lalu, tim redaksi Inside Tax bertamu ke kantor pusat Direktorat Jenderal Pajak (DJP). Kedatangan kami ke sana tak lain adalah untuk berbincang dengan Bapak Kismantoro, Direktur Penyuluhan, Pelayanan, dan Hubungan Masyarakat DJP. Dalam kesempatan yang berharga tersebut, tim redaksi dan Pak Kismantoro banyak memperbincangkan perkembangan dunia perpajakan Indonesia saat ini. Berikut rangkumannya: “InsideTax Magazine is very interesting to read. Reviews are discussed in depth analysis with using language that is easy to understand. InsideTax Magazine is recommended for tax practitioners. I hope InsideTax Magazine can add the number of publishing in a year and more intensive in promoting the magazine so more people can get benefit and knowledge from this magazine.” Pentingnya Pendidikan Pajak Deviyanto The Dlava SF Consulting Saat ditanyakan mengenai kondisi perpajakan Indonesia, hal pertama yang diutarakan Pak Kismantoro adalah tentang pemahaman pajak masyarakat Indonesia. Beliau menekankan bahwa kepatuhan pajak sangat dipengaruhi oleh pemahaman masyarakat akan pajak. Pemahaman tersebut sangat erat kaitannya dengan tingkat pendidikan dan jangkauan informasi tentang pajak. Menurutnya, pemerataan tingkat pendidikan dan penyebaran informasi pajak belum berjalan dengan baik. Beliau menambahkan, pendidikan tentang pajak seharusnya dilakukan sedini mungkin. Sayangnya, pendidikan pajak baru bisa dinikmati oleh mereka yang duduk di bangku kuliah, itupun hanya jurusan tertentu saja yang berhubungan dengan pajak. Menurutnya, pendidikan pajak sebaiknya bisa dimasukkan ke dalam kurikulum sekolah seperti pendidikan antikorupsi yang sudah bisa dimasukkan ke setiap jenjang studi. Terkait hal tersebut, DJP telah memberi usulan kepada Kementerian Pendidikan Nasional (Kemendiknas) untuk memasukkan pajak sebagai salah satu materi pelajaran di sekolah. “ Drs. Kismantoro Petrus, M.B.A. P endidikan pajak sebaiknya bisa dimasukkan ke dalam kurikulum sekolah seperti pendidikan antikorupsi yang sudah bisa dimasukkan ke setiap jenjang studi... Pendidikan pajak lebih menekankan kepada peserta didik tentang pentingnya pajak untuk membangun negeri ini .” 14 NEWSFLASH insidenewsflash INTERNASIONAL Departemen Pajak Penghasilan Memeriksa Orang yang Membawa Emas dari Luar Negeri economictimes.indiatimes.com Setelah membayar bea masuk, data keuangan dari warga negara India yang membawa emas dari luar India, akan diserahkan oleh otoritas bea cukai kepada Departemen Pajak Penghasilan. Sesuai peraturan yang berlaku, warga negara India yang telah tinggal di luar negeri selama lebih dari enam bulan diperbolehkan untuk membawa 1 kg emas setelah membayar bea masuk. Tarif bea masuk yang dikenakan adalah 10 persen, dan dibayar dalam mata uang negara di mana emas itu dibeli. Jika mereka tinggal di luar negeri selama lebih dari 1 tahun, mereka dapat membawa perhiasan emas senilai Rs 50.000 untuk pria dan Rs 100.000 untuk wanita. Direktorat Intelijen Pendapatan (DRI), sebagai badan utama yang bertanggung jawab untuk memeriksa penyelundupan dan penghindaran bea masuk, mengatakan sedikitnya 3.000 kg emas telah dibawa secara legal ke India setelah membayar bea masuk, selama tahun 2013-2014. “Terdapat peningkatan orang yang membawa emas secara legal ke India. Hal ini memunculkan kecurigaan bahwa mereka akan menjual kembali emas-emas tersebut ke penadah di India. Untuk itu, data keuangan mereka juga diserahkan kepada Departemen Pajak Penghasilan agar dapat memantau sumber pendapatan mereka,” ujar salah seorang pejabat senior DRI. Pejabat itu menyebutkan bahwa keuntungan yang besar dapat diperoleh jika membawa emas ke India. Seseorang dapat memperoleh Rs 200.000 jika dia menjual 1 kg emas (Seharga Rs 161.000) yang dibelinya dari negara lain (asing). IT insidenewsflash Joint Venture Asing Bayar USD 7,63 Juta Koreksi Transfer Pricing Tax Notes International Sebuah perusahaan joint venture (JV) asing di Cina, baru-baru ini membayar Pajak Penghasilan Badan sebesar CNY 46.480.000 (sekitar USD 7.630.000), kepada kantor Administrasi Pajak Cina (SAT) di Provinsi Shandong. Hal ini dilakukan akibat koreksi transfer pricing (TP) sebesar CNY 598.000.000 (sekitar USD 98.140.000) terhadap laba kena pajak JV, pada tahun pajak 20042007. Menurut SAT, JV telah memindahkan sumber penerimaan negara ke luar negeri, dengan melakukan impor bahan baku dari pihak afiliasinya di luar negeri, dengan harga yang terlalu tinggi. DOMESTIK JV merupakan perusahaan manufaktur ponsel yang 70% kepemilikannya berada di tangan sebuah perusahaan elektronik asing. JV mulai memproduksi ponsel GSM (standar internasional) pada tahun 2003 dan menikmati tax holiday selama 5 tahun. Pada Agustus 2008, kantor pajak menemukan bahwa JV melakukan transaksi hubungan istimewa sebesar CNY 2 miliar (sekitar USD 328.210.000). Namun, margin dari laba kotor dan laba usaha menurun selama empat tahun sehingga kantor pajak mulai melakukan audit TP. IT insideHEADLINE Insentif Pajak untuk Kegiatan Riset akan Diperbesar Kementerian Keuangan (Kemenkeu) tengah mengupayakan insentif pajak yang lebih besar bagi kegiatan riset dan pengembangan (R&D), untuk membangun dan mengatasi persoalan SDM Indonesia dengan lebih cepat. Upaya ini, diharapkan mampu membawa Indonesia untuk lepas dari ancaman middle income trap (negara berpendapatan menengah), dan tidak secara terus menerus mengandalkan buruh murah sebagai daya saing. Kantor pajak meminta JV untuk memberikan informasi lebih lanjut tentang metode TP dan proses pembelian untuk bahan baku yang dibeli dalam transaksi hubungan istimewa. Setelah 20 kali bernegosiasi, kantor pajak dan JV menyepakati beberapa hal yakni analisis TP, metode TP yang dipilih, indikator tingkat keuntungan yang dipilih, dan menentukan perusahaan sejenis sebagai pembanding. Karena pembelian barang baku dengan transaksi hubungan istimewa tidak berada pada harga wajar, pada tahun 2013 kantor pajak menerapkan transactional net margin method untuk menentukan keuntungan yang wajar dari JV selama tahun 2004-2007. Rencana formal dari insentif ini adalah bagi mereka yang memberikan atau melakukan pelatihan kerja, biayanya dapat ditambah untuk mengurangi penghasilan bruto kena pajak. Namun demikian, Kemenkeu masih membicarakan persoalan ini, mengingat ketentuan umum pajak di Indonesia hanya mengatur insentif pajak sebatas pengurangan atau penghapusan pajak (tax holiday) saja. Terlepas dari hal tersebut, yang perlu menjadi perhatian adalah kejelasan mengenai definisi R&D, baik definisi dari R&D itu sendiri, jenis pengeluaran R&D yang diperbolehkan, maupun jenis kegiatan R&D yang termasuk dalam ruang lingkup pemberian insentif. Kejelasan definisi R&D dapat menghindari dalam praktik pemberian insentif. multiinterpretasi 43 InsideTax|Edisi 19|Tahun 2014 insideheadline IT Capres dan Caleg Perlu Sikapi Soal Pajak Persoalan pajak dan pendapatan negara telah menarik perhatian International NGO Forum on Indonesian Development (INFID). Dalam jumpa persnya (Menilai Ulang Kebijakan Pajak di Indonesia) di Jakarta, INFID menyatakan bahwa persoalan pajak dan pendapatan negara perlu menjadi perhatian dan agenda kerja para calon presiden (capres) dan calon anggota legislatif (caleg) di Pemilu 2014. Namun, hal tersebut tidak berarti anak-anak sekolah sudah diajari cara menghitung pajak. Pendidikan pajak lebih menekankan kepada peserta didik tentang pentingnya pajak untuk membangun negeri ini. Seperti yang kita ketahui, pajak digunakan untuk membiayai berbagai keperluan n e g ar a dan haja t hi dup o r an g b any ak . Dengan ditanamkannya pemahaman Menurut Direktur Eksekutif INFID, Sugeng Bahagijo, persoalan pajak belum menjadi ulasan dalam agenda kerja para capres dan caleg. Akibatnya, pengelolaan pajak sebagai sumber terbesar pendapatan negara menjadi tidak tercapai, dan target pajak pun nyaris tidak pernah tercapai. Menurutnya, Indonesia dapat mengikuti langkah Prancis untuk menerapkan tarif pajak khusus kepada golongan superkaya agar dapat menggenjot pendapatan dari pajak. IT InsideTax | Edisi 15 | Mei-Juni 2013 InsideTax|Edisi 19|Tahun 2014 31 Desain Kelembagaan Administrasi Perpajakan: Perlukah Ditjen Pajak Terpisah dari Kementerian Keuangan? Darussalam, B. Bawono Kristiaji, dan Hiyashinta Klise1 “E ENLIGHTENMENT 1. Pendahuluan taxenlightenment Apa yang membuat suatu sistem pajak di suatu negara dianggap lebih efisien dari sistem pajak negara lain? Menurut Kaldor, ketentuan atau peraturan perpajakan yang sesuai saja tidaklah cukup atau mungkin justru tidak berpengaruh banyak. Hal yang lebih menentukan justru terletak pada seberapa efektif dan efisien administrasi pajak di suatu negara. 2 Gambaran Kondisi Organisasi Ditjen Pajak Komparasi dengan Negara Lain Komposisi Pegawai Ditjen Pajak dan WP Terdaftar Rasio Pegawai Pajak dengan Penduduk (2013): Komparasi dengan Negara Lain Tahun Deskripsi Jumlah WP Wajib Pajak terdaftar terdaftar Jumlah pegawai pajak Jumlah Account Representative (AR) Jumlah Pemeriksa Jumlah WP per AR Jumlah WP per Pemeriksa 2009 2010 2011 2012 15.911.576 19.112.590 22.319.073 24.812.569 31.825 31.590 31.733 31.316 5.190 5.203 6.218 6.285 3.031 3.066 4.495 3.673 5.250 4.394 3.589 4.252 Jerman 4.309 3.948 5.079 Australia PENERIMAAN PAJAK (miliar rupiah) BELANJA Ditjen Pajak (miliar rupiah) TAX COLLECTION COST RATIO PENERIMAAN/ BELANJA (miliar rupiah) JUMLAH PEGAWAI PENERIMAAN/ PEGAWAI (miliar rupiah) 544.528 627.888 724.719 835.250 995.200 3.905 3.701 4.148 4.606 5.400 0,72% 0,59% 0,56% 0,55% 0,54% 139,45 169,74 179,06 181,34 184,30 31.825 31.590 31.733 31.316 30.762 17,11 19,88 23,40 26,67 32,35 2009 2010 2011 2012 APBN-P 2013 1 Darussalam adalah Managing Director DANNY DARUSSALAM Tax Center; B. Bawono Kristiaji adalah Partner, Tax Research and Training Service di DANNY DARUSSALAM Tax Center; dan Hiyashinta Klise adalah Researcher, Tax Research and Training Service di DANNY DARUSSALAM Tax Center. Rasio Pegawai Pajak dengan Penduduk 1 : 727 110 ribu Jumlah Pegawai Pajak 5.758 Produktivitas SDM Ditjen Pajak TAHUN 80 juta Jumlah Penduduk Sumber: Direktorat Jenderal Pajak, 2013. 25 ribu Jumlah Pegawai Pajak Jepang Sumber: Direktorat Jenderal Pajak, 2013. Jepang 2 6 25 juta Nicholas Kaldor, Collected Economic Essays Vol. (Nicholas Kaldor, 1980) Lalu apa yang dimaksud dengan administrasi perpajakan? Administrasi perpajakan tidak dapat dilepaskan dari segala ketentuan hukum pajak, karena administrasi pajak merupakan kaitan antara ketentuan hukum perpajakan dan bagaimana sistem pajak dapat bekerja. 3 Dengan kata lain, administrasi pajak berfungsi untuk mengimplementasikan dan menegakkan hukum pajak berdasarkan wewenang yang diberikan oleh undang- 8: Reports on Taxation II (London: Holmes & Meier Publishers, 1980). 3 Char Developing Countries: An Economic Perspective,” IMF Working Paper No. 87/42, (1987). undang perpajakan.4 Oleh karena itu, administrasi perpajakan mencakup hal-hal yang berkaitan dengan segala manajemen atau sistem kerja dalam pelaksanaan ketentuan hukum pajak, mulai dari memungut pajak, pemberian sanksi, dan sebagainya. Segala upaya untuk melakukan administrasi perpajakan di suatu negara pada umumnya diletakkan pada suatu badan/lembaga (otoritas pajak) yang diberikan kewenangan oleh undang-undang, yang bertindak sebagai administrator pajak yang bertugas untuk memfasilitasi sekaligus mendorong kepatuhan Wajib Pajak terhadap ketentuan perpajakan. 5 INTERMEZZO 4 Matthijs Alink dan Victor van Kommer, Handbook on Tax Administration (Amsterdam: IBFD, 2011), 87. 5 Pada dasarnya terdapat tujuh komponen utama dari administrasi perpajakan, yaitu: (i) “tax ministry” yang bertugas mengawasi, memprediksi, dan menetapkan target penerimaan pajak; (ii) ”tax department” yaitu otoritas pajak pada umumnya; (iii) badan pengawas eksternal; (iv) pengadilan atau InsideTax | Edisi 16 | Juli-Agustus 2013 Jumlah Penduduk Rasio Pegawai Pajak dengan Penduduk 1 : 1.000 120 juta Jumlah Penduduk Rasio Pegawai Pajak dengan Penduduk 1 : 1.818 66 ribu Jumlah Pegawai Pajak Tax Collection Cost Ratio (2011): Komparasi dengan Negara Lain fficiency of a tax system is not determined only by appropriate legal regulation but also by the efficiency and integrity of the tax administration .” Jerman Prancis Indonesia Malaysia 240 juta Belanda Indonesia “Great magazine, scientific and provide useful information.” Jumlah Penduduk Australia Rasio Pegawai Pajak dengan Penduduk 1 : 7.700 Singapura Amerika Serikat 31 ribu Jumlah Pegawai Pajak Sumber: Laporan OECD Sumber: Direktorat Jenderal Pajak, 2013. Perbandingan Anggaran Gaji Pegawai dan Anggaran Information and Technology (IT): Komparasi dengan Negara Lain Perbandingan Anggaran IT Perbandingan Anggaran Gaji Negara Perbandingan Anggaran Gaji/Total Anggaran 2011 (%) Negara Malaysia 82,4 Australia Jerman 81,6 Belanda Prancis 80,8 Prancis Jepang 80,7 Jerman Amerika Serikat 72,9 Amerika Serikat Belanda 72,0 Jepang Australia Singapura Indonesia 63,1 55,3 50,5 Malaysia Singapura Indonesia Dini Triasrini Directorate General of Taxes Perbandingan Anggaran IT/Total Anggaran 2011 (%) 39,4 21,5 15,0 14,2 8,6 6,5 3,6 2,4 1,5 Sumber: Laporan OECD InsideTax|Edisi 18|Edisi Khusus 25 7 2014 MEDIA PROFILE “The presence of InsideTax magazine in the middle of the lack of taxation media (in this case, media in a magazine form) is considered greatly effective, in view of tax issues that develop rapidly. Moreover, InsideTax Magazine not only discussing the latest issue in domestic taxation area, but also discussing about international taxation in each edition, that’s why this magazine is very suitable for practitioners and academicians. Keep on success for InsideTax Magazine!” PajakMania’s Team OUR readers Most of InsideTax Magazine readers are came from professionals in the field of taxation for example: tax authorities; practitioners; academicians in the fields of taxation, accounting, economics, and law; and corporate executives. Further, InsideTax Magazine is also much in demand by business people, students, and the general public who interested in domestic and international taxation issues. “InsideTax Magazine has become tax magazine which is necessary for all tax societies in Indonesia, especially academicians. The contents are very comprehensive, including articles with exploration of concept and theory of taxation, latest issue of tax policy, the controversial issue of international taxation and transfer pricing which is the mainstay of DDTC. Personally, I hope InsideTax Magazine can improve its quality and be part of the development of science and taxation knowledge in Indonesia.” Titi Muswati Putranti Lecturer, Fiscal Administration Science, Universitas Indonesia our TRANSFORMATION A Rapid growing of the taxation in Indonesia along the brand new era has demanded InsideTax Magazine editorial team to keep developing the technology in the deployment InsideTax Magazine. Therefore to reach more readers, InsideTax Magazine now available in digital version that can be downloaded from our website with access more rapid and easier. magazine version 99 99 99 99 99 65% Modern lifestyle Environmental friendly Ease of access Fun and attractive Free D igital reading will completely take over. It’s lightweight and it’s fantastic for sharing. Over time it will take over. -BILL GATES- 35% digital print *based on readers survey, March 2014 We are the 1st Digital Tax Magazine in Indonesia 9 2014 MEDIA PROFILE With transform to digital version, InsideTax Magazine expect to be embracing more readers. InsideTax magazine not only links with our website, but also facilitates readers with an access to newsstand application for mobile. our market InsideTax Magazine has a huge potential market to promote or publicize your products and events to potential consumers. With our new digital version of magazine we can get more readers so it can facilitate you to reach the consumers market in more effective way. As digital media which has more than 7,500 valid email databases, 15,000 number of visits and 7,000 unique visitors (per month) according to our latest website statistics that keep increasing monthly, and thousand followers in social media, InsideTax magazine have giving more opportunities for your advertisement. Bureau Van Dijk Empowering transfer pricing analysis TP Catalyst offers you: • the ability to create expert standard TP reports • reduced transfer pricing risk • access to detailed, comparable arm’s length company data • access to detailed arm’s length royalty rate information, loan agreements, licensing agreements, documentation and comparables • superior efficiency in your TP management processes 2 Inside Tax | Edisi 14 | Maret 2013 Blue Band singapore@bvdinfo.com 65 6496 9000 ONLINE New online collection: International Tax Structuring Decision making is easier when you have all the facts Ford Lexis A Collection of Matthew Bender's Tax Titles ad_Layout 1 12/23/13 4:54 PM Pag Structuring your business in a tax-efficient manner can be challenging. What’s more, keeping track of all current changes and developments can be a daunting task, but it is essential when deciding your next strategic move. Thankfully, you do not need to be in the dark. Your road map to informed decision making number of website visits and unique visitors Answering your needs, we are pleased to introduce International Tax Structuring, a new comprehensive online guide that will help you take control in planning the future of your business and enable you to be the expert. This practical and unique publication provides detailed information on the tax structuring implications of relevant cross-border business transactions that businesses and their tax advisers are considering in the current changing climate (e.g. the publication addresses the OECD BEPS Action Plan). 14,969 Number of visits Unique visitors Dana New TP Catalyst Pro version now available tpcatalyst.com How it works • The publication provides a comprehensive overview of international tax structuring in relation to the typical growth pattern of a domestic business that is expanding internationally by the gradual stages typical of most business cycles. • Clear diagrams in each chapter demonstrate the connections between concepts, facilitating ease of use. • Summarizing tables at the end of each chapter can be used as a checklist of actions and points to consider. • The collection also includes the Holding Companies Tables Comparison tool. A Collection of Matthew Bender’s Tax Titles Order your copy today! Annual price: € 600/ $ 800 (VAT excl.) Special client offer – International Tax Structuring Plus Foreign Tax & Trade Briefs, 2nd Edition Clients who have access to the Country Analyses will also benefit from a tool that complements the publication. This tool enables you to view selected countries side by side, documenting all the steps you need to consider along the way. ISBN: 978-142-249-035-8 Bringing you the latest tax and trade information to 128 foreign countries and territories on a regular quarterly basis. It includes information on individual tax, partnership and business profit tax, import licenses, tax treaties and more. Handle your critical international business ventures with confidence! Annual price: € 450/ $ 600 (VAT excl.) (Please note: This discounted price is only applicable when purchased as an add-on in conjunction with a Regional and/or Global Explorer Plus and includes the tool.) Foreign Tax & Trade Briefs – International Withholding Tax Treaty Guide ISBN: 978-082-051-292-1 For more information visit our website: www.ibfd.org This latest release of Foreign Tax & Trade Briefs - International Witholding Tax Treaty Guide provides the withholding tax rates for more than 2,000 treaties, worldwide, paid on Interest on foreign loan, dividends, royalties, rentals, bank deposits, technical fees and shipping and aircraft income. Tax attorneys and advisors; public accounting firms, in-house corporate tax practitioners; government tax officials will find this extremely useful. IBFD P.O. Box 20237 1000 HE Amsterdam The Netherlands Telephone: +31-20-554 0176 Email: info@ibfd.org Investors’ Guide to the Chinese Tax System: Navigating Safely Through Unfamiliar Waters IBFD, Your Portal to Cross-Border Tax Expertise ISBN: 978-076-984-780-1 This practical, one-volume treatise offers comprehensive coverage of the Chinese tax rules from the perspective of the business investor, aims to provide a systematic explanation of Chinese tax rules, and introduces tax structuring methods for the investor to reach an overall tax efficient business structure. ITS/A01/F ITS_A01_F.indd 1 6,932 18-10-2013 12:40:00 IBFD Lexis Guide to FATCA Compliance ISBN: 978-076-985-373-4 Develop the best practice compliance strategy, starting by determining what information is needed for planning meetings with outside FATCA experts! This book will guide a lead FATCA compliance officer in designing a plan of internal action within the enterprise and interaction with outside FATCA advisors with a view of best leveraging available resources and budget. Also includes a guide to the work flow and decision processes. 4,707 For Sp T: T E: J 60 2,261 10 2014 MEDIA PROFILE Jan ‘13 Apr ‘13 Jul ‘13 Oct ‘13 Jan ‘14 Mar ‘14 rATE CARD April - December 2014 NO 1 ITEMS (in IDR ‘000) OPTION RATE/EDITION Static Ads & Hyperlink Static Ads With Video & Hyperlink 9,000 12,000 PSD / JPG / PNG / PDF / INDD / AI 21 X 29 cm 2 INSIDE PAGE FULL PAGE BANNER (FRONT PAGE), after greetings and before headline Static Ads & Hyperlink Static Ads With Video & Hyperlink FULL PAGE BANNER (MIDDLE PAGE), after headline and at the first half of magazine Nexis A Practical Guide to U.S. Transfer Pricing 7,000 10,000 Static Ads & Hyperlink 6,000 Static Ads With Video & Hyperlink 9,000 Static Ads & Hyperlink 5,000 Static Ads With Video & Hyperlink 7,500 Text Based & Hyperlink 9,000 Text Based With Video & Hyperlink 12,000 PSD / JPG / PNG / PDF / INDD / AI 21 X 29 cm One of the hottest topics in international tax today, transfer pricing rules are an inescapable part of doing business internationally and this title provides an in-depth analysis of the US rules. It is designed to help multinationals cope with US transfer pricing rules and procedures, taking into account the international norms established by the Organisation for Economic Co-operation and Development (OECD). FULL PAGE BANNER (BACK PAGE), second half of the magazine Rhoades & Langer, U.S. International Taxation & Tax Treaties ISBN: 978-082-052-778-9 This title features in-depth analysis of all relevant Internal Revenue Code provisions and Treasury Regulations and Rulings, annotated text of every U.S. income tax treaty, as well as key features such as practical examples, diagrams, summary status sheets to identify all treaties and agreements currently in force, concise general rules, and timesaving examples and tables designed to speed and simplify your work. Tax Havens of the World ISBN: 978-082-051-722-3 Examine tax havens in more than 70 areas around the world with this edition! It rates each on the basis of 30 vital features, with in-depth analysis of tax reform pitfalls. Expert, inside information tells you how to: gain a foothold in a specific tax haven, qualify for investment and capital incentives, insulate profits, plan a business or trust, offshore banking units, limited partnerships and venture capital enterprises, know where to transfer funds for lowest withholding rates, captive insurance company, bank or trust, and more! A must-read. 3 r more info or to order, please contact: ADVERTORIAL 21 X 29 cm FLV / F4V / MPEG4 Max duration 30" and Max Size 1 MB PSD / JPG / PNG / PDF / INDD / AI 21 X 29 cm LexisNexis Regional Contact Centre T: +65 6349 0110 E: help.sg@lexisnexis.com Price do not include VAT and other charges (if any). Discount continuous folding position 15% - 30%. FLV / F4V / MPEG4 Max duration 30" and Max Size 1 MB PSD / JPG / PNG / PDF / INDD / AI ISBN: 978-082-056-949-9 pektra Tetty +0215820333 or +08129393660 Jakarta@spektra-aa.co.id FLV / F4V / MPEG4 Max duration 30” and Max Size 1 MB 64 mon ge 1 REMARKS Cover COVER 1 (Inside Front Cover) - Full Page Inside Tax | Edisi 14 | Maret 2013 SIZE (Portrait) 21 X 29 cm FLV / F4V / MPEG4 Max duration 30" and Max Size 1 MB Picture, and Text Provided by Client Picture, Text, and Video Provided by Client 11 2014 MEDIA PROFILE InsideTax MEDIA TREN PERPAJAKAN Menara Satu Sentra Kelapa Gading 5th Floor (Unit #0501) & 6th Floor (Unit #0601 - #0602) Jl. Bulevar Kelapa Gading LA3 No. 1, Summarecon Kelapa Gading, Jakarta Utara, 14240, Indonesia +6221 2938 5758 +6221 2938 5759 insidetax@dannydarussalam.com marketing.insidetax@dannydarussalam.com www.dannydarussalam.com @ddtcindonesia