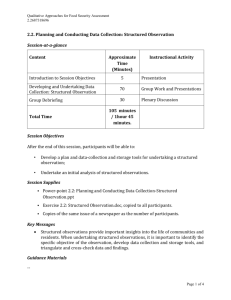

The Small Companies and Groups (Accounts and Directors' Report

advertisement