to view one of our SAMPLE MULTI

advertisement

EXAMPLE OF MULTI-STATE INCOME TAX RETURN

JUSTIN and JUSTINE CASE

ONE MILITARY W-2 IN –JUSTIN $40,000 income

ONE CIVILIAN W-2 CA –JUSTINE $20,000 income

MARRIED FILING JOINTLY

STATIONED IN CA

NO DEPENDENTS

This is a military tax return with income from two different states. Active military

Husband Justin has $40,000 of income and paid $2,000 in state taxes to his home state

of Indiana. Spouse, Justine has $20,000 of income and paid $1,000 in state taxes to her

home state of California.

This is a line by line example of what an incorrect and correctly prepared military tax

return looks like. The incorrectly prepared tax return shows a state refund of $28.00 in

Indiana and they owe $28.00 in California. The correctly prepared state tax return

shows a state refund of $855.00 in Indiana and $1,000.00 in California. There is a total

difference of $1,855.00 between the correct and incorrect state tax returns.

The reason this happens is that tax software atomically imports the combined income

into both states. It is then up to the tax preparer to know how to do this on a state by

state basis. Also based on years of experience the best way to do this depends on the

individual state. Some states are relatively straight forward about how to do this and

other states are rather complex.

The main strategy to properly preparing a multi-state military tax return is it must be

prepared in a step by step fashion. Step one is to determine if there is any special tax

treatment for active military income in this particular state. Step two is to isolate active

duty military income from spouse’s income or any other non-military civilian income.

Step three would be to isolate spouse’s civilian or military income to the appropriate

state. In addition to the steps some states may require the return to be filed as “married

and separate” or to prepare two separate returns in order to maximize tax advantages

and amount of tax return.

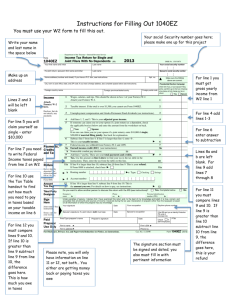

DIRECTIONS: Please refer to the page number of the PDF document in the table below

and then look at the corresponding form number. Then look at the line or box number to

see how much income is being used to calculate the state tax. You can then refer to the

refund column to see the difference.

NOTE: Any incorrectly prepared military state tax return over the past three years can

be amended in order to receive the proper amount.

Page#

3

5

5

5

5

6

6

6

6

7

7

8

10

10

10

11

12

12

13

14

14

14

14

16

Form#

Line# Box# State Income Taxes Refund

Federal 1040

7

60,000

W-2

1

IN

40,000

W-2

15

IN

W-2

16

IN

40,000

W-2

17

IN

2,000

W-2

1

CA

20,000

W-2

15

CA

W-2

16

CA

20,000

W-2

17

CA

1,000

IT-40

1

IN

60,000

IT-40

7

IN

58,000

IT-40

22

IN

28

CA RES. INC. 540

12

CA

60,000

CA RES. INC. 540

13

CA

60,000

CA RES. INC. 540

19

CA

52,318

CA RES. INC. 540

111

CA

-28

* IT-40 PNR

1

IN

40,000

* IT-40 PNR

7

IN

33,666

* IT-40 PNR

22

IN

855

* CA NON-RES 540NR

12

CA

20,000

* CA NON-RES 540NR

13

CA

60,000

* CA NON-RES 540NR

14

CA

40,000

* CA NON-RES 540NR

17

CA

20,000

* CA NON-RES 540NR 125

CA

1,000

* CORRECTLY PREPARED STATE TAX RETURN

Form

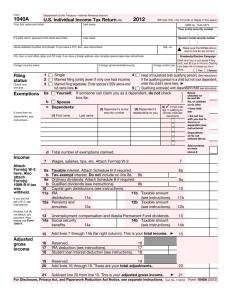

Department of the Treasury - Internal Revenue Service

1040

(99)

U.S. Individual Income Tax Return

2012

For the year Jan. 1-Dec. 31, 2012, or other tax year beginning

OMB No. 1545-0074 IRS Use Only - Do not write or staple in this space.

, 2012, ending

Your first name and initial

See separate instructions.

, 20

Last name

JUSTIN

Your social security number

CASE

If a joint return, spouse's first name and initial

131-65-2217

Last name

JUSTINE

Spouse's social security number

CASE

212-54-1187

Home address (number and street). If you have a P.O. box, see instructions.

Apt. no.

Make sure the SSN(s) above

and on line 6c are correct.

123 MAIN ST

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

Presidential Election Campaign

SAN DIEGO, CA 92101

Foreign country name

Foreign province/county

Foreign postal code

Check here if you, or your spouse if filing

jointly, want $3 to go to this fund. Checking

a box below will not change your tax or

refund.

You

Filing Status

1

2

Check only one

box.

3

Exemptions

6a

4

Single

X

the qualifying person is a child but not your dependent, enter this

Married filing jointly (even if only one had income)

Married filing separately. Enter spouse's SSN above

and full name here.

b

X

X

c

Dependents:

child's name here.

5

Qualifying widow(er) with dependent child

Yourself. If someone can claim you as a dependent, do not check box 6a . . . . . . . .

Spouse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1) First name

(2) Dependent's

social security number

(3) Dependent's

relationship to you

Last name

}

(4) X if child

under age 17

qualifying for

child tax credit

(see instr.)

If more than four

dependents, see

instructions and

check here

Attach Form(s)

W-2 here. Also

attach Forms

W-2G and

1099-R if tax

was withheld.

If you did not

get a W-2,

see instructions.

Enclose, but do

not attach, any

payment. Also,

please use

Form 1040-V.

Adjusted

Gross

Income

7

8a

b

9a

b

Total number of exemptions claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . . . . . . . . . . .

7

Taxable interest. Attach Schedule B if required . . . . . . . . . . . . . . . . . . . . . .

8a

Tax-exempt interest. Do not include on line 8a . . . . . . .

Qualified dividends . . . . . . . . . . . . . . . . . . . . .

2

0

0

0

Add numbers on

lines above

2

60,000.

8b

Ordinary dividends. Attach Schedule B if required . . . . . . . . . . . . . . . . . . . . . .

9a

9b

10

Taxable refunds, credits, or offsets of state and local income taxes . . . . . . . . . . . . . .

10

11

Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . . . . . . . . . . . .

12

13

Capital gain or (loss). Attach Schedule D if required. If not required, check here . . . .

13

14

Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . . . . . . . . .

15a

IRA distributions . . . . .

15a

b Taxable amount . . . . . . .

15b

16a

Pensions and annuities . .

16a

b Taxable amount . . . . . . .

16b

17

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . . .

17

18

Farm income or (loss). Attach Schedule F . . . . . . . . . . . . . . . . . . . . . . . . .

18

19

Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20a

Social security benefits . .

21

Other income. List type and amount

21

22

Combine the amounts in the far right column for lines 7 through 21. This is your total income

22

60,000.

23

Educator expenses . . . . . . . . . . . . . . . . . . . . .

24

Certain business expenses of reservists, performing artists, and

0.

60,000.

b Taxable amount . . . . . . .

20a

14

19

20b

23

fee-basis government officials. Attach Form 2106 or 2106-EZ .

24

25

Health savings account deduction. Attach Form 8889 . . . . .

25

26

Moving expenses. Attach Form 3903

. . . . . . . . . . . .

26

27

Deductible part of self-employment tax. Attach Schedule SE . .

27

28

Self-employed SEP, SIMPLE, and qualified plans . . . . . . .

28

29

Self-employed health insurance deduction . . . . . . . . . .

29

30

Penalty on early withdrawal of savings . . . . . . . . . . . .

30

31a

Alimony paid

31a

32

IRA deduction . . . . . . . . . . . . . . . . . . . . . . .

33

Student loan interest deduction . . . . . . . . . . . . . . .

33

34

Tuition and fees. Attach Form 8917 . . . . . . . . . . . . .

34

35

Domestic production activities deduction. Attach Form 8903 . .

35

36

Add lines 23 through 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

37

Subtract line 36 from line 22. This is your adjusted gross income . . . . . . . . . . .

37

b Recipient's SSN

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

UYA

Boxes checked

on 6a and 6b

No. of children

on 6c who:

lived with you

did not live with

you due to divorce

or separation

(see instructions)

Dependents on 6c

not entered above

d

Income

Spouse

Head of household (with qualifying person). (See instructions.) If

32

Form

1040 (2012)

Form 1040 (2012)

Tax and

Credits

JUSTIN

38

39a

b

Standard

Deduction

forPeople who

check any

box on line

39a or 39b or

who can be

claimed as a

dependent,

see

instructions.

All others:

Single or

Married filing

separately,

$5,950

Married filing

jointly or

Qualifying

widow(er),

$11,900

Head of

household,

$8,700

40

41

42

43

44

45

46

47

48

42

Alternative minimum tax (see instructions). Attach Form 6251 . . . . . . . . . . . . . . . . .

Add lines 44 and 45 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Foreign tax credit. Attach Form 1116 if required . . . . . . . . . . 47

Credit for child and dependent care expenses. Attach Form 2441 . . 48

45

51

56

46

5,209.

54

0.

5,209.

49

55

56

8919 . . . . . . 57

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required . . . . . 58

Household employment taxes from Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . 59a

First-time homebuyer credit repayment. Attach Form 5405 if required . . . . . . . . . . . . . . . 59b

Unreported social security and Medicare tax from Form:

57

58

44

50

53

Add lines 47 through 53. These are your total credits . . . . . . . . . . . . . . . . . . . . .

Subtract line 54 from line 46. If line 54 is more than line 46, enter -0- . . . . . . . . . . . . .

Self-employment tax. Attach Schedule SE . . . . . . . . . . . . . . . . . . . . . . . . . . . .

54

a

4137

b

60

Other taxes. Enter code(s) from instructions

61

61

Add lines 55 through 60. This is your total tax . . . . . . . . . . . . . . . . . . . . . . .

Federal income tax withheld from Forms W-2 and 1099 . . . . . . 62

6,000.

63

2012 estimated tax payments and amount applied from 2011 return

Earned income credit (EIC) . . . . . . . . . . . . . NO

. . . . . . 64a

62

64a

b Nontaxable combat pay election. .

65

60

65

68

70

Amount paid with request for extension to file . . . . . . . . . . .

Excess social security and tier 1 RRTA tax withheld . . . . . . . .

Credit for federal tax on fuels. Attach Form 4136 . . . . . . . . . .

71

Credits from Form: a

71

72

Add lines 62, 63, 64a, and 65 through 71. These are your total payments . . . . . . . . . .

If line 72 is more than line 61, subtract line 61 from line 72. This is the amount you overpaid . . . .

Amount of line 73 you want refunded to you. If Form 8888 is attached, check here . . . .

68

69

73

74a

2439 b

Reserved c

8801 d

8885

b

Routing number

d

Account number

Amount of line 73 you want applied to your 2013 estimated tax

75

76

77

5,209.

64b

Additional child tax credit. Attach Schedule 8812 . . . . . . . . . .

American opportunity credit from Form 8863, line 8 . . . . . . . .

Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . . .

67

Amount

You Owe

41

43

52

11,900.

48,100.

7,600.

40,500.

5,209.

40

Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . . . . . .

Tax (see instructions). Check if any from: a

Form(s) 8814 b

Form 4972 c

962 election

Residential energy credits. Attach Form 5695 . . . . . . . . . . .

c

Other credits from Form: a

3800

b

8801

66

Direct deposit?

See

instructions.

39b

Itemized deductions (from Schedule A) or your standard deduction (see left margin) . . . . . .

Subtract line 40 from line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Exemptions. Multiply $3,800 by the number on line 6d . . . . . . . . . . . . . . . . . . . . .

Child tax credit. Attach Schedule 8812, if required . . . . . . . . .

63

Refund

If your spouse itemizes on a separate return or you were a dual-status alien, check here

51

53

131-65-2217 Page 2

. . 38

60,000.

}

52

b

If you have a

qualifying

child, attach

Schedule EIC.

{

Education credits from Form 8863, line 19 . . . . . . . . . . . . .

Retirement savings contributions credit. Attach Form 8880 . . . . .

49

59a

Payments

Amount from line 37 (adjusted gross income) . . . . . . . . . . . . . . . . . . . . . . . .

Check

You were born before January 2, 1948,

Blind.

Total boxes

if:

Spouse was born before January 2, 1948,

Blind.

checked

39a 0

50

55

Other

Taxes

and JUSTINE CASE

c Type:

66

67

69

70

Checking

73

74a

6,000.

791.

791.

76

0.

72

Savings

75

Amount you owe. Subtract line 72 from line 61. For details on how to pay, see instructions

Estimated tax penalty (see instructions) . . . . . . . . . . . . .

77

Third Party

Designee

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Sign

Here

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Joint return?

See instr.

Keep a copy

for your

records.

Your signature

Paid

Preparer

Use Only

Designee's

name

Date

Yes. Complete below.

Spouse's signature. If a joint return, both must sign.

Date

Daytime phone number

Your occupation

(619)555-1212

Spouse's occupation

OFFICE MGR.

Print/Type preparer's name

Firm's name

Preparer's signature

No

Personal identification

number (PIN)

USMC

Firm's address

UYA

Phone

no.

Date

Check

if

self-employed

If the IRS sent you an Identity Protection

PIN, enter it

here (see inst.)

PTIN

Firm's EIN

Phone no.

Form

1040

(2012)

This W-2 belongs to:

X JUSTIN

a Employ ee's social security

JUSTINE

OMB No.

1545-0008

X Standard W-2 (Ty ped or computer generated)

Non-Standard W-2 (Altered or hand written)

131-65-2217

Form W-2c, Corrected Wage and Tax Statement

b Employ er identif ication

1 Wages, tips, other comp 2 Federal inc tax withheld

53-9990000

40,000.00

3 Social security wages

c Employ er's name

4,000.00

4 Social Sec tax withheld

0.00

DFAS

5 Medicare wages and tips

Employ er's address

0.00

1240 East Ninth Street

State

Employ er's

Cleveland

OH

0.00

6 Medicare tax withheld

Zip Code

44199

Employ er's f oreign country

7 Social security tips

0.00

8 Allocated tips

0.00

0.00

9

10 Dependent care benef its

11 Nonqualif ied plans

12 Code

0.00

Foreign prov ince/county

0.00

Foreign postal code

13 Statutory employ ee

e Employ ee's f irst

JUSTIN

Employ ee's last

Suf f .

D

700.00

Q

5,000.00

Retirement plan

0.00

Third-party sick pay

0.00

CASE

f

0.00

Employ ee's address

123 MAIN ST

State

Employ ee's

SAN DIEGO

CA

Zip Code

92101

Employ ee's f oreign country

Foreign prov ince/county

15 State State ID

IN

80501907

Amount

0.00

14 See

se

ction d

e xpande

below.

0.00

0.00

Foreign postal code

16 State wages

17 State inc tax

18 Local wages

19 Local W/H

40,000.00

2,000.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

W-2 Wage and Tax

2012

20 Local name

Department of the Treasury Internal Rev enue

State me nt

Othe r Ite ms reported on this copy of Form

W-2

This W-2 belongs to:

X JUSTINE

JUSTIN

a Employ ee's social security

OMB No.

1545-0008

X Standard W-2 (Ty ped or computer generated)

Non-Standard W-2 (Altered or hand written)

212-54-1187

Form W-2c, Corrected Wage and Tax Statement

b Employ er identif ication

1 Wages, tips, other comp 2 Federal inc tax withheld

33-9875214

20,000.00

3 Social security wages

c Employ er's name

2,000.00

4 Social Sec tax withheld

0.00

TARGET

5 Medicare wages and tips

Employ er's address

0.00

6 Medicare tax withheld

0.00

123 ELM DR

State

Employ er's

SAN JOSE

CA

Zip Code

92871

Employ er's f oreign country

7 Social security tips

0.00

8 Allocated tips

0.00

0.00

9

10 Dependent care benef its

11 Nonqualif ied plans

12 Code

0.00

Foreign prov ince/county

0.00

Foreign postal code

0.00

Retirement plan

0.00

Third-party sick pay

0.00

JUSTINE

Suf f .

CASE

f

0.00

Employ ee's address

123 MAIN ST

State

Employ ee's

SAN DIEGO

CA

Zip Code

92101

Employ ee's f oreign country

Foreign prov ince/county

15 State State ID

CA

5628874

500.00

13 Statutory employ ee

e Employ ee's f irst

Employ ee's last

D

Amount

0.00

14 See

se

ction d

e xpande

below.

0.00

0.00

Foreign postal code

16 State wages

17 State inc tax

18 Local wages

19 Local W/H

20,000.00

1,000.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

W-2 Wage and Tax

2012

20 Local name

Department of the Treasury Internal Rev enue

State me nt

Othe r Ite ms reported on this copy of Form

W-2

Form

2012

IT-40

State Form 154

(R11 / 9-12)

Indiana Full-Year Resident

Individual Income Tax Return

Due April 15, 2013

If filing for a fiscal year, enter the dates (see instructions) (MM/DD/YYYY):

to:

from

Your Social

Security Number

131

65

2217

Spouse's Social

Security Number

Place “X” in box if applying for ITIN

Initial

Last name

Your first name

JUSTIN

212

54

1187

Place “X” in box if applying for ITIN

Suffix

CASE

If filing a joint return, spouse's first name

Initial

JUSTINE

Last name

Suffix

CASE

Present address (number and street or rural route)

Place "X" in box if you are

married filing separately.

Zip/Postal code

123 MAIN ST

State

City

SAN DIEGO

CA

92101

School corporation number (see pages 59 and 60 )

Foreign country 2-character code (see pg. 6)

Enter below the 2-digit county code numbers (found on the back of Schedule CT-40) for the county where you lived and

worked on January 1, 2012.

County where

County where

County where

County where

you lived

you worked

spouse lived

spouse worked

Round all entries

1. Enter your federal adjusted gross income (AGI) from your federal tax return (from Form 1040,

line 37; Form 1040A, line 21; or from Form 1040EZ, line 4)

Federal AGI

1

60000.00

2. Enter amount from Schedule 1, line 8, and enclose Schedule 1

2

.00

3

60000.00

Indiana Deductions

4

.00

Indiana Adjusted Income

5

60000.00

Indiana Exemptions

6

2000.00

State Taxable Income

7

58000.00

11

1972.00

Indiana Add-Backs

3. Add line 1 and line 2

4. Enter amount from Schedule 2, line 12, and enclose Schedule 2

5. Subtract line 4 from line 3

6. You must complete Schedule 3. Enter amount from Schedule 3, line 5,

and enclose Schedule 3

7. Subtract line 6 from line 5

8. State adjusted gross income tax: multiply line 7 by 3.4% (.034)

(if answer is less than zero, leave blank)

9. County tax. Enter county tax due from Schedule CT-40

(if answer is less than zero, leave blank)

10. Other taxes. Enter amount from Schedule 4, line 4 (enclose sch.)

8

1972.00

9

.00

10

.00

11. Add lines 8, 9, and 10. Enter total here and on line 16 on the back

15112111064

Indiana Taxes

12. Enter credits from Schedule 5, line 8 (enclose schedule)

2000.00

12

13. Enter offset credits from Schedule 6, line 7 (enclose schedule) 13

14. Automatic Taxpayer Refund credit. Leave blank if not eligible. See instructions on page 9.

Enter $111 if you are eligible

Enter $222 if joing filing and both eligible

14

Enter $111 if joing filing but only one is eligible

.00

.00

Indiana Credits

15

2000.00

Indiana Taxes

16

1972.00

17. If line 15 is equal to or more than line 16, subtract line 16 from line 15 (if smaller, skip to line 24)

17

28.00

18. Amount from line 17 to be donated to the Indiana Nongame Wildlife Fund

18

.00

19

28.00

Total to be applied to your estimated tax account (a + b + c; cannot be more than line 19)

20d

.00

21. Penalty for underpayment of estimated tax from Schedule IT-2210 or IT-2210A (enclose sch.)

21

.00

22. Refund: Line 19 minus lines 20d and 21. Note: If less than zero, see line 24

22

28.00

24. If line 16 is more than line 15, subtract line 15 from line 16. Add to this any amount on line 21

(see instructions on page 13 )

24

.00

25. Penalty if filed after due date (see instructions)

25

.00

26. Interest if filed after due date (see instructions)

26

.00

15. Add lines 12, 13 and 14

16. Enter amount from line 11

19. Subtract line 18 from line 17

Overpayment

20. Amount from line 19 to be applied to your 2013 estimated tax account (see instructions on page 11 ).

Enter your county code

county tax to be applied $

a

.00

Spouse's county code

county tax to be applied $

b

.00

c

.00

Indiana adjusted gross income tax to be applied

23. Direct Deposit (see page 12)

c. Type:

$

Checking

Savings

Your Refund

Hoosier Works MC

a. Routing Number

b. Account Number

c. Place an "X" in the box if refund will go to an account outside the United States

.00

Amount You Owe 27

27. Amount Due: Add lines 24, 25 and 26

Do not send cash. Please make your check or money order payable to: Indiana Department of Revenue.

Sign and date this return after reading the Authorization statement on Schedule 7. You must enclose Schedule 7.

Your Signature

Date

Spouse's Signature

If enclosing payment mail to: Indiana Department of Revenue, P.O. Box 7224, Indianapolis, IN 46207-7224.

Mail all other returns to: Indiana Department of Revenue, P.O. Box 40, Indianapolis, IN 46206-0040.

15112121064

Date

For Privacy Notice, get form FTB 1131.

California Resident

Income Tax Return

APE

131-65-2217

JUSTIN

JUSTINE

2012

2

0

00

0

00

0

208

60000

60000

0

0

60000

7682

52318

1236

208

1028

0

1028

0

0

0

0

0

540

CA

212-54-1187

AC

12

A

R

RP

92101

45

46

47

48

61

62

63

64

71

72

73

74

75

91

92

93

94

95

400

401

402

403

01-01-1981

0

0

0

1028

0

0

0

1028

1000

0

0

0

1000

0

0

0

28

0

0

0

0

0

404

405

406

407

408

410

412

413

414

419

420

421

422

423

110

111

112

113

115

116

117

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

28

0

0

0

0

0

01-01-1983

APE

FS

3800

3803

SCHG1

5870A

5805 5805F

DESIGNEE

TPID

FN

CCF

3805P

NQDC

3540

3805Z

3807

3808

3809

3549A

IRC 1341

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Sign

Here

It is unlawful

to forge a

spouse's/

RDP's

signature.

Joint tax

return?

(see instr.)

Your signature

Daytime phone number (optional)

C1 Side 1

DO NOT ATTACH FEDERAL RETURN

P

CASE

CASE

CASE

123 MAIN ST

SAN DIEGO

01

06

09

10

11

12

13

14

16

17

18

19

31

32

33

34

35

40

41

42

43

44

FORM

Spouse's/RDP's signature (if a joint tax return, both must sign)

619-555-1212

Date

Your email address (optional). Enter only one.

Paid preparer's signature (declaration of preparer is based on all information of which preparer has any knowledge)

PTIN

Firm's name (or yours, if self-employed)

Firm's address

FEIN

Do you want to allow another person to discuss this return with us? (see instructions)

Print Third Party Designee's Name

. . . . . . . . . . .

Telephone Number

031

3101126

Yes

No

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Your name:

CASE

Filing Status

Your SSN or ITIN: 131-65-2217

1

2

Single

X

Married/RDP filing jointly. (see instructions)

3

Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here

4

Head of household (with qualifying person). (see instructions)

5

Qualifying widow(er) with dependent child. Enter year spouse/RDP died.

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . .

6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here (see instructions) . . . .

Exemptions

6

Whole dollars only

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked 2 or 5, enter 2 in the box.

If you checked the box on line 6, see instructions . . . . . . . . . . . . . . . . . . . . . 7

2 X $104 = $

. . 8

X $104 = $

X $104 = $

8 Blind: If you (or your spouse/RDP) are visually impaired, enter 1; if both are visually impaired, enter 2

9 Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2

9

208.

10 Dependents: Do not include yourself or your spouse/RDP.

First Name

Dependent's

relationship to you

Last Name

Total dependent exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxable

Income

10

X $321 = $

$

11 Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 . . . . . . .

11

12 State wages from your Form(s) W-2, box 16 . . . . . . . . . . . . . . . . . .

60,000.

12

13 Enter federal adjusted gross income from Form 1040, line 37; Form 1040A, line 21; Form 1040EZ, line 4

13

14 California adjustments - subtractions. Enter the amount from Schedule CA (540), line 37, column B . . .

14

15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses (see instructions) . . . . . 15

16 California adjustments - additions. Enter the amount from Schedule CA (540), line 37, column C . . . .

16

17 California adjusted gross income. Combine line 15 and line 16 . . . . . . . . . . . . . . . . . . . .

17

18 Enter the larger of your CA standard deduction OR your CA itemized deductions. . . . . . . . . .

18

19 Subtract line 18 from line 17. This is your taxable income . If less than zero, enter -0- . . . . . . . . .

19

31 Tax. Check box if from:

Tax

X

Tax Table

Tax Rate Schedule

32

33 Subtract line 32 from line 31. If less than zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . .

33

Payments

Schedule G-1

Form FTB 5870A . . . . .

35

40 Nonrefundable Child and Dependent Care Expenses Credit, (See inst.). Attach Form FTB 3506. . . . .

40

41 New jobs credit, amount generated (see instructions) . . . . . . . . . . . . . .

42

amount . . . . . . . . . . . . . . . .

43

44 Credit

Code

amount . . . . . . . . . . . . . . . .

45 To claim more than two credits (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

44

46 Nonrefundable renter's credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

46

47 Add line 40 and line 42 through line 46. These are your total credits . . . . . . . . . . . . . . . . . .

47

48 Subtract line 47 from line 35. If less than zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . .

48

61 Alternative minimum tax. Attach Schedule P (540) . . . . . . . . . . . . . . . . . . . . . . . . . .

61

62 Mental Health Services Tax (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

62

63 Other taxes and credit recapture (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

63

64 Add line 48, line 61, line 62, and line 63. This is your total tax . . . . . . . . . . . . . . . . . . . . .

64

71 California income tax withheld (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

71

72 2012 CA estimated tax and other payments (see instructions) . . . . . . . . . . . . . . . . . . . .

72

73 Real estate and other withholding (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . .

73

74 Excess SDI (or VPDI) withheld (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

74

75 Add line 71, line 72, line 73, and line 74. These are your total payments (see instructions) . . . . . . .

75

Side 2 Form 540 C1 2012

031

3102126

60,000.

60,000.

7,682.

52,318.

1,236.

208.

1,028.

1,028.

41

42 New jobs credit, amount claimed (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

Code

60,000.

34

35 Add line 33 and line 34 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

43 Credit

Other

Taxes

31

32 Exemption credits. Enter the amount from line 11. If your federal AGI is more than $169,730 (see instr.)

34 Tax. (see instructions) Check box if from:

Special

Credits

FTB 3803 .

FTB 3800 or

208.

45

0.

1,028.

1,028.

1,000.

1,000.

Your name:

CASE

Overpaid Tax/

Tax Due

Use Tax

Your SSN or ITIN: 131-65-2217

91 Overpaid tax. If line 75 is more than line 64, subtract line 64 from line 75. . . . . . . . . . . . . . .

91

92 Amount of line 91 you want applied to your 2013 estimated tax . . . . . . . . . . . . . . . . . . . .

92

93 Overpaid tax available this year. Subtract line 92 from line 91 . . . . . . . . . . . . . . . . . . . . .

93

94 Tax due. If line 75 is less than line 64, subtract line 75 from line 64 . . . . . . . . . . . . . . . . . .

94

95 Use Tax. This is not a total line (see instructions) . . . . . . . . . . . . . . .

Code

C

O

N

T

R

I

B

U

T

I

O

N

S

California Seniors Special Fund (see instructions) . . . . . .

Alzheimer’s Disease/Related Disorders Fund . . . . . . . .

California Fund for Senior Citizens . . . . . . . . . . . . .

Rare and Endangered Species Preservation Program . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

400

Add code 400 through code 423. This is your total contribution . . . . . . . . . . . . . . . . . . . . . . . . .

110

State Children’s Trust Fund for the Prevention of Child Abuse

California Breast Cancer Research Fund . . . . . .

California Firefighters’ Memorial Fund . . . . . . . .

Emergency Food For Families Fund . . . . . . . .

California Peace Officer Memorial Foundation Fund .

California Sea Otter Fund . . . . . . . . . .

Municipal Shelter Spay-Neuter Fund . . . . .

California Cancer Research Fund . . . . . . .

ALS/Lou Gehrig's Disease Research Fund . .

.

.

.

.

Child Victims of Human Trafficking Fund . . .

.

California YMCA Youth and Government Fund.

.

.

California Youth Leadership Fund . . . . . . .

School Supplies for Homeless Children Fund .

.

State Parks Protection Fund/Parks Pass Purchase.

110

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

402

403

404

405

406

407

408

410

412

413

414

419

420

421

422

423

111 AMOUNT YOU OWE. Add line 94, line 95, and line 110 (see instructions). Do Not Send Cash.

Interest and

Penalties

112 Interest, late return penalties, and late payment penalties . . . . . . . . . . . . . . . . . . . . . . . . 112

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0009 . .

Pay online – Go to ftb.ca.gov for more information.

FTB 5805 attached

Amount

401

Amount

You Owe

113 Underpayment of estimated tax. Check box:

28.

95

28.

111

FTB 5805F attached . .

113

28.

114 Total amount due (see instructions). Enclose, but do not staple, any payment . . . . . . . . . . . . . 114

Refund and

Direct Deposit

115 REFUND OR NO AMOUNT DUE. Subtract line 95 and line 110 from line 93 (see instructions).

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0009

115

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip (see instructions).

0.

Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below:

Routing number

Checking

Savings

Type

Account number

116 Direct deposit amount

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below:

Routing number

Checking

Savings

Type

031

Account number

3103126

117 Direct deposit amount

Form 540 C1 2012

Side 3

Form

Indiana Part-Year or Full-Year Nonresident

Individual Income Tax Return

IT-40PNR

State Form 472

(R 11 / 9-12)

2012

If filing for a fiscal year, enter the dates (see instructions) (MM/DD/YYY):

from:

Your Social

Security Number

131

65

2217

Spouse's Social

Security Number

JUSTIN

212

54

1187

Place “X” in box if applying for ITIN

Suffix

Place “X” in box if applying for ITIN

Initial

Last name

Your first name

Due April 15, 2013

to:

CASE

If filing a joint return, spouse's first name

Initial

JUSTINE

Suffix

Last name

CASE

Present address (number and street or rural route)

Place “X” in box if you are

married filing separately.

Zip/Postal code

123 MAIN ST

State

City

SAN DIEGO

CA

92101

School corporation number (see pages 61 and 62)

Foreign country 2-character code (see pg. 5)

9999

Enter below the 2-digit county code numbers (found on the back of Schedule CT-40PNR) for the county where you lived and

worked on January 1, 2012.

County where

you lived

00

County where

you worked

County where

spouse lived

00

County where

spouse worked

00

00

Round all entries

1. Complete Schedule A first. Enter here the amount from Section 3, line 37B, and enclose

Schedule A

Indiana Income

1

40000.00

2. Enter amount from Schedule B, line 6, and enclose Schedule B

2

.00

3

40000.00

Indiana Deductions

4

5000.00

Indiana Adjusted Income

5

35000.00

Indiana Exemptions

6

1334.00

State Taxable Income

7

33666.00

Indiana Taxes 11

1145.00

Indiana Add-Backs

3. Add line 1 and line 2

4. Enter amount from Schedule C, line 12, and enclose Schedule C

5. Subtract line 4 from line 3

6. You must complete Schedule D. Enter amount from Schedule D, line 7,

and enclose Schedule D

7. Subtract line 6 from line 5

8. State adjusted gross income tax: multiply line 7 by 3.4% (.034)

(if answer is less than zero, leave blank)

9. County tax. Enter county tax due from Schedule CT-40PNR

(if answer is less than zero, leave blank)

8

1145.00

9

.00

10. Other taxes. Enter amount from Schedule E, line 4 (enclose sch.)

10

.00

11. Add lines 8, 9 and 10. Enter total here and on line 16 on the back

15712111064

12. Enter credits from Schedule F, line 8 (enclose schedule)

12

2000.00

13. Enter offset credits from Schedule G, line 7 (enclose schedule)

14. Automatic Taxpayer Refund credit

Enter $111 if joint filing but only one is eligible (leave blank

if not eligible; see instructions on page 9 )

13

.00

14

.00

Indiana Credits

15

2000.00

Indiana Taxes

16

1145.00

17. If line 15 is equal to or more than line 16, subtract line 16 from line 15 (if smaller, skip to line 24)

17

855.00

18. Amount from line 17 to be donated to the Indiana Nongame Wildlife Fund

18

.00

19

855.00

Total to be applied to your estimated tax account (a + b + c; cannot be more than line 19)

20d

.00

21. Penalty for underpayment of estimated tax from Schedule IT-2210 or IT-2210A (enclose sch.)

21

.00

22. Refund: Line 19 minus lines 20d and 21. Note: If less than zero, see line 24 instructions

22

855.00

24. If line 16 is more than line 15, subtract line 15 from line 16. Add to this any amount on line 21

(see instructions on page 13 )

24

.00

25. Penalty if filed after due date (see instructions)

25

.00

26. Interest if filed after due date (see instructions)

26

.00

15. Add lines 12, 13 and 14

16. Enter amount from line 11

Overpayment

19. Subtract line 18 from line 17

20. Amount from line 19 to be applied to your 2013 estimated tax account (see instructions on page 11 ).

Enter your county code

county tax to be applied $

a

.00

Spouse's county code

county tax to be applied $

b

.00

c

.00

Indiana adjusted gross income tax to be applied

23. Direct Deposit (see page 12)

c. Type

$

Checking

Savings

Your Refund

Hoosier Works MC

a.

Routing Number

b.

Account Number

d.

Place an "X" in the box if refund will go to an account outside the United States

.00

27. Amount Due: Add lines 24, 25 and 26

Amount You Owe 27

Do not send cash. Please make your check or money order payable to: Indiana Department of Revenue.

Sign and date this return after reading the Authorization statement on Schedule H. You must enclose Schedule H.

Your Signature

Date

Spouse's Signature

If enclosing payment mail to: Indiana Department of Revenue, P.O. Box 7224, Indianapolis, IN 46207-7224.

Mail all other returns to: Indiana Department of Revenue, P.O. Box 40, Indianapolis, IN 46206-0040.

15712121064

Date

For Privacy Notice, get form FTB 1131.

FORM

California Nonresident or Part-Year

Resident Income Tax Return 2012

Long Form

540NR

C1

Side 1

APE

131-65-2217

JUSTIN

JUSTINE

CASE

CASE

CASE

123 MAIN ST

SAN DIEGO

Filing Status

1

2

3

4

5

CA

212-54-1187

92101

P

AC

A

R

RP

12

01-01-1981

01-01-1983

Single

X

Married/RDP filing jointly. (see instructions)

Married/RDP filing separately. Enter spouse's/RDP's SSN or ITIN above and full name here

Head of household (with qualifying person). (see instructions)

Qualifying widow(er) with dependent child. Enter year spouse/RDP died

.

If your California filing status is different from your federal filing status, fill in the box here . . . . .

6 If someone can claim you (or your spouse/RDP) as a dependent, fill in the box (see instr.) . . . .

Exemptions

U

6

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the pre-printed dollar amount for that line.

7 Personal: If you filled in 1, 3, or 4 above, enter 1 in the box. If you filled in 2 or 5, enter 2 in the box.

If you checked the box on line 6, see instructions. . . . . . . . . . . . . . . . . . . .

8 Blind: If you (or your spouse/RDP) are visually impaired, enter 1; if both are visually impaired, enter 2

7

8

9 Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 . . . .

9

2

0

0

Whole dollars only

X $104 = $

X $104 = $

X $104 = $

208.

10 Dependents:

First name

Total

Taxable

Income

Last name

Dependent's

relationship to you

Total dependent exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 0

X $321 = $

11 Exemption amount: Add line 7 through line 10 . . . . . . . . . . . . . . . . . . . 11

$

12 Total California wages from your Form(s) W-2, box 16 . . . . . . . . . . . . . . .

12

20,000.

13 Enter federal AGI from Form 1040, line 37; 1040A, line 21; 1040EZ, line 4; 1040NR, line 36; or 1040NR-EZ, line 10 . . .

13

14 California adjustments - subtractions. Enter the amount from Schedule CA (540NR), line 37, column B .

14

15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses (see instructions) . . . . . 15

208.

60,000.

40,000.

20,000.

16 California adjustments - additions. Enter the amount from Schedule CA (540NR), line 37, column C . .

16

17 Adjusted gross income from all sources. Combine line 15 and line 16 . . . . . . . . . . . . . . . . .

17

20,000.

Your California standard deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . .

18

19 Subtract line 18 from line 17. This is your total taxable income. If less than zero, enter -0- . . . . . .

19

7,682.

12,318.

18 Enter the larger of: Your California itemized deductions from Schedule CA (540NR), line 43; OR

031

3131124

Your name:

CASE

CA

Taxable

Income

Your SSN or ITIN: 131-65-2217

31

123.

35 CA Taxable Income from Schedule CA (540NR), Part IV, line 49 . . . . . . . . . . . . . . . . . . .

35

36

36 CA Tax Rate. Divide line 31 by line 19 . . . . . . . . . . . . . . . . . .

0.0100

37 CA Tax Before Exemption Credits. Multiply line 35 by line 36 . . . . . . . . . . . . . . . . . . . . . 37

38

38 CA Exemption Credit Percentage. Divide line 35 by line 19. If more than 1, enter 1.0000

1.0000

12,318.

31 Tax. Fill in the box if from:

X

Tax Table

Tax Rate Schedule

FTB 3800

32 CA adjusted gross income from Schedule CA (540NR), Part IV, line 45 . . .

FTB 3803

20,000.

32

123.

39 CA Prorated Exemption Credits. Multiply line 11 by line 38. If the amount on line 13 is more than

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

39

40 CA Regular Tax Before Credits. Subtract line 39 from line 37. If less than zero, enter -0- . . . . . . . .

Schedule G-1

FTB 5870A . . . . . . . .

41 Tax (see instructions). Check the box if from:

42 Add line 40 and line 41.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

40

$169,730 (see instr.)

Special

Credits

0.

50

52

53

1.000000

55 Credit amount (see instructions)

55

56

56 New jobs credit, amount generated (see instructions) . . . . . . . . . . . .

57 New jobs credit, amount claimed (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . .

57

58 Enter credit name

code number

and amount . .

58

59 Enter credit name

code number

and amount . .

59

60 To claim more than two credits (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

60

61 Nonrefundable renter's credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

61

. . . . . . . . . . . . .

62

63 Subtract line 62 from line 42. If less than zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . .

63

71 Alternative minimum tax. Attach Schedule P (540NR) . . . . . . . . . . . . . . . . . . . . . . . .

71

. . . . . . . . . . . . . . . . . . . . . . . . . . .

73 Other taxes and credit recapture (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . .

72

. . . . . . . . . . . . . . . . . . . .

74

0.

1,000.

62 Add line 50, line 55 and line 57 through line 61. These are your total credits

72 Mental Health Services Tax (see instructions)

74 Add line 63, line 71, line 72, and line 73. This is your total tax

Payments

42

51

If more than 1, enter 1.000 (see instructions) . . . . . . . . . . . . . . . . 54

Other Taxes

41

50 Nonrefundable Child and Dependent Care Expenses Credit (see page 20). Attach form FTB 3506 . . .

51 Credit for joint custody head of household (see instructions) . . . . . . . . .

52 Credit for dependent parent (see instructions) . . . . . . . . . . . . . . .

53 Credit for senior head of household (see instructions) . . . . . . . . . . . .

54 Credit percentage. Divide line 35 by line 19.

208.

0.

73

. . . . . . . . . . . . . . . . . . . . . . . . . .

81

82 2012 CA estimated tax and other payments (see instructions) . . . . . . . . . . . . . . . . . . . .

82

83 Real estate or other withholding (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

83

. . . . . . . . . . . . . . . . . . . . . . . . .

85 Add line 81, line 82, line 83, and line 84. These are your total payments . . . . . . . . . . . . . . .

84

81 California income tax withheld (see instructions)

84 Excess SDI (or VPDI) withheld. (see instructions)

Overpaid Tax/ 101 Overpaid tax. If line 85 is more than line 74, subtract line 74 from line 85 .

102 Amount of line 101 you want applied to your 2013 estimated tax . . . . .

Tax Due

103 Overpaid tax available this year. Subtract line 102 from line 101 . . . . .

104 Tax due. If line 85 is less than line 74, subtract line 85 from line 74 . . .

Side 2 Long Form 540NR 2012

031

3132124

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

0.

85

1,000.

101

1,000.

102

103

104

1,000.

Your name:

CASE

Your SSN or ITIN: 131-65-2217

Code

400

C

O

N

T

R

I

B

U

T

I

O

N

S

Amount

. . . . . . . .

410

Alzheimer's Disease/Related Disorders Fund . . .

401

Municipal Shelter Spay-Neuter Fund . . . . .

412

California Fund for Senior Citizens . . . . . . .

402

California Cancer Research Fund . . . . . .

413

ALS/Lou Gehrig’s Disease Research Fund . .

414

Child Victims of Human Trafficking Fund . . .

419

California YMCA Youth and Government Fund

420

California Seniors Special Fund (see instructions)

California Sea Otter Fund

Rare and Endangered Species

Preservation Program . . . . . . . . . . . .

403

State Children's Trust Fund for the Prevention

of Child Abuse . . . . . . . . . . . . . .

404

California Youth Leadership Fund . . . . . .

421

California Breast Cancer Research Fund . . . . .

405

School Supplies for Homeless Children Fund .

422

California Firefighters’ Memorial Fund . . . . . .

406

State Parks Protection Fund/Parks Pass Purchase

423

Emergency Food For Families Fund . . . . . . .

407

California Peace Officer Memorial

Foundation Fund . . . . . . . . . . . . . .

408

120 Add code 400 through code 423. This is your total contribution . . . . . . . . . . . . . . . . . . . .

Amount

You Owe

121 AMOUNT YOU OWE. Add line 104 and line 120 (see instructions). Do not send cash.

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001 . . . . .

120

0.

121

Pay Online – Go to ftb.ca.gov form more information.

Interest and

Penalties

122 Interest, late return penalties, and late payment penalties . . . . . . . . . . . . . . . . . . . . . . .

122

FTB 5805F attached .

123

124 Total amount due (see instructions). Enclose, but do not staple, any payment . . . . . . . . . . . .

124

Refund and

Direct Deposit

125 REFUND OR NO AMOUNT DUE. Subtract line 120 from line 103.

123 Underpayment of estimated tax. Check the box:

FTB 5805 attached

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0001 . . . . .

1,000.

125

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip

(see instructions) Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 125) is authorized for direct deposit into the account shown below:

Checking

Savings

Routing number

Account number

Type

126 Direct deposit amount

The remaining amount of my refund (line 125) is authorized for direct deposit into the account shown below:

Checking

Savings

Routing number

Type

127 Direct deposit amount

Account number

IMPORTANT: Attach a copy of your complete federal return.

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete.

Sign

Here

It is unlawful

to forge a

spouse’s/RDP’s

signature.

Joint tax return?

(see instr.)

Your signature

Spouse's/RDP's signature

(if a joint return, both must sign)

Daytime phone number (optional)

X

X

Date

(619)555-1212

Your email address (optional). Enter only one email address.

Paid preparer's signature (declaration of preparer is based on all information of which preparer has any knowledge)

PTIN

Firm's name (or yours if self-employed)

FEIN

Firm's address

Do you want to allow another person to discuss this tax return with us (see instructions)? .

. . . . . . . . .

Yes

No

Telephone Number

Print Third Party Designee's Name

031

3133124

Long Form 540NR C1 2012 Side 3