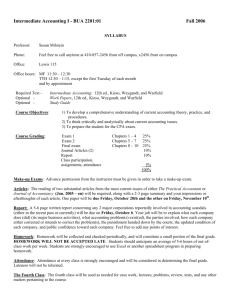

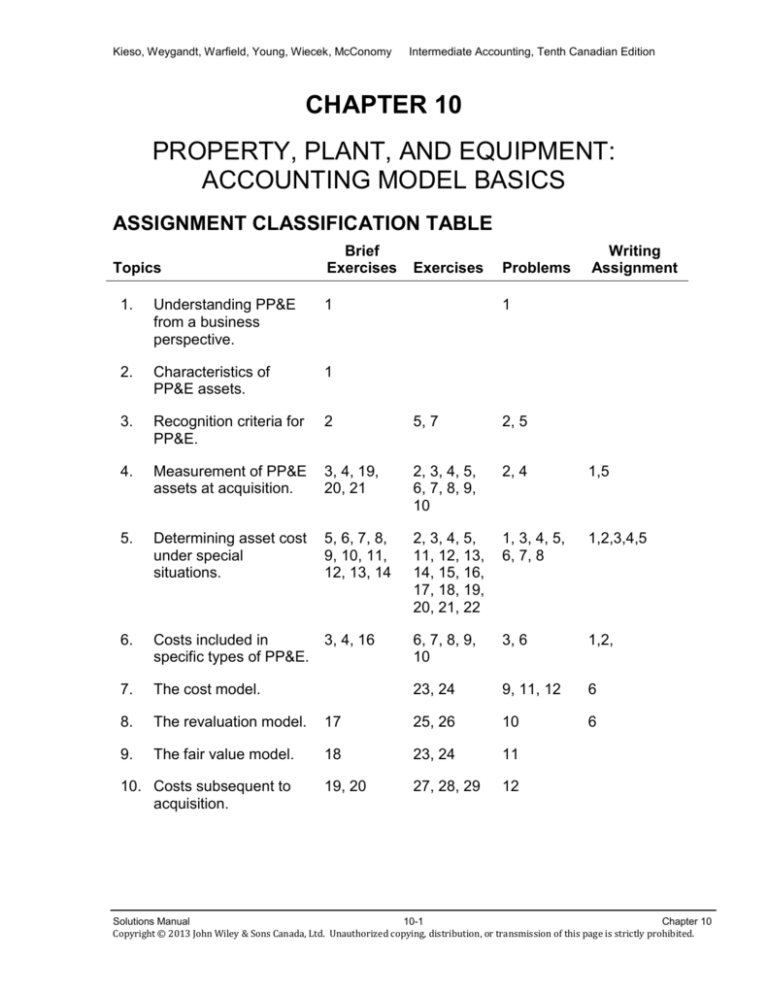

PP&E Accounting: Chapter 10 Assignment Guide

advertisement