Financial Literacy Initiative Report

advertisement

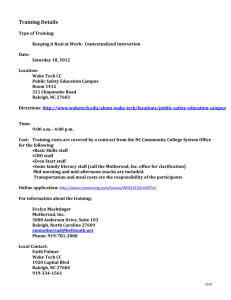

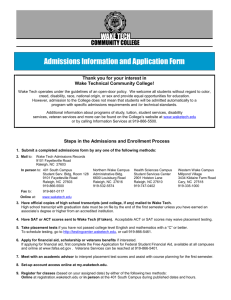

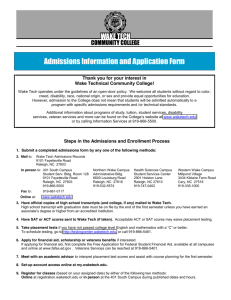

Fall 2013 & Spring 2014 Financial Literacy Initiative Report Report Contents Table of Contents Initiative Overview page 3 Initiative Awareness PR page 5 GED / ABE Overview page 6 GED / ABE Events page 7 GED / ABE Results page 8 Staff / Workplace Overview page 16 Staff / Workplace Event page 17 Staff /Workplace Survey page 18 Staff / Workplace Awareness page 19 Open House Overview page 20 Open House Results page 21 Open House Awareness page 22 In-Class Overview page 24 In-Class Results page 25 In-Class Awareness page 26 Spring Fling Overview page 27 Spring Fling Awareness page 28 Spring Fling Event page 29 Between fall 2013 and spring 2014, the SunTrust Foundation Center for Financial Education at Wake Technical Community College enhanced its programs aimed at raising financial literacy competencies among Wake Tech students, staff, and community members. The campaign was expanded to include more than 30 live instruction and promotional events, reaching over 450 participants. The inaugural semester of Wake Tech’s Center for Financial Education, the organization supported by this financial education partnership, opened in spring 2013 to serve students, faculty, and the whole community. Over the past school year the campaign has gained momentum by expanding outreach, forming new on-campus partnerships, and sponsoring more events. In collaboration with the SunTrust Foundation and the National Financial Educators Council (NFEC), Wake Technical Community College has adopted a holistic approach to promoting the financial wellbeing of its current and prospective students. In addition, the Center campaigns serve parents, staff, adult learners, and on-campus organizations. The campaign has expanded its outreach by building new partnerships, distributing flyers around campus, creating an online and social media presence, word-of-mouth networking, and using the NFEC’s email list to inform more than 20,000 people about the SunTrust Foundation Center for Financial Education. By staging high-profile events, the Center was able to raise awareness about the available resources for students. The 2013-14 campaign kicked off in September with the Center’s GED workshop series. Members of the GED class participated in a series of events which took place over four class periods. They learned important money management topics including lessons about credit, debt, savings, money management, and investment basics. The courses featured multimedia components and practical activities aimed at improving participants’ financial foundations. Course graduates received Certificates of Accomplishment at the Graduation Celebration held October 15, 2014. This celebration also served as the kickoff event for the larger financial literacy campaign. Kimberly Knox, lead instructor for the National Financial Educators Council, commented, “It’s great being with the class for 5 weeks. They were responsive, interested in the lessons and did well on their testing. The feedback provided by the students was encouraging and they felt this information will make a true difference in their lives.” The next set of events was designed to serve Wake Tech faculty and staff. Steve Repak, a Certified Financial Planner™, Army veteran, and author of Dollars & Uncommon Sense, taught two Retirement Planning & Investing workshops covering topics of investment preparation, risk management, and inflation. The overarching goal of the class was to help Wake Tech employees prepare for long-term financial wellness by building solid plans and outlining clear action steps toward retirement. On December 10, 2013, the Center expanded efforts to support a local nonprofit organization, Jack and Jill of America. From this nonprofit’s inception in 1938 to present day, its overarching theme and goal has been to groom well-adjusted young people and prepare them to become future leaders. Kimberly Knox led the presentation that helped Wake County youth gain muchneeded financial literacy skill sets. The campaign hosted five Open House events to introduce prospective students, and in some cases their parents, to college money management lessons. The objective of the events was to make new students familiar with the Center for Financial Education and the resources available to help them improve their financial capabilities. The Center for Financial Education celebrated Financial Literacy Month with contests and a booth at the College’s Spring Fling. More than 40 students stopped by the booth and participated in a Jeopardy-style game that gave them the opportunity to jump into the Money Booth. The Center also celebrated Financial Educators Day in April to honor educators who have contributed to this financial literacy initiative. This year the in-class financial literacy programs were expanded through collaboration with three new partners on campus: the COSMO department, dental hygiene program, and Business 125 classes. Over a hundred students were reached during nine in-class events featuring projectbased workshops, videos, and real-world activities. Participants left primed to take action toward improving their financial capabilities. A new event introduced this year – Fun Facts & Snacks and Motivational Mondays – gave students access to financial education events outside the classroom. The objective was to provide multiple events that covered similar topics so students could fit money education into a variety of school, work, and personal life schedules. These events drew students from various departments and majors to learn about budgeting, savings, credit, and investing basics. The second (fall 2013) and third (spring 2014) semesters of the Center for Financial Education continue to demonstrate Wake Tech’s and the SunTrust Foundation’s commitment to improving financial outcomes for students, staff, and faculty. The financial literacy program represents successful collaboration between the college, community, and students toward empowering the community with financial knowledge. I have become more confident that my plans and goals will be successful. Thank you. “ ” Cosmetology Student Course Participant GED/ABE Financial Education Classes On September 4, 2014 the first event opened the second semester of the SunTrust Foundation Center for Financial Education at Wake Technical Community College. A five-week training series for the General Education Degree (GED) and Adult Basic Education (ABE) classes were presented with the goal to equip adult participants with real-world money management skills. A total of 46 participants took part in the coursework, learning lessons about credit, debt, savings, money management, and investment basics. Certified Financial Education Instructor Kimberly Knox led the courses, which featured multimedia, videos, and practical hands-on activities presented with the goal of improving students’ financial foundation. Participants finished the five-week course having completed a viable personal budget and financial plan, and knowing action steps they can take to build credit, eliminate debt, begin to invest, and repay student loans. The GED/ABE event series concluded with a Graduation Ceremony where graduates were awarded Certificates of Accomplishment. Participating students expressed their excitement about the crucial information they gained throughout this workshop series. Graduates also enjoyed the recognition they received at the awards event. “The students were engaged, asked good questions, and expressed that they understood the importance of the subject matter,” stated Kim Knox. “There were many ‘aha’ moments when you saw the students grasp important concepts. It’s great to know the lessons they learned will benefit them both now and in the future.” After completing their fourth event and passing the financial literacy exam, graduates were invited to the awards ceremony held October 15, 2014. Both the course educators and representatives from Wake Tech attended the ceremony to honor the graduates’ achievements. Students received Certificates of Accomplishment and other prizes to commend them for completing the class. Both the training courses and the spring semester 2013 events measured results by gathering data on surveys, pretests, and post-tests. Testing for the fall 2014 series was modified to include measures of students’ long-term retention. Pretests were given prior to the first class on September 4 and compared with tests given well after the course concluded in March. The results demonstrated that students retained many of the key concepts learned even four months after the final class. The financial illiteracy epidemic in the U.S. has created major problems at both the community and national levels. Wake Tech has taken a proactive approach to addressing the problem by sponsoring this workshop series and financial wellness campaign. “ Excellent presentation! The instructor was knowledgeable and I learned the importance of having a nest egg. Prioritizing. Pre-Test Student Survey 100% 90% 80% 70% High Rating 60% \ 50% Neutral / 40% Low Rating 30% 20% 10% 0% 1 2 3 4 Question 5 Rated 1) Do you believe that learning how to manage money will benefit you? ‘Yes’, ‘Maybe’ or ‘No’ 2) Have you ever taken a class on personal finance before? ‘Yes’, ‘Maybe’ or ‘No’ 3) How do you feel when you think about your personal financial situation? ‘Yes’, ‘Maybe’ or ‘No’ 4) Are you interested in learning about money? ‘Yes’, ‘Maybe’ or ‘No’ 5) If you took a personal finance class do you think you would handle your money differently after? ‘Yes’, ‘Maybe’ or ‘No’ Topic Interests Investing Participants were asked to “select the topics they were most interested in learning about. Below is the list of their responses 30% 70% Budgeting No Student Loans 22% 78% Yes Yes 56% No 44% Yes No Debt Credit 52% 48% Yes No Saving Money 61% Yes No “ At first when I heard I had to attend this 22% 78% 39% Yes No course, I thought it was going to be boring; It was not boring and the speaker was excellent. I enjoyed it very much. ” Post-Test Student Survey 100% 90% 80% 70% High Rating 60% \ 50% Neutral / 40% Low Rating 30% 20% 10% 0% 1 2 3 4 Question 5 6 Rated 1) I feel more confident about the money topics covered in this course. ‘Yes’ to ‘Not at all’ 2) The information presented is something that will benefit me. ‘Yes’ to ‘Not at all’ 3) Please rate how much you learned. ‘A lot’ to ‘Not Much’ 4) Please rate how valuable the information was to you. ‘Valuable’ to ‘No Value’ 5) Please rate how valuable the information was to you. ‘Yes’ to ‘Not at all’ 6) Please rate the instructor. ‘Excellent’ to ‘Poor’ Pre/Post-Test Comparison By Question 100% 80% 60% 40% 20% 0% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Pre-Test Post-Test Post Test Pass/Fail Analysis Pre Test Pass/Fail Analysis 40% 60% Pass Fail 100% Pass Fail Pre/Post-Test Comparison By Question 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 0% 10% 20% 30% 40% Post-Test 50% 60% Pre-Test 70% 80% 90% 100% Question Key 1. The elements of a budget include a. planned expenses. b. planned income. c. an evaluation of the difference between one’s income and expenses. d. a, b, and c 2. Which of the following is not an example of a need? a. food b. housing c. top brand clothing d. medical care insurance 3. Setting financial goals a. is not really necessary. b. is only needed if you own a business. c. is only needed if you are wealthy. d. places you on a sustainable path to establishing financial freedom. 4. The acronym, BBB, stands for a. Better Business Budget. b. Bargain! Bargain! Bargain! c. Budget Before Buying. d. Buy Before Budgeting. 5. Developing your financial skills a. places you in a position to help your loved ones. b. provides you with the ability to pursue your passions. c. can help you make a positive difference in the world. d. a, b, and c 6. A credit bureau a. collects and stores consumer repayment information. b. collects and stores consumer savings data. c. collects and stores consumer medical information. d. collects and stores consumer investment information. 7. Which of the following categories influence your FICO score? a. outstanding debt b. payment history c. types of credit used d. a, b, and c 8. Your credit history is a. a detailed report of your savings and assets. b. a detailed budgeting plan. c. a detailed report that measures your ability to pay back money you borrow. d. a detailed report of your tax payments. 9. Good credit means a. you keep your financial commitments most of the time. b. you honor the only the debts that are the most important. c. you build wealth through a sustainable investment plan. d. you honor your commitments and pay all your bills on time. 10. To build an excellent credit rating, you should a. get a complimentary copy of your credit report each year. b. create and follow a debt reduction plan. c. set-up an automatic payment system for your bills. d. a, b, and c 11. A checking account is a. a savings account that pays the depositor a high rate of interest. b. a credit account. c. a transactional account that allows for deposits and withdrawals. d. an investment account. 12. One of the biggest benefits from investing is a. the ability to credit an excellent credit history. b. the ability to make sizable contributions to your favorite charity. c. the ability develop solid business relationships. d. the ability to make money from money that you did not earn. 13. How will the ‘rule of 72’ help you when considering investments a. it lets me know when my investment is up 72% b. it lets me know when my investment will double c. it can reduce my risk d. all of the above 14. The beauty of compounding interest is a. you make money off of the interest the bank pays you. b. you make money off of the money you deposit. c. your money can grow faster if you keep the interest you earn in investment. d. a, b, and c 15. The “Law of Supply and Demand” states a. when more people want a product, supply prices go up. b. when more people want a product, supply prices go down. c. when more people want a product, supply prices do not change. d. when less people want a product, supply prices go up. 16. A consequence on defaulting on a student loan could be a. the opportunity to live without student loan debt. b. enjoying more money in your checking account. c. many years of poor credit and financial instability. d. a “stress free” life that one enjoys with no debts. 17. You can minimize the accrual of college debt by a. reducing your living expense. b. graduating early or on-time. c. securing employment. d. a, b, and c 18. The approximate monthly “take home” pay for a $42,000 per year salary would be a. $3,600.00 b. $4,200.00 c. $2,500.00 d. $5,000.00 19. To create a “post college” debt payoff plan, you should a. b. c. d. contact all of your creditors. set-up automated payments. pay the maximum amount on high interest credit cards. a, b, and c 20. It is wise to work while in college to a. reduce you course load. b. earn extra money to reduce your need for student loans. c. live in a really nice apartment. d. live a extravagant lifestyle. Wake Tech Employees and Staff Receive Workplace Financial Wellness Events Wake Technical Community College faculty and staff had an opportunity to participate in two personal finance events during the fall 2013 campaign. The “Retirement Planning & Investing” Workshop series was offered to any employees interested in participating in a 90-minute workshop designed to help them plan for retirement. The Retirement Planning & Investing workshop covered topics of investment preparation, risk management, inflation, and more. The overarching goal of the class was to help Wake Tech employees prepare for long-term financial wellbeing by building a solid plan and outlining clear action steps toward retirement. The Center takes a holistic approach to promoting financial wellness which extends beyond students to also benefit staff. According to the Cambridge Human Resource Group, lack of financial education for workers is “the most critical unaddressed workplace issue.” And USA Today recently reported, “Financial stress is having an impact on the workplace, potentially draining productivity and increasing emotional stress on the job.” Steve Repak, a Certified Financial Planner™, Army veteran, and author of Dollars & Uncommon Sense: Basic Training for Your Money, was the course instructor. Steve has appeared on NPR, Bloomberg, Market Watch, and Wall Street Journal Radio. His work has been featured in Forbes, Investor’s Business Daily, BusinessWeek, MSN Money, and Yahoo Finance. Steve’s expertise as an educator is demonstrated by how well his presentations are received by audiences. In addition, post-surveys indicated that the course material made an important impact on participant knowledge. One staff member commented, “The instructor was very enthusiastic and it’s one of the best classes I’ve been to.” Another event attendee stated, “Great information! The energy of presenter shows he has a passion for what he does.” On a five-point scale, participants rated the event four or higher on all survey questions asked, either about the event or about the presenter. The focus of the Center for Financial Education and their programming is to deliver real-world lessons that employ multiple touch points, collaboration, and modern marketing techniques to maximize campaign benefits. Providing a workplace financial education to the staff not only helps improve their financial capabilities but it helps the Center enlist them into the overall initiative. Workplace Event The instructor kept it lively and informative! A lot of good information that I will likely be able to use in the future. “ Staff Survey Results Participants Responses I feel more confident about money matters. Rated 4 out of 5 The information presented is something I will use. Rated 4.5 out of 5 Please rate how much you learned. Rated 4.1 out of 5 Please rate how valuable the information was to you. Rated 4.3 out of 5 Please rate how much fun you had during the training. Rated 4.3 out of 5 Please rate the volunteer or teacher. Rated 4.8 out of 5 I really liked the interaction between the group and the facilitator. One of the best classes I’ve ever been to. “ ” Do this again with Steve Repak and allow him two hours minimum. “ “ ” The seminar was very informative and was presented clearly. It gave enough information to clearly give you a path to financial assistance. ” Students Learn about Center Resources at Open House Events During its 2013-14 open house events, the Center for Financial Education reached more than 75 students with personal finance workshops. The aim of these events is to prepare students for the financial decisions they’ll need to make in the real world, while also giving them useful information about the financial aid process. Various workshops offered by the SunTrust Foundation Center for Financial Education at Wake Technical Community College reach both students and their parents. The open house financial literacy events served several purposes. First, they made new students aware of the resources available through the Center for Financial Education. Second, students received lessons about the practical money management skills they will need in college and beyond. Finally, students also learned about financial aid and the options for helping them finance their college educations. Live instructor training, multimedia, and practical activities form the cornerstones of the open house events. These workshops recognize various learning styles and incorporate multiple methods to engage participants, creating a productive learning environment and boosting information retention. The open house events are just one piece of a comprehensive and innovative financial literacy campaign launched in January 2013. With support from the SunTrust Foundation, Wake Tech sponsored these events as part of the fall 2013 and spring 2014 campaign, which delivered more than 30 events to students, staff, and the community. Open House Results Students I feel more confident about money matters. Rated 4.4 out of 5 The information presented is something I will use. Rated 4.9 out of 5 Please rate how much you learned. Rated 4.5 out of 5 Please rate how valuable the information was to you. Rated 4.8 out of 5 Please rate how much fun you had during the training. Rated 3.9 out of 5 Please rate the volunteer or teacher. Rated 5 out of 5 The information was presented in ways that made it easy to understand. I’m much more confident about reaching my goals now. “ ” Parents Do you feel personal finance knowledge will help your child? Rated 4.86 out of 5 The information presented is something your child will use. Rated 4.71 out of 5 Please rate how much you feel your child learned. Rated 4.43 out of 5 Did you personally find the information presented valuable? Rated 4.79 out of 5 Considering Wake Tech’s campus-wide financial literacy program, do you feel our college is looking out for the best interest of your child? Rated 4.29 out of 5 Please rate the instructor. Rated 4.64 out of 5 The seminar was very informative and was presented clearly. It gave enough information to clearly give you a path to financial assistance. “ ” New Partnerships for Financial Literacy Yield Positive Gains The fall 2013 and spring 2014 semesters marked important expansion for the SunTrust Foundation Center for Financial Education at Wake Technical Community College. The Center extended the reach of its financial literacy initiative by collaborating with three new partners, conducting in-class events for the COSMO department, dental hygiene program, and Business 125 classes. In partnership with the teachers and department heads, the Center staged nine in-class events that reached over 100 students. Students who attended these special events left with practical money knowledge and action steps they could take to ensure their future financial wellness. The cosmetology curriculum provides competency-based knowledge, scientific/artistic principles, and hands-on fundamentals associated with the cosmetology industry. To help the COSMO department fulfill its goals, the Center for Financial Education collaborated with instructors to deliver four presentations to cosmetology students. One student participant in the cosmetology department’s personal finance class stated, “You have inspired me in so many ways. Thank you so much for helping with starting our careers.” Another student shared these thoughts: “I have become more confident that my plans and goals will be successful.” The Business 125 course covers individual and family financial decisions, with emphasis on building useful skills for buying, managing finances, increasing resources, and coping with current economic conditions. The Center contributed to several of the Business 125 classes to expand students’ learning and bring guest speakers to offer unique perspectives on personal finance. Wake Tech’s dental hygiene program prepares students to assess, plan, implement, and evaluate dental hygiene care for individual patients and promote oral wellness in the community. The Center taught dental hygiene program enrollees important lessons on savings and budgeting to round out the curriculum. In collaboration with various departments, teachers, and administrative staff, the Center for Financial Education reached students who expressed particular interest in more focused topics. The workshops were chosen to match each department’s mission while providing information to improve students’ financial capabilities. In-Class Results Participant Responses I feel more confident about money matters. Rated 3.8 out of 5 The information presented is something I will use. Rated 4.8 out of 5 Please rate how much you learned. Rated 3 out of 5 Please rate how valuable the information was to you. Rated 4.5 out of 5 Please rate how much fun you had during the training. Rated 5 out of 5 Please rate the volunteer or teacher. Rated 4.8 out of 5 Informative and to the point, using real-life examples. Excellent presentation! “ ” Spring Fling Builds Financial Wellness in Fun Ways Games, prizes, and blowing money—these were the features enjoyed by visitors to the Money Booth at this year’s Wake Tech Spring Fling. The SunTrust Foundation Center for Financial Education hosted the booth, which invited Spring Fling attendees to jump in and grab as many prizes as they could hold. While the Spring Fling is held annually at Wake Technical Community College, this year marked the first time the financial education booth appeared at the event. The SunTrust Foundation Center for Financial Education represents one piece of a larger financial literacy campaign being sponsored by Wake Tech, SunTrust, and the National Financial Educators Council (NFEC). The booth sought to attract participant interest in the personal finance campaign by featuring games, prizes, and a money blower. The annual Spring Fling was held on the Main Campus grounds at Wake Tech. Current and prospective students seemed to greatly enjoy the activities, games, and social interaction at the Fling. Students who stopped by the Money Booth were invited to take part in a Jeopardy-style game asking questions related to personal finance. Based on their answers, some students were then invited to enter the Money Booth and take a chance at winning various prizes. “Financial literacy can be fun,” said Vince Shorb, CEO of the National Financial Educators Council. “We commend the Center for Financial Education for bringing events to the campus and community that promote financial wellness in unique formats that get people interested and involved.” The Spring Fling also represented the launch of the Financial Scavenger Hunt. This practical game-based learning activity has students complete real-world activities to compete for prizes. Participants in the Scavenger Hunt learned how to get free copies of credit reports, use a compounding interest calculator, and visit the career counseling office—all activities that promote financial wellness. Each student who participated in the Spring Fling event received a code that enabled competition in the Financial Scavenger Hunt. At the Money Booth, students also learned about the Financial Empowerment Workshops and were urged to participate in the ongoing activities sponsored by the Center. The Spring Fling is one event in a series of chances Wake Tech offers students and community members to gain solid financial knowledge while having fun in the process. In collaboration with SunTrust and the NFEC, Wake Tech presents a holistic financial education initiative that represents the college’s commitment to helping students gain key personal finance skills by presenting educational events using methods to which students relate. www.WakeTech.edu/Financial-Education