Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

CHAPTER OUTLINE

Spotlight: Company X

1 Building a Management Team

Describe the characteristics and value of a strong management team.

Management Team – Managers and other key persons who give a company its

general direction

Teams may change, but must be accomplished respectfully

Add team members as needed

Provides diversity of talent making venture stronger

Competence required depends on type of business and nature of operations

Using family allows the owner to know and trust as well as pay less (sometimes)

How does the team concept fit the individualistic nature of most entrepreneurs?

For example, how does an entrepreneur learn to delegate?

Achieving Balance

Competence in all areas (finance, marketing, etc.)

Competent insiders and outside specialists

Expanding Social Networks

Social network – an interconnected system comprising relationships with other

people

Used to access information or get advice

Communicates legitimacy and jump-starting sales

Popular choices

LinkedIn.com

Twitter.com

Yelp.com

Facebook.com

Social capital – The advantages created by an individual’s connections in a

social network.Reciprocation – a powerful social rule based on an obligation to

repay in kind what another has done for or provided to us

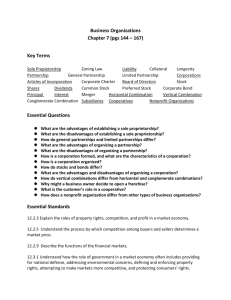

2 Choosing a Legal Form of Organization

Explain the common legal forms of organization used by small businesses. Exhibit 8-1

Forms of Legal Organization for Small Businesses

As each of these legal forms is discussed, have students suggest local businesses that fit

each option.

The Sole Proprietorship Option

Business owned by one person, who bears unlimited liability for the enterprise

Most basic business form

Unlimited liability – liability on the part of an owner that extends beyond the

owner’s investment in the business

Exhibit 8-2 Percentage of Small Businesses by Legal Form of Organization

indicates Sole Proprietorship makes up largest percentage

The Partnership Option

Legal entity formed by two or more co-owners to carry on a business for profit

78

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

Qualifications of Partners

Involves consideration of legal issues as well as personal and managerial

factors

Should be honest, healthy, capable, and compatible

Exhibit 8-3 The Advantages and Disadvantages of Partnerships

Suggestions

Choose your partner carefully

Be open, but cautious, about partnerships with friends

Test-drive the relationship, if possible

Create a combined vision for he business

Prepare for the worst

Rights and Duties of Partners

Partnerships agreement – document that states explicitly the rights and duties

of partners (especially important with family members)

Joint and several liability – liability of each partner resulting from any one

partner’s ability to legally bind the other partners

Termination of a Partnership

Death, incapacity, or withdrawal of a partner ends partnership

Requires liquidation or reorganization of the business

May result in substantial losses to all partners, but may be necessary

The C Corporation Option

Definitions

Corporation – business organization that exists as a legal entity and provides

limited liability to its owners

Legal entity – business organization that is recognized by the law as having a

separate legal existence

C corporation – ordinary corporation, taxed by the federal government as a

separate legal entity

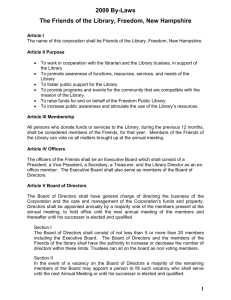

The Corporate Charter

Document that establishes a corporation’s existence

Sometimes called articles of incorporation or certificate of incorporation

Brief, in accord with state law, and broad in its statement of the firm’s powers

Corporate bylaws outline the basic rules for ongoing formalities and decisions

of corporation such as size of board of directors, duties and responsibilities of

directors and officers, scheduling meetings of directors and shareholders, etc.

Rights and Status of Stockholders

Ownership evidenced by stock certificates (a document specifying the number

of shares owned by a stockholder)

Pre-emptive right – right of stockholders to buy new shares of stock before

they are offered to the public

Limited Liability of Stockholders- stockholder liability restricted to the amount of

money they invest in the business

Death or Withdrawal of Stockholders – ownership easily transferable

79

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

Maintaining Corporate Status

Must hold annual meetings of both the shareholders and the board of directors

Keep minutes to document the major decisions of shareholders and directors

Maintain bank accounts separate from owners’ bank accounts

File separate income tax return for the business

3 Criteria for Choosing an Organizational Form (see Exhibit 8-4 Comparison of Basic

Legal Forms of Organization)

Identify factors to consider in choosing among the primary legal forms of organization

Initial Organizational Requirements and Costs

Liability of Owners

Choosing form for simplicity can cost more than money

Incorporation will not protect a firm’s owners from liability

Piercing the Corporate Veil – situation in which the courts conclude that

incorporation has been used to perpetuate a fraud, skirt a law, or commit some

wrongful act, and thus remove liability protections from the corporate entity

No form of organization can protect from all forms of liability

Most banks and many suppliers will require small business owners to sign a

personal guarantee before loaning money or extending credit regardless of the

form of organization

Continuity of Business

Transferability of Ownership

Management Control

Attractiveness for Raising Capital

Income taxes

Sole proprietorship

Partnership

C Corporation

Have students discuss each of these criteria and indicate which are the most important to

them and tell why they are important.

4 Specialized Forms of Organization

Describe the unique features and restrictions of five specialized organizational forms.

The Limited Partnership – partnership with at least one general partner and one or

more limited partners

General partner – A partner who has unlimited liability and remains personally

liable for debts of the business

Limited partners – A partner who is not active in its management and has limited

personal liability. The S Corporation (Subchapter S Corporation)

Type of corporation that offers limited liability to its owners but is taxed by the

federal government as a partnership

Must meet specific requirements

No more than 100 stockholders allowed

All stockholders must be individuals or certain qualifying estates and trusts

Only one class of stock can be outstanding

Fiscally, the corporation must operate on a calendar-year basis

80

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

Shareholders may not include nonresident aliens

The Limited Liability Company

Form of organization in which owners have limited liability buy pay personal

income taxes on business profits

Major advantage is the liability protection

Usually the best choice for new businesses

Ability to pass taxable income on to shareholders

Easier to set up

More flexible

Significant tax advantages

Better to us a C corporation if you want to:

Provide extensive fringe benefits to owners or employees

Offer stock options to employees

Go public or sell out at some time in the future

Eventually convert to a C corporation

The Professional Corporation

Form of corporation that shields owners from liability and is set up for individuals

in certain professional practices

Does not protect a practitioner from his/her own negligence or malpractice

Applies to narrow range of enterprises

Many states require this form of organization before a practice can operate

The Nonprofit Corporation

Form of corporation for enterprises established to serve civic, educational,

charitable, or religious purposes but not for generation of profits

Most become 501[c](3) organizations

IRS will not allow this option for an individual or partnership

Organizational test – verification of whether a nonprofit organization is staying

true to its stated purpose

5 Forming Strategic Alliances

Understand the uses of strategic alliances in small businesses.

An organizational relationship that links two or more independent business entities

in a common endeavor

Strategic Alliances with Large Companies

Alliances created with both other large corporations and small businesses

Exhibit 8-6Most Popular Small Business Alliances by Type

Strategic Alliances with Small Companies

Provides mutual competitive strength

Allows them to reach goals that would otherwise be too costly or too difficult for

small businesses to accomplish on their own

Setting Up and Maintaining Successful Strategic Alliances

Challenging to find a suitable partner

Spreads the risk of entering new markets

Helps small players with unattractive balance sheets appear stable to the end

buyer

81

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

Steps to help succeed

Establish a healthy network of contacts

Identify and contact individuals within a firm who are accessible

Do your homework, and you will win points just for being prepared

Learn to speak and understand the “language” of your partner

Make sure any alliance offer is clearly a win-win opportunity

Continue to monitor the progress of the alliance to ensure that goals and

expectations are being met, and make changes as they become necessary

6 Making the Most of a Board of Directors

Describe the effective use of boards of directors and advisory councils.

The governing body of a corporation, elected by the stockholders

Contributions of Directors

May help with long term strategic decisions

Reviews major policy decisions

Advises on external business conditions and proper reaction to the business cycle

Provide informal advice on specific problems

Offers access to important personal contacts

Selection of Directors

Firm’s attorney, banker, accountant, local management consultants, and other

business executives available, but lack independence needed to look at firm

critically

Outside directors more objective in decisions and advice

Nature and needs of business help determine qualifications required for directors

Compensation of Directors

Compensation varies greatly

Some pay no fees at all

May be annual retainer, board meeting fees, pay for committee work

Money may not be their primary motivation for serving on the board

An Alternative: An Advisory Council

A group that serves as an alternative to a board of directors, acting only in an

advisory capacity

Qualified outsiders serve

Functions much like board of directors

SOURCES OF VIDEO AND OTHER INSTRUCTIONAL MATERIALS

The SBA at http://www.sba.gov/smallbusinessplanner/index.html offers information

on incorporation and permits and licensing. You can also check your state government

Web site for small business and incorporation information.

ANSWERS TO END-OF-CHAPTER DISCUSSION QUESTIONS

1. Why would investors tend to favor a new business led by a management team

over one headed by a lone entrepreneur? Is this preference justified?

82

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

Investors are concerned that management has a blend of important management

skills and that the founder has the ability to perform in a professional way. They

realize that the typical “idea person” who starts a business is deficient in some area

of management. This preference appears justified for most ventures of substantial

size.

2. Discuss the merits of the three most basic legal forms of organization.

Sole proprietorship is the most widely used form of organization. However, the

corporation is the most important form when the volume of business activity is

considered. Why is this true? Most small firms are proprietorships, but most big

firms are corporations. Reasons for dominance of the corporate form among big

firms are the feature of limited liability and the possibility of acquiring large

amounts of capital. The third legal form of organization is the partnership (with

general and limited options), but most entrepreneurs contend that the drawbacks of

this form outweigh its advantages.

3. Does the concept of limited liability apply to a sole proprietorship? Why or why

not?

The concept of limited liability that applies to the corporate form of organization

does not apply to a proprietorship because the business is considered an extension

of the individual and not a separate entity. This means that creditors can take the

owner’s personal assets outside the business if the business fails.

4. Suppose a partnership is set up and operated without a formal partnership

agreement. What problems might arise? Explain.

If articles of partnership are not put in writing, disagreements and

misunderstandings may arise about the respective responsibilities of the partners,

the way in which profits are to be distributed, and many other matters. This can

seriously interfere with the normal profitable operation of the business. By reducing

understandings to written form, partners can minimize misunderstandings,

differences in viewpoints, and overlooked issues.

5. Evaluate the three major forms of organization in terms of management control

by the owner and sharing of the firm’s profits.

In a proprietorship, the owner has complete and absolute control. In a general

partnership, an owner must share control with the other partner or partners, and

each partner generally has the power to make commitments binding on the

partnership. In the corporation, control must be shared with other stockholders. This

may not be a problem, however, if the majority owner controls practically all of the

stock. Indeed, if one owner has as much as 51 percent of the stock, in most states

83

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

that owner can name the board of directors. However, the majority stockholder

usually has some concern about, as well as some legal obligations to, minority

stockholders. Hence, dilution of ownership control is a feature of the corporate form

of business organization.

In a sole proprietorship, all profits go to the proprietor. In a partnership, however,

profits are shared equally unless the articles of partnership stipulate an unequal

sharing ratio. In a corporation, profits legally belong to the corporation, but

directors (usually named by the majority stockholder) can declare dividends so that

stockholders get a share of the earned profits.

6. What is an S corporation, and what are its principal advantages?

The S corporation is taxed as a partnership and thus avoids the corporate income

tax. Depending on the circumstances of the corporation and the owners, this can

create significant tax savings. Its use is limited to small firms.

7. Why are strategic alliances helpful to many small businesses? What steps can

an entrepreneur take to create strategic alliances and to prevent their failure?

According to strategic alliance experts, strategic alliances are becoming crucial in

building businesses of all kinds and at an earlier stage than ever before. They can

decrease cycle time by allowing startups to access another firm's resources. Since

an opportunity will often go to the entrepreneur who is fast enough to exploit it,

many now see strategic alliances as an essential part of their plan for growth. Such

partnerships represent one way to cope with the rapid change of today's business

environment.

Two-thirds of all alliances run into serious problems within two years of their

creation, and 70% of them do not survive, which shows that alliances are hard to

manage. Taking some basic steps can help entrepreneurs establish healthy alliances

and reduce the risk of their failure. These are (1) establish a healthy network of

contacts, (2) identify and contact individuals within the firm who are likely to return

your call, (3) outline the partner's continuing financial benefits from the alliance,

(4) show the partner that your firm can deliver value to the alliance across several

fronts, and (5) learn to speak and understand the "language" of your partner.

Despite sound planning and execution, many strategic alliances fail, but some upfront planning can head off unnecessary failures.

8. How might a board of directors be of value to management in a small

corporation? What qualifications are essential for a director? Is ownership of

stock in the firm a prerequisite for being a director?

84

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

In the small corporation, a properly selected board of directors can be of real value

to the entrepreneur. The board members can be called on to advise the entrepreneur

on the solution of major problems; that is, they can act as de facto management

consultants. They can also assist with policy formulation and redefinition of

business strategy.

The business owner should select outside board members on the basis of their

interest in and potential contributions to the organization. Many individuals are

potentially good board members, and the best available talent should be selected.

The purchase of stock should not be required, although such an agreement might

make service on the board of directors an attractive proposition for a capable

director.

9. What may account for the failure of most small companies to use boards of

directors as more than rubber stamps? What impact is this likely to have on the

business?

There are no doubt many reasons. Many small business owners have never even

thought about the possibility. Some owners are confident of their own abilities and

see no benefit in having a board. Others have misconceptions concerning difficulty

in attracting board members and levels of compensation. Probably the greatest

reason is lack of assurance that a board would be of real value.

If an entrepreneur uses a board of directors as merely a rubber stamp, his or her

small business stands to lose the insights of directors who can help the entrepreneur

look beyond the next few months to make important, long-term strategic decisions.

A well-selected board of directors can also bring supplementary knowledge and

broad experience to corporate management. By virtue of their backgrounds,

directors can fill gaps in the experience of a management team. The board should

meet regularly to provide maximum assistance to the chief executive. In board

meetings, ideas should be debated, strategies determined, and the pros and cons of

policies explored. In this way, the chief executive is assisted by the experience of

all the board members. Their combined knowledge makes possible more intelligent

decisions on issues crucial to the firm. By utilizing the experience of a board of

directors, the chief executive of a small corporation is in no way giving up active

control of its operations. Instead, by consulting with and seeking the advice of the

board’s members, he or she is simply drawing on a larger pool of business

knowledge. A group will typically make better decisions than will a single

individual working in isolation. An active board of directors serves management

in several important ways: by reviewing major policy decisions, by advising on

external business conditions and on proper reaction to the business cycle, by

providing informal advice from time to time on specific problems that arise, and by

offering access to important personal contacts. With a strong board, a small firm

may gain greater credibility with the public, as well as with the business and

85

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

financial communities. All this potential advantage is lost when an entrepreneur

does not use his or her board of directors as they were meant to be used.

10. How do advisory councils differ from boards of directors? Which would you

recommend to a small company owner? Why?

An advisory council is similar to a board, but members generally do not have a

legal liability to the stockholders. Some individuals may be reluctant to accept

directorships if they entail legal liability. Either system can function effectively.

The advisory council system should be used if necessary to attract qualified

contributors to the business. Also, advisory councils appear less threatening to

some owners.

COMMENTS ON CHAPTER “YOU MAKE THE CALL” SITUATIONS

Situation 1

1. How relevant are the individual personalities to the success of this

entrepreneurial team? Do you think Green and Stroder have a chance to survive

their “partnership”? Why or why not?

Personalities of partners are extremely relevant to the success of a business. The

fact that Green and Stroder were close friends as teenagers suggests that they will

be able to get along with each other. Since they have agreed to have Stroder do all

the work, there should not be many opportunities for a “personality clash.” This

should be a fair arrangement. If not, problems may arise regardless of the

personalities involved.

2. Do you consider it an advantage or a disadvantage that the members of this team

are the same age?

In most cases it is probably an advantage. World views often vary from age to age,

and they can influence individual priorities regarding money, family, and life in

general. However, the amount of experience, which usually comes with age, is

about the same for each of these young entrepreneurs, and this may prove to be a

major limitation of the team.

3. On balance, is it good or bad that the company will be started by two men who

are very close friends? What are the potential benefits and drawbacks of mixing

business and friendship in this case?

86

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

As long as the friends create a partnership agreement that carefully outlines the

duties and responsibilities for each of the partners and which they each have their

personal lawyer review before they sign, the partnership could be a good choice.

Their personalities may balance each other and help improve the business itself.

For example, since Green is only supplying cash, and he would be the limited

partner. It appears that he has greater personal assets than Stroder, and this

arrangement would limit Green’s exposure to liability claims that might arise

through activities of the business.

Situation 2

1. What are the advantages and disadvantages of running the business as a sole

proprietorship? As a C corporation?

Matthew Freeman must decide whether to remain organized as a sole proprietorship

or incorporate his business. Because he is already operating as a sole

proprietorship, this would place the least administrative burden on him. He would

have fewer reporting requirements. Taxes on his business income would be

reported on Schedule C of his personal income taxes. He would also be required

to file quarterly estimated tax payments. As a sole proprietorship, however, he has

unlimited personal liability for any debts incurred by the business and any lawsuits

brought against the business. Thus, his personal property (e.g., house, cars) is at

risk. In his particular situation, he will also lose some business if he remains a sole

proprietorship because some large companies will not deal with a sole proprietor.

Furthermore, Freeman is not considered an employee and cannot enjoy tax-free

fringe benefits such as insurance and hospitalization. And when organized as a sole

proprietorship no other person can conduct business for the company. These

disadvantages of a sole proprietorship can be overcome by incorporating.

If incorporated, Freeman will enjoy limited liability and his personal assets will not

be at risk. As an employee of the corporation, he will be entitled to certain fringe

benefits. As a corporation, his business may also have greater legitimacy in the

eyes of other organizations, including large corporations and lending institutions.

Incorporation will, however, involve costs and administrative burdens to establish

the corporation. He must draw up legal documents (e.g., articles of incorporation)

and issue stock to begin the corporation. This process is usually done in

consultation with a lawyer and/or a Certified Public Accountant. The on-going

reporting requirements for a corporation are more burdensome than for a sole

proprietorship. Corporate records must be maintained and accounts must be kept

separate from all personal accounts. Depending on the type of corporation chosen

(see notes for next question), Freeman may be subject to double taxation.

2. If Freeman decided to incorporate his business, which types of corporations can

he form? Which type would you recommend? Why?

87

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

Freeman may choose either a "C corporation" or an "S corporation". Each of these

offers the advantage of limited liability and the legitimacy needed for constituents

that would prefer not to deal with a sole proprietorship. In choosing between the

options, then, other issues should be considered. The primary consideration seems

to be the tax implications.

A " C corporation" must pay corporate income taxes on any income. If dividends

are declared, the corporation first pays corporate income tax on these and then

individual shareholders pay personal income tax on the dividends. An "S

corporation" allows a business to have the benefit of limited liability while being

taxed as a partnership. Taxable income and losses are passed to the stockholders

rather than the corporation paying corporate income taxes. Thus, dividends are not

subject to double taxation. An "S corporation" is limited in many other respects

(e.g., no more than 75 shareholders, only one class of stock, corporation must be

domestic), but none of these are relevant for Freeman’s decision. Thus, it appears

that the "S corporation" provides the necessary benefits with the least tax burden.

Situation 3

1. Would you accept the investment and the conditions that go along with it, or

refuse it and go a different direction?

Perhaps Patton and Marks should look for outside financing using a different

source. If their financial records are strong enough and they have developed a

relationship with their banker, they may be able to borrow if they need additional

funds to expand.

2. Can one outside member on a board of three make any real difference in the way

the board operates?

Unless Patton and Marks develop a strong set of corporate bylaws or partnership

agreement depending on the business form, the angel could wield pressure in the

form of withholding funds if he doesn’t agree with decisions. This could certainly

undermine their control.

3. If you were the owners, whom would you include on the board?

If a board of directors is formed, it should include both owners and the angel as

well as at least one outsider who has no connection with the angel. This would

allow advice independent of all parties. The choice of this person should be

carefully researched possibly using someone like the strategic alliance

matchmakers.

4. If Patton and Marks decide to form a board of directors, what will determine its

usefulness or effectiveness? Do you predict that it will be helpful? Why or why

not?

88

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

The corporate bylaws would determine whether the board would be useful or

effective. Bylaws should be carefully reviewed to be sure they would not be a

hindrance to the operation of the business. Such a board could be very helpful in

adding to the experience and ability of Patton and Marks. On the other hand, the

board could prove to be a roadblock if the angel uses it to force the business to run

as he wants rather than understanding that Patton and Marks know their business

and should be given credence in terms of their ability and experience in running

this particular business.

SUGGESTED SOLUTION TO CASE 8: D’ARTAGNAN

1. How would you describe the entrepreneurial team of Daguin and Faison?

Was it ever a balanced team? What did each member bring to the business?

Can you see gaps in their skills and capabilities that should have been

covered in some way?

The company founders never really worked as a team. They fought things out.

Each member brought special skills to the business: Daiguin brought the food

business know-how while Faison brought the business skills. Gaps in their skills

include people skills. The lack of these skills appeared throughout their

association with each other and their methods of handling their employees. For

example, employees took sides as the business suffered before Daguin finally

purchased the company from Faison.

2. What does this case reveal about the critical factors that can determine the

success or failure of a business that is led by more than a single

entrepreneur? What was “the beginning of the end: for Daguin and Faison’s

working relationship?

Establishing specific responsibilities, developing partnership agreements, etc. are

vital for business operations. The beginning of the end appears to be the listeria

bacteria problem that caused retailers to become angry with D’Artagnan.

However, the beginning of the business probably was the beginning of the end

due to the incompatibility of the two individuals involved in the business.

3. What form of organization did Daguin and Faison choose for D’Artagnan?

Assess the advantages and disadvantages of the major organizational forms

mentioned in Chapter 8 and decide which one would have been the best

choice for D’Artagnan.

89

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

Basically D’Artanan was a partnership as defined in the case. Exhibit 8-4 is a

comparison of the basic legal forms of organization and provides the basis for this

discussion.

Sole Proprietorship:

Advantages: no registration or filing fees, ownership of company name and

assets may be transferred easily, absolute management freedom

Disadvantages: unlimited liability, business continuity poor, raising capital

difficult, income from the business is taxed as personal income to the owner

General Partnership:

Advantages: generally no registration or filing fee,

Disadvantages: unlimited liability, without partnership agreement dissolved

upon withdrawal or death of partner, ownership transfer requires the consent

of all partners, majority vote of partners required for control, raising capital

limited to partners’ ability and desire to contribute capital, income taxed as

personal income to the partners

C Corporation:

Advantages: liability limited to investment in company, continuity of business

unaffected by shareholder withdrawal or death, Ownership easily transferred

by transferring shares of stock, usually the most attractive form for raising

capital

Disadvantages: Most expensive and greatest requirements for organization,

compliance with state regulations for corporations required, shareholders have

final control but usually board of directors controls company policies, taxed

on income and stockholder taxed on any dividends received

D’Artagnan probably should have been a partnership with a partnership

agreement. Since the lawyer caused them to sign a buy-sell agreement that

included a shotgun clause and they took out life insurance, the business operated

and changed hands with a pre-ordained plan.

Students’ answers will vary. Regardless of the structure they choose, they need to

provide a rationale for their choice in terms of the concepts and discussions from

the chapter.

4. Would a formal board of directors have made a difference in the relationship

between Daguin and Faison and the operation of D’Artagnan? Draw up a

profile of an ideal board for the company.

A formal board might have made a difference because it could have developed a

communication link between the partners and helped to avoid the employee

problems. However, a board could also have taken sides and caused even more

90

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.

Chapter 8 The Organizational Plan: Teams, Structures,

Alliances, and Directors

problems for the business. The type of board might have made a difference. If the

board were paid for performance, they probably would have made decisions based

on the best practices for the business.

Again, students’ answers will vary, but should be based on concepts and

discussions from the chapter.

91

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated or posted to a publicly

accessible website, in whole or in part.