Introduction to Accounting Systems

advertisement

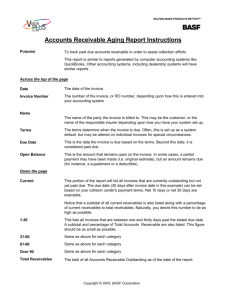

Introduction to Accounting Systems Class #1 September 25 Today, we will discuss what an accounting information system and go through a simple example of a system. The purpose of today’s class is to give you some background on the course. This material will be repeated later in the course (in more depth). Below is some background material which introduces what I am hoping to get across in this class. Note: the material from today’s lecture will not be on the first exam. The purpose of today’s lecture is to introduce some context for our discussions in class periods 3-6. This material will be repeated (for the most part) in the control section of the course, beginning in Class period # 7. • What is an accounting information system? When most people hear the term, accounting information systems, they immediately conjure up images of computerized systems for producing financial statements. But this is NOT what accounting information systems are! When you took your first course in accounting, you probably learned how to analyze transactions and record them in a general journal. For example you might have been asked to prepare a journal entry for the rental payment for office space for the next 6 months. You learned to debit an asset (prepaid rent) and to credit another asset (cash). Prepaid Rent Cash 4800.00 4800.00 If you were the accountant for this company, what would cause you to make the entry? Do you constantly monitor all of the company’s employees to see if they might be engaging in transactions? Obviously, not! The answer to this question is that you will have an invoice or a statement from your landlord. As you make payment on the invoice, you will record the payment. This gives a clue regarding the subject matter of this course. This course is about the processes we go through in recording information in our accounting records. An accounting information system is, therefore, a set of processes we employ to enter accounting information into our records and the means by which we record, store, and summarize that information. If we focus on a computerized system, a clerk might enter information from invoices, a computer might store this information in a disk file, and various computer programs might be written to summarize and use this information or print reports. • Why do we care about accounting information systems? Another way of asking this question is: what do we wish to accomplish with our system? There are several related answers to this question, including the following: 1. Make certain that the transaction information that is recorded fully and correctly reflects the transactions which have occurred. 2. Provide some protection against theft and fraudulent financial statements. 3. Provide managers with the type of information that they require to make decisions. To make certain that our records reflect reality, we must standardize the way we do things. If we sometimes wait until Friday to record cash receipts and we sometimes record them as they are received, then we run the risk of either not recording a given cash receipt (thinking that we recorded it when we received it when in fact we did not) or recording it twice (thinking that we did not record it when it was received - when in fact we did). For a particular company it may be better to record all cash receipts as they are received or it may be better to record them all at the end of the day. To provide protection against theft, we will want to be able to assign responsibility for our assets and record-keeping to particular individuals. If cash turns up short at a cash register at the end of the day, we want to be able to trace the problem to a particular individual. This is why each cashier at the grocery store has his or her own cash register tray. The choice of a computerized accounting system or a manual accounting system (hand recording of information in a general journal) may depend on how the owners or managers of the company plan to use the information (as well as the number of transactions which must be recorded and stored). As an example of decision-driven technology, consider the monthly statement for a credit card. This statement would include a line-item for each purchase transaction, but would not include each item purchased as a separate line-item. You would just have a single entry for a purchase from a given store on a given date. This is because the store gives you an itemized receipt, so storage of this information by the creditcard company would be redundant. Conversely, you must have a detailed summary with a specific line-item for each transaction in order to reconcile your receipts to your statement. So a single line-item summarizing all purchase transactions would not be sufficient. The first two items are termed control characteristics of the system. How does the system (the way you process information) influence the likelihood that your information is correct and does it provide some checks against theft? The third item relates to the efficiency of the information system at providing useful information for management decisions. We will focus, in this course, on the control characteristics of the system. Specifically, we will want our system to provide some assurance of the following issues: 1. All transactions which were entered into were recorded. In other words, there are no transactions (such as purchases for credit) which exist, but which did not get recorded. 2. All transactions which were recorded actually occurred. We want to make sure that transactions did not accidentally get recorded twice and that no fraudulent transactions were recorded. 3. All transactions which occurred and which were recorded were properly authorized. Suppose the mailroom clerk sold the company truck for $25.00 to his best friend! 4. All recorded transactions are recorded and transcribed accurately. We want to make sure (first of all) that everything got entered correctly! The double-entry system of bookkeeping helps with this. We will refer to these control objectives of the system as Input completeness (#1), input validity (#2 and #3), and input accuracy (#4). We will also be concerned with some other “accuracy” and “completeness” issues related to updating the general ledger, but we will worry about this later. These control issues will be discussed in the last segment of the course. • Transaction cycles When a company sells its product, it increases one asset (either cash or accounts receivable) and decreases another (inventory). Profit comes from the difference in value between the asset received and the asset given up. We can think of the sale and purchase of inventory as cycles. You continually have to purchase new items to sell our you will go out of business. Similarly, you can’t afford to buy inventory without selling it on a continuous basis. This can be seen in the figure below: cash decreases cash increases Cash Receipt Sale Payment of A/P Increase A/R Decrease Invty Invty increases Purchase Inventory Billing/Acct. Receivable Cash Receipts Cycle Purchase/Acct.Payable/ Cash Disbursements Cycle These cycles are important because we can use our knowledge about the relationships between sales, accounts receivable, and cash receipts (inventory, purchases, accounts payable, and cash disbursements) to decrease the possibility of errors and theft. As an example, consider a situation in which a customer calls and says that he received an invoice from your company and that he never purchased anything. You should be able to trace the invoice (the bill) back to a sales transaction and a contract to purchase. This brings up an interesting question: how could we trace an invoice back to a contract to purchase? The answer to this question is what this course is all about. The primary way we make sure that our system achieves the control objectives we outlined above is by establishing documentation procedures that tie recorded transactions to existing transactions. • The importance of transaction documents Consider the following simplified scenario: When we receive an invoice in the mail for goods purchased from one of our vendors, we will want to make certain that the invoice reflects the correct amounts (the amounts we agreed to pay when we placed the order) and that we actually received the goods in good condition. To achieve all of these objectives, we will reconcile several documents. 1. When we received the goods, the receiving clerk prepared a receiving report. The receiving report will detail what we actually received (in good condition). 2. The receiving clerk will then reconcile the receiving report with the Purchase Order to make certain that what we received was what we ordered. 3. The accounts payable clerk (which is who will receive the invoice) will then reconcile the invoice to the receiving report and purchase order to make certain that we are paying the correct amounts for goods received in good condition which we did order. Note that by performing these reconciliations, we achieve objectives 2, 3 and part of 4 above. We make sure that the recorded transaction actually occurs and that it is properly authorized - and that the correct amounts get recorded. There are other “things” we do which will achieve objectives 1 and 4 more completely, but we will talk about them later. This is a primary reason why documents are used in the processing of transactions. • Business transactions Businesses engage in many types of transactions. They sell their product or their service, they purchase inventory or equipment, they pay their employees they pay vendors they process accounts receivable transactions, and make major investments in plant and equipment. All businesses, however, must have some type of revenue generating transaction and must incur some expenses related to that revenue generation. The simplest types of business transactions are sales to customers and purchases from vendors. Businesses exchange their inventory for cash or for a promise to pay (an account receivable) from the customer. They also purchase replacement inventory from vendors with a promise to pay for the goods (an account payable). In addition, they receive money from account receivables and pay money on account payables. We will focus on these four types of transactions in describing our comprehensive system. Our primary system input for recording business transactions will be the document. The reason for this is that we can always trace back from a “journal entry” to a piece of paper (which we call a document) which tells the details of the transaction. Why is this important? There are two reasons. The first reason that it is important to have a document is that it provides us with a tool to make data entry (recording of journal entries) more accurate and dependable. In addition, though, it gives us a means of checking back to see if transactions are recorded correctly. The documents will be processed and reviewed by several people. In addition, the documents will serve different purposes at different points of the processing. For example, a Sales Order is a document which a company prepares to tell the account’s receivable department the details of a proposed sale. The account’s receivable department will then determine whether the customer should be allowed credit for the transaction. If credit is allowed, accounts receivable will use the sales order to prepare an invoice. The warehouse clerk will use the sales order to pick the goods and prepare them for shipment. The shipping clerk will use the sales order to prepare a packing slip which will be included with the goods. The reason several people are involved in the processing of a given document is that a single individual is more likely to make undetected mistakes (or perhaps commit fraud without detection) if there are no checks and balances on their work. For example, if the sales manager prepared the sales order and used that to prepare the invoice, then any errors in the sales order would also find their way to the invoice. In addition, the account receivable would never get recorded and the customer might not be a good credit risk. Now we turn our attention to a specific system: the recording of sales transactions and cash receipts. We will discuss the people that are involved with processing transactions, the documents that are processed within the system, and what the processes are. In addition, we will discuss why we do what we do in processing the transactions. You can think of our description sort of like a play. We will describe the cast and what they do. The documents serve as “stage props.” • Newport Company - a simple example of a comprehensive system Now we will go through a model system for Newport Company. Newport Company is a wholesaler of life vests. Before we begin, I want to introduce three types of records which Newport Company keeps: • General Ledger The General Ledger refers to the file or book in which the transactions and balances for all accounts are maintained. Transactions and balances are grouped by accounts - and within each account, by date. • General Journal Also referred to as the book of original entry, the General Journal is where transactions of all types are recorded. A transaction in the General Journal will reflect changes in (at least) two General Ledger accounts. These affects will be transcribed into the General Ledger. • Subsidiary Ledger The Subsidiary Ledger details transactions for a specific vendor or customer. The details in this ledger (kept in the local department) should reconcile with the General Ledger. These databases may be books (paper) or computerized files.1 For the purpose of our discussion, we will assume that they are paper. Now we shall discuss the processes (the system) for recording sales transactions on account (receivable). • Processes for recording sales Customer companies send Purchase Orders to Newport. This PO is forwarded to the Sales Clerk for processing. The sales clerk will then prepare a Sales Order header. A Sales Order header is a Sales Order which has not been approved or filled.2 You can think of it as a “proposed sale.” The Sales Order header contains the customer identification information, the items which will be sold and their prices. It is important to note, though, that the sale is not approved. The sales clerk does not have that authority that is the domain of the accounts receivable department. The Accounts Receivable Clerk will approve the sale and indicate that the sale is approved by signing (or initialing) the Sales Order. This Sales Order will be used to prepare a Packing Slip and an Invoice. The purpose of the Sales Order is for internal use of approval and filling the order; the purpose of the Packing Slip is to serve as a receipt to the customer - so that the customer can check the goods against the Packing Slip; the Invoice will serve as a bill for the customer which will advise the customer of the amount to pay. The accounts receivable clerk then sends two copies of the Sales Order to the Shipping clerk, one which has all of the numbers “blacked out.” This document will be the Packing Slip. The numbers are blacked out so that people on the loading dock at Newport and at Delta Marine will not know the value of the goods that they are handling. The shipping clerk will fill the order, file a copy of the Packing Slip and will prepare a Bill of Lading.3 The shipping clerk will pack a copy of the Packing Slip with the goods and will give the Bill of Lading to the common carrier with the goods. The shipping clerk will then send the other copy of the Packing Slip and the Bill of Lading to the accounts receivable clerk to inform him that the goods had been shipped. The accounts receivable clerk will update the Accounts Receivable Subsidiary Ledger. The accounts receivable clerk will then complete the Invoice and send copies of the Invoice to the customer and to the General Ledger Department. In the General Ledger department, the Accounting clerk will prepare an entry in the General Journal. The 1 The term database is used because the data is stored in a structured way, whether in a ledger book or in a computer file. For example, each transaction in the general journal will have a transaction number and a date. Transactions are recorded chronologically. Each transaction has an amount and account titles which are affected. We will discuss this in greater depth in block 3 of the course. 2 An order is filled when the goods have been prepared for shipping. 3 Frequently a Bill of Lading will just be a receipt filled out by the common carrier detailing the number of packages and other shipping information. If you have ever shipped anything by UPS or Federal Express, the receipt you get is a Bill of Lading. accounts receivable clerk will file another copy of the Invoice in the Accounts Receivable Master File. The next section will discuss the processes for recording cash receipts from accounts receivable. • Processes for cash receipts Assume we have received a Check and Remittance Advice from the customer. The mailroom clerk will annotate the Checks and Remittance Advices. On each Check, (s)he will write the Remittance Advice (Invoice) number. That way, if the Check is returned from the bank unpaid, the accounts receivable clerk can find the Invoice and contact the customer. On each Remittance Advice, the mailroom clerk will write the Check number. That way, if Newport needs to contact the customer about their account, they can tell the customer the Check number. It also helps the cashier when (s)he reconciles the Remittance Advices to the Checks. Usually Checks are batched together and Remittance Advices are batched together and the batches correspond. In other words, every Remittance Advice in the batch of Remittance Advices corresponds to a single Check in the batch of Checks. The accounts receivable clerk will use the annotated Remittance Advice to record the payment in the customer’s Accounts Receivable Subsidiary Ledger. The accounts receivable clerk will also prepare a Deposit Slip from the batch of Remittance Advices. The Deposit Slip will then be forwarded to the cashier. A notification of the total of cash receipts will be sent from the accounts receivable clerk to the General Ledger office. The cashier will reconcile the batch of Checks to the Deposit Slip (which was created from the batch of Remittance Advices). This guarantees that the amount recorded as a credit to Accounts Receivable is the same as the amount recorded as a debit to Cash. The cashier then takes the deposit to the bank and forwards a copy of the bank’s Deposit Receipt to the General Ledger office. In the General Ledger office, the Accounting clerk will reconcile the total of cash receipts (which could be a listing of customer accounts paid - or just a notification of the amount) to the bank’s Deposit Receipt and prepare an entry in the General Journal. The next section will begin our discussion of the purchase cycle for Newport. We present this in two parts, too. First we will discuss the processing of purchase transactions; then we will discuss the processing of accounts payable. • Processes for recording purchases The processes for recording purchases can be broken down into four events: (1) ordering, (2) receiving, (3) recording of an account payable and approval of the payable, and (4) payment of the account payable. • Ordering The inventory manager (or some other requisitioning entity) sends a Purchase Requisition to the purchasing manager. An example of a Purchase Requisition appears on page 18. The purchasing manager approves the requisition, determines which vendor would be best, and prepares a Purchase Order. The Purchase Order is sent to the vendor. At some point the vendor sends a Vendor Acknowledgement to Newport and this is forwarded to the purchasing manager. Note that this Vendor Acknowledgement designates a sales order number. This number provides a means of communication between the two companies. Suppose Newport wanted to find out the status of Purchase Order number 2215. If they called Catalina and asked about the status of their order, Catalina would ask for the sales order number - because their files are structured by sales order number. The purchasing manager would write down this sales order number on the Purchase Order in the Purchase Order Master File. Then, if he wanted to know something about the order, he could pull the Purchase Order and find the sales order number. • Receiving The receiving processes are initiated by the receipt of goods on the loading dock (usually by a common carrier - like Yellow Freight or UPS). The receiving personnel have a copy of the Purchase Order. Included with the shipment of goods is a copy of the Packing Slip, too. The receiving personnel will inspect and count the goods and will also compare the Packing Slip and the Purchase Order. From this inspection, they will prepare a Receiving Report. The Receiving Report details what was received and the condition. The process of preparing a Receiving Report is important because the receiving personnel are acknowledging the receipt in good condition. • Establishing an account payable The next event to occur will be the establishing of an account payable. Once the accounts payable department has received an Invoice from the vendor and a Receiving Report from the receiving department, the accounts payable clerk will reconcile these two documents and reconcile them to the copy of the Purchase Order and approve the Invoice for payment. Note that we know from the reconciliation that (1) the goods arrived in good condition, (2) they were the goods that we ordered, and (3) the price is the same price which was approved by the purchase manager. The account payable clerk will approve the invoice and place the invoice in the Accounts Payable Master File. This file is described below: • Accounts Payable Master File The Accounts Payable Master File is a tickler file which includes all of the invoices which have been approved for payment, sorted by the date due. The file is called a tickler file because the cashier (who will make the payments) will finger through the invoices (each day or once a week) seeing which invoices are due. The motion of fingering through the files looks sort of like “tickling” the invoices. • Payment of accounts payable Our final event in the purchasing cycle involves the payment of accounts payable. Since approval for payment must come from the accounts payable department, we can be sure that every payment reflects a real account payable. The cashier goes through the Accounts Payable Master File and finds which invoices need to be paid and then makes the payment. In the description for each check, the cashier should note the original PO number. Now we have examples of the following documents: • Purchase Order (from a customer) • Invoice (Sales Order would be a less complete version of the same document) • Packing Slip • Purchase requisition • Vendor acknowledgement PURCHAS ORDE Delta Marine 414 Willow Ave Eugene, OR 97401 (503)689-5511 The following number must appear on all related correspondence, shipping papers, and invoices: P.O. NUMBER: 1416 To: Ship To: Newport Company 198 Louwer Ave Portland, OR 97221 (503)313-2111 Delta Marine 414 Willow Ave Eugene, OR (503)689-5511 P.O. DATE REQUISITIONER SHIP VIA F.O.B. POINT TERMS 9/18/95 Handel UPS ground Destination 2/10, n/30 QTY 14 UNIT units DESCRIPTION UNIT PRICE Safety cushion $ 13.83 TOTAL $ 193.62 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 SUBTOTAL $ 193.6 SALES TAX $ 0.0 SHIPPING & HANDLING $ 0.0 OTHER $ 0.0 TOTAL $ 193.6 1. Please send two copies of your invoice. 2. Enter this order in accordance with the prices, terms, delivery method, and specifications listed above. 3. Please notify us immediately if you are unable to ship as specified. 4. Send all correspondence to: J. F. Handel Delta Marine 414 Willow Ave Eugene, OR 97401 503-689-5511 ; Fax (503)689-1115 Authorized by Date Charge Sale Invoice Sold To: 198 Louwer Ave. Portland, OR 97221 (503) 313-2111 Invoice No. 731 Date 9/30 Prepared by JRS Terms 2/10, n/30 Delta Marine 414 Willow Ave Eugene, OR 97401 Cust. PO Date Signed by Quantity Ordered 14 Important: Product Number 1416 9/18 Handel Ship. Date Shipped VIA BOL No. Description 10/5 UPS 1983 Quantity Shipped A1513 Safety cushion All returns must be made within 10 days and accompanied by an invoice copy and packed in the original carton (copy 1 - customer copy) 14 Unit Price Extensio n 13.83 193.62 Total Sale Acct No. 193.62 D1100 Verified by JH Charge Sale Invoice Sold To: 198 Louwer Ave. Portland, OR 97221 (503) 313-2111 Invoice No. 731 Date 9/30 Prepared by JRS Terms 2/10, n/30 Delta Marine 414 Willow Ave Eugene, OR 97401 Cust. PO Date Signed by Quantity Ordered 14 Product Number 1416 9/18 Handel Description A1513 Safety cushion Ship. Date Shipped VIA BOL No. 10/5 UPS 1983 Quantity Shipped 14 Unit Price Extensio n 13.83 193.62 Total Sale Acct No. Important: All returns must be made within 10 days and accompanied by an invoice copy and packed in the original carton (copy 4 - packing slip) Verified by 193.62 D1100 JH CONTROL BUSINESS FORMS Newport company 198 Louwer Ave Portland, OR 97221 (503)313-2111 PURCHASE REQUISITION Date For Dept. Date Required For Resale NEWPORT PART NO.ITEM RCSV-Cat RCMV-Cat RCLV-Cat BSV-Cat BMV-Cat BLV-Cat BXV-Cat INDEPENENCE, MISSOURI Not For Resale 1 2 3 4 5 A C C T N O NO. 14200 J O B N O QUANTITY U / M DESCRIPTION 100 100 100 100 160 160 40 DELIVER TO REQUESTED BY AUTHORIZED BY APPROVED BY SPACES BELOW FOR USE OF PURCHASING DEPARTMENT ORDER FROM BUYER SPECIAL INSTRUCTIONS UNIT PRICE Red children's vest - small Red children's vest - small Red children's vest - small Blue vest - small Blue vest - medium Blue vest - large Blue vest - Xlarge PO NO ORDER DATE FOB VIA TERMS DELIV. DATE 14.95 14.95 15.45 16.50 17.50 17.50 19.45 JRS C Vendor Acknowledgement atalina Vests to: 1516 Oceanside Drive Riverview, CA 92110 (619)321-1144 Newport Company 198 Louwer Ave. Portland, OR 97221 This is to acknowledge that your purchase order, Number 2215 ___________ , has been received, accepted without 9/26/95 modification and should be shipped on __________ . If you have any questions about your order, please call Aaron Jacobs at (619)321-1162. Refer to sales order number 9822333 We appreciate your business A523 Accounting Information Systems September 25, 2011 A523 - Reed Smith 1 What we will do today • • • • Introduce the course and ourselves Go over the syllabus Digress into a discussion of IUPUI and You Have a brief introduction into accounting information systems A523 - Reed Smith 2 What is a system? • Name some examples of systems… • What do these examples have in common? A523 - Reed Smith 3 1 Then, what is an information Storage system? Data about the business or an event Processing Retrieval Decision making A523 - Reed Smith 4 What are we going to study in this course? • Documentation - how to describe a system and its characteristics. • Control - How do we design accounting systems to minimize the likelihood of errors and/or fraud • Databases - How do we use data? How does the system handle the data? How are databases structured? A523 - Reed Smith 5 What are we going to do this term? • Learn how to diagram a system (DFDs and flowcharts) • Learn about control issues important to accountants • Learn about how accounting “works” (particularly in today’s technological environment) • Learn about database structures (with attention to accounting issues) A523 - Reed Smith 6 2 Syllabus Profess o r : Reed Smith Class times: Thursday Office: BUS 402 6 Office Hours : Wednesday and Thursday Phone: 274-0867 e-mail: jrsmith2@iupui.edu Web: bus.iupui.edu/johresmi/index.htm l 6:00 – 8:40 PM 4:30 – 5:30 PM A523 - Reed Smith 7 Syllabus - materials • Class notes – Will be available on the web – NEED TO BRING SOME WITH YOU TO CLASS • Perry-Schneider text • Systems Understanding Aid A523 - Reed Smith 8 Syllabus - the way things work • Regular updates/modifications to they syllabus will be on ONCOURSE – YOU ARE RESPONSIBLE FOR THESE A523 - Reed Smith 9 3 Syllabus Exam 1 300 pts Exam 2 300 pts Systems Understanding Aid 300 pts Project 1 50 pts Project 2 50 pts Total 1000 pts A523 - Reed Smith 10 Exams • Exam 1 – Diagramming accounting systems • Exam 2 – Database management issues – Control issues and fraud A523 - Reed Smith 11 Projects • Project 1 – Perry/Schneider text (details to come) • Project 2 – Microsoft Excel - pretty easy A523 - Reed Smith 12 4 Systems Understanding Aid • Available at the bookstore • DON’T buy a used one. – They are always missing things. • Due date and further information will be forthcoming A523 - Reed Smith 13 Attendance/Participation • Attendance in class is highly recommended! – You are responsible for information discussed in class • Attendance for VIDEO presentations. A523 - Reed Smith 14 A little about me… Reed Smith Accounting (BS, MAcc Tennessee) (PhD, Ohio State) (Faculty: Texas, Oregon, SUNY-Buffalo, Indiana University) e-mail: jrsmith2@iupui.edu I I I I am a big college football enthusiast. also like to sail and swim. play Zimbabwean music on Marimba and Mbira. used to play guitar, but don’t find much time to do that any more. A523 - Reed Smith 15 5 So I don’t forget • Next week, we will be working on documenting accounting systems. • Bring five or so colored pencils or highlighters to class. • Also print out and bring the notes for these classes. A523 - Reed Smith 16 6 System Descriptions What we will do today… • Today, we will describe the billing and cash receipts systems of a simple company • The points to think about are – Why do we do all of the things that we do? – How can we tell this story more efficiently and (perhaps) effectively? • We will tell the story sort of like a “play” with characters acting out parts. The Players Sales Transactions Sales manager Accounts Receivable clerk Shipping Clerk Mailroom clerk Cashier General Ledger Clerk Sales and Billing Process Sales (approving the transaction) •Sales Dept: From the Purchase Order, fill out the Charge Sale Invoice document, leaving blank the “verified by” space then give it to A/R. This is a Sales Order Header. •Accts Rec: Approve the transaction and complete the Sales Order. This will be an invoice when the items have been shipped. Send 2 copies of the invoice to Shipping (one is a packing slip). Send an “approved” copy back to Sales. •Sales Dept: Send the vendor acknowledgement back to the customer. Inform the customer of the sales order number for future correspondence, give them someone to contact and an estimated date. Sales (executing the transaction) •Shipping: Fills the order, notes the quantity shipped and computes the extension and total sale. Sends a copy to the customer (as a packing slip). Fills in the BOL# and returns to A/R. •Accts Rec: Record the account receivable in the A/R subsidiary ledger (This is like a file for this particular customer). Send a copy of the complete invoice to the G/L department. Send a copy of the complete invoice to the customer. Sales (recording the sale in the General Journal) •G/L department (accounting) Record the invoice from Accounts Receivable. SALES Sales clerks receives a PO Prepares Sales Order Header Forwards to Accounts Receivable for approval Prepare S/O Accounts Receivable A/R Checks the A/R subsidiary ledger Approves the transaction and annotates the SO header making it a Sales Order Returns Sales Order to sales clerk. Ap Send copies to shipping (one is Packing Slip) v ed p ro Shipping A r pp ov ed SALES Sales Prepare vendor acknowledgement Send to customer Prepare V/A Customer SHIPPING A ove ppr d Fills the order, notes the quantity shipped and computes the extension and total sale. Sends a copy to the customer (as a packing slip). Fills in the BOL# and returns to A/R. Invoice Customer A/R w/ BOL Invoice A/R Record the account receivable in the A/R subsidiary ledger (This is like a file for this particular customer). Send a copy of the complete invoice to the G/L department. Send a copy of the complete invoice to the customer. Invoice Invoice Customer G/L G/L Invoice Record the invoice from Accounts Receivable. Accts. Rec Sales XXX XXX