Purple Book 2015 Chapter 6

advertisement

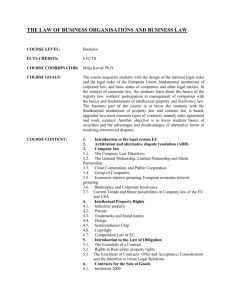

Insolvency Risk 6.1 Summary • T he insolvency rate of the PPF universe (number of insolvency events for sponsors of PPF-eligible schemes divided by the total number of scheme sponsors) has fallen sharply since the second quarter of 2013, reaching 0.32 per cent (four-quarter moving average basis) in the second quarter of 2015. • T he UK economy has seen strong growth since early 2013. GDP in the second quarter of 2015 was 5.2 per cent above the pre-crisis high in the first quarter of 2008, despite the challenging environment in the eurozone, the UK’s biggest trading partner. • S maller schemes tend to have higher insolvency probabilities. The average one-year ahead insolvency probability for schemes with fewer than 100 members is 1.1 per cent, considerably higher than for schemes with between 1,000 and 4,999 members which stood at 0.53 per cent at the end of the first quarter of 2015. • F rom Levy Year 2015/16, Experian is the new provider of insolvency scores for the purpose of the PPF levy determination. In order to improve predictive power and account for the different composition of the PPF universe of companies as opposed to the UK broad corporate sector, Experian has constructed a PPF-specific model. • The model is calibrated to predict insolvencies within the PPF-specific universe of employers that sponsor eligible DB pension schemes. In addition to improved predictability, the PPF-specific model provides greater transparency and stability and increased resilience due to the use of, primarily, published financial data, and additionally is less vulnerable to manipulation8. 6 Further information on the Experian model can be found on the PPF website: www.pensionprotectionfund.org.uk/levy/Pages/LevyPublications.aspx 8 the purple book | 2015 45 The PPF-universe insolvency rate has been trending down since Q2 2013. Count of insolvency events over quarter Figure 6.1 | PPF universe insolvency rates* 60 Insolvency events in surplus at assessment date Insolvency events in deficit at assessment date Four-quarter moving average of total insolvency events 50 40 30 20 10 0 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12 13 13 14 14 15 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 2 4 4 2 4 2 2 4 4 2 2 2 4 4 4 2 4 2 4 2 Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q 2 Source: The UK Insolvency Service and the PPF / The Pensions Regulator *There are around 2.7 million companies in the UK, compared to around 14,000 in the PPF universe. Figure 6.2 | UK company liquidations 7% 0 2000 3% 3000 1% 4000 -1% 5000 6000 -3% 7000 Real GDP growth, YoY (LHS) Number of liquidations (Quarterly, RHS) -5% 8000 -7% 46 the purple book | 2015 Q2 5 Q2 3 Source: O ffice for National Statistics and the UK Insolvency Service 20 1 Q2 20 1 Q2 20 11 Q2 20 09 Q2 20 07 Q2 20 05 Q2 20 03 Q2 20 01 Q2 19 99 Q2 19 97 Q2 19 95 19 93 19 9 1 Q2 9000 Liquidations (inverted scale) 1000 5% GDP Growth GDP growth has been strong since the end of 2013, and GDP in Q2 2015 was 5.2 per cent above the pre-crisis level in Q1 2008. The number of company liquidations has been trending down since 2013. Figure 6.3 | A verage one-year ahead insolvency probability based on Experian failure scores* by scheme size as measured by number of members, as at 31 March 2015 Average insolvency probability 1.2% Smaller schemes tend to have higher insolvency probabilities. 1.0% 0.8% 0.6% 0.4% 0.2% 0.0% Under 100 100-999 1,000-4,999 5,000-9,999 10,000 and over Number of members Source: PPF/The Pensions Regulator *Experian failure scores are converted into credit ratings. These are then converted into the probability of insolvency over the next year. This conversion uses a mapping matrix that takes into account data on historical company insolvencies. the purple book | 2015 47