2012 Economic Health Strategic Plan

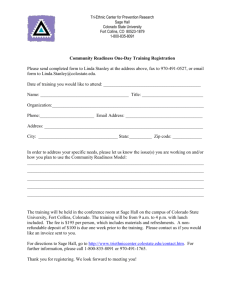

advertisement