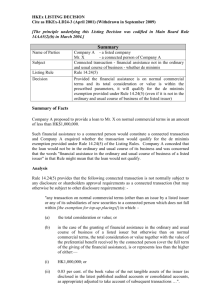

APPLICABLE PRICING SUPPLEMENT REDINK RENTALS (RF

advertisement

CM/CM 29072015/REDI27556.2 Rentworks APS_Revised Execution/#3417174v3 APPLICABLE PRICING SUPPLEMENT REDINK RENTALS (RF) LIMITED (Incorporated in South Africa with limited liability under registration number 2015/090404/06) Issue of R15 073 000 Secured Class A Notes under its Secured Note Programme Transaction No.2 – RentWorks Africa Proprietary Limited Rental Receivables This document constitutes the Applicable Pricing Supplement relating to the issue of Notes described in this Applicable Pricing Supplement. This Applicable Pricing Supplement must be read in conjunction with the Programme Memorandum issued by Redink Rentals (RF) Limited, dated 29 May 2015. To the extent that there is any conflict or inconsistency between the contents of this Applicable Pricing Supplement and the Programme Memorandum, the provisions of this Applicable Pricing Supplement shall prevail. Any capitalised terms not defined in this Applicable Pricing Supplement shall have the meanings ascribed to them in the section of the Programme Memorandum entitled "Terms and Conditions of the Notes" or in the Common Terms Agreement in relation to this Transaction No.2, dated on or about 17 August 2015. References in this Applicable Pricing Supplement to the Terms and Conditions are to the section of the Programme Memorandum entitled "Terms and Conditions of the Notes". References to any Condition in this Applicable Pricing Supplement are to that Condition of the Terms and Conditions. The Issuer certifies that to the best of its knowledge and belief there are no facts that have been omitted from this Applicable Pricing Supplement which would make any statement false or misleading and that all reasonable enquiries to ascertain such facts have been made and that this Applicable Pricing Supplement contains all information required by Applicable Law and the JSE Debt Listings Requirements. The Issuer accepts full responsibility for the information contained in this Applicable Pricing Supplement, the Programme Memorandum and the annual financial report and any amendment to the annual financial report or any supplements from time to time, except otherwise stated therein. The Issuer certifies that the Principal Amount of the Notes to be issued and described in this Applicable Pricing Supplement together with the aggregate Outstanding Principal Amount of all other Notes in issue at the Issue Date will not exceed the Transaction Limit as specified in item 59 below. 1 Rentworks APS_Revised Execution/#3417174v3 29072015 DESCRIPTION OF THE TRANSACTION 1 Transaction No.2 Acquisition by the Issuer from RentWorks Africa Proprietary Limited of Sale Assets (as defined in the Sale Agreement) 2 Seller RentWorks Africa Proprietary Limited 3 Address, description and significant business activities of the Seller RentWorks Place, Turnberry Office Park, 48 Grosvenor Road, Bryanston RentWorks Africa Proprietary Limited provides asset rental and management services. The company was established in 1998 and was one of the first companies to offer genuine residualbased rental solutions. For further information, please see: www.rentworks.co.za 4 Servicer FRS Rental Services Proprietary Limited 5 Back-up Servicer N/A 6 Description of the Business Activities of the Administrator TMF Corporate Services (South Africa) Proprietary Limited is part of the TMF Group, a provider of financial, legal and HR services in more than 80 countries. The TMF Group is one of the largest independent administrators of structured finance entities in the world, with teams located in all key onshore and offshore locations. They are experts in structured finance and provide services to more than 2,000 special purpose vehicles around the globe 7 Description of assets to be acquired ("Sale Assets") All the right, title and interest of the Seller a) to receive Rental Payments, as such term is defined in the Sale Agreement ("Sale Assets Agreement Payments") payable under the Rental Agreement which forms the subject of Transaction 2 ("Sale Assets Agreement") and as specified in a Sale Notice to the Sale Agreement; and b) to enforce payment of the Sale Assets Agreement Payments; 2 Rentworks APS_Revised Execution/#3417174v3 29072015 c) in the account nominated in writing by the Seller into which the Obligor must make payment of all amounts owing under the relevant Sale Assets Agreement, whether by electronic funds transfer or in terms of a debit order instruction; d) the relevant equipment (as described in the Sale Notice to the Sale Assets Agreement); e) the Sale Assets Agreement, other than in respect of the Seller's right, title and interest in and to Excluded Amounts, such amounts being those amounts which are relevant to Transaction 2 and which are specified as Excluded Amounts/ Claims in the Sale Notice to the Sale Agreement; and f) the relevant collateral security, that is, the relevant Rental Collateral Security as specified in the Sale Notice to the Sale Agreement. Please see Annexure B, which contains the relevant extracts from the Sale Agreement and Annexure C, which includes the relevant extracts from the Sale Notice 8 Description of Security to be provided to Secured Creditors of Transaction No.2 Pursuant to the Security SPV Guarantee, dated on or about 21 August 2015 ("Transaction No.2 Security SPV Guarantee"), the Security SPV undertakes in favour of each Secured Creditor of Transaction No.2 to pay to it the full amount then owing to it by the Issuer if an Event of Default should occur under the Notes or the respective Transaction Documents in relation to Transaction No.2. The liability of the Security SPV pursuant to the Transaction No.2 Security SPV Guarantee will be limited in the aggregate of the net amount recovered by the Security SPV from the Issuer arising out of the Issuer Indemnity, dated on or about 3 Rentworks APS_Revised Execution/#3417174v3 29072015 17 August 2015 ("Transaction No.2 Issuer Indemnity"), in terms of which the Issuer irrevocably and unconditionally indemnifies the Security SPV from and holds the Security SPV harmless against all and any claims arising out of, or in the enforcement of, the Transaction No.2 Security SPV Guarantee. The Issuer's obligations in terms of the Transaction No.2 Issuer Indemnity are secured by the cession in securitatem debiti agreement, dated on or about 17 August 2015, ("Transaction No.2 Security Agreement") in terms of which the Issuer cedes in securitatem debiti to and in favour of the Security SPV all of the Ceded Rights, where "Ceded Rights" means all the Issuer's rights, title and interests in and to (a) the bank account opened in the name of the Issuer with Nedbank Limited, account number 1110818688 , into which all monies received or to be received by the Issuer in relation to Transaction No.2 will be deposited ("Transaction No.2 Transaction Account"); (b) all monies held from time to time in the name of or on behalf of the Issuer in the Transaction No.2 Transaction Account; (c) any Permitted Investment (as defined in the Programme Memorandum) to be made by the Issuer (or the Administrator on behalf of the Issuer) with cash standing to the credit of the Transaction No.2 Transaction Account from time to time; (d) the Transaction Documents (as set out below) in relation to Transaction No.2; and (e) the Sale Assets (as defined in the Sale Agreement, and specifically described in 7 above), in relation to Transaction No.2, whether 4 Rentworks APS_Revised Execution/#3417174v3 29072015 actual, prospective or contingent, direct or indirect, common law or statutory, whether a claim to payment of money or to performance of any other obligation, and whether or not the said rights and interests were within the contemplation of the parties at the Date of Signature of the Security Agreement 9 Transaction Documents The documents constituting the transaction titled "Transaction No.2 – RentWorks Africa Proprietary Limited – Rental Receivables", being – (a) the Transaction Indemnity; No.2 (b) the Transaction No.2 Security SPV Guarantee; (c) the Transaction Agreement; (d) each Note; (e) the Sale Agreement; (f) the Servicing Agreement; (g) the Preference Share Subscription Agreement; (h) the Note Subscription Agreement (if applicable); and (i) the Common Terms Agreement No.2 Issuer Security DESCRIPTION OF THE NOTES 10 Issuer Redink Rentals (RF) Limited 11 Status and Class of the Notes Secured Class A Notes 12 Tranche number 1 13 Series number 2 14 Aggregate Tranche 15 Issue Date 31 August 2015 16 Minimum Denomination per Note R1 000 000 17 Issue Price 100% Principal Amount of this R15 073 000 5 Rentworks APS_Revised Execution/#3417174v3 29072015 18 Applicable Business Day Convention Following Business Day 19 Determination Date means the last day of each calendar month 20 Interest Commencement Date 31 August 2015 21 Final Redemption Date 5 July 2018, subject to Clause 8 of the Sale Agreement Please see Annexure B, which contains the relevant extracts from the Sale Agreement 22 Repayment of principal Principal will be repaid during the term of the Notes on each Payment Date, as set out in Annexure D 23 Use of Proceeds The net proceeds of the issue of this Tranche will be used to purchase Sale Assets as described under item 7 above 24 Specified Currency Rand 25 Hedge Counterparty N/A 26 Safe Custody Agent Nedbank Limited 27 Senior Expense Facility Provider(s) N/A 28 Account Bank Nedbank Limited 29 Calculation Agent, if not TMF Corporate Services (South Africa) Proprietary Limited ("TMF") N/A 30 Specified Office of the Calculation Agent 36th Floor World Trade Centre Cnr West Road South and Lower Road Sandton 2196 31 Transfer Agent, if not TMF N/A 32 Specified Office of the Transfer Agent 36th Floor World Trade Centre Cnr West Road South and Lower Road Sandton, 2196 33 Paying Agent, if not Nedbank Limited N/A 6 Rentworks APS_Revised Execution/#3417174v3 29072015 34 Specified Office of the Paying Agent 36th Floor World Trade Centre Cnr West Road South and Lower Road Sandton, 2196 FIXED RATE NOTES 35 Fixed Interest Rate N/A 36 Payment Date(s) N/A 37 Interest Period(s) N/A 38 Any other items relating to the particular method of calculating interest N/A FLOATING RATE NOTES 39 Payment Date(s) 5 October, 5 January, 5 April and 5 July, or if such a day is not a Business Day, the immediately following Business Day. 40 Interest Commencement Date 31 August 2015 41 Manner in which the Interest Rate is to be determined Screen Rate Determination 42 Margin/Spread for the Interest Rate 450 basis points to be added to the Reference Rate 43 If ISDA Determination 44 45 (a) Floating Rate Option N/A (b) Designated Maturity N/A (c) Reset Date(s) N/A If Screen Determination (a) Reference Rate (including relevant period by reference to which the Interest Rate is to be calculated) 3 month JIBAR (b) Rate Determination Date(s) The first Business Day of each Interest Period (c) Relevant Screen Reference Code page and If Interest Rate to be calculated otherwise than by reference to the previous two sub-clauses above, insert ZAR-JIBAR-SAFEX N/A 7 Rentworks APS_Revised Execution/#3417174v3 29072015 basis for determining Interest Rate/Margin/Fall back provisions 46 If different from the Calculation Agent, agent responsible for calculating amount of interest N/A 47 Any other terms relating to the particular method of calculating interest N/A GENERAL 48 Additional selling restrictions 49 International (ISIN) 50 Stock Code RED201 51 Financial Exchange JSE Interest Rate Market 52 Dealer(s) N/A 53 Method of distribution Private Placement 54 Rating assigned to this Tranche of Notes (if any) N/A 55 Rating Agency N/A 56 Governing Law South Africa 57 Last Day to Register By 17h00 on 30 September, 31 December, 31 March and 30 June until the Final Maturity Date 58 Books Closed Period The Register will be closed from 1 October to 4 October, 1 January to 4 January, 1 April to 4 April and 1 July to 4 July (all dates inclusive) in each year until the Final Maturity Date. 59 Transaction Limit R10 000 000 000 60 Aggregate Outstanding Principal Amount of Notes in issue on the issue Date of this Tranche R20 000 000, excluding this Tranche of Notes and any other Tranche(s) of Notes to be issued on the Issue Date Securities N/A Numbering ZAG000129180 OTHER PROVISIONS 61 Description of additional Terms and Conditions relating to the Notes and/or amendments to the Priority of Payments 1. The Pre-Enforcement Priority of Payments as contained in the Programme Memorandum is amended as set out in Annexure A; 2. The Post-Enforcement Priority of 8 Rentworks APS_Revised Execution/#3417174v3 29072015 Payments as contained in the Programme Memorandum is amended as set out in Annexure A; 3. RentWorks Africa Proprietary Limited as Seller under the Sale Agreement is a Secured Creditor for purposes of and as set out in the Post-Enforcement Priority of Payments; 4. In terms of the Sale Agreement, after delivery of an Enforcement Notice and subject to the Post-Enforcement Priority of Payments, the Seller shall, pro rata and pari passu with the Noteholders, be entitled to receive an amount in the ratio which the Seller's Claim in respect of the Residual Value bears to the Noteholders' claims under the Transaction at that time; 5. After payment of the Seller's Claim in respect of the Residual Value to the Seller, the Seller shall be entitled to receive an amount equal to the Residual Value Differential; 6. The "Seller's Claim in respect of the Residual Value” shall in all instances be the Residual Value plus interest from the date of issuance of the Notes to the date of delivery of the Enforcement Notice, at the weighted average rate equal to the Interest Rate applicable to the Notes plus the margin referred to in 42 above; 7. The "Residual Value" shall be the amount as specified in the relevant Sale Notice; 8. The "Residual Value Differential" shall be – (a) the difference between the Residual Value calculated at the Seller's standard internal rate of return from time to time; and (b) the amount of the Seller's 9 Rentworks APS_Revised Execution/#3417174v3 29072015 Claim in respect Residual Value. of the ADDITIONAL INFORMATION 62 (a) number and value of assets 1 (one) Sale Asset with an aggregate gross rental value of R15 700 000 Please see Annexure C, which includes the relevant extracts from the Sale Notice (b) the seasoning of the assets N/A (c) rights of recourse against the originator to the extent allowed in law, including a list of material representations and warranties given to the Issuer relating to the Sale Assets See clause 5 of the Sale Agreement rights to substitute the assets and the qualifying criteria See clause 5.5 of the Sale Agreement the treatment of amortisation of the assets See clause 8 of the Sale Agreement (d) (e) (f) early Please see Annexure B, which contains the relevant extracts from the Sale Agreement Please see Annexure B, which contains the relevant extracts from the Sale Agreement Please see Annexure B, which contains the relevant extracts from the Sale Agreement level of concentration of the obligors in the asset pool, identifying obligors that account for 10% or more of the asset value 100% (g) where there is no concentration of obligors above 10%, the general characteristics and descriptions of the obligors N/A (h) Financial lessee The annual financial statements of Basil Read Mining SA Proprietary Limited will be made available within six months from the date of its financial year end, at the request of the Seller and / or Issuer, and will be made available at www.redinkrentals.co.za (i) Financial year end of lessee statements for the Basil Read Limited Mining SA Proprietary The financial year end of Basil Read Mining SA Proprietary Limited is 31 December 10 Rentworks APS_Revised Execution/#3417174v3 29072015 (j) Availability of this Pricing Supplement Applicable This Applicable Pricing Supplement will be made available at www.redinkrentals.co.za 63 Legal jurisdiction where the Eligible Assets are situated South Africa 64 Eligibility Criteria See Annexures C and D of the Sale Agreement Please see Annexure B, which contains the relevant extracts from the Sale Agreement DISCLOSURE REQUIREMENTS IN TERMS OF PARAGRAPH 3(5) OF THE COMMERCIAL PAPER REGULATIONS 65 At the date of this Applicable Pricing Supplement: 66 Paragraph 3(5)(a) The ultimate borrower is the Issuer. 67 Paragraph 3(5)(b) The Issuer is a going concern and can in all circumstances be reasonably expected to meet its commitments under the Notes. 68 Paragraph 3(5)(c) The auditor of the Issuer is Sizwe Ntsaluba Gobodo. 69 Paragraph 3(5)(d) As at the date of this issue: the Issuer has not issued any Notes (excluding Notes issued under this Applicable Pricing Supplement); and it is anticipated that the Issuer will issue ZAR500 000 000 Notes during its current financial year (including Notes issued under this Applicable Pricing Supplement). 70 Paragraph 3(5)(e) Prospective investors in the Notes are to consider this Applicable Pricing Supplement, the Programme Memorandum and the documentation incorporated therein by reference in order to ascertain the nature of the financial and commercial risks of an investment in the Notes. In addition, prospective investors in the Notes are to consider the latest audited financial statements of the Issuer which are incorporated into the Programme Memorandum by reference and which may be requested from the Issuer. 11 Rentworks APS_Revised Execution/#3417174v3 29072015 71 Paragraph 3(5)(f) There has been no material adverse change in the Issuer’s financial position since the date of its last audited financial statements. 72 Paragraph 3(5)(g) The Notes issued will be listed. 73 Paragraph 3(5)(h) The funds to be raised through the issue of the Notes are to be used by the Issuer for its general corporate purposes and / or to refinance the amounts outstanding under existing Notes in issue. 74 Paragraph 3(5)(i) The Notes are secured. 75 Paragraph 3(5)(j) Sizwe Ntsaluba Gobodo, the auditor of the Issuer, has confirmed that nothing has come to its attention to indicate that this issue of Notes issued under the Programme will not comply in all respects with the relevant provisions of the Commercial Paper Regulations. The Transaction Documents are available for inspection by Noteholders, during normal office hours, at the Specified Office of the Issuer. Investor reports will be made available at www.redinkrentals.co.za. Application is hereby made to list this Tranche of Notes, as from 27 August 2015, pursuant to the Redink Rentals (RF) Limited Secured Note Programme. REDINK RENTALS (RF) LIMITED By: _____________________________ By: Director, duly authorised _________________________ Director, duly authorised Paul Lutge Name: _____________________________ Name: R. Thanthony 27 August 2015 Date: _____________________________ Date: 27 August 2015 12 Rentworks APS_Revised Execution/#3417174v3 29072015 ANNEXURE A – PRIORITY OF PAYMENTS 1 Pre-Enforcement Priority of Payments 1.1 In relation to each Transaction, the funds standing to the credit of the relevant Transaction Account as determined on each Determination Date and the Senior Expense Reserve (if required), will be applied on each Payment Date in relation to that Transaction, after taking into account Excluded Amounts, in the order of priority set out below. Prior to the delivery of an Enforcement Notice in respect of that Transaction, this pre-enforcement priority of payments shall apply and payments will be made in the following order - 1.1.1 first, to pay or provide for the Issuer's liability or potential liability for Tax and any statutory fees, costs and expenses, attributable to the receipts or accruals made by the Issuer under that Transaction; 1.1.2 second, to pay or provide for pari passu and pro rata - 1.1.2.1 the remuneration due and payable to the Security SPV and/or the Security SPV Owner Trustee (inclusive of VAT, if any) and any fees, costs, charges, liabilities and expenses (inclusive of VAT, if any) incurred by the Security SPV and/or the Security SPV Owner Trustee under the provisions of the Security Agreements and/or any of the Programme Documents, in relation to the Transaction, and/or the Notes; 1.1.2.2 the remuneration due and payable to the Issuer Owner Trustee (inclusive of VAT, if any) and any fees, costs, charges, liabilities and expenses (inclusive of VAT, if any) incurred by the Issuer Owner Trustee under the provisions of the Security Agreements and/or any of the Programme Documents, in relation to the Transaction, and/or the Notes; and 1.1.2.3 all fees, costs, charges, liabilities and expenses (inclusive of VAT, if any) incurred by the Issuer in relation to the Transaction, which are due and payable to third parties and incurred without breach by the Issuer of its obligations under the Programme Documents and not provided for payment elsewhere (including payment of the Rating Agency, the Safe Custody Agent, the JSE, the audit fees, legal fees, the directors of the Issuer and company secretarial expenses); 1.1.3 third, to pay or provide for pari passu and pro rata - 1.1.3.1 the fee due and payable to the Servicer (inclusive of VAT, if any) together with costs and expenses which are due and payable to the Servicer under the Servicing Agreement; 1.1.3.2 the fee due and payable to the Administrator (inclusive of VAT, if any) together with costs and expenses which are due and payable to the Administrator under the Administration and Agency Agreement; 1.1.3.3 all amounts due and payable or accrued to the Transfer Agent, Calculation Agent and Paying Agent in relation to the Transaction, in accordance with the Administration and Agency Agreement; and 13 Rentworks APS_Revised Execution/#3417174v3 29072015 1.1.3.4 all amounts due and payable or accrued to the Arranger and/or the Debt Sponsor in relation to the Transaction, in accordance with the Programme Agreement; 1.1.4 fourth, to pay or provide for any net settlement amounts and Hedge Termination Amounts due and payable to any Hedge Counterparty, in relation to the Transaction, in accordance with the Hedging Agreements (but excluding any Hedge Termination Amounts where the Hedge Counterparty is in default) and swap reinstatement payments due and payable in respect of a new Hedge Counterparty, in relation to the Transaction; 1.1.5 fifth, to pay or provide for pari passu and pro rata, all amounts of interest, fees and other expenses due and payable to the Noteholders in respect of the Notes on each Payment Date; 1.1.6 sixth, to pay or provide for, pari passu and pro rata, all amounts of principal due and payable to the Noteholders on that Payment Date or Final Redemption Date, as the case may be; 1.1.7 seventh, to pay or credit funds to the Senior Expense Reserve, in order to fund the Senior Expense Reserve up to the Senior Expense Reserve Required Amount; 1.1.8 eighth, to pay or provide for, Hedge Termination Amounts due and payable to any Hedge Counterparty in accordance with the Hedging Agreements where the Hedge Counterparty is in default; 1.1.9 ninth, to pay or provide for, the Programme Management Fee (inclusive of VAT, if any) due and payable to the Programme Manager in accordance with the Programme Management Agreement; 1.1.10 tenth, to pay or provide for, all amounts, interest and principal due and payable to the Senior Expense Facility Provider(s) in accordance with the Senior Expense Facility Agreement; 1.1.11 eleventh, to pay or provide for, any other fees, interest, costs or expenses due and payable under any Tranche of Notes or any Programme Document in relation to the Transaction, which have not previously been paid; 1.1.12 twelfth, to pay or provide for dividends payable to the Preference Shareholders; and 1.1.13 thirteenth, to pay or provide for dividends payable to the holder of the ordinary shares in the issued share capital of the Issuer. 2 2.1 Post-Enforcement Priority of Payments In relation to each Transaction, after taking into account Excluded Amounts, the funds standing to the credit of the relevant Transaction Account and the Senior Expense Reserve (if required), after the delivery of an Enforcement Notice will be applied in the order of priority set out below - 14 Rentworks APS_Revised Execution/#3417174v3 29072015 2.1.1 first, to pay or provide for the Issuer's liability or potential liability for Tax and any statutory fees, costs and expenses, attributable to the receipts or accruals made by the Issuer under that Transaction; 2.1.2 second, to pay all amounts payable by the Issuer under the Issuer Indemnity; 2.1.3 third, to pay or provide for pari passu and pro rata - 2.1.3.1 the remuneration due and payable to the Security SPV and/or the Security SPV Owner Trustee (inclusive of VAT, if any) and any fees, costs, charges, liabilities and expenses (inclusive of VAT, if any) incurred by the Security SPV and/or the Security SPV Owner Trustee under the provisions of the Security Agreements and/or any of the Programme Documents, in relation to the Transaction, and/or the Notes; 2.1.3.2 the remuneration due and payable to the Issuer Owner Trustee (inclusive of VAT, if any) and any fees, costs, charges, liabilities and expenses (inclusive of VAT, if any) incurred by the Issuer Owner Trustee under the provisions of the Security Agreements and/or any of the Programme Documents, in relation to the Transaction, and/or the Notes; 2.1.3.3 all fees, costs, charges, liabilities and expenses (inclusive of VAT, if any) incurred by the Issuer in relation to the Transaction, which are due and payable to third parties and incurred without breach by the Issuer of its obligations under the Programme Documents and not provided for payment elsewhere (including payment of the Rating Agency, the JSE, the Safe Custody Agent, audit fees, legal fees, the directors of the Issuer and company secretarial expenses); 2.1.4 fourth, to pay or provide for pari passu and pro rata - 2.1.4.1 the fee due and payable to the Servicer (inclusive of VAT, if any) together with costs and expenses which are due and payable to the Servicer under the Servicing Agreement; 2.1.4.2 the fee due and payable to the Administrator (inclusive of VAT, if any) together with costs and expenses which are due and payable to the Administrator under the Administration and Agency Agreement; 2.1.4.3 all amounts due and payable or accrued to the Transfer Agent, Calculation Agent and Paying Agent in relation to the Transaction, in accordance with the Administration and Agency Agreement; and 2.1.4.4 all amounts due and payable or accrued to the Arranger and/or the Debt Sponsor in relation to the Transaction, in accordance with the Programme Agreement; 2.1.5 2.1.5.1 fifth, to pay or provide for pari passu and pro rata – any net settlement amounts and Hedge Termination Amounts due and payable to any Hedge Counterparty, in relation to the Transaction, in accordance with the Hedging Agreements (but 15 Rentworks APS_Revised Execution/#3417174v3 29072015 excluding any Hedge Termination Amounts where the Hedge Counterparty is in default); 2.1.5.2 all amounts of interest and principal due and payable to the relevant Noteholders in respect of the Notes; 2.1.5.3 the Seller's Claim in respect of the Residual Value to the Seller; 2.1.6 sixth, to pay or provide for, the Residual Value Differential to the Seller; 2.1.7 seventh, to pay or provide for, the Hedge Termination Amounts due and payable to any Hedge Counterparty, in relation to the Transaction, in accordance with the Hedging Agreements where the Hedge Counterparty is in default; 2.1.8 eighth, to pay or provide for, the Programme Management Fee (inclusive of VAT, if any) due and payable to the Programme Manager in accordance with the Programme Management Agreement; 2.1.9 ninth, to pay or provide for, all amounts, interest and principal due and payable to the Senior Expense Facility Provider(s) in accordance with the Senior Expense Facility Agreement; 2.1.10 tenth, to pay or provide for, any other fees, interest, costs or charges due and payable under any Tranche of Notes or any Programme Document in relation to the Transaction, which have not previously been paid; 2.1.11 eleventh, to pay or provide for dividends payable to the Preference Shareholders; and 2.1.12 twelfth, to pay or provide for dividends payable to the holder of the ordinary shares in the issued share capital of the Issuer. 16 Rentworks APS_Revised Execution/#3417174v3 29072015 ANNEXURE B – EXTRACTS FROM SALE AGREEMENT […] 1 INTERPRETATION […] 1.4 The following expressions shall bear the meanings assigned to them below and cognate expressions shall bear corresponding meanings […] 1.4.26 "Rental Agreement" - 1.4.26.1 an agreement for the rental of certain Equipment concluded by the Seller and a Lessee/Renter; or 1.4.26.2 an agreement for the rental of certain Equipment concluded by a Rentor and a Lessee/Renter and ceded to the Seller, which agreement - 1.4.26.3 shall be in a form approved by the Seller and the Issuer from time to time (it is agreed that, as at the effective date hereof, the rental agreement may be in the form of either a singular (once off) rental agreement or in the form of a rental schedule to the master rental agreement concluded between the Rentor and the Lessee/Renter or between the Seller and the Lessee/Renter ("Master Rental Agreement"), each such rental schedule constituting an independent rental agreement upon the terms and the conditions of the Master Rental Agreement and the said rental schedule); and 1.4.26.4 shall not incorporate an option or a right on the part of the Lessee/Renter to acquire ownership of the Equipment at any time during or after termination of the agreement, or, if such option is given, is only given to a Lessee/Renter in circumstances where the transaction falls outside of the application of the National Credit Act ("NCA") by virtue of the transaction size and/or the Lessee/Renter being a juristic person whose asset value/ annual gross turnover of the Lessee/Renter exceeds the thresholds determined under the NCA from time to time or by virtue of the Lessee/Renter being an organ of state or by virtue of any further exemptions or exclusions enacted under the NCA from time to time, and which agreement forms the subject of a Sale Notice which is duly accepted by the Issuer in terms of 3.2. For the sake of clarity, where the Obligor has contracted with the Seller or the Rentor or the Originator for the acquisition, rental or use of equipment which is exclusively software or software systems, such agreement shall, for the purposes of this Agreement, the Servicing Agreement and the Programme, be classified as an Eligible Securities Agreement; […] 17 Rentworks APS_Revised Execution/#3417174v3 29072015 1.4.32 "Sale Assets" - all the right, title and interest of the Seller in - 1.4.32.1 the Receivables; 1.4.32.2 the Account (to the extent that the monies in the Account represent Sale Assets Agreement Payments which are collected by the Seller on behalf of the Servicer and/or the Issuer from time to time in terms of a sub-contracting agreement between the Servicer and the Seller or any other agreement between the Issuer and the Seller); 1.4.32.3 the Equipment (if applicable), including the right to receive the Insurance Proceeds and Sale Proceeds upon the occurrence of an event of default during the Initial Term of the Rental Agreement as set out in 7.4 of this Agreement. For all purposes hereof, the Issuer acknowledges and agrees that, notwithstanding anything to the contrary in this Agreement, the Sale Assets under Sale Assets Agreements which are ceded to the Seller by a Rentor or an Originator and which are sold and ceded to the Issuer in terms hereof are limited to the rights sold and ceded to the Seller under the sale and cession agreement concluded between such Rentor or the Originator and the Seller; 1.4.32.4 the Sale Assets Agreement, other than in respect of the Seller's right, title and interest in and to the Excluded Amounts/Claims; and 1.4.32.5 the Rental Collateral Securities or Eligible Securities Collateral, as the case may be; […] 5 REPRESENTATIONS AND WARRANTIES 5.1 Representations and Warranties by the Seller The Seller represents and warrants to the Issuer in respect of the Sale Assets sold to it that, as at the relevant Transfer Date of such Sale Assets - 5.1.1 it has been duly incorporated as a company with limited liability in accordance with the laws of the RSA, is validly existing under those laws and has power and authority to carry on its business as it is now being conducted; 5.1.2 it has full power and authority to enter into and perform its obligations (if any) under the Sale Assets Agreement and the Rental Collateral Security and/or Eligible Securities Collateral and to exercise its rights thereto (if any); 5.1.3 the Seller has or will have, immediately after it has paid the relevant supplier or Originator or Rentor, as the case may be, from the proceeds of the Purchase Price received from the Issuer, title and full power and authority to sell the Sale Assets as provided in this Agreement and, the Sale Assets are, upon payment having been effected to the supplier, Originator or Rentor, as the case may be, the exclusive property of the Seller, free of all encumbrances and rights of set-off, counterclaim or other equity; 18 Rentworks APS_Revised Execution/#3417174v3 29072015 5.1.4 in the case of a Rental Agreement, the Rental Agreement and the Rental Collateral Security as attached or specified in the relevant Sale Notice contain all the contractual arrangements between the Seller and the Lessee/Renter concerning the Equipment; 5.1.5 the Seller has not made any representations or warranties to the Lessee/Renter in relation to the taxation or accounting treatment of the Rental Agreement; 5.1.6 no litigation or other dispute proceeding has been notified or threatened in relation to the Sale Assets Agreement or any Rental Collateral Security or Eligible Securities Collateral of which the Seller is aware; 5.1.7 there has been no default or event of default (howsoever described in the Sale Assets Agreement) in relation to the Sale Assets Agreement or any Rental Collateral Security or Eligible Securities Collateral pertinent thereto of which the Seller is aware; provided that the Seller shall not be in breach of this warranty if the default of the Lessee/Renter relates to payment of Interim Rentals or Sale Assets Agreement Payments not sold, to the extent that such default has not persisted for a duration of longer than three months as reckoned from the first payment date as defined or envisaged in the Rental Agreement; 5.1.8 the Sale Assets Agreement and Rental Collateral Securities or Eligible Securities Collateral are in all respects legally binding and otherwise in order and valid and will have been duly completed and signed by or on behalf of the parties thereto, who are fully aware of all the terms, conditions and stipulations thereof; 5.1.9 the Equipment or, if applicable, the software subject of an Eligible Securities Agreement, has been or will be delivered to the Obligor; 5.1.10 except as otherwise disclosed, no guarantee has been given or representation has been made by the Seller to the Obligor in respect of the suitability or otherwise of the Equipment or any software subject of a Sale Assets Agreement or any part thereof; 5.1.11 all facts and circumstances material to the transaction known to the Seller as at the Transfer Date and not known to the Issuer and which would be reasonably likely to be material to the Issuer and/or to the Purchase Price have been disclosed to the Issuer, (including but not limited to the details required to be delivered to the Issuer in terms of 3.1.4); 5.1.12 the Rental Agreement will comply with such requirements pertaining to the Public Finance Management Act, 1999, Local Government Municipal Finance Management Act, 2003, and the regulations thereto in accordance with such requirements or approvals as may have been reasonably stipulated by the Issuer from time to time in writing, provided that it shall be deemed that the Seller has complied with this warranty if the Issuer has provided such documentation as the Issuer may have stipulated in this regard and the Issuer has accepted the same and has purchased the Rental Agreement; 19 Rentworks APS_Revised Execution/#3417174v3 29072015 5.1.13 to the best of its knowledge, all documentation executed by or on behalf of an Obligor has been properly executed by person(s) that prima facie are duly authorised thereto and, where necessary, is properly registered and stamped; and 5.1.14 the Sale Assets comply with the Eligibility Criteria, as set out in [the Annexure below] […]. 5.2 Undertakings by the Seller The Seller will not, without the Issuer's prior consent - 5.2.1 do anything which would result in any waiver, set-off or reduction arising in respect of the Obligor's (or any provider of any Rental Collateral Security or Eligible Securities Collateral) obligations under any Sale Assets Agreement or any Rental Collateral Security or Eligible Securities Collateral forming the subject of any Sale Notice accepted by the Issuer insofar as they relate to the Sale Assets; or 5.2.2 do anything to modify the Sale Assets Agreement or any Rental Collateral Security or Eligible Securities Collateral in any way insofar as they relate to the Sale Assets. 5.3 No Other Reliance The Issuer acknowledges that, other than the representations made in 5.1, it has not relied upon any representations made by the Seller to induce it to purchase any Sale Assets. Without derogating from the generality of the aforegoing, the Issuer specifically acknowledges and agrees that the Seller has not undertaken any investigation and/or assessment into the financial conditions and/or creditworthiness of the Obligor and that it makes no representations and assumes no risk whatsoever in that regard. 5.4 Undertakings by the Issuer Unless necessary for the Issuer to enforce its rights under this Agreement, or under any other agreement, the Issuer will not communicate with the Obligor in any manner in relation to this Agreement or the Sale Assets or the Sale Assets Agreement or any Rental Collateral Security or Eligible Securities Collateral nor send any promotional material, bank statements, auditor's confirmation certificates or similar material to the Obligor for the duration of this Agreement. 5.5 Indemnity by the Seller/Repurchase Obligations of the Seller 5.5.1 Subject to 5.6, the Seller shall indemnify the Issuer, upon first written demand, against any loss, liability, expense and/or any costs incurred by the Issuer arising out of the non performance of or breach of any obligation of the Seller under this Agreement or the Sale Assets Agreement and/or a breach by the Seller of any of the representations, warranties and undertakings contained in 5.1 and 5.2 of this Agreement. 5.5.2 The Issuer undertakes to notify the Seller in writing of any event referred to in 5.5.1 in respect of which it has a claim against the Seller under the above indemnity. The Seller shall be entitled (but not obliged), in its sole 20 Rentworks APS_Revised Execution/#3417174v3 29072015 discretion, and within five Business Days of receipt of the Issuer's notice and, upon written notice to the Issuer, to elect to repurchase the relevant Sale Asset ("Affected Asset") if the event referred to in 5.5.1 relates to a Sale Asset or Sale Asset Agreement, upon the following terms and conditions 5.5.2.1 the consideration payable by the Seller to the Issuer on any such repurchase of an Affected Asset ("Repurchase Price") shall be calculated in the same manner as the settlement amount referred to in 8.1 below or, subject to the prior written consent of the Security SPV, such lesser amount as may be agreed between the parties at the time. The Seller shall pay the Repurchase Price to the Issuer not later than three Business Days after it has notified the Issuer of its election to repurchase the Affected Asset; 5.5.2.2 upon receipt of the Repurchase Price, the Issuer shall deliver the Sale Assets Agreement and the Rental Collateral Securities or Eligible Securities Collateral in respect of the Affected Asset to the Seller and the Issuer’s right, title and interest in and to the Sale Assets Agreement and the Rental Collateral Securities or Eligible Securities Collateral in question, together with ownership in the Equipment subject of the Rental Agreement (if any), shall be deemed to have been ceded and transferred back to the Seller upon such delivery, provided that the non-delivery of the documents shall not affect the validity of the aforesaid cession of the Issuer’s right, title and interest in and to the Affected Asset and/or the Sale Assets Agreement and/or the Rental Collateral Securities or the Eligible Securities Collateral in question, if the Seller elects in its discretion not to require the same and/or does not receive the same for any reason whatsoever. 5.5.3 For the avoidance of doubt - 5.5.3.1 the Seller shall always have the right to dispute any claim which the Issuer may have against the Seller under the indemnity referred to in 5.5.1 after payment of the amount claimed by the Issuer under 5.5.1 or payment of the Repurchase Price under 5.5.2 above; 5.5.3.2 the Issuer and the Security SPV agree that the Seller's liability to the Issuer for any and all claims, losses, damages or expenses from any cause whatsoever shall in no event exceed the amounts as would be payable by the Seller to the Issuer in respect of the Affected Asset had the Seller elected to repurchase the Affected Asset in terms of this 5.5 plus arrear interest plus legal costs on a party and party scale.; and 5.5.3.3 in no event shall the Seller be liable to the Issuer or any third party for any claim, loss, expense, harm or damage to such party arising directly or indirectly as a result of the Obligor’s inability to pay any amounts owing under the Sale Assets Agreement or under this Agreement. 5.6 Notwithstanding anything to the contrary contained in this Agreement, neither party shall be liable to the other party for any indirect or consequential loss or damage, including without limitation, loss of profit, revenue, anticipated 21 Rentworks APS_Revised Execution/#3417174v3 29072015 savings, business transactions or goodwill or other Sale Asset Agreements unless such indirect or consequential loss or damage resulted from the wilful misconduct or fraud on the part of the other party. […] 8 EARLY SETTLEMENT 8.1 Settlement Amount In respect of all rights under the Sale Assets Agreement which are sold to the Issuer, the Issuer may allow voluntary early settlement of the amount outstanding under the Sale Assets Agreement, upon receipt of a written request from the Seller or Servicer, as the case may be, provided that the Issuer shall receive an amount equal to the aggregate of - 8.1.1 the amount of any Sale Assets Agreement Payments owing and unpaid up to and including the early settlement date; plus 8.1.2 the net present value (as determined under 8.3) of the Sale Assets Agreement Payments that would have been payable under the Sale Assets Agreement after the early settlement date had the Receivables not been settled early; plus 8.1.3 break costs incurred by the Issuer due to such early settlement, if any, as referred to in the relevant Sale Notice. Notwithstanding that the Issuer may allow voluntary early settlement in terms of this 8.1, the Issuer shall nevertheless be bound by the restrictions provided for in 3.4.3 in respect of the disposal of the Equipment. 8.2 Restrictions on Termination Rights Save as set out in 8.1 above, the Issuer acknowledges that, in recognition of the Seller’s interests in, inter alia, the Residual Value, the Excess Usage Charges, the return of the Equipment after termination of a Rental Agreement, and the Seller's obligations (if any) vis-à-vis an Originator or Rentor in respect of their respective interests in the Sale Assets, it shall not agree to an early settlement of the Sale Assets under the Sale Assets Agreement or otherwise, or to agree to a voluntary early termination of the Sale Assets Agreement without the Seller's prior written consent (which shall not be unreasonably withheld). 8.3 Calculation 8.3.1 For the purposes of 5.5.2.1, 7.3.2, and 8.1.2, the net present value of Sale Assets Agreement Payments shall (unless the Issuer and the Seller agree otherwise) be calculated in accordance with the default provisions of the relevant Sale Assets Agreement 8.3.2 In the case of the repurchase of an Affected Asset or indemnity payment in terms of 5.5.2.1 or a settlement in terms of 7.3.2, or a settlement in terms of 8.1.2, the net present value of Sale Assets Agreements Payments shall be calculated to include a net present value of the Sale Assets Agreement Payments discounted at a rate equal to the interest 22 Rentworks APS_Revised Execution/#3417174v3 29072015 rate applicable to the issued Notes as referred to in the Applicable Pricing Supplement issued in respect of the Rental Agreement or Sale Asset Agreement in question. 8.3.3 In the event of a dispute between the Issuer and the Seller as to the calculation of the amounts referred to in 8.1 8.3 and 8.3.2, the parties shall refer such dispute within three Business Days of the occurrence of such dispute, to an independent auditor appointed for this purpose by the Issuer and the Seller. In the absence of agreement between the parties within two Business Days after the parties are required to appoint an independent auditor, an independent auditor shall be appointed by the President for the time being of the South African Institute of Chartered Accountants (or its successor body). The independent auditor appointed shall act as an expert and not as an arbitrator and its decision shall be final and binding on the parties. The costs of the independent auditor shall be borne by the Seller and the Issuer on a 50/50 basis. […] ANNEXURE TO THE SALE AGREEMENT - ELIGIBILITY CRITERIA (RENTAL AGREEMENTS) Eligibility Criteria for Rental Agreements The general criteria that each Rental Agreement must satisfy in order to qualify for acquisition by the Issuer are set out below. With respect to Each Rental Agreement: 1 the Seller has sole and exclusive legal title to the Rental Agreement, and is entitled to enforce its rights and obligations thereunder; 2 the sale and transfer by the Seller of its right, title and interest in and to the Rental Agreement and, where applicable, the Equipment, does not breach the provisions of such Rental Agreement; 3 the Rental Agreement may be sold and transferred without the consent of the Lessee/Renter under such agreement; 4 the Rental Agreement constitutes an unconditional, irrevocable valid, binding and enforceable obligation of the Lessee/Renter to pay such amounts as are due and payable from time to time under the Rental Agreement in accordance with the terms of the Rental Agreement; 5 payments or instalments due under the Rental Agreement are not subject to set off, counterclaim, withholding or reduction; 6 Rental Payments under the Rental Agreement are required to be paid periodically over the term of such agreement; 7 the Rental Agreement is not in arrears at the time of sale to the Issuer: provided that the Seller shall not be in breach of this criterion if the default of the Lessee/Renter relates to payment of Excluded Amounts to the 23 Rentworks APS_Revised Execution/#3417174v3 29072015 extent that such default has not persisted for a duration of longer than three months as reckoned from the first payment date as defined in the Rental Agreement; 8 unless this requirement is otherwise waived by the Issuer in writing, the Rental Agreement is denominated in Rand; 9 the Rental Agreement has not been amended or modified, except in writing, and copies of all such amendments and modifications, if any, are reflected in or attached to the relevant agreement; and 10 the Rental Agreement is not subject to the provisions of the National Credit Act, 2007; In addition to the above criteria, with respect to Equipment subject of the Rental Agreement: 1 there is no obligation on the Seller under the Rental Agreement to repair or maintain the Equipment or to render technical support or other services in respect of the Equipment; 2 unless the Seller notifies the Issuer in writing otherwise and/or the Issuer waives this requirement in writing, in the Seller’s reasonable opinion, the Initial Term of the Rental Agreement does not exceed the expected life of such Equipment; 3 upon sale and cession on the Transfer Date, ownership of Equipment subject of the Rental Agreement will pass to the Issuer; 4 as at the Transfer Date, the Equipment shall be covered by comprehensive casualty insurance up to its full insurable value; and 5 as at the Transfer Date, the Equipment was not situated on any leased premises, or if so situated, the Rental Agreement obliges the Lessee/Renter to notify the landlord of such premises in writing (or the Seller has notified the landlord of the premises in writing by registered mail) that the ownership of such Equipment does not vest in the landlord’s tenant. a 24 CM/CM 29072015/REDI27556.2 Rentworks APS_Revised Execution/#3417174v3 ANNEXURE C - APPLICABLE CONTENTS OF THE RELEVANT SALE NOTICE We refer to […] the Rental Agreement No. 42013638 dated 17 August 2015 entered into by the Seller and Basil Read Mining SA Proprietary Limited (registration number 1990/005815/07)] ("the Lessee/Renter"), [….], (the "Rental Agreement"). […] 1.4 the Rental Collateral Security for the Sale Assets are: The guarantee dated [on or about 21 August 2015] given by Basil Read Holdings Limited ("the Guarantor") in favour of the Seller, its successors in title, cessionaries and/or assigns and/or anyone who takes transfer of rights under the guarantee or its successors or assigns ("the Beneficiary"), in connection with the obligations and indebtedness of whatsoever nature and howsoever arising (whether same are existing, future and/or contingent) of Basil Read Mining SA Proprietary Limited, Registration Number 1990/005815/07 ("the Lessee/Rentor"); […] 1.9 Excluded Amounts: N/A; […] 1.12 Equipment: Liebherr Excavator R984C Excavator, Bucket No: B8037 – Serial Number:35100; 25 CM/CM 29072015/REDI27556.2 Rentworks APS_Revised Execution/#3417174v3 ANNEXURE D – PRINCIPAL REPAYMENT SCHEDULE Payment Date Estimate Scheduled Principal Repayment 05-Oct-15 R 1 144 993 05-Jan-16 05-Apr-16 05-Jul-16 05-Oct-16 05-Jan-17 05-Apr-17 05-Jul-17 05-Oct-17 05-Jan-18 R R R R R R R R R 05-Apr-18 R 1 236 573 05-Jul-18 R 1 128 444 2 1 1 1 1 1 1 1 1 773 000 027 051 080 114 142 170 202 015 732 678 902 537 090 019 575 441 26