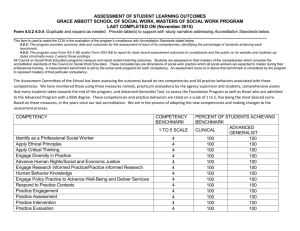

CA Practical Experience Requirements

advertisement