Technical Bulletin

Technical

Bulletin

Income tests for government benefits and tax offsets

In brief

Background

Concepts and definitions from

1 July 2009

This Technical Bulletin looks at the „income‟ that is referred to when determining eligibility to receive the following forms of Government assistance:

Government superannuation co-contribution

Senior Australians Tax Offset (SATO)

Pensioner tax offset (ie low income aged persons rebate)

Dependant tax offset (spouse and non-spouse)

Mature Age Worker Tax Offset (MAWTO)

Spouse superannuation contributions tax offset

Commonwealth Seniors Health Card (CSHC)

Tax deduction for personal superannuation contributions

Other Government support payments and tax offsets impacted by these reforms are also identified and briefly outlined.

The income tests used in determining eligibility for a range of means-tested

Government financial assistance programmes were expanded on 1 July

2009 to include certain contributions to superannuation, total net investment losses and adjusted fringe benefits.

This bulletin includes details on the new concepts applying from 1 July

2009.

Reportable Superannuation Contributions (RSC) include reportable employer superannuation contributions (RESC) and personal deductible superannuation contributions.

Reportable Employer Superannuation Contributions (RESC)

A reportable employer superannuation contribution is an amount contributed to a superannuation fund or an RSA where all of the following apply: a) by an employer, or an associate of the employer, for an employee‟s benefit in respect of the income year; and b) the employee has, or might reasonably be expected to have had, the capacity to influence at least one of the following: i. the size of the amount of the contribution; or ii. the way the amount is contributed so that his or her assessable income is reduced; and c) the contributions are additional to the compulsory contributions made under any of the following: o superannuation guarantee law; o an industrial agreement; o the trust deed or governing rules of a superannuation fund; or o a federal, state or territory law.

If an employer makes contributions that exceed their SG or mandated contribution requirements, but the employee was unable to influence the amount of the excess, then the excess will generally not be considered

RESC. For example:

1

Concepts and definitions - cont

the excess is made because of the employer‟s payroll system limitations

(ie the payroll system calculates the 9% SG amount on all earnings not just ordinary time earnings); and

the excess is paid under an industrial agreement, and the employee had no involvement in the preparation of the agreement, aside from voting on it.

Generally salary sacrifice contributions are RESC, as are employer contributions the employee could have chosen to receive as salary and wages rather than superannuation contributions. Therefore, RESC specifically exclude superannuation guarantee (SG) payments and mandated employer contributions.

More detail on RESC is included in our Technical Bulletin: Reportable Employer

Superanuation Contributions.

Employers are required to report RESC on Payment Summaries for the 2009/10 and subsequent years.

Adjusted fringe benefits total will be determined using the following formula:

Taxpayer‟s reportable fringe benefits total x (1 – FBT rate)

Note that where an employee's total fringe benefits is $2,000 or less (ie total reportable fringe benefit of $3,738 or less), these fringe benefits do not have to be reported on the employee's payment summary. This means they would be excluded from an individual‟s reportable fringe benefits.

Total net investment loss is a new concept which includes net losses (gross income less allowable deductions) on all financial investments and rental property.

This new concept replaces „net rental property losses‟ from 1 July 2009.

A financial investment is defined to include:

shares;

an interest in a managed investment scheme;

a forestry interest in a forestry managed investment scheme;

rights and options in relation to the above investments;

an investment of something of a “like nature” to any of the above.

An individual will have a total net investment loss for an income year if their deductions from financial investments and rental property exceed their gross income from those investments.

This means that from 1 July 2009 tax losses are effectively added back to taxable income for the purposes of determining eligibility for certain Government support payments and tax offsets.

Income for surcharge purposes is defined as the sum of:

modified taxable income (taxable income plus certain distributions from family trusts that are not taxable);

reportable fringe benefits total;

reportable superannuation contributions (ie. RESC plus personal deductible contributions);

total net investment loss;

exempt foreign employment income (if your taxable income is $1 or more).

Note: amounts withdrawn from superannuation to which the low rate cap amount

($160,000 for 2010/11 ) has been applied are not included in „income for surcharge purposes‟.

2

Impact on

Government support payments and tax offsets

Example 1 Impact of the inclusion of

RESC on the substantially self employed

Rebate income is the sum of:

taxable income;

reportable superannuation contributions (ie. RESC plus personal deductible contributions);

total net investment loss; and

adjusted fringe benefits total.

Rebate income is used to determine an individual‟s eligibility for SATO and the pensioner tax offset from 1 July 2009.

Government superannuation co-contribution

From 1 July 2009 the definition of total income for the purposes of the cocontribution includes:

assessable income;

reportable fringe benefits; and

RESC

As assessable income is used to assess eligibility, total net investment loss and personal deductible contributions are already included in the income base.

For further information refer to the Technical bulletin: Contributions: Government cocontributions.

Deduction for personal superannuation contributions

From 1 July 2009, RESC is included in the income base used to determine eligibility to claim a deduction for personal super contributions.

Individuals can claim a deduction for personal super contributions if less than 10% of their assessable income, reportable fringe benefits and RESC is attributable to activities that resulted in them being treated as an employee for the purposes of the

Superannuation Guarantee (Administration) Act 1992 (SGAA ‟92).

As assessable income is used to assess eligibility, total net investment loss and personal deductible contributions are already included as the income base.

Jack, aged 45, largely works freelance but is employed one to two days a week with a professional photography studio.

In 2010/11

Jack‟s earnings included:

Salary

SG Contributions

$ 5,000

$ 540

Salary Sacrifice contributions (RESC)

Reportable fringe benefits (RFB)

Freelance income

Assessable income + RFB + RESC=

$ 4,200

$70,000

$ 3,800

$83,000

Jack will be ineligible to claim a tax deduction for any personal contributions made to superannuation as he will fail the 10% test. The percentage of assessable income, RFB and RESC attributable to employment as an employee will be greater than 10% of $83,000.

(Salary + RFB + RESC)/Total Income = $5,000 + $3,800 + $4,200) / $83,000 =

15.7%

3

Impact on

Government support payments and tax offsets cont.

Spouse superannuation contributions tax offset

From 1 July 2009 the income test to determine eligibility to claim the spouse superannuation contributions tax offset will include RESC. Therefore, for an individual to be eligible to claim the spouse superannuation contributions tax offset (assuming all other eligibility criteria are met) the total of their spouse‟s:

assessable income;

reportable fringe benefits; and

RESC need to be less than $13,800 for the financial year in which the contribution is made.

As assessable income is used to assess eligibility, total net investment loss and personal deductible contributions are already included as the income base.

Senior Australians tax offset (SATO)

From 1 July 2009

„rebate income‟ replaces „taxable income‟ as the income test for

SATO. This change also applies to the income test for the individual‟s spouse where applicable. Therefore to be eligible for SATO (assuming all other eligibility criteria is met), their rebate income is the sum of an individual‟s:

taxable income;

RESC;

personal deductible superannuation contributions;

total net investment loss; and

adjusted fringe benefits total will need to be below the relevant thresholds (for 2010/11, the cut-off thresholds are

$48,525 for singles and $39,496 each for couples).

Pensioner tax offset

From 1 July 2009 „rebate income‟ replaces „taxable income‟ as the income test and is defined above under SATO. Therefore to be eligible for the pensioner tax offset

(assuming all other eligibility criteria are met), their rebate income will need to be below the relevant thresholds (for 2010/11, the cut-off thresholds are $48,525 for singles and $39,496 each for couples).

Mature age worker tax offset (MAWTO)

Eligibility is for the MAWTO is based on „net income from working‟.

From 1 July 2009 „net income from working‟ which includes assessable income that is primarily a reward for personal effort or skills, less any related deductions plus RESC.

The upper threshold for this offset is currently $63,000 and the maximum rebate is

$500.

As assessable income is used to assess eligibility, total net investment loss and personal deductible contributions are already included in the income base.

Commonwealth Seniors Health Card (CSHC)

Eligibility for the CSHC is based on adjusted taxable income which includes taxable income, employer provided fringe benefits (non-grossed up amount), target foreign income

1

and total net investment losses. From 1 July 2009, the adjusted taxable income also includes RSC.

1

Social Security Act 1991, Section 10A defines „target foreign income‟ as foreign income that is not:

(a) taxable income; or (b) received in the form of a fringe benefit.

4

Impact on

Government support payments and tax offsets cont.

Legislative references

Medicare Levy Surcharge

From 1 July 2009 liability is determined by „income for surcharge purposes‟ which is defined as the sum of:

modified taxable income (taxable income plus certain distributions from family trusts that are not taxable);

reportable fringe benefits total;

RSC (ie RESC plus personal deductible superannuation contributions);

total net investment loss;

exempt foreign employment income (if your taxable income is $1 or more).

Notes:

1. Amounts withdrawn from superannuation to which the low rate cap amount ($160,000 for 2010/11) has been applied are not included in „income for surcharge purposes‟.

2. RESC are included in calculating whether or not an individual or couple exceeds the

Medicare levy surcharge threshold. However, the actual surcharge is only applied to taxable income and any applicable reportable fringe benefits. Amounts withdrawn from superannuation to which the low rate cap applies is not included in taxable income.

Other support payments and tax offsets

Other Government support payments and tax offsets impacted by the income test reforms include:

Child care benefit

Baby bonus

Family tax benefit A & B

Child support

Higher education loan program (HELP)

Dependant tax offsets (spouse, child-housekeeper, housekeeper; invalid-relative, parent or parent-in-law)

Income Tax Assessment Act 1936

Section 160AAAA (Senior Australian Tax Offset)

Section 159J (rebates for dependants)

Income Tax Assessment Act 1997

Subdivision 290-C (ability to claim a personal tax deduction for contributions made from 1 July 2007)

Division 61 - General tax offset

Subdivision 290-D - Tax offsets for spouse contributions

Social Security Act 1991

Section 1071-3 Adjusted taxable income

Superannuation (Government Co-contribution for Low Income Earners) Act 2003

Part 2, Division 1 (eligibility criteria)

Part 2, Division 2 (amount of co-contribution)

Taxation Administration Act 1953

Subdivision 16-C (Definition of reportable employer superannuation contribution)

Related ATO Rulings/Determinations

ATO Interpretative Decision 2010/112: Superannuation: Reportable employer superannuation contributions: additional superannuation contributions made by employer

5

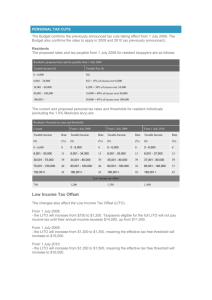

Summary table

The table below summarises the income bases to be used from 1 July 2009 to determine the eligibility for the support payments and tax offsets outlined in this bulletin.

Support payment / tax offset

Government co-contribution

Deduction for personal superannuation contributions

Income bases used to determine eligibility from 1 July 2009

RESC + assessable income + reportable fringe benefits

RESC + assessable income + reportable fringe benefits

Pre 1 July 2009 income bases assessable income + reportable fringe benefits assessable income + reportable fringe benefits

Spouse superannuation contributions tax offset

Senior Australians tax offset

(SATO) and pensioner tax offset

Mature Age worker tax offset

(MAWTO)

Commonwealth Seniors

Health Card (CSHC)

Spouse‟s RESC + assessable income + reportable fringe benefits

„rebate income‟ (taxable income, RSC, total net investment loss & adjusted fringe benefits total) net income from working (RESC + assessable income that is primarily a reward for personal effort or skills, less any related deductions plus reportable fringe benefits) adjusted taxable income for purposes of this card (taxable income, employer provided fringe benefits, target foreign income, RSC and total net investment loss) spouse‟s assessable income + reportable fringe benefits taxable income net income from working

(assessable income that is primarily a reward for personal effort or skills, less any related deductions) adjusted taxable income (taxable income, reportable fringe benefits, target foreign income and net rental property loss)

Medicare levy surcharge and

Tax offset for Medicare levy surcharge (lump sum payments in arrears)

Child care benefit, Baby bonus, Family tax benefit,

Child support payments,

Repayment of HELP debts modified taxable income + RSC + reportable fringe benefits + total net investment loss + exempt foreign employment income (if your taxable income is $1 or more) adjusted taxable income (taxable income + adjusted fringe benefits + RSC, certain tax-free pensions or benefits from Centrelink/DVA and total net investment loss repayment income (taxable income, RSC, exempt foreign income, reportable fringe benefits, total net investment loss) modified taxable income + reportable fringe benefits adjusted taxable income (taxable income + fringe benefits) repayment income (taxable income, exempt foreign income, reportable fringe benefits, net rental property loss)

Dependant tax offsets combined adjusted taxable income of the taxpayer and their spouse (where relevant) is less than the income cap. Cap will be indexed in line with the income limit for Family Tax

Benefit Part B (currently $150,000).

The dependant‟s income still needs to be taxable income of taxpayer is less than the income cap (currently

$150,000) and their dependant‟s income is below applicable low income thresholds. separate net income of dependant is less than applicable low income thresholds.

Spouse tax offset below applicable unchanged low income thresholds. The depe ndant‟s „adjusted taxable income‟ will be assessed in determining the taxpayer‟s eligibility for a dependency tax offset. The concept of separate net income is repealed. existing income cap (currently $150,000) will continue to apply to taxpayer‟s adjusted taxable income only income base for spouse will be adjusted taxable income taxable income of taxpayer and separate net income of spouse

FOR GENERAL INFORMATION ONLY

This information has been prepared by BT Funds Management Ltd ABN 63 002916 458.

It is provided solely for the general information of external financial advisers and must not be relied on as a substitute for legal, tax or other professional advice. Further, it must not be copied, used, reproduced or otherwise distributed or circulated to any retail client or other party. The information is given in good faith and has been derived from sources believed to be accurate at its issue date. However, it should not be considered a comprehensive statement on any matter nor relied upon as such. BT Funds Management Ltd (including its related entities, employees and directors) does not give any warranty of reliability or accuracy or accept any responsibility arising in any way including by reason of negligence for errors or omissions in the information.

6