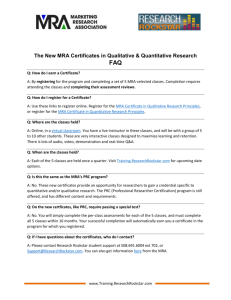

4G Evolution

advertisement

August 18, 2011 4G Deployment Update Wayne Sun CIO Global Mobile Corporation. 1 Licensed date License of business: Northern Taiwan Population: 13 million 30MHz, 2595~2625MHz Launch Date Jan. 5 2010 – Hsinchu City & County May 20, 2010 – Taipei City 2011 - New Taipei and Tao Yuan 2 population: 53% Internet usage: 80% population: 47% Internet usage: 20% 人口 100萬 以上 3 人口 50萬 以上 核心 地域 (北部) Taipei (660萬) Taoyuan(310萬) Jhongli 重點 地域 (中,南) Taichung (430萬) Kaosiung(380萬) Changhua Chiayi Tainan Pintong 連江縣 2009 (1.5M POPs) • Hsinchu City, County Taipei City Taoyuan County 2010~2011 (8.5M POPs) • Taipei City • New Taipei City • Roaming: • Domestic service to south Taiwan • International – U.S., Korea (Japan and 4 Taipei County Hsinchu City Hsinchu County Taoyuan County Malaysia to come) Keelung City Lienchiang County Miaoli County Yilan County • Provide best 4G service • Leader in 4G service in Greater China with 660,000 users by 2011 • Achieve 90% coverage in northern Taiwan by 2014 • Consolidation with other 4G license • Pioneer in 4G launch, collaboration with China • Capture 10% of market share in Taiwan mobile broadband market 5 4G OPPORTUNITY AND CHALLENGES 6 Global Mobile Data Traffic – 108% CAGR expected Equivalent to…. 22,500,000 B 180,000 B 18,000 B 3,600 B 900 B 2.4 B Million Terabyte/month 5 4 3 (160 B/each) (20 KB/each) (200 KB/each) (1 MB/min) (4 MB/each) (1.5 GB/each) 2 2.2m 1 0 0.09m Source : Cisco, Feb 2010 7 text messages text emails web page views minutes of YouTube video Music downloads HD video downloads 0.2m 0.6m 1.2m 3.6m TB Internet penetration Internet web popularity Social Networking 3 out of top 10 websites in Taiwan are Google web sites: • Facebook is #2 in terms of popularity. • About 59% of online user are members of Facebook (~41% of population), driving growth of smartphones and apps even further. • 75% of users are below 34 years. #4 Google TW #5 YouTube #3 Google Int. (#15 Blogger) There are 3x more mobile broadband subscribers (16.5m at end of 2010) than fixed broadband. Taiwan’s first fully digital generation What happens if today's youngsters (~15.6% age group 0-14 years) become adults? • • • • What will be important then? How will they use communication services? What devices will be used? How do trends shape new behavior and patterns? Source: CIA world fact book, Alexa.com, ITU 8 High-end devices multiply traffic E-reader = x2 Smartphone = x 10 - 24 Mobile Broadband Subscriber [Billion] 3.0 2.5 Mobile Handheld 2.0 Mobile Laptop 1.5 Handheld game console = x 60* 1.0 0.5 Tablet = x 122* Mobile Phone Projector = x 300 Laptop = x 515-1,300 0.0 2010 2011 2012 2013 2014 2015 Mobile Internet Traffic [ExaByte/year] 25 20 Example: HSPA Devices, GSMA 4/’11 Besides ~3000 HSPA devices, there is a growing number of devices others than mobile phones, laptops… that support HSPA as well: • 48 Personal Media Players, UMPCs • 24 Femtocells • 12 E-book readers • 8 Cameras • 27 Mobile tablets 9 Mobile Handheld Mobile Laptop 15 10 5 0 2010 2011 2012 2013 2014 2015 Smartphone penetration acceleration •Sales: 20-25% of handsets sold in 2009, 30-40% in 2010-2011(est.), then >50% •Device variety: more exciting devices in 2010, non-exclusive iPhone, Androidbased tablet, PCs, … •Pull and Push Strong consumer pull, CSPs push Taiwan: iPhone and Android based devices are the most often used to surf the internet. 40,00 35,00 30,00 25,00 20,00 15,00 31.4% 10,00 5,00 10% 0,00 Penetration of customer base (%) Smartphone owners in France (%) % of smartphone handsets sold Source: Exane BNP Paribas, 2010; NSN 2011 10 iPhone Android NetFront Nokia Source: StatCounter Webbrowser, 02/2010-02/2011 Opera iPodTouch Question: What do you do on the Internet? Group Average in % Browsing & searching the web Brazil Algeria South Africa Russia Romania (n=545 fixed) (n=706 mob) (n=663 fixed) (n=49 mob) (n=500 fixed) (n=55 mob) (n=291 fixed) (n=306 mob) (n=645 fixed) (n=132 mob) (n=700 fixed) (n=101 mob) 93 95 Reading/ Sending e-Mails 91 92 Downloading smaller files (<10MB) Downloading larger files (>10MB) 63 78 Playing online games 27 34 IP Telephony/Calling 27 24 92 98 91 96 89 82 88 98 90 98 94 89 98 92 90 86 59 84 53 51 47 55 61 45 12 29 15 16 5 11 76 62 7 16 87 45 19 19 64 65 27 42 46 46 61 64 Fixed Internet at home at least weekly Mobile Internet anywhere at least monthly 11 45 45 33 22 33 19 20 68 79 52 57 28 27 22 84 91 41 36 32 47 6 19 18 28 33 34 37 52 71 48 57 54 72 82 27 95 97 57 68 56 71 72 33 44 46 51 65 Uploading files 98 98 38 47 52 52 18 26 93 97 67 83 40 49 Watching videos, using web cam Watching high definition TV Indonesia 30 36 18 23 69 29 45 17 27 Top 10 mobile web sites Top 10 fixed web sites 1. Google 1. Google Local 2. Google 3. Facebook 4. Yahoo! 5. YouTube 6. Blogger.com 7. Wikipedia 8. Orkut 9. Rediff.com 2. Facebook 3. YouTube 4. Orkut 5. Getjar 6. Zedge.net 7. Yahoo! 8. Wikipedia 9. Songs.pk 10. Vuclip.com 10. Twitter Opera.com August 2010 Alexa.com December 2010 12 Seven of the top 10 are the same Mobile video traffic will exceed 50% of total mobile data in 2011,and Mobile video has the highest growth rate of any application category 2008 2015 20.9% Mobile Web-Data 6.1% Mobile P2P 4.7% Mobile M2M 1.5% Mobile Gaming 0.4% Mobile VoIP P2P 65% Latency Insensitive 1 2 Video 66.4% Latency 1Sensitive 2 Source: Based on 12% smartphones 2008 and 25% 2012 (Bank of America Merrill Lynch report); Cisco VNI, 2011 13 14 Source: Cisco VNI, June 2011 Source: UBS, as of Q310 15 Source: Credit Swiss, Asia Pacific/Taiwan Equity Research 16 No other technology but 4G has the capacity to deal with growing data traffic demands! In the past month, our 4G customers are using: Top DL: 1,708 GB Top UL: 375 GB On average, 8.2 GB per customer! TRS G1 WiMAX WCDMA HSPA+ GSM Source: Global Mobile Corp. June 2011 17 17 Nielsen’s Law and Edholm’s Law 100000.00 10000.00 MB per second 1000.00 Nielsen’s Law of fixed internet bandwidth Linear extrapolation GPON 100 Mbps WiMAX – 40 Mbps VDSL2 25-50 Mbps ADSL 6-8 Mbps ADSL 1-3 Mbps HSDPA – 1.884 Mbps 100.00 10.00 01.00 UMTS – 0.384 Mbps GPRS – 0.075 Mbps 00.10 Edholm’s Law of wireless speed growth 00.01 00.00 00.00 1983 1987 1991 1995 1999 2003 2007 2011 2015 2019 2023 Source: Nokia Siemens Networks 18 Year of user availability BUSINESS CHALLENGES 19 • Cell site acquisition • Device proliferation • Regulatory constraints • Technology neutrality • Service restriction • Spectrum availability 20 JP Morgan Telco team on the impact of 4G services on telecom financials: • Spectrum is significantly more important in a 4G world than a 2G world, Asian regulators are behind their peers in the US and EU in making additional spectrum available. • Asian operators may see more base station proliferation than global peers as wireless data usage ramp, unless additional spectrum is made available. • Operators basically face a choice - either spend on spectrum or spend on base stations...the numbers don't really work out any other way. 21 The Users’ expectation… ..leads to the operator’s challenges • best price, transparent flat rate • full Internet • click-bang responsiveness • reduce cost per bit • provide high data rate • provide low latency Devices & applications drive traffic growth Reduction of network cost is necessary to remain profitable Traffic Revenue Profitability Voice dominated Data dominated Time Source: Light Reading (adapted) Reduce cost per bit and improve end user experience 22 $/bit Traffic volume Revenues and Traffic decoupled However… 23 Interactive Education Interactive Monitoring & Ordering Shipments Tracking Inventory Control Fleet Management Surveillance Safety Monitoring Real Estate, Wool, Grain, Potatoes Warehouse management Safety control Remote Medical Treatment Wireless medical services 24 25 26 Webcam WiMAX Internet Smart Phone Local Storage GMC Storage Cloud 27 28 29 30 31 WiMAX or LTE BUILD NOW OR WAIT? 32 FDD LTE • Early FDD LTE ecosystem mainly building on 2600 (Europe, APAC) 2100 (Japan) 1800 (GSM refarming) 1700/2100 AWS (North America) 1600 (US – wholesale) 800 digital dividend (Europe, APAC) Upper 700 MHz (Verizon) Lower 700 MHz, B/C (AT&T) TD-LTE • Early TD-LTE ecosystem 2300 (India, APAC, China) 2600 (Europe, China, USA) 33 © Nokia Siemens Networks Company Confidential Source: Operator, 11.2010 Dongle / Data card CPE MiFi (mobile hotspot) Terminal (Tablet PC) Mobile phone 34 10Q3 10Q4 11Q1 11Q2 11Q3 Single mode pre-commercial Multi- mode precommercial Single mode pre-commercial Multi- mode precommercial Single mode pre-commercial Single mode pre-commercial TD-LTE+GSM/TDSCDMA Demo proto 11Q4 12Q1 12Q2 Multi- mode commercial Multi- mode commercial Multi- mode precommercial Multi- mode precommercial Pre-commercial Multi- mode commercial Multi- mode Dual-mode commercial Commercial Single-mode Commercial ▪ Simultaneous WiMAX and TD-LTE services during transition phase - To care for existing WiMAX customers - To minimize service interruption - Fast migration to TD-LTE technology Frequency Migration Plan Now 16e 16e 16e N=3 Direct transition ▪ Easy upgrade to TD-LTE by adding TD-LTE channel card ▪ Same cell sites with TD-LTE Final LTE 20MHz N=1 16e 10Mhz N=1 1) Add TD-LTE channel card * Reused H/W: DU shelf, RRH, Backhaul, Antenna, etc. 2) Add optic cable 35 Digital Unit 4 to 5 years is needed for proliferation of ecosystems 180+ to mass deployments 150+ WiMAX 102 100 WCDMA 50 2 0 1 LTE Year 1 WCDMA for diversity of devices 120+ WiMAX 100 50 10 4 0 LTE Year 1 Year 5 36 150 Number of Device Models Number of Operators 150 Year 5 * Note : WiMAX and WCDMA was deployed since Jun 2006 and Oct 2001, respectively. (Source : GSA ; WiMAX Forum, Mar 2010 ; Informa, Feb 2010; Samsung estimates) 37 • WiMAX2 (16m) has full backward compatibility with WiMAX (16e) • Increase of WiMAX2 capable device enables system capacity enhancement 38 SCENARIO (1/2) a - sector g - sector a - sector g - sector Configuration change of 16e & Add 2nd carrier for 16m #0 #1 #2 b - sector 16e (10MHz, 2T2R) b - sector #0 #1 #2 16m (10MHz, 2T2R) 16m MRA 16m MRA 16m MRA 16e MRA 16e MRA 16e MRA 16e MRA 16e MRA 16e MRA Add 3 x 16m channel cards Current 39 Step-1 SCENARIO (2/2) a - sector g - sector a - sector g - sector Configuration change for 16m 20MHz #0 #1 #2 b - sector 16e (10MHz, 2T2R) b - sector 16m (10 or 20MHz, 2T2R) 16m MRA 16m MRA 16m MRA 16e MRA 16e MRA 16e MRA Step-1 40 16m MRA 16m MRA 16m MRA Step-2 #0 #1 #2 Source: UQ Communications, July 2011 41 WiMAX(16e) by UQ Communications DC-HSDPA by SoftBank 42 FD-LTE by NTT Docomo The result of the downlink comparison test is as bellow: • WiMAX is about 10Mbps, • LTE is about 6Mbps, • DC-HSDPA is about 2Mbps 43 • UQ to have 20,000 BTS • • • • 44 and 2M subs by 2012 KT WiBro expansion KCC to License 4th Operator – WiMAX2 UQ and YTL signed MoA for WiMAX2 cooperation GMC to provide 70% coverage and 660,000 subs by end of 2011 Questions? Wayne.Sun@GlobalMobile.com.tw