SHAPING THE MARKET OFFERINGS A

advertisement

A-PDF Split DEMO : Purchase from www.A-PDF.com to remove the watermark

SHAPING THE MARKET OFFERINGS

I N THIS CHAPTER, W E WILL

ADDRESS THE FOLLOWING

QUESTIONS:

1.

What are t h e characteristics of

products and how can they be

classified?

2.

How can companies differentiate

products?

3.

How can a company build and

manage its product mix and

product lines?

4.

How can companies combine

products t o create strong cobrands or ingredient brands?

5.

How can companies use

packaging, labeling, warranties,

and guarantees as marketing

CHAPTER 12

SETTING PRODUCT

STRATEGY

At the heart of a great brand is a great product. Product is a key

element in the market offering. Market leaders generally offer

products and services of superior quality.

erhaps no other high-end

manship,

market

dominance,

One-hundred-fifty

processes

mass-produced

ing a Steinway

combines

and longevity

Despite

from its humble origins in New York

pianos a year and has only 2 percent of all keyboard

25 percent

Not surprisingly,

(where it has a market

piano

only a few

patents

thousand

unit sales in the

of the sales dollars and 35

Steinway owns the market

share over 95 percent)

build-

requires

and relies on 120 technical

the fact that it can produce

States, Steinway commands

pianos.

company retains many

takes nine months t o a year. A Steinway

and innovations.

crafts-

pianos take roughly 20 days to build,

12,000 parts, most of them handcrafted,

of the profits.

the skilled

of Steinway

years o l d , the family-run

of the same manufacturing

City. Although

product

United

percent

in concert

halls

and with composers

and

musicians.^

A Steinway concert grand: the great product at the

heart of a great brand.

371

372

PART 5

SHAPING THE MARKET OFFERINGS

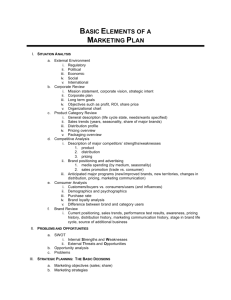

Marketing planning begins with formulating an offering t o meet target customers' needs or wants. The customer will judge the offering by three basic elements: product features and quality, services mix and quality, and price (see

Figure 12.1). In this chapter, we examine product; in Chapter 13, services; and

in Chapter 14, prices. All three elements must be meshed into a competitively

attractive offering.

Value-based prices

• • •

• ••

Product Characteristics and Classifications

Many people think that a product is a tangible offering, but a product can be more than that.

A product is anything that can be offered to a market to satisfy a want or need. Products that

are marketed include physical goods, services, experiences, events, persons, places, properties, organizations, information, and ideas.

Product Levels: T h e Customer Value Hierarchy

|

FIG.

12.1

Components of the Market Ottering

FIG. 1 2 . 2 |

Five Product Levels

In planning its market offering, the marketer needs to address five product levels (see Figure

12.2).2 Each level adds more customer value, and the five constitute a customer value hierarchy. The fundamental level is the core benefit: the service or benefit the customer is really

buying. A hotel guest is buying "rest and sleep." The purchaser of a drill is buying "holes."

Marketers must see themselves as benefit providers.

At the second level, the marketer has to turn the core benefit into a basic product. Thus a

hotel room includes a bed, bathroom, towels, desk, dresser, and closet.

At the third level, the marketer prepares an expected product, a set of attributes and conditions buyers normally expect when they purchase this product. Hotel guests expect a clean

bed, fresh towels, working lamps, and a relative degree of quiet. Because most hotels can

meet this minimum expectation, the traveler normally will settle for whichever hotel is most

convenient or least expensive.

At the fourth level, the marketer prepares an augmented product that exceeds customer

expectations. In developed countries, brand positioning and competition take place at this

level. In developing countries and emerging markets such as China and India, however,

competition takes place mostly at the expected product level.

Differentiation arises on the basis of product augmentation. Product augmentation

also leads the marketer to look at the user's total consumption system: the way the user

performs the tasks of getting and using products and related services.3 As Levitt observed

long ago:

SETTING PRODUCT STRATEGY

The new competition is not between what companies produce in their factories,

but between what they add to their factory output in the form of packaging, services, advertising, customer advice, financing, delivery arrangements, warehousing, and other things that people value.4

Some things should be noted about product-augmentation strategy. First, each augmentation adds cost. Second, augmented benefits soon become expected benefits and necessary

points-of-parity. Today's hotel guests expect cable or satellite television with a remote control and high-speed Internet access or two phone lines. This means competitors will have to

search for still other features and benefits. Third, as companies raise the price of their augmented product, some competitors offer a "stripped-down" version at a much lower price.

Thus, alongside the growth of fine hotels like Four Seasons and Ritz Carlton, we see the

emergence of lower-cost hotels and motels like Motel 6 and Comfort Inn, which cater to

clients who simply want the basic product.

i-

JAMESTOWN

CONTAINER

CO.

What could be harder to differentiate than corrugated cardboard? Yet, Jamestown Container Company, the lead

supplier of corrugated products for companies such as 3M, has formed strategic partnerships with area manufacturers to provide every part of the shipping system. It not only provides boxes, but also offers tape, shrinkwrap, and everything else needed either to display or to ship a customer's final product. "It's a combination for

survival," says the company's Chief Operating Officer. "More customers want to call one place for everything. We

n

have to keep reinventing ourselves and form these kinds of relationships to remain competitive."5

At the fifth level stands the potential product, which encompasses all the possible augmentations and transformations the product or offering might undergo in the future. Here is

where companies search for new ways to satisfy customers and distinguish their offer. For

instance, in an era when customers are demanding ever-faster Internet and wireless connections, Verizon is investing its capital in creating a raft of potential products:

r-

VERIZON

Rather than be seen as a follower in the highly competitive telecom industry, Verizon is pushing fast into totally

new territory. For one thing, Verizon is rolling out fiber-optic connections to every home and business in its

29-state territory over the next 10 to 15 years. This will allow the lightning-fast transmission of everything from

traditional phone service to HDTV. The company is no less aggressive when it comes to wireless technology.

Verizon has covered Manhattan with more than 1,000 Wi-Fi hot spots that lets any Verizon broadband subscriber

use a laptop to tap into the Net wirelessly when near a Verizon pay phone. The company is also deploying 3G, a

third-generation wireless service that lets customers make super-speedy Net connections from their mobile

phones. In short, the company is investing billions in services customers don't even know they want yet, but

a

which—Verizon is betting—will set the standard for the entire industry.6

Also consider the customization platforms new e-commerce sites are offering, from

which companies can learn by seeing what different customers prefer. Proctor & Gamble, for

example, has developed Reflect.com, which offers customized beauty products created

interactively on the Web site.

Product Classifications

Marketers have traditionally classified products on the basis of characteristics: durability, tangibility, and use (consumer or industrial). Each product type has an appropriate marketing-mix

strategy.7

DURABILITY AND TANGIBILITY Products can be classified into three groups, according to

durability and tangibility:

I. Nondurable goods are tangible goods normally consumed in one or a few uses, like beer

and soap. Because these goods are consumed quickly and purchased frequently, the

appropriate strategy is to make them available in many locations, charge only a small

markup, and advertise heavily to induce trial and build preference.

CHAPTER 12

374

PART 5

SHAPING THE MARKET OFFERINGS

2. Durable goods are tangible goods that normally survive many uses: refrigerators,

machine tools, and clothing. Durable products normally require more personal selling

and service, command a higher margin, and require more seller guarantees.

3. Services are intangible, inseparable, variable, and perishable products. As a result, they

normally require more quality control, supplier credibility, and adaptability. Examples

include haircuts, legal advice, and appliance repairs.

CONSUMER-GOODS CLASSIFICATION The vast array of goods consumers buy can be

classified on the basis of shopping habits. We can distinguish among convenience, shopping, specialty, and unsought goods.

The consumer usually purchases convenience goods frequently, immediately, and with a

minimum of effort. Examples include tobacco products, soaps, and newspapers.

Convenience goods can be further divided. Staples are goods consumers purchase on a regular basis. A buyer might routinely purchase Heinz ketchup, Crest toothpaste, and Ritz

crackers. Impulse goods are purchased without any planning or search effort. Candy bars

and magazines are impulse goods. Emergency goods are purchased when a need is urgent—

umbrellas during a rainstorm, boots and shovels during the first winter snowstorm.

Manufacturers of impluse and emergency goods will place them in those outlets where consumers are likely to experience an urge or compelling need to make a purchase.

Shopping goods are goods that the consumer, in the process of selection and purchase,

characteristically compares on such bases as suitability, quality, price, and style. Examples

include furniture, clothing, used cars, and major appliances. Shopping goods can be further

divided. Homogeneous shopping goods are similar in quality but different enough in price to

justify shopping comparisons. Heterogeneous shopping goods differ in product features and

services that may be more important than price. The seller of heterogeneous shopping goods

carries a wide assortment to satisfy individual tastes and must have well-trained salespeople

to inform and advise customers.

Specialty goods have unique characteristics or brand identification for which a sufficient

number of buyers are willing to make a special purchasing effort. Examples include cars,

stereo components, photographic equipment, and men's suits. A Mercedes is a specialty

good because interested buyers will travel far to buy one. Specialty goods do not involve

making comparisons; buyers invest time only to reach dealers carrying the wanted products.

Dealers do not need convenient locations, although they must let prospective buyers know

their locations.

Unsought goods are those the consumer does not know about or does not normally think

of buying, like smoke detectors. The classic examples of known but unsought goods are life

insurance, cemetery plots, gravestones, and encyclopedias. Unsought goods require advertising and personal-selling support.

INDUSTRIAL-GOODS CLASSIFICATION Industrial goods can be classified in terms of how

they enter the production process and their relative costliness. We can distinguish three

groups of industrial goods: materials and parts, capital items, and supplies and business services. Materials and parts are goods that enter the manufacturer's product completely. They

fall into two classes: raw materials and manufactured materials and parts. Raw materials fall

into two major groups: farm products (e.g., wheat, cotton, livestock, fruits, and vegetables)

and natural products (e.g., fish, lumber, crude petroleum, iron ore). Farm products are supplied by many producers, who turn them over to marketing intermediaries, who provide

assembly, grading, storage, transportation, and selling services. Their perishable and seasonal nature gives rise to special marketing practices. Their commodity character results in

relatively little advertising and promotional activity, with some exceptions. At times, commodity groups will launch campaigns to promote their product—potatoes, cheese, and beef.

Some producers brand their products—Dole salads, Mott's apples, and Chiquita bananas.

Natural products are limited in supply. They usually have great bulk and low unit value

and must be moved from producer to user. Fewer and larger producers often market them

directly to industrial users. Because the users depend on these materials, long-term supply

contracts are common. The homogeneity of natural materials limits the amount of demandcreation activity. Price and delivery reliability are the major factors influencing the selection

of suppliers.

Manufactured materials and parts fall into two categories: component materials (iron,

yarn, cement, wires) and component parts (small motors, tires, castings). Component materials are usually fabricated further—pig iron is made into steel, and yarn is woven into cloth.

SETTING PRODUCT STRATEGY

CHAPTER 12

375

A Beef Council ad, part of the "Beef, It's

What's for Dinner" campaign of TV and

print ads designed to promote beef as a

good food.

The standardized nature of component materials usually means that price and supplier reliability are key purchase factors. Component parts enter the finished product with no further

change in form, as when small motors are put into vacuum cleaners, and tires are put on

automobiles. Most manufactured materials and parts are sold directly to industrial users.

Price and service are major marketing considerations, and branding and advertising tend to

be less important.

Capital items are long-lasting goods that facilitate developing or managing the finished

product. They include two groups: installations and equipment. Installations consist of

buildings (factories, offices) and heavy equipment (generators, drill presses, mainframe

computers, elevators). Installations are major purchases. They are usually bought directly

from the producer, with the typical sale preceded by a long negotiation period. The producer's sales force includes technical personnel. Producers have to be willing to design to

specification and to supply postsale services. Advertising is much less important than personal selling.

Equipment comprises portable factory equipment and tools (hand tools, lift trucks) and

office equipment (personal computers, desks). These types of equipment do not become

part of a finished product. They have a shorter life than installations but a longer life than

operating supplies. Although some equipment manufacturers sell direct, more often they

use intermediaries, because the market is geographically dispersed, the buyers are numerous, and the orders are small. Quality, features, price, and service are major considerations.

The sales force tends to be more important than advertising, although the latter can be used

effectively.

Supplies and business services are short-term goods and services that facilitate developing or managing the finished product. Supplies are of two kinds: maintenance and repair

items (paint, nails, brooms), and operating supplies (lubricants, coal, writing paper, pencils).

Together, they go under the name of MRO goods. Supplies are the equivalent of convenience

376

PART 5

SHAPING THE MARKET OFFERINGS

goods; they are usually purchased with minimum effort on a straight rebuy basis. They are

normally marketed through intermediaries because of their low unit value and the great

number and geographic dispersion of customers. Price and service are important considerations, because suppliers are standardized and brand preference is not high.

Business services include maintenance and repair services (window cleaning, copier

repair) and business advisory services (legal, management consulting, advertising).

Maintenance and repair services are usually supplied under contract by small producers or

are available from the manufacturers of the original equipment. Business advisory services

are usually purchased on the basis of the supplier's reputation and staff.

Ill

Differentiation

To be branded, products must be differentiated. Physical products vary in their potential for

differentiation. At one extreme, we find products that allow little variation: chicken, aspirin,

and steel. Yet even here, some differentiation is possible: Perdue chickens, Bayer aspirin, and

India's Tata Steel have carved out distinct identities in their categories. Procter & Gamble

makes Tide, Cheer, and Gain laundry detergents, each with a separate brand identity. At the

other extreme are products capable of high differentiation, such as automobiles, commercial buildings, and furniture. Here the seller faces an abundance of design parameters,

including form, features, performance quality, conformance quality, durability, reliability,

repairability, and style.8

Marketers are always looking for new dimensions of differentiation. Otis Elevator

Company has upped the ante in its category by making its elevators smarter:

OTIS

ELEVATOR

COMPANY

At a typical bank of elevators in an office building lobby, you press the "up" button and take the first elevator that

comes, with no idea how many stops there will be until you get to your floor. Now Otis has developed a "smart"

elevator. You key in your floor on a centralized panel. The panel tells you which elevator is going to take you to

your floor. Your elevator takes you right to your floor and races back to the lobby. With this simple change, Otis

has managed to turn every elevator into an express. This remarkable differentiator means a speedier ride and

less groaning and sighing by riders, but it also has big benefits for builders. Buildings need fewer elevators for

a given density of people, so builders can use the extra space for people rather than people conveyers.9

Product Differentiation

FORM Many products can be differentiated in form—the size, shape, or physical structure

of a product. Consider the many possible forms taken by products such as aspirin. Although

aspirin is essentially a commodity, it can be differentiated by dosage size, shape, color, coating, or action time.

5 Most products can be offered with varying features that supplement its basic

function. A company can identify and select appropriate new features by surveying recent

buyers and then calculating customer value versus company cost for each potential feature.

The company should also consider how many people want each feature, how long it would

take to introduce each feature, and whether competitors could easily copy the feature.

Companies must also think in terms of feature bundles or packages. Auto companies often

manufacture cars at several "trim levels." This lowers manufacturing and inventory costs.

Each company must decide whether to offer feature customization at a higher cost or a few

standard packages at a lower cost.

PERFORMANCE QUALITY Most products are established at one of four performance levels: low, average, high, or superior. Performance quality is the level at which the product's

primary characteristics operate. Firms should not necessarily design the highest performance level possible. The manufacturer must design a performance level appropriate to the

target market and competitors' performance levels. A company must also manage performance quality through time. Continuously improving the product can produce the high

returns and market share. Lowering quality in an attempt to cut costs often has dire consequences. Schlitz, the number-two beer brand in the United States in the 1960s and 1970s,

SETTING PRODUCT STRATEGY

was driven into the dust because management adopted a financially motivated strategy to

increase its short-term profits and curry favor with shareholders. In fact, quality is becoming

an increasingly important parameter for differentiation as companies adopt a value model

and provide higher quality for less money. Cataloger J. Crew is raising the prices of its merchandise as it raises the quality bar higher:

J.

CREW

J. Crew is returning to a tradition of preppy quality goods. It is adding pleats to the backs of its shirts and having them made in Italy instead of China. Its shoes are also being made in Italy, and the company is tailoring

trousers to fit better. The cover of the Fall 2003 catalog reflected the company's emphasis on quality by crisply

portraying each color-dyed stitch, the weave of the wool, and each tiny pearl collar button.10

ONFORMANCI QUALITY Buyers expect products to have a high conformance quality,

which is the degree to which all the produced units are identical and meet the promised

specifications. Suppose a Porsche 944 is designed to accelerate to 60 miles per hour within

10 seconds. If every Porsche 944 coming off the assembly line does this, the model is said to

have high conformance quality. The problem with low conformance quality is that the product will disappoint some buyers.

DURABILITY Durability, a measure of the product's expected operating life under natural

or stressful conditions, is a valued attribute for certain products. Buyers will generally pay

more for vehicles and kitchen appliances that have a reputation for being long lasting.

However, this rule is subject to some qualifications. The extra price must not be excessive.

Furthermore, the product must not be subject to rapid technological obsolescence, as is the

case with personal computers and video cameras.

RELIABILITY Buyers normally will pay a premium for more reliable products. Reliability is

a measure of the probability that a product will not malfunction or fail within a specified

time period. Maytag, which manufactures major home appliances, has an outstanding reputation for creating reliable appliances.

REPAIRABILITY Repairability is a measure of the ease of fixing a product when it malfunctions or fails. Ideal repairability would exist if users could fix the product themselves with little cost in money or time. Some products include a diagnostic feature that allows service

people to correct a problem over the telephone or advise the user how to correct it. Many

computer hardware and software companies offer technical support over the phone, or by

fax or e-mail. Cisco put together a Knowledge Base of Frequently Asked Questions (FAQs) on

its Web site which it estimates handles about 80 percent of the roughly 4 million monthly

requests for information, and saves the company $250 million annually. Each new call and

solution goes to a tech writer who adds the solution to the FAQs, thus reducing the number

of future phone calls.11

STYLE Style describes the product's look and feel to the buyer. Car buyers pay a premium

for Jaguars because of their extraordinary look. Aesthetics play a key role in such brands as

Absolut vodka, Apple computers, Montblanc pens, Godiva chocolate, and Harley-Davidson

motorcycles.12 Style has the advantage of creating distinctiveness that is difficult to copy. On

the negative side, strong style does not always mean high performance. A car may look sensational but spend a lot of time in the repair shop.

Design: The Integrative Force

As competition intensifies, design offers a potent way to differentiate and position a company's products and services.13 In increasingly fast-paced markets, price, and technology are

not enough. Design is the factor that will often give a company its competitive edge. Design

is the totality of features that affect how a product looks and functions in terms of customer

requirements.

Design is particularly important in making and marketing retail services, apparel, packaged

goods, and durable equipment. All the qualities we have discussed are design parameters. The

CHAPTER 12

377

378

PART 5

SHAPING THE MARKET OFFERINGS

designer has to figure out how much to invest in form, feature development, performance,

conformance, durability, reliability, repairability, and style. To the company, a well-designed

product is one that is easy to manufacture and distribute. To the customer, a well-designed

product is one that is pleasant to look at and easy to open, install, use, repair, and dispose of.

The designer has to take all these factors into account.

The arguments for good design are particularly compelling for smaller consumer-products

companies and start-ups that don't have big advertising dollars. That's how one small brewery

got noticed.

FLYING

FISH

BREWING

CO.

Before he started his company, founder Gene Muller sent Pentagram Design Company a case of beer bottles

with blank labels and a note that said, "This space available for good design." He told Pentagram partner

Michael Beirut that he wanted something a breed apart from the usual mountain-range motif themes that everyone else seemed to be doing. The Pentagram design Muller liked most and picked for his start-up was a fishbone propeller plane. Flying Fish Brewing Company was born. Not only has the eye-catching image helped sell

the beer, but the company's merchandise sales (T-shirts, hats, and pint glasses) have been surprisingly strong,

especially at music festivals.14

Certain countries are winning on design: Italian design in apparel and furniture;

Scandinavian design for functionality, aesthetics, and environmental consciousness. Braun, a

German division of Gillette, has elevated design to a high art in its electric shavers, coffeemakers, hair dryers, and food processors. The company's design department enjoys equal status

with engineering and manufacturing. The Danish firm Bang & Olufsen has received many

kudos for the design of its stereos, TV equipment, and telephones. "Marketing Insight: Design

as a Powerful Marketing Tool" describes some successes and failures in design.

Services Differentiation

When the physical product cannot easily be differentiated, the key to competitive success

may lie in adding valued services and improving their quality. The main service differentiators are: ordering ease, delivery, installation, customer training, customer consulting, and

maintenance and repair.

ORDERING EASE Ordering ease refers to how easy it is for the customer to place an order

with the company. Baxter Healthcare has eased the ordering process by supplying hospitals

with computer terminals through which they

send orders directly to Baxter. Many banks

now provide h o m e banking software to help

customers get information and do transactions more efficiently. Consumers are now able

to order and receive groceries without going to

the supermarket.

A group of franchisees learning the business at McDonald's Hamburger U. in Oak Brook, Illinois.

DELIVERY Delivery refers to how well the

product or service is delivered to the customer. It includes speed, accuracy, and care

attending the delivery process. Today's customers have grown to expect delivery speed:

pizza delivered in one-half hour, film developed in one hour, eyeglasses m a d e in one

hour, cars lubricated in 15 minutes. Levi

Strauss, Benetton, and The Limited have

a d o p t e d computerized quick response systems (QRS) that link the information systems

of their suppliers, manufacturing plants, distribution centers, and retailing outlets.

Cemex, a giant cement company based in

Mexico, has transformed the cement busi-

SETTING PRODUCT STRATEGY

MARKETING INSIGHT

C7

Manufacturers, service providers, and retailers seek new designs to

create differentiation and establish a more complete connection with

consumers. Holistic marketers recognize the emotional power of

design and the importance to consumers of how things look and feel.

Design is now more fully integrated into the marketing management

process. For example:

•

After seeing some of their brands lose share to competitors with

stronger designs and aesthetics, Procter & Gamble appointed a

Chief Design Officer in 2001 and now hands out an A. G. Lafley

Design award each Fall. Lafley, P&G's CEO, is credited with pushing for more products to involve design at the front end—not as

an afterthought. These products, such as Crest Whitestrips, Olay

Daily Facials, and the whole line of Swifter Quick Clean products,

have generated more trials, more repurchases, and more sales.

CHAPTER 12

DESIGN AS A POWERFUL MARKETING TOOL

thetics is often the only way to make a product stand out." Design

can shift consumer perceptions to make brand experiences more

rewarding. Consider the lengths Boeing went to to make its 777 airplane seem roomier and more comfortable. Raised center bins, side

luggage bins, divider panels, gently arched ceilings, and raised seats

make the aircraft interior seem bigger. As one design engineer noted,

"If we do our jobs, people don't realize what we have done. They just

say they feel more comfortable."

Designers sometimes put a human face—literally—on their

products. The Porsche Boxster's bulges and curves can be seen as

suggestive of muscle; the Apple iMac was thought by one designer to

be "a head stuck to a body via a long skinny arm"; and Microsoft's

optical mouse can be seen as an outstretched hand. When Frog

Design set out to make a Disney cordless phone for kids, it wanted

the design to live up to the famed Disney imagery. After exhaustive

• Sweden's IKEA has become one of the top furniture retailers in the study, Frog defined the composite elements of a Disney character

world in part through its ability to design and manufacture inex- and applied it to the phone. The eyes were interpreted in terms of the

pensive furniture that doesn't seem cheap. Another Scandinavian LCD screen and were made as big as possible; the torso was intercompany, Finland's Nokia, is credited with taking a little black blob preted in terms of the housing of the phone and was S-shaped, with

with tiny buttons and turning it into an object of desire. Nokia was a roundness in the top front and bottom back; and the feet were

the first to introduce user-changeable covers for cellphones, the interpreted in terms of the base and charger stand, which used builtfirst to have elliptical-shaped, soft, and friendly forms, and the first up plastic to emulate a sock pushed up around an ankle.

with big screens. In the early 1990s, Nokia controlled only 12 perA bad design can also ruin a product's prospects. Sony's e-Villa

cent of the global market for cell phones. Today, it is the world

Internet appliance was intended to allow consumers to have Internet

leader in handsets, with 38 percent of the market.

access from their kitchens. But at nearly 32 pounds and 16 inches,

With an increasingly visually oriented culture, translating brand the mammoth product was so awkward and heavy that the owner's

meaning and positioning through design is critical. "In a crowded manual recommended customers bend their legs, not their back, to

marketplace," writes Virginia Postrel in The Substance of Style, "aes- pick it up. The product was eventually withdrawn after three months.

Sources: A. G. Lafley, "Delivering Delight," Fast Company, June 2004, p. 51; Frank Nuovo, "A Call for Fashion," Fast Company, June 2004, p. 52; Bobbie

Gossage, "Strategies: Designing Success," Inc. Magazine, May 2004, pp. 27-29; Jim Hopkins, "When the Devil Is in the Design," USA Today, December

31, 2001, p. 3B; J. Lynn Lunsford and Daniel Michaels, "Masters of Illusion," Wall Street Journal, November 25, 2002, pp. B1, B5; Jerome Kathman,

"Building Leadership Brands by Design," Brandweek, December 1, 2003, p. 20; Bob Parks, "Deconstructing Cute," Business 2.0, December

2002/January 2003, pp. 47-50; Lisa Margonelli, "How Ikea Designs Its Sexy Price Tags," Business 2.0, October 2002, pp. 106-112.

ness by promising to deliver concrete faster than pizza. Cemex equips every truck with a

global positioning system (GPS) so that its real-time location is known and full information is available to drivers and dispatchers. Cemex is able to promise that if your load is

more than 10 minutes late, you get a 20 percent discount.15

INSTALLATION Installation refers to the work done to make a product operational in its

planned location. Buyers of heavy equipment expect good installation service.

Differentiating at this point in the consumption chain is particularly important for companies with complex products. Ease of installation becomes a true selling point, especially

when the target market is technology novices. For customers wishing to connect to the

Internet using a high-speed digital subscriber line (DSL), Pacific Bell developed installation

kits that included an interactive software setup program so customers could complete their

DSL setup in less than an hour.16

CUSTOMER TRAINING Customer training refers to training the customer's employees to

use the vendor's equipment properly and efficiently. General Electric not only sells and

installs expensive X-ray equipment in hospitals; it also gives extensive training to users of

this equipment. McDonald's requires its new franchisees to attend Hamburger University in

Oak Brook, Illinois, for two weeks, to learn how to manage the franchise properly.

379

380

PART 5

SHAPING THE MARKET OFFERINGS

CUSTOMER CONSULTING Customer consulting refers to data, information systems, and

advice services that the seller offers to buyers.

-

HERMAN

MILLER

INC.

Herman Miller, a large office furniture company, has partnered with a California firm to show corporate clients

how to get the full benefits out of its furnishings. The firm, Future Industrial Technologies, specializes in workplace ergonomics training. Working through Herman Miller's dealership network, customers can arrange twohour training sessions for small groups of employees. The sessions are run by some of the 1,200 physical therapists, occupational therapists, registered nurses, and chiropractors who work under contract to Future Industrial

Technologies. While customer ergonomics training results in only modest revenue gains for Herman Miller, the

company feels that teaching healthy work habits creates higher levels of satisfaction for customers and sets

Herman Miller products apart.17

MAINTENANCE AND REPAIR Maintenance and repair describes the service program for

helping customers keep purchased products in good working order. Hewlett-Packard offers

online technical support, or "e-support," for its customers. In the event of a service problem,

customers can use various online tools to find a solution. Those aware of the specific problem can search an online database for fixes; those unaware can use diagnostic software that

finds the problem and searches the online database for an automatic fix. Customers can also

seek online help from a technician.18

-

BEST

BUY

As consolidation and competitive pricing among electronics retailers continues, companies are increasingly

looking for new ways to stand out in the crowd. That's why Best Buy contracted with the Geek Squad, a

small residential computer services company in its home market of Minnesota's twin cities, to revamp the

chain's in-store computer repair services. Previously, PCs were sent to regional repair facilities, a process

that was time-consuming and ultimately contributed to a high degree of consumer dissatisfaction. Now

about half of all repairs are made in Best Buy stores. But the real differentiator is the Geek Squad's ability

to make house calls (at a higher fee). Geek Squad house calls are called a "Beetle Roll" because of the

squad's signature fleet of hip VW Beetles. Geek Squad employees even dress differently for house calls—

they wear a distinctive "geek" look as opposed to the traditional Best Buy blue they wear at the in-store service centers.19

Ill Product and Brand Relationships

Each product can be related to other products.

The Product Hierarchy

The product hierarchy stretches from basic needs to particular items that satisfy those

needs. We can identify six levels of the product hierarchy (using life insurance as an

example):

1. Need family -The core need that underlies the existence of a product family. Example:

security.

2. Product family - All the product classes that can satisfy a core need with reasonable

effectiveness. Example: savings and income.

3. Product class -A group of products within the product family recognized as having a

certain functional coherence. Also known as product category. Example: financial

instruments.

SETTING PRODUCT STRATEGY

CHAPTER 12

381

4. Product line -A group of products within a product class that are closely related because

they perform a similar function, are sold to the same customer groups, are marketed

through the same outlets or channels, or fall within given price ranges. A product line

may be composed of different brands or a single family brand or individual brand that

has been line extended. Example: life insurance.

5. Product type - A group of items within a product line that share one of several possible

forms of the product. Example: term life insurance.

6. Item (also called stockkeeping unit or product variant) - A distinct unit within a brand

or product line distinguishable by size, price, appearance, or some other attribute.

Example: Prudential renewable term life insurance.

Product Systems and Mixes

A product system is a group of diverse but related items that function in a compatible

manner. For example, PalmOne handheld and smartphone product lines come with

attachable products including headsets, cameras, keyboards, presentation projectors,

e-books, MP3 players, and voice recorders. A product mix (also called a product assortment) is the set of all products and items a particular seller offers for sale. A product mix

consists of various product lines. In General Electric's Consumer Appliance Division,

there are product-line managers for refrigerators, stoves, and washing machines. NEC's

(Japan) product mix consists of communication products and computer products.

Michelin has three product lines: tires, maps, and restaurant-rating services. At

Northwestern University, there are separate academic deans for the medical school, law

school, business school, engineering school, music school,

speech school, journalism school, and liberal arts school.

A company's product mix has a certain width, length, depth, and

consistency. These concepts are illustrated in Table 12.1 for selected

Procter & Gamble consumer products.

• The width of a product mix refers to how many different product

lines the company carries. Table 12.1 shows a product-mix width of

five lines. (In fact, P&G produces many additional lines.)

a The depth of a product mix refers to the total number of items in

the mix. In Table 12.1, it is 20. We can also talk about the average

length of a line. This is obtained by dividing the total length (here

20) by the number of lines (here 5), or an average product length

of 4.

E The width of a product mix refers to how many variants are

offered of each product in the line. If Tide comes in two scents

(Mountain Spring and Regular), two formulations (liquid and powder), and two additives (with or without bleach), Tide has a depth of

eight as there are eight distinct variants. The average depth of P&G's

product mix can be calculated by averaging the number of variants

within the brand groups.

v. The consistency of the product mix refers to how closely related

the various product lines are in end use, production requirements,

distribution channels, or some other way. P&G's product lines are

consistent insofar as they are consumer goods that go through the

same distribution channels. The lines are less consistent insofar as

they perform different functions for the buyers.

These four product-mix dimensions permit the company to

expand its business in four ways. It can add new product lines, thus

widening its product mix. It can lengthen each product line. It can

add more product variants to each product and deepen its product

mix. Finally, a company can pursue more product-line consistency.

To make these product and brand decisions, it is useful to conduct

product-line analysis.

The PalmOne Zire 31 handheld. Owners can select from more than

20,000 available applications and use the expansion slot to add more

memory, applications, or MP3 tunes.

382

PART 5

TABLE 1 2 . 1

SHAPING THE MARKET OFFERINGS

Product-Mix Width and Product-Line Length for Procter & Gamble Products (including Dates of Introduction)

Product-Mix Width

PRODUCT

LINE

LENGTH

Detergents

Toothpaste

Bar Soap

Disposable

Diapers

Paper Products

Ivory Snow (1930)

Gleem (1952)

Ivory (1879)

Pampers (1961)

Charmin (1928)

Dreft (1933)

Crest (1955)

Camay (1926)

Luvs (1976)

Puffs (1960)

Tide (1946)

Zest (1952)

Cheer (1950)

Safeguard (1963)

Dash (1954)

Oil of d a y (1993)

Bounty (1965)

Bold (1965)

Gain (1966)

Era (1972)

Product-Line Analysis

In offering a product line, companies normally develop a basic platform and modules that

can be added to meet different customer requirements. Car manufacturers build their cars

around a basic platform. Homebuilders show a model home to which additional features

can be added. This modular approach enables the company to offer variety while lowering

production costs.

Product-line managers need to know the sales and profits of each item in their line in

order to determine which items to build, maintain, harvest, or divest.20 They also need to

understand each product line's market profile.

SALES AND PROFITS Figure 12.3 shows a sales and profit report for a five-item product

line. The first item accounts for 50 percent of total sales and 30 percent of total profits. The

first two items account for 80 percent of total sales and 60 percent of total profits. If these

two items were suddenly hurt by a competitor, the line's sales and profitability could collapse. These items must be carefully monitored and protected. At the other end, the last item

delivers only 5 percent of the product line's sales and profits. The product-line manager may

consider dropping this item unless it has strong growth potential.

Every company's product portfolio contains products with different margins.

Supermarkets make almost no margin on bread and milk; reasonable margins on canned

and frozen foods; and even better margins on flowers, ethnic food lines, and freshly baked

goods. A local telephone company makes different margins on its core telephone service,

call waiting, caller ID, and voice mail.

A company can classify its products into four types that yield different gross margins,

depending on sales volume and promotion. To illustrate with personal computers:

• Core product. Basic computers that produce high sales volume and are heavily promoted

but with low margins because they are viewed as undifferentiated commodities.

• Staples. Items with lower sales volume and no promotion, such as faster CPUs or bigger

memories. These yield a somewhat higher margin.

m Specialties. Items with lower sales volume but which might be highly promoted, such as

digital moviemaking equipment; or might generate income for services, such as personal

delivery, installation, or on-site training.

& Convenience items. Peripheral items that sell in high volume but receive less promotion,

such as computer monitors, printers, upscale video or sound cards, and software.

Consumers tend to buy them where they buy the original equipment because it is more convenient than making further shopping trips. These items can carry higher margins.

SETTING PRODUCT STRATEGY

CHAPTER 12

383

FIG. 12.3 I

Product-item Contributions to a Product

Line's Total Sales and Profits

The main point is that companies should recognize that these items differ in their potential for being priced higher or advertised more as ways to increase their sales, margins,

or both.21

MARKET PROFILE The product-line manager must review how the line is positioned

against competitors' lines. Consider paper company X with a paperboard product line.22

Two paperboard attributes are weight and finish quality. Paper weight is usually offered at

standard levels of 90, 120, 150, and 180 weight. Finish quality is offered at low, medium,

and high levels. Figure 12.4 shows the location of the various product-line items of company X and four competitors, A, B, C, and D. Competitor A sells two product items in the

extra-high weight class ranging from medium to low finish quality. Competitor B sells four

items that vary in weight and finish quality. Competitor C sells three items in which the

greater the weight, the greater the finish quality. Competitor D sells three items, all lightweight but varying in finish quality. Company X offers three items that vary in weight and

finish quality.

The product map shows which competitors' items are competing against company

X's items. For example, company X's low-weight, medium-quality paper competes

against competitor D's and B's papers, but its high-weight, medium-quality paper has no

direct competitor. The map also reveals possible locations for new items. No manufacturer offers a high-weight, low-quality paper. If company X estimates a strong unmet

demand and can produce and price this paper at low cost, it could consider adding this

item to its line.

Another benefit of product mapping is that it identifies market segments. Figure 12.4

shows the types of paper, by weight and quality, preferred by the general printing industry,

the point-of-purchase display industry, and the office supply industry. The map shows that

FIG. 12.4 I

Product Map for a Paper-Product Line

Source: Benson P. Shapiro, Industrial Product

Policy: Managing the Existing Product Line.

(Cambridge, MA: Marketing Science Institute

Report No. 77-110).

Medium

Low (90)

Medium (120)

Paperweight

High (150)

Extra high (11

384

PART 5

SHAPING THE MARKET OFFERINGS

company X is well positioned to serve the needs of the general printing industry but is less

effective in serving the other two industries.

Product-line analysis provides information for two key decision areas—product-line

length and product-mix pricing.

Product-Line Length

Company objectives influence product-line length. One objective is to create a product line

to induce upselling: Thus General Motors would like to move customers up from the

Chevrolet to the Buick to the Cadillac. A different objective is to create a product line that

facilitates cross-selling: Hewlett-Packard sells printers as well as computers. Still another

objective is to create a product line that protects against economic ups and downs;

Electrolux offers white goods such as refrigerators, dishwashers, and vacuum cleaners under

different brand names in the discount, middle-market, and premium segments, in part in

case the economy moves up or down.23 Companies seeking high market share and market

growth will generally carry longer product lines. Companies that emphasize high profitability will carry shorter lines consisting of carefully chosen items.

Product lines tend to lengthen over time. Excess manufacturing capacity puts pressure on the

product-line manager to develop new items. The sales force and distributors also pressure the

company for a more complete product line to satisfy customers. But as items are added, costs

rise: design and engineering costs, inventory-carrying costs, manufacturing-changeover costs,

order-processing costs, transportation costs, and new-item promotional costs. Eventually, someone calls a halt: Top management may stop development because of insufficient funds or manufacturing capacity. The controller may call for a study of money-losing items. A pattern of product-line growth followed by massive pruning may repeat itself many times.

A company lengthens its product line in two ways: by line stretching and line filling.

LINE STRETCHING Every company's product line covers a certain part of the total possible

range. For example, BMW automobiles are located in the upper price range of the automobile market. Line stretching occurs when a company lengthens its product line beyond its

current range. The company can stretch its line down-market, up-market, or both ways.

D o w n - M a r k e t S t r e t c h A company positioned in the middle market may want

to introduce a lower-priced line for any of three reasons:

1. The company may notice strong growth opportunities as mass retailers such as Wal-Mart,

Best Buy, and others attract a growing number of shoppers who want value-priced goods.

2. The company may wish to tie up lower-end competitors who might otherwise try to

move up-market. If the company has been attacked by a low-end competitor, it often

decides to counterattack by entering the low end of the market.

3. The company may find that the middle market is stagnating or declining.

A company faces a number of naming choices in deciding to move down-market. Sony,

for example, faced three choices:

1. Use the name Sony on all of its offerings. (Sony did this.)

2. Introduce lower-priced offerings using a sub-brand name, such as Sony Value Line.

Other companies have done this, such as Gillette with Gillette Good News and Ramada

Limited. The risks are that the Sony name loses some of its quality image and that some

Sony buyers might switch to the lower-priced offerings.

3. Introduce the lower-priced offerings under a different name, without mentioning Sony;

but Sony would have to spend a lot of money to build up the new brand name, and the

mass merchants may not even accept a brand that lacks the Sony name.

Moving down-market carries risks. Kodak introduced Kodak Funtime film to counter

lower-priced brands, but it did not price Kodak Funtime low enough to match the lowerpriced film. It also found some of its regular customers buying Funtime, so it was cannibalizing its core brand. It withdrew the product. On the other hand, Mercedes successfully

introduced its C-Class cars at $30,000 without injuring its ability to sell other Mercedes cars

for $100,000 and up. John Deere introduced a lower-priced line of lawn tractors called Sabre

from John Deere while still selling its more expensive tractors under the John Deere name.

SETTING PRODUCT STRATEGY

CHAPTER 12

385

A print ad for Gallo of Sonoma showing

members of the younger generation of

the Gallo family, with the tagline: "New

Generation. World Class."

U p - M a r k e t S t r e t c h Companies may wish to enter the high end of the market

for more growth, higher margins, or simply to position themselves as full-line manufacturers. Many markets have spawned surprising upscale segments: Starbucks in coffee,

Haagen-Dazs in ice cream, and Evian in bottled water. The leading Japanese auto companies have each introduced an upscale automobile: Toyota's Lexus; Nissan's Infiniti; and

Honda's Acura. Note that they invented entirely new names rather than using or including

their own names.

Other companies have included their own name in moving up-market. Gallo introduced

Gallo of Sonoma (priced at $10 to $30 a bottle) to compete in the premium wine segment,

using the founder's grandchildren as spokespeople in an intensive push-and-pull campaign. With a hip, young, and fun image, case sales volume tripled to 680,000 in 1999.

General Electric introduced the GE Profile brand for its large appliance offerings in the

upscale market.24 Some brands have used modifiers to signal a noticeable, although presumably not dramatic, quality improvement, such as Ultra Dry Pampers, Extra Strength

Tylenol, or PowerPro Dustbuster Plus.

Two-Way Stretch Companies serving the middle market might decide to stretch their

line in both directions. Texas Instruments (TI) introduced its first calculators in the

medium-price-medium-quality end of the market. Gradually, it added calculators at the

lower end, taking market share away from Bowmar, and at the higher end to compete

386

PART 5

SHAPING THE MARKET OFFERINGS

with Hewlett-Packard. This two-way stretch won TI early market leadership in the handcalculator market.

Holiday Inn Worldwide also has performed a two-way stretch of its hotel product line.

The hotel chain broke its domestic hotels into five separate chains to tap into five different

benefit segments—the upscale Crowne Plaza, the traditional Holiday Inn, the budget

Holiday Inn Express, and the business-oriented Holiday Inn Select and Holiday Inn Suites &

Rooms. Different branded chains received different marketing programs and emphasis.

Holiday Inn Express has been advertised with the humorous "Stay Smart" advertising campaign showing the brilliant feats that ordinary people could attempt after staying at the

chain. By basing the development of these brands on distinct consumer targets with unique

needs, Holiday Inn is able to ensure against overlap between brands.

LINE FILLING A product line can also be lengthened by adding more items within the

present range. There are several motives for line filling: reaching for incremental profits,

trying to satisfy dealers who complain about lost sales because of missing items in the line,

trying to utilize excess capacity, trying to be the leading full-line company, and trying to

plug holes to keep out competitors.

BMW

AG

In four years BMW has morphea" from a one-brand, five-model carmaker into a three-brand, 10-model powerhouse. Not only has the carmaker expanded BMW's product range downward with Mini Coopers and its compact

1 -series models, but it has also built it upward with Rolls-Royce, while filling the gaps in between with its X3 Sports

Activity Vehicle, and a 6-series coupe. The company has used line filling successfully to boost its appeal to the

wannabe-rich, the rich, and the super-rich, all without departing from its pure premium positioning.25

Line filling is overdone if it results in self-cannibalization and customer confusion. The

company needs to differentiate each item in the consumer's mind. Each item should possess a just-noticeable difference. According to Weber's law, customers are more attuned to

relative than to absolute difference.26 They will perceive the difference between boards

2 and 3 feet long and boards 20 and 30 feet long but not between boards 29 and 30 feet

long. The company should also check that the proposed item meets a market need and is

not being added simply to satisfy an internal need. The infamous Edsel automobile, on

which Ford lost $350 million in the late 1950s, met Ford's internal positioning needs for a

car between its Ford and Lincoln lines but not the market's needs.

LINE MODERNIZATION, FEATURING, AND PRUNING Product lines need to be modernized. A company's machine tools might have a 1970s look and lose out to newer-styled competitors' lines. The issue is whether to overhaul the line piecemeal or all at once. A piecemeal

approach allows the company to see how customers and dealers take to the new style. It is

also less draining on the company's cash flow, but it allows competitors to see changes and

to start redesigning their own lines.

In rapidly changing product markets, modernization is continuous. Companies plan

improvements to encourage customer migration to higher-valued, higher-priced items.

Microprocessor companies such as Intel and AMD, and software companies such as

Microsoft and Oracle, continually introduce more advanced versions of their products. A

major issue is timing improvements so they do not appear too early (damaging sales of the

current line) or too late (after the competition has established a strong reputation for more

advanced equipment).

The product-line manager typically selects one or a few items in the line to feature. Sears

will announce a special low-priced washing machine to attract customers. At other times,

managers will feature a high-end item to lend prestige to the product line. Sometimes a

company finds one end of its line selling well and the other end selling poorly. The company

may try to boost demand for the slower sellers, especially if they are produced in a factory

that is idled by lack of demand; but it could be counterargued that the company should promote items that sell well rather than try to prop up weak items.

Product-line managers must periodically review the line for deadwood that is depressing

profits. "Marketing Insight: Rationalizing Brand Portfolios for Growth" describes some

SETTING PRODUCT STRATEGY

MARKETING INSIGHT

CHAPTER 12

RATIONALIZING BRAND PORTFOLIOS FOR GROWTH

In 1999, Unilever owned more than 1,600 distinct brands. Some of

Unilever's famed brands include Lipton tea, Snuggle fabric softener,

Ragu pasta sauces, Bird's-Eye frozen foods, Close-Up toothpaste,

Calvin Klein fragrances, and Dove personal-care products. But more

than 90 percent of its profits came from just 400 brands. That year, the

company announced its "Path to Growth" program designed to get the

most value from its brand portfolio by eliminating three-quarters of its

brands by 2003. The company intended to retain global brands such as

Lipton, as well as regional brands and "local jewels" such as Persil, the

leading detergent in the United Kingdom. Unilever co-chairman Niall

FitzGerald likened the brand reduction to weeding a garden so "the

light and air get in to the blooms which are likely to grow the best."

Unilever is not alone. Multibrand companies all over the world are

attempting to optimize their brand portfolios. In many cases, this has

led to a greater focus on core brand growth and to concentrating

energy and resources on the biggest and most established brands.

Hasbro has designated a set of core toy brands, including Gl Joe,

Transformers, and My Little Pony, to emphasize in its marketing.

Procter & Gamble's "back to basics strategy" concentrates on its thirteen $1 billion-plus brands, such as Tide, Crest, Pampers, and

Pringles.

At the same time, firms have to be careful to avoid overreliance

on existing brands at the expense of any new brands. Kraft spent the

early part of the 2000s introducing one line extension after another

of its established brands, such as Oreo cookies, Chips Ahoy, and

Jell-0. Some extensions failed. A Chips Ahoy extension, Gooey Warm

n' Chewy, turned out to be tricky to eat and too pricey. Extension proliferation meant that the company missed out on important health

and nutrition trends in the marketplace. Stagnant sales led to the

ouster of co-CEO Betsy Holden in December 2003.

Sources: John Willman, "Leaner, Cleaner, and Healthier Is the Stated Aim," Financial Times, February 23, 2000; John Thornhill, "A Bad Time to Be in

Consumer Goods," Financial Times, September 28, 2000; "Unilever's Goal: 'Power Brands'," Advertising Age, January 3, 2000; "Unilever Axes 25,000

Jobs," CNNfn, February 22,2000; Harriet Marsh, "Unilever a Year Down the 'Path'," Marketing, February 22,2001, p. 30. Patricia O'Connell, "A Chat with

Unilever's Niall Fitzgerald," BusinessWeek Online, August 2,2001; Nirmalya Kumar, "Kill a Brand, Keep a Customer," Harvard Business Review (December

2003): 86-95; Sarah Ellison, "Kraft's Stale Strategy," Wall Street Journal, December 18, 2003, pp. B1, B6; Brad Stone, "Back to Basics," Newsweek,

August 4, 2003, pp. 42-44.

developments with that strategy. The weak items can be identified through sales and cost

analysis. A chemical company cut down its line from 217 to the 93 products with the largest

volume, the largest contribution to profits, and the greatest long-term potential. Pruning is

also done when the company is short of production capacity. Companies typically shorten

their product lines in periods of tight demand and lengthen their lines in periods of slow

demand.

Product-Mix Pricing

Chapter 14 describes pricing concepts, strategies, and tactics in detail, but it is useful to consider some basic product-mix pricing issues here. Price-setting logic must be modified when

the product is part of a product mix. In this case, the firm searches for a set of prices that

maximizes profits on the total mix. Pricing is difficult because the various products have

demand and cost interrelationships and are subject to different degrees of competition. We

can distinguish six situations involving product-mix pricing: product-line pricing, optionalfeature pricing, captive-product pricing, two-part pricing, by-product pricing, and productbundling pricing.

PRODUCT-LINE PRICING Companies normally develop product lines rather than single

products and introduce price steps.

INTEL

Intel has segmented its product line into microprocessors aimed at specific markets, such as cheap PCs, midtier "performance" PCs, and powerful servers. This strategy let Intel balance thin profits from chips like the

Celeron—new models of which sell for as little as $150 and go into low-priced PCs—with cash cows like the

Itanium workstation and server chips, which cost up to $4,200 each. The company's most profitable chips are

the Pentium 4 chips, priced between $300 and $600, depending on processor speed.27

387

388

PART 5

SHAPING THE MARKET OFFERINGS

Print ad for Intel® Centrino™, part of

Intel's product line of microprocessors

segmented by market. Centrino mobile

technology is a set of notebook

technologies designed specifically for

wireless notebook PCs, and for the top of

the market.

In many lines of trade, sellers use well-established price points for the products in

their line. A men's clothing store might carry men's suits at three price levels: $200, $400,

and $600. Customers will associate low-, average-, and high-quality suits with the three

price points. The seller's task is to establish perceived quality differences that justify the

price differences.

OPTIONAL-FEATURE PRICING Many companies offer optional products, features, and

services along with their main product. The automobile buyer can order electric window

controls, defoggers, light dimmers, and an extended warranty. Pricing is a sticky problem,

because companies must decide which items to include in the standard price and which to

offer as options. For many years, U.S. auto companies advertised a stripped-down model for

$10,000 to pull people into showrooms. The economy model was stripped of so many features that most buyers left the showroom spending $13,000.

Restaurants face a similar pricing problem. Customers can often order liquor in addition

to the meal. Many restaurants price their liquor high and their food low. The food revenue

covers costs, and the liquor produces the profit. This explains why servers often press hard

to get customers to order drinks. Other restaurants price their liquor low and food high to

draw in a drinking crowd.

CAPTIVE-PRODUCT PRICING Some products require the use of ancillary, or captive,

products. Manufacturers of razors, digital phones, and cameras often price them low and

set high markups on razor blades and film, respectively. AT&T may give a cellular phone free

if the person commits to buying two years of phone service.

SETTING PRODUCT STRATEGY

•

HEWLETT-PACKARD

In 1996, Hewlett-Packard (HP) began drastically cutting prices on its printers, by as much as 60 percent in some

cases. HP could afford to make such dramatic cuts because customers typically spend twice as much on

replacement ink cartridges, toner, and specialty paper as on the actual printer over the life of the product. As the

price of printers dropped, printer sales rose, as did the number of aftermarket sales, HP now owns about 40 percent of the worldwide printer business. Its inkjet supplies carry 35 percent profit margins and generated

$2.2 billion in operating profits in 2002—over 70 percent of the company's total.28

There is a danger in pricing the captive product too high in the aftermarket. Caterpillar,

for example, makes high profits in the aftermarket by pricing its parts and service high. This

practice has given rise to "pirates," who counterfeit the parts and sell them to "shady tree"

mechanics who install them, sometimes without passing on the cost savings to customers.

Meanwhile, Caterpillar loses sales.29

TWO-PART PRICING Service firms often engage in two-part pricing, consisting of a

fixed fee plus a variable usage fee. Telephone users pay a minimum monthly fee plus

charges for calls beyond a certain area. Amusement parks charge an admission fee plus

fees for rides over a certain minimum. The service firm faces a problem similar to

captive-product pricing—namely, how much to charge for the basic service and how

much for the variable usage. The fixed fee should be low enough to induce purchase of

the service; the profit can then be made on the usage fees.

BY-PRODUCT PRICING The production of certain goods—meats, petroleum products, and

other chemicals—often results in by-products. If the by-products have value to a customer

group, they should be priced on their value. Any income earned on the by-products will

make it easier for the company to charge a lower price on its main product if competition

forces it to do so. Australia's CSR was originally named Colonial Sugar Refinery and its early

reputation was formed as a sugar company. The company began to sell by-products of its

sugar cane: waste sugar cane fiber was used to manufacture wallboard. By the mid 1990s,

through product development and acquisition, CSR had become one of the top 10 companies in Australia selling building and construction materials.

PRODUCT-BUNDLING PRICING Sellers often bundle products and features. Pure bundling

occurs when a firm only offers its products as a bundle. Michael Ovitz's former company,

Artists Management Group, would sign up a "hot" actor if the film company would also

accept other talents that Ovitz represented (directors, writers, scripts). This is a form of tiedin sales. In mixed bundling, the seller offers goods both individually and in bundles. When

offering a mixed bundle, the seller normally charges less for the bundle than if the items

were purchased separately. An auto manufacturer might offer an option package at less than

the cost of buying all the options separately. A theater company will price a season subscription at less than the cost of buying all the performances separately. Because customers

may not have planned to buy all the components, the savings on the price bundle must be

substantial enough to induce them to buy the bundle.30

Some customers will want less than the whole bundle. Suppose a medical-equipment

supplier's offer includes free delivery and training. A particular customer might ask to forgo

the free delivery and training in exchange for a lower price. The customer is asking the seller

to "unbundle" or "rebundle" its offer. If a supplier saves $100 by not supplying delivery and

reduces the customer's price by $80, the supplier has kept the customer happy while increasing its profit by $20.

Studies have shown that as promotional activity increases on individual items in the bundle, buyers perceive less saving on the bundle and are less apt to pay for the bundle. This

research has offered the following three suggested guidelines for correctly implementing a

bundling strategy:31

s Don't promote individual products in a package as frequently and cheaply as the bundle.

The bundle price should be much lower than the sum of individual products or the consumer will not perceive its attractiveness.

CHAPTER 12

389

390

PART 5

SHAPING THE MARKET OFFERINGS

• Limit promotions to a single item in the mix if

you still want to promote individual products.

Another option: alternate promotions, one after

another, in order to avoid conflicting promotions.

• If you decide to offer large rebates on individual products, it must be the absolute exception

and done with discretion. Otherwise, the consumer uses the price of individual products as an

external reference for the bundle, which then

loses value.

Co-Branding and Ingredient

Branding

D-BRANDING Products are often combined

with products from other companies in various

ways. A rising phenomenon is the emergence of

co-branding—also called dual branding or brand

bundling—in which two or more well-known

existing brands are combined into a joint product

and/or marketed together in some fashion.32 One

form of co-branding is same-company co-brandCo-branding: Part of a video ad directed at children for two General Mills products, Trix cereal

ing, as when General Mills advertises Trix and

and Yoplait yogurt.

Yoplait yogurt. Still another form is joint-venture

co-branding, as in the case of General Electric and

Hitachi lightbulbs in Japan and the Citibank AAdvantage credit card. There is multiple-sponsor

co-branding, as in the case of Taligent, a technological alliance of Apple, IBM, and Motorola.33

Finally, there is retail co-branding where two retail establishments, such as fast-food restaurants, use the same location as a way to optimize both space and profits:

CINN ABON

When you think of Cinnabon, you think of—or catch a whiff of—only one thing: cinnamon rolls. However, this 18year-old chain needed to add a new dimension in order to spark sales at its franchises, all tucked into shopping

malls. To do that Cinnabon is now co-branding with Freshen, a seller of smoothie drinks. The two concepts work well

because people get thirsty while eating a cinnamon roll and Freshen offers a healthy alternative to soda. The match

has already "freshened" Cinnabon's sales, which have spiked 3 to 4 percent at the co-branded locations.34

The main advantage to co-branding is that a product may be convincingly positioned

by virtue of the multiple brands involved. Co-branding can generate greater sales from

the existing target market as well as open additional opportunities with new consumers

and channels. Co-branding also can reduce the cost of product introduction because

two well-known images are combined, accelerating potential adoption. And co-branding may be a valuable means to learn about consumers and how other companies

approach them. Companies within the automotive industry have reaped all of these

benefits of co-branding.

The potential disadvantages of co-branding are the risks and lack of control from becoming aligned with another brand in the minds of consumers. Consumer expectations about

the level of involvement and commitment with co-brands are likely to be high, so unsatisfactory performance could have negative repercussions for the brands involved. If the other

brand has entered into a number of co-branding arrangements, there may be a risk that

overexposure will dilute the transfer of any association. It may also result in a lack of focus

on existing brands.

A necessaiy condition for co-branding success is that the two brands separately have brand

equity—adequate brand awareness and a sufficiently positive brand image. The most important requirement is that there is a logical fit between the two brands such that the combined

brand or marketing activity maximizes the advantages of the individual brands while minimizing the disadvantages. Research studies show that consumers are more apt to perceive cobrands favorably if the two brands are complementary rather than similar:35

SETTING PRODUCT STRATEGY

i-

GODIVA

AND

SLIM-FAST

Godiva (fine chocolate) rates high on taste and richness, whereas Slim-Fast (weight-loss products) rates favorably on calorie content and value. In an academic research study, a hypothetical cake-mix extension of either

brand alone was judged by sample consumers to be similar to the parent brand. For instance, Godiva cake mix

was judged to be good tasting but high on calories, whereas Slim-Fast cake mix was perceived to be low on both

calories and taste. In contrast, co-brands such as Slim-Fast cake mix by Godiva or Godiva cake mix by Slim-Fast

•

were judged to possess the desirable attributes of both brands.

Besides these strategic considerations, co-branding ventures must be entered into and

executed carefully. There must be the right kind of fit in values, capabilities, and goals, in

addition to an appropriate balance of brand equity. There must be detailed plans to legalize

contracts, make financial arrangements, and coordinate marketing programs. As one executive at Nabisco put it, "Giving away your brand is a lot like giving away your child—you want

to make sure everything is perfect." The financial arrangement between brands may vary,

although one common approach involves a licensing fee and royalty from the brand more

involved in the production process.

Brand alliances involve a number of decisions.36 What capabilities do you not have? What

resource constraints are you faced with (people, time, money, etc.)? What growth goals or

revenue needs do you have? In assessing a joint branding opportunity, a number of questions need to be asked. Is it a profitable business venture? How does it help to maintain or

strengthen brand equity? Is there any possible risk of dilution of brand equity? Does it offer

any extrinsic advantages (e.g., learning opportunities)?

INGREDIENT BRANDING Ingredient branding is a special case of co-branding. It involves

creating brand equity for materials, components, or parts that are necessarily contained

within other branded products. Some successful ingredient brands include Dolby noise reduction, Gore-Tex water-resistant fibers, and Scotchgard fabrics. Some popular ingredientbranded products are Betty Crocker baking mixes with Hershey's chocolate syrup, Lunchables

lunch combinations with Taco Bell tacos, and Lay's potato chips made with KC Masterpiece

barbecue sauce.

An interesting take on ingredient branding is "self-branding" in which companies advertise and even trademark their own branded ingredients. For instance, Westin Hotels advertises its "Heavenly Bed" and "Heavenly Shower." The Heavenly Bed has been so successful

that Westin now sells the bed, pillows, sheets, and blankets via an online catalog, along with

other "Heavenly" gifts and bath items. If you can do it well, it makes much more sense to

self-brand ingredients because you have more control and can develop the ingredient to suit

your purposes.37