Technology and Life Sciences IPO Survey

advertisement

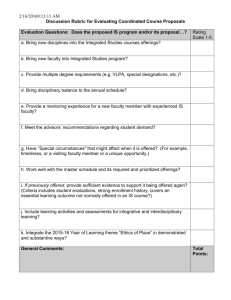

H1 2013 Key Metrics for Recent Technology and Life Sciences Initial Public Offerings H1 2013 Fenwick fenwick & west llp Key Metrics for Recent Technology and Life Sciences Initial Public Offerings H1 2013 Survey Introduction and Background This is a half-yearly update of our full 2011-2012 IPO survey available at fenwick.com/iposurvey. We provide this report to our clients and friends interested in understanding recent IPO activity of technology and life sciences companies. This information comprises a number of tables and charts reflecting selected statistics that we believe provide useful information about activity in these markets. This is followed by the listing of technology and life sciences IPOs priced in the first half of 2013. We hope that you find this useful. Please contact Daniel J. Winnike at dwinnike@fenwick.com or Jeffrey R. Vetter at jvetter@fenwick.com if you care to discuss this information or, as always, contact members of your client service team for more information. Survey Contents Survey Results.......................................................................................................................................................1 Offerings Completed.............................................................................................................................................. 2 Size of Offering 2013, First Half.............................................................................................................................. 3 Size of Offering 2011-2012..................................................................................................................................... 4 Aggregate Amount Raised 2013, First Half............................................................................................................... 5 Aggregate Amount Raised 2011-2012...................................................................................................................... 6 Price Changes Between the Red Herring and Initial Offering Price��������������������������������������������������������������������������� 7 Price Changes Around the Expiration of the Lock Up............................................................................................... 11 List of Offerings: First Half 2013.............................................................................................................................12 Methodology........................................................................................................................................................14 Survey Results The first half of 2013 culminated with Q2 representing the strongest quarter for technology and life sciences IPOs in more than 10 quarters. The life sciences sector was especially active, with 18 offerings in the first half of the year. Life sciences IPOs were at the top end of the scale in terms of size of the offering. Zoetis, a wholly owned subsidiary of Pfizer, raised more than $2.2 billion and Quintiles Transnational raised more than $900 million. Life sciences IPOs were also at the lower end in terms of size, with three offerings each raising less than $50 million. The largest technology offering, Tableau Software, raised $250 million. Technology deals tended to show upward pricing momentum through the process, with 33.3% of the 2013 offerings pricing above, 53.3% within and 13.3% below their red herring range and 86.7% closing above their offering price in first day trading. Of the life sciences offerings, 11.2% priced above, 44.4% within and 44.4% below their red herring range, with several offerings featuring an IPO price that was more than 35% below the red herring midpoint. Life sciences IPOs fared better on their first day of trading with 72.2% closing up. Further reflective of these trends, approximately 63% of technology deals featured an aggregate value in the $50–$100 million range at the red herring stage, but at final pricing half of the deals fell into the $75–$125 million range and only 12% were in the $50–$75 million range. Among life sciences deals in the first half of 2013, 55% were in the $50–$75 million range at the red herring stage, while at final pricing 55% of deals were in the $25–$75 million range. JOBS Act Implications In a post-JOBS Act era, it is interesting to note that among the 33 IPOs considered in this survey, five issuers who were otherwise eligible to avail themselves of the SEC’s confidential submission process, elected not to do so. Another five issuers didn’t qualify under the JOBS Act — four submitted public filings prior to the law’s April 5, 2012 enactment and a fifth issuer, Zoetis, was the lone issuer that did not to qualify as an “emerging growth company” due to revenues in excess of $1 billion. Among the 23 issuers who filed confidentially, four elected to only make one confidential submission prior to their first public filing of the S-1, meaning that they elected not to take full advantage of the new confidential submission process. Also of note was that many of the IPOs from the first half of 2013 had been initially submitted to or filed with the SEC in either late 2012 or early 2013, suggesting that most of the IPOs during the first half of 2013 progressed on a normal track, rather than having a “backlog” of IPOs that had cleared the SEC, waiting for a market window to open. Most of the filings appeared to follow the standard SEC review track, with some registration statements being declared effective in as little as 2.5 months, with others taking 3-5 months to progress through the SEC review process. key metrics for recent technology and life sciences initial public offerings h1 2013 1 Offerings Completed The table below shows the number of technology and life sciences IPOs completed through the first half of 2013. IPOs Completed per Quarter Q1per2011 - Q2 2013half 2013 ipos quarter 2011—first Life Sciences IPOs completed Technology IPOs completed 15 12 9 6 3 0 2011Q1 2011Q2 2011Q3 2011Q4 2012Q1 2012Q2 2012Q3 2012Q4 2013Q1 2013Q2 key metrics for recent technology and life sciences initial public offerings h1 2013 2 Size of Offerings 2013, First Half The following scatter graph tables plot all technology and life sciences IPOs completed in the first half of 2013 in terms of the initial offering price per share and number of shares offered. The first table shows these statistics at the red herring stage for the offerings and the second table is based on actual pricing of the offering. red herring (midpoint price): 2013, 2013, first half Red Herringdeal Dealcomparison Comparison (Midpoint Price): 1st Half $50 $45 $40 Quintiles Transnational Holdings $35 Technology Life Sciences $30 Tableau Software $25 Zoetis CDW $20 EVERTEC $15 $2B $10 $750M $5 $10M $0 1 10 100 1,000 Bubble Size = deal size Number of Shares in Millions (logarithmic scale) ipo deal 2013, first1st halfHalf IPO Dealcomparison: Comparison: 2013, $50 $45 Quintiles Transnational Holdings $40 $35 Technology $30 Life Sciences Tableau Software Zoetis $25 $20 CDW EVERTEC $15 $2.2B $10 $947M $5 $21M $0 1 10 100 1,000 Bubble Size = deal size Number of Shares in Millions (logarithmic scale) key metrics for recent technology and life sciences initial public offerings h1 2013 3 Size of Offerings 2011-2012 The following scatter graph tables plot all technology and life sciences IPOs completed in 2011 and 2012 in terms of the initial offering price per share and number of shares offered. The first table shows these statistics at the red herring stage for the 2011 and 2012 offerings and the second table is based on actual pricing of the offering. Red Deal Comparison (Midpoint red herring comparison (midpointPrice): price): 2011-2012 2011-2012 Red Herring Herring Dealdeal Comparison (Midpoint Price): 2011-2012 $50 $50 $45 $45 $40 $40 $35 $35 Share Share Price Price Technology (63 deals) Technology (63 deals) Life Sciences (27 deals) Life Sciences (27 deals) Facebook Facebook $30 $30 $25 $25 Workday Workday $20 $20 Vantiv Vantiv $15 $15 Freescale Freescale Semiconductor Semiconductor Groupon Groupon $10 $10 $10.6B $10.6B Zynga Zynga $1B $1B $5 $5 $0 $0 1 1 $12M $12M 10 10 100 100 1000 1000 Bubble Size = deal size Bubble Size = deal size Number of Shares in Millions (logarithmic scale) Number of Shares in Millions (logarithmic scale) IPO Comparison: 2011-2012 IPO Deal Deal Comparison: 2011-2012 ipo deal comparison: 2011-2012 $50 $50 $45 $45 $40 $40 Facebook Facebook $35 $35 $30 $30 Share Share Price Price Technology (63 deals) Technology (63 deals) Life Sciences (27 deals) Life Sciences (27 deals) Workday Workday $25 $25 $20 $20 Vantiv Vantiv Groupon Groupon Freescale Semiconductor Freescale Semiconductor $15 $15 $16B $16B Zynga Zynga $10 $10 $5 $5 $0 $0 1 1 $1B $1B 10 10 100 100 Number of Shares in Millions (logarithmic scale) Number of Shares in Millions (logarithmic scale) 1000 1000 Bubble Size = deal size Bubble Size = deal size key metrics for recent technology and life sciences initial public offerings h1 2013 4 Aggregate Amount Raised 2013, First Half The following tables provide information about aggregate deal size at the red herring stage and based on the actual pricing of the offering. The first two tables provide information for tech and life sciences company offerings at the red Distribution of Deal Size (Red Herring Midpoint): 2013, 1st Half herring stage and second two(Red tablesHerring provide information for 2013, tech and1st life sciences Distribution ofthe Deal Size Midpoint): Half offerings based on the actual Distribution of Deal Size (Red Herring Midpoint): 2013, 1st Half pricing. 33.3% 33.3% Distribution of Deal Size (Red Herring Midpoint): 2013, 1st Half 33.3% 33.3% 33.3% distribution of 33.3% deal size (red herring midpoint): 2013, first half 33.3% 33.3% 13.3% 13.3% 6.7% 6.7% 13.3% 6.7% 6.7% 6.7% 6.7% % of deals $0 $25M $50M 6.7% 13.3% $75M $100M $125M $150M $175M $200M 6.7% $400M $425M 6.7% $575M $600M % of deals deal size $0 $25M $50M $75M $100M $125M6.7% $150M $175M $200M $400M6.7% $425M $575M $600M 6.7% deal % ofsize deals $200M $400M $425M $575M $600M deal % of size deals $200M $400M $425M $575M $600M deal size Technology Deal Size Distribution $25M $50M $75M $100M $125M $150M $175M Technology Deal Size Distribution $0 $25M $50M $75M $100M $125M $150M $175M Technology Deal Size Distribution 55.6% Technology Deal Size Distribution 55.6% $0 55.6% 55.6% 22.2% 22.2% 22.2% 22.2% $25M $50M $25M $50M 11.1% 11.1% 5.6% 5.6% 11.1% 5.6% 5.6% % of deals $725M 5.6%$750M $2B5.6% % of deals deal size $725M $2B deal % ofsize deals $75M $100M $125M 11.1% $75M $100M $125M $750M 5.6% Life Sciences Deal Size Distribution $50M $75M $100M $125M $725M $750M Life $25M Sciences Deal Size Distribution $50M $75M $100M $125M $725M $750M Life $25M Sciences Deal Size Distribution Life Sciences Deal Size Distribution 5.6% $2B deal % of size deals $2B deal size distribution of 46.7% deal size (final ipo price): 2013, first half 46.7% 46.7% 46.7% 20.0% 20.0% 20.0% 20.0% 6.7% 6.7% 6.7% 6.7% 6.7% 6.7% 6.7% 6.7% 6.7% 6.7% % of deals $0 $25M $50M $75M $100M $125M6.7% $150M $175M6.7% $200M $225M $250M6.7% $275M 6.7% $375M $400M 6.7% $500M $525M % of deals deal size $0 $25M $50M $75M $100M $125M6.7% $150M $175M6.7% $200M $225M $250M6.7% $275M $375M6.7% $400M $500M $525M 6.7% deal % ofsize deals $200M $225M $250M $275M $375M $400M $500M $525M deal % of size deals $200M $225M $250M $275M $375M $400M $500M $525M deal size Technology Deal Size Distribution $25M $50M $75M $100M $125M $150M $175M Technology Deal Size Distribution $0 $25M $50M $75M $100M $125M $150M $175M Technology Deal Size Distribution 38.9% 38.9% Technology Deal Size Distribution $0 38.9% 38.9% 16.7% 16.7% 16.7% 11.1% 16.7% 16.7% 11.1% 16.7% 11.1% $25M $50M $25M $50M 16.7% 16.7% 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% % of deals 5.6% % of deals deal size 5.6% deal % ofsize deals $75M $100M $125M5.6% $150M 11.1% $75M $100M $125M $150M 5.6% $925M 5.6%$950M $2.2B $925M $950M 5.6% $2.2B Life$25M Sciences Deal Size Distribution deal $50M $75M $100M $125M $150M $925M $950M $2.2B % of size deals Life Sciences Deal Size Distribution deal size $25M $50M $75M $100M $125M $150M $925M $950M $2.2B Life Sciences Deal Size Distribution Life Sciences Deal Size Distribution key metrics for recent technology and life sciences initial public offerings h1 2013 5 Aggregate Amount Raised 2011-2012 The following tables provide information about aggregate deal size at the red herring stage and based on the actual pricing of the offering. The first two(Red tables provide information for2011-2012 tech and life sciences company offerings at the red Distribution of Deal Size Herring Midpoint): herring stage andof theDeal second two(Red tablesHerring provide information for tech and life sciences offerings based on the actual Distribution Size Midpoint): 2011-2012 pricing. Distribution of Deal Size (Red Herring Midpoint): 2011-2012 27.0% Distribution of Deal Size (Red Herring Midpoint): 2011-2012 20.6% 27.0% distribution of deal size (red herring midpoint): 2011-2012 14.3% 20.6% 27.0% 20.6% 27.0% 14.3% 7.9% 6.3% 3.2% 4.8% 4.8% 1.6% 1.6% 1.6% % of deals 4.8% 4.8% 3.2% deal size $01.6%$25M $125M $150M $175M $200M $225M $250M $275M $300M $500M $750M 1.6% $1B 1.6% $1.25B >$10B 1.6% 1.6% 1.6% 1.6%$50M $75M $100M % of deals 14.3% 7.9% 6.3% deal size 4.8% 4.8% $0 $25M $50M $75M $100M $125M 7.9% $150M $175M 3.2% $200M $225M $250M $275M $300M $500M $750M $1B $1.25B >$10B 6.3% 1.6% 1.6% 1.6% 1.6% 1.6% 1.6% 1.6% % of deals 4.8% 4.8% 3.2% 1.6% 1.6% 1.6% 1.6% 1.6% 1.6% 1.6% % of size deals deal $25M $50M $75M $100M $125M $150M $175M $200M $225M $250M $275M $300M $500M $750M $1B $1.25B >$10B $0 1.6% 1.6% 20.6% 14.3% 7.9% 1.6% 6.3% 1.6% Technology Deal Size Distribution Technology Deal Size Distribution $0 $25M $50M $75M $100M $125M $150M $175M $200M $225M $250M $275M $300M 55.6% Technology Deal Size Distribution 55.6% Technology Deal Size Distribution $500M $750M $1B $1.25B deal size >$10B 55.6% 55.6% 18.5% 18.5% 7.4% 3.7% 18.5% 7.4% 3.7% $0 $25M $50M 3.7% 3.7% 3.7% 3.7% % of deals 3.7% 3.7% 3.7% 18.5% 3.7% size $75M $100M $125M $150M $175M $200M %deal of deals $100M $125M $150M $175M $200M Life Sciences$75M Deal Size Distribution 3.7% 3.7% 3.7% 3.7% Life Sciences Deal Size 3.7% 3.7%Distribution 3.7% 3.7% 3.7% 7.4% $0 $25M $50M 3.7% 7.4% deal size % of deals $0 $25M $50M % of deals $75M $100M $125M $150M $175M $200M deal size $0 $25M $50M $75M $100M $125M $150M $175M $200M deal size Life Sciences Deal Size Distribution Life Sciences Deal Size Distribution Distribution of Deal Size (Final IPO Price): 2011-2012 Distribution of Deal Size (Final IPO Price): 2011-2012 distribution of deal size (final ipo price): 2011-2012 25.4% Distribution 25.4% of Deal Size (Final IPO Price): 2011-2012 15.9% 14.3% Distribution of Deal Size (Final IPO Price): 2011-2012 6.3% 1.6% 14.3% 15.9% 25.4% 6.3% 25.4% 6.3% 6.3% 6.3% 6.3% 1.6% 3.2% 4.8% 4.8% 1.6% 1.6% 1.6% 3.2% 1.6% 0% 4.8% 4.8% 15.9% 3.2% $0 1.6%$25M $50M $200M $225M $250M $275M $300M $325M $350M $750M 3.2% $1B 14.3%$75M $100M $125M $150M $175M 1.6% 1.6% 1.6% 1.6%$375M $500M 0% 15.9% 14.3% $25M $50M $75M $100M $125M $150M $175M $200M $225M $250M $275M $300M $325M $350M $375M $500M $750M $1B $0 6.3% 6.3% 6.3% 4.8% 4.8% 3.2% 3.2% 6.3% 6.3% 6.3% 1.6% 1.6% 1.6% 1.6% 1.6% 4.8% 4.8% 0% 3.2% 3.2% 1.6% 1.6% 1.6% 1.6% 1.6% $25M $50M $75M $100M $125M $150M $175M $200M $225M $250M $275M $300M $325M $350M $375M 0% $0 $500M $750M $1B 33.3% $0 $750M $1B $25M $50M $75M $100M $125M $150M $175M $200M $225M $250M $275M $300M $325M $350M $375M $500M 29.6% 33.3% 25.9% Technology Deal Size Distribution Technology Deal Size Distribution Technology Deal Size Distribution 29.6% Technology Deal Size Distribution $16B 1.6% $16B $16B % of deals deal size % of deals deal size 1.6% % of deals 1.6% % of size deals deal $16B deal size 25.9% 33.3% 33.3% 3.7% 29.6% 29.6% 25.9% 3.7% 3.7% 25.9% 3.7% $25M $0 $50M % of deals 3.7% 3.7% size $75M $100M $125M $150M %deal of deals $50M $75M $100M $125M $150M deal size Life$25M Sciences Deal Size Distribution 3.7% 3.7% 3.7% Life Sciences Deal Size Distribution % of deals 3.7% 3.7% 3.7% $0 $0 $25M $50M $75M $100M $125M $150M % of size deals deal $0 $25M $50M $75M $100M $125M $150M deal size key metrics for recent technology and life sciences initial public offerings Life Sciences Deal Size Distribution Life Sciences Deal Size Distribution h1 2013 6 Price Changes Between the Red Herring and Initial Offering Price Estimating the offering price for the IPO in the red herring prospectus and pricing the IPO upon completion of marketing efforts are processes that are equal parts science and art. The tables below show the median and average prices for tech and life sciences IPOs from the red herring stage to the actual public offering price to the close price on the first day of trading. median prices for life sciences & technology ipo deals 2013, first half $19.98 $20 2013 H1 2011–2012 $18 $16 Technology $15.50 $14.00 $14.00 $14.00 $13.00 $16.26 $14.35 $14.00 $12 Life Sciences $10 $10.00 $10.11 Final Price 1st Day Close $8 Red Herring average prices for life sciences & technology ipo deals 2013, first half compared to 2011–2012 $21.21 $20 2013 H1 2011–2012 $19.56 $18 $16 Technology $16.23 $15.86 $15.37 $14.39 $15.33 $12.96 $13.75 $14 $12 $15.88 $11.21 Life Sciences $9.93 $10 $8 Red Herring Final Price 1st Day Close key metrics for recent technology and life sciences initial public offerings h1 2013 7 Price Changes (continued) The first two tables show the percentage of technology and life sciences deals with a final IPO price that falls above, within and below the red herring range in H1 2013 compared with the 2011-2012 time period. The lower table shows the percentage of technology and life sciences deals that closed up or closed down on their first day of trading in H1 2013. relation of final ipo price to original red herring range (% of deals) 2013, first half relation of final ipo price to original red herring range (% of deals) 2011–2012 Technology Technology 33.3% 47.6% Life Sciences Life Sciences Deals Above Range 11.2% 53.3% 44.4% Deals Above Range Within Range Within Range Below Range Below Range 44.4% 7.4% 29.6% 28.6% 63.0% 23.8% 13.3% relation of price at 1st day close to final ipo price (% of deals) 2013, first half Technology Life Sciences 86.7% 72.2% Closed Up Closed Flat 11.1% 13.3% 16.7% Closed Down key metrics for recent technology and life sciences initial public offerings h1 2013 8 Price Changes (continued) The tables below show the five technology and life sciences company offerings with the largest percentage gain and loss on the first day of trading. 34.2% Textura Corporation 59.3% Gigamon, Inc. 63.7% Xoom Corporation 77.7% Tableau Software, Inc. Marketo, Inc. Enanta Pharmaceuticals, Inc. 37.7% Chimerix, Inc. 53.3% Aratana Therapeutics, Inc. 58.3% Epizyme, Inc. bluebird bio, Inc. biggest movers - ipo price to price at 1st day close 2013, first half 49.8% 39.4% 22.7% 8.1% CDW Corporation 2.2% EVERTEC, Inc. -5.9% 1.0% Cyan, Inc. KaloBios Pharmaceuticals, Inc. -10.0% Gogo, Inc. 0% Technology Price Change from IPO to 1st Day Close Tremor Video, Inc. 0% Tetraphase Pharmaceuticals, Inc. -7.1% Omthera Pharmaceuticals, Inc. NanoString Technologies, Inc. -19.4% -7.6% Ambit Biosciences Corporation Life Sciences Price Change from IPO to 1st Day Close key metrics for recent technology and life sciences initial public offerings h1 2013 9 Price Changes (continued) The tables below show the five technology and life sciences company offerings with the largest percentage increase, and largest percentage decrease, from the red herring midpoint to actual initial public offering price. Model N, Inc. Xoom Corporation Rally Software Development Corporation 14.8% 14.3% 0% 0% Gigamon, Inc. Silver Spring Networks, Inc. -16.7% 0% Cyan, Inc. CDW Corporation -38.5% Omthera Pharmaceuticals, Inc. KaloBios Pharmaceuticals, Inc. Ambit Biosciences Corporation -50.0% Aratana Therapeutics, Inc. Insys Therapeutics, Inc. -52.9% 16.7% Technology Price Change from Red Herring Midpoint to IPO -20.9% -38.5% 16.7% 3.5% Life Sciences Price Change from Red Herring Midpoint to IPO -42.9% Marin Software Incorporated Tableau Software, Inc. 26.5% Tremor Video, Inc. 5.3% PTC Therapeutics, Inc. 7.1% Quintiles Transnational Holdings, Inc. 10.6% Epizyme, Inc. 13.3% Zoetis, Inc. bluebird bio, Inc. biggest movers - red herring price to final ipo price 2013, first half key metrics for recent technology and life sciences initial public offerings h1 2013 10 Price Changes Around the Expiration of the Lock-Up In order to assist the development of an orderly market for the shares being offered, IPO underwriters require the stockholders of the offering company to agree not to sell shares of the company’s common stock for a specified period without the underwriters’ consent. Customarily this period is 180 days and applies equally to all holders delivering the “lock-up” agreement, although in a few instances the lock up may roll off in stages and different holders may be subject to different restrictive periods. Upon expiration of the lock-up period, there generally is an influx of “supply,” as pre-IPO stockholders have their first ability to sell shares into the public market. The table below shows the average and median changes in the closing trading price of the subject company shares for the period beginning two weeks prior, and ending two weeks following, the scheduled expiration of the lock-up period for lockups expiring in the first half of 2013. percent change of share prices surrounding end of lock-up period 2013, first half 20% End of Lock-Up 12.9% Life Sciences Avg 10% 3.4% Life Sciences Median -0% -1.7% Technology Median -5.3% Technology Avg -10% -20% 2 wk prior Lock-up 2 wk post key metrics for recent technology and life sciences initial public offerings h1 2013 11 List of Offerings: First Half 20131 The following table presents the technology and life sciences offerings priced in the first half of 2013. company name ticker symbol primary industry priced final shares2 final pricing final deal size KaloBios Pharmaceuticals, Inc. NasdaqGM:KBIO Life Science 1/2013 8,750,000 $8.00 $70,000,000 LipoScience, Inc. NasdaqGM:LPDX Life Science 1/2013 5,000,000 $9.00 $45,000,000 Xoom Corporation NasdaqGS:XOOM Technology 2/2013 6,325,000 $16.00 $101,200,000 Zoetis Inc. NYSE:ZTS Life Science 2/2013 86,100,000 $26.00 $2,238,600,000 Enanta Pharmaceuticals, Inc. NASDAQ:ENTA Life Science 3/2013 4,000,000 $14.00 $56,000,000 Marin Software Incorporated NYSE:MRIN Technology 3/2013 7,500,000 $14.00 $105,000,000 Model N, Inc. NYSE:MODN Technology 3/2013 6,740,000 $15.50 $104,470,000 Silver Spring Networks Inc. NYSE:SSNI Technology 3/2013 4,750,000 $17.00 $80,750,000 Tetraphase Pharmaceuticals, Inc. NasdaqGM:TTPH Life Science 3/2013 10,714,286 $7.00 $75,000,002 Chimerix, Inc. NasdaqGM:CMRX Life Science 4/2013 7,320,000 $14.00 $102,480,000 EVERTEC, Inc. NYSE:EVTC Technology 4/2013 25,263,159 $20.00 $505,263,180 Omthera Pharmaceuticals, Inc.3 NasdaqGM:OMTH Life Science 4/2013 8,000,000 $8.00 $64,000,000 Rally Software Development Corp. NYSE:RALY Technology 4/2013 6,000,000 $14.00 $84,000,000 Ambit Biosciences Corporation NasdaqGM:AMBI Life Science 5/2013 8,125,000 $8.00 $65,000,000 ChannelAdvisor Corporation NYSE:ECOM Technology 5/2013 5,750,000 $14.00 $80,500,000 Cyan, Inc. NYSE:CYNI Technology 5/2013 8,000,000 $11.00 $88,000,000 Epizyme, Inc. NasdaqGM:EPZM Life Science 5/2013 5,142,000 $15.00 $77,130,000 Insys Therapeutics, Inc. NasdaqGM:INSY Life Science 5/2013 4,000,000 $8.00 $32,000,000 Marketo, Inc. NasdaqGS:MKTO Technology 5/2013 6,059,509 $13.00 $78,773,617 Portola Pharmaceuticals, Inc. NasdaqGM:PTLA Life Science 5/2013 8,422,758 $14.50 $122,129,991 1 The survey does not include offerings on the OTC Bulletin Board, Nasdaq Capital Market, or those with proceeds of less than $10 million. 2 Final share numbers do not reflect any exercise of the over-allotment option. 3 Agreed to be acquired on May 27, 2013. key metrics for recent technology and life sciences initial public offerings h1 2013 12 company name ticker symbol primary industry priced final shares2 final pricing final deal size Receptos, Inc. NasdaqGM:RCPT Life Science 5/2013 5,200,000 $14.00 $72,800,000 Quintiles Transnational Holdings Inc. NYSE:Q Life Science 5/2013 23,684,210 $40.00 $947,368,400 Tableau Software, Inc. NYSE:DATA Technology 5/2013 8,200,000 $31.00 $254,200,000 Aratana Therapeutics, Inc. NasdaqGM:PETX Life Science 6/2013 5,750,000 $6.00 $34,500,000 bluebird bio, Inc. NasdaqGS:BLUE Life Science 6/2013 5,941,176 $17.00 $100,999,992 CDW Corporation NasdaqGS:CDW Technology 6/2013 23,250,000 $17.00 $395,250,000 Esperion Therapeutics, Inc NasdaqGM:ESPR Life Science 6/2013 5,000,000 $14.00 $70,000,000 Gigamon Inc. NYSE:GIMO Technology 6/2013 6,750,000 $19.00 $128,250,000 Gogo Inc. NasdaqGS:GOGO Technology 6/2013 11,000,000 $17.00 $187,000,000 NanoString Technologies, Inc. NasdaqGM:NSTG Life Science 6/2013 5,400,000 $10.00 $54,000,000 PTC Therapeutics Inc. NasdaqGS:PTCT Life Science 6/2013 8,372,000 $15.00 $125,580,000 Textura Corporation NYSE:TXTR Technology 6/2013 5,000,000 $15.00 $75,000,000 Tremor Video, inc. NYSE:TRMR Technology 6/2013 7,500,000 $10.00 $75,000,000 key metrics for recent technology and life sciences initial public offerings h1 2013 13 Methodology Data points used in the compilation and analysis of this information were gathered using a variety of resources, including, but not limited to, filings made with the U.S. Securities and Exchange Commission, lock-up expiration dates from EDGAR Online IPO Deal Data, and daily stock trading price data. The exact dates upon which lock-ups expired were estimated based on disclosure in the prospectuses and may further be approximate in the case of dates falling on holidays or weekends. Companies were assigned to the Technology and Life Sciences sectors based on SIC codes and other company descriptors. The information in the tables and charts regarding offering size does not reflect any exercise of the underwriters’ over-allotment, or green shoe, option. Information at the red herring stage is based on midpoint of the range, and on the number of shares offered, as reflected on the cover page of the first preliminary, or red herring, prospectus. The information regarding the actual offering size is based on the price to the public and the aggregate number of shares offered as reflected on the cover page of the final prospectus. The closing price on the first day of trading is the closing price on the company’s primary exchange on the first day of public trading of the shares following the pricing of the offering. Disclaimer The preparation of the information contained herein involves assumptions, compilations and analysis, and there can be no assurance that the information provided herein is error-free. Neither Fenwick & West LLP nor any of its partners, associates, staff or agents shall have any liability for any information contained herein, including any errors or incompleteness. The contents of this report are not intended, and should not be considered, as legal advice or opinion. Sign-Up Information To be placed on an email list for future editions of this survey, please visit fenwick.com/iposurvey and go to the signup link at the bottom of the page. © 2013 Fenwick & West LLP key metrics for recent technology and life sciences initial public offerings h1 2013 14 Fenwick fenwick & west llp