course title - Rady School of Management

advertisement

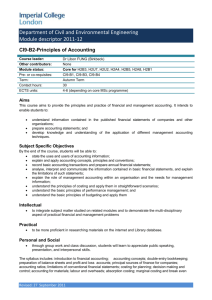

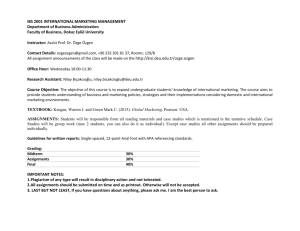

Undergrad, Fall 2014 is tri bu ti o n MGT 5: Managerial Accounting PROFESSOR: Robert Houskeeper, CPA EMAIL: rvhous@gmail.com PHONE: (760) 271-1516 OFFICE HOURS: Tuesdays and Thursdays 11:30 AM to 12:15 PM OFFICE LOCATION: Rady 2E122 OBJECTIVES or D The goals of this course are to provide the students with an understanding of (1) cost concepts and accumulation systems, (2) cost volume profit analysis, (3) planning & control concepts, and (4) the use of accounting information in decision-making. MATERIALS Required Weygandt, Kimmel and Kieso (2012). Managerial Accounting (6thed) GRADING Points [or percentage] 32% 32% 36% 100 ht © Assignments Quizzes Exam I Exam II Total N ot f ASSIGNMENTS Reading assignments follow the course outline (by chapter). TED problems should be reviewed prior to class. yr ig POINTS DISTRIBUTION C op A AB+ B BC+ 95 - 100 Points 90 - 94 87 - 89 84 - 86 80 - 83 77 - 79 C CD+ D DF 74 - 76 70 - 73 67 - 69 64 - 66 60 - 63 0 - 59 ATTENDANCE The course material necessitates each student’s proactive involvement. In addition to reading the text, problem solving in the classroom is essential to comprehension of the subject matter. Class Topic & Activities Chapter 1: Introduction, managerial vs. financial accounting, manufacturing cost terms & concepts Oct 7 Oct 9 Oct 14 Chapter 1: Cost of goods manufactured Chapter 2: Job order costing Chapter 2: Job order costing continued Oct 16 Oct 21 Oct 23 Oct 28 Oct 30 Nov 4 Chapter 3: Process costing Chapter 3: Process costing continued Chapter 4: Activity based costing Chapter 4: Activity based costing continued Chapter 5: Fixed and variable cost projections Chapter 5: Cost volume profit analysis (single product) Exam 1 Nov 6 (Ex 1-11, Ex 1-12, Ex 1-14, Ex 1-16) (Ex 2-5, Ex 2-10, Ex 2-12, P 2-4A) (Ex 3-8, Ex 3-9, Ex 3-13, P 3-4A) (Ex 4-1, Ex 4-3, Ex 4-4, P 4-2A) (Ex 5-3, Ex 5-5) (Ex 5-11, Ex 5-14, P 5-5A) Dec 2 Chapter 11: Standard costing (Ex 11-5, Ex 11-6 Ex 11-7, P 11-3A) Dec 4 Chapter 11: Standard costing continued Dec 9 Chapter 12: Capital investments Dec 11 Dec 18 (8 AM) Chapter 12: Capital investments continued FINAL EXAM (Ex 8-11, Ex 8-12) (Ex 9-14, P 9-4A) (Ex 10-10, P 10-3A) © N ot f (Ex 6-3, Ex 6-5, Ex 6-6, P 6-1B) Nov 18 Nov 20 Nov 25 Chapter 6: Cost volume profit analysis (multiple products) Chapter 8: Transfer pricing Chapter 9: Cash budgets Chapter 10: Flexible budgets (Ex 12-3, Ex 12-4, Ex 12-8, P 12-4A, P 12-5A) yr ig ht Nov 13 Assignments or D Date Oct 2 is tri bu ti o n SCHEDULE LEARNING OUTCOMES C op Chapter 1: Chapter 2: Explain the differences between managerial and financial accounting. Define the objectives of managerial accounting in a business environment. Define the three classes of manufacturing costs. Differentiate between product vs. period cost and direct vs. indirect cost. Prepare a schedule of cost of goods manufactured and cost of goods sold. Construct cost accumulation systems under job order costing. Compute the predetermined overhead rate, overhead applied and overapplied vs. underapplied overhead. Allocate variances to WIP, FG and COGS. Calculate Process Costing equivalent units and cost per equivalent unit. Allocate costs between ending inventory and COGS using the weighted average method. Chapter 4: Explain why traditional volume based costing systems tend to distort product costs. Compute overhead application using multiple drivers vs. single volume based drivers. Chapter 5: Differentiate between fixed and variable costs. Explain the difference between step-variable and step-fixed costs. Project estimated costs using the High/Low Method. Chapter 6: Compute sales units and sales revenue at break-even point. Calculate sales units and sales revenue required to achieve targeted after-tax profits for single and multiple product operations. Chapter 8: Calculate the optimal transfer price among related parties. Chapter 9: Prepare a cash budget for a merchandising entity Chapter 10: Prepare a flexible budget. Calculate the sales volume and sales price variances. Chapter 11: Calculate labor and material cost under a standard costing system. Calculate direct labor and direct material price and efficiency variances. Chapter 12: Determine after-tax cash flows over multiple accounting periods associated with capital investments. Calculate IRR and NPV for capital expenditure decisions. ot f or D is tri bu ti o n Chapter 3: N Please note that the learning outcomes are not intended to be all inclusive. Topics may be added or deleted at the discretion of the instructor. © ACADEMIC INTEGRITY yr ig ht Integrity of scholarship is essential for an academic community. As members of the Rady School, we pledge ourselves to uphold the highest ethical standards. The University expects that both faculty and students will honor this principle and in so doing protect the validity of University intellectual work. For students, this means that all academic work will be done by the individual to whom it is assigned, without unauthorized aid of any kind. The complete UCSD Policy on Integrity of Scholarship can be viewed at: http://senate.ucsd.edu/manual/Appendices/Appendix2.pdf C op How the Honor Code applies to this course: The University trusts each student to maintain high standards of honesty and ethical behavior. All assignments submitted in fulfillment of course requirements must be the student’s own work. STUDENTS WITH DISABILITIES A student who has a disability or special need and requires an accommodation in order to have equal access to the classroom must register with the Office for Students with Disabilities (OSD). The OSD will determine what accommodations may be made and provide the necessary documentation to present to the faculty member. is tri bu ti o n The student must present the OSD letter of certification and OSD accommodation recommendation to the appropriate faculty member in order to initiate the request for accommodation in classes, examinations, or other academic program activities. No accommodations can be implemented retroactively. C op yr ig ht © N ot f or D Please visit the OSD website for further information or contact the Office for Students with Disabilities at (858) 534-4382 or osd@ucsd.edu.