Evaluating Your Communication Tools

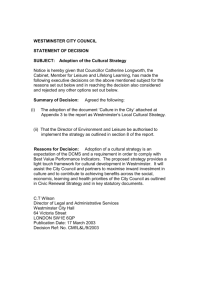

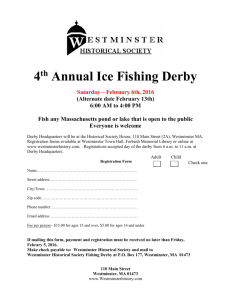

advertisement