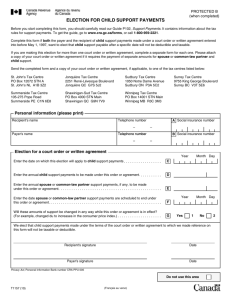

General Income Tax and Benefit Package for 2012 – 5000g

advertisement