Spring 2013 - RKM Advisors, Inc.

advertisement

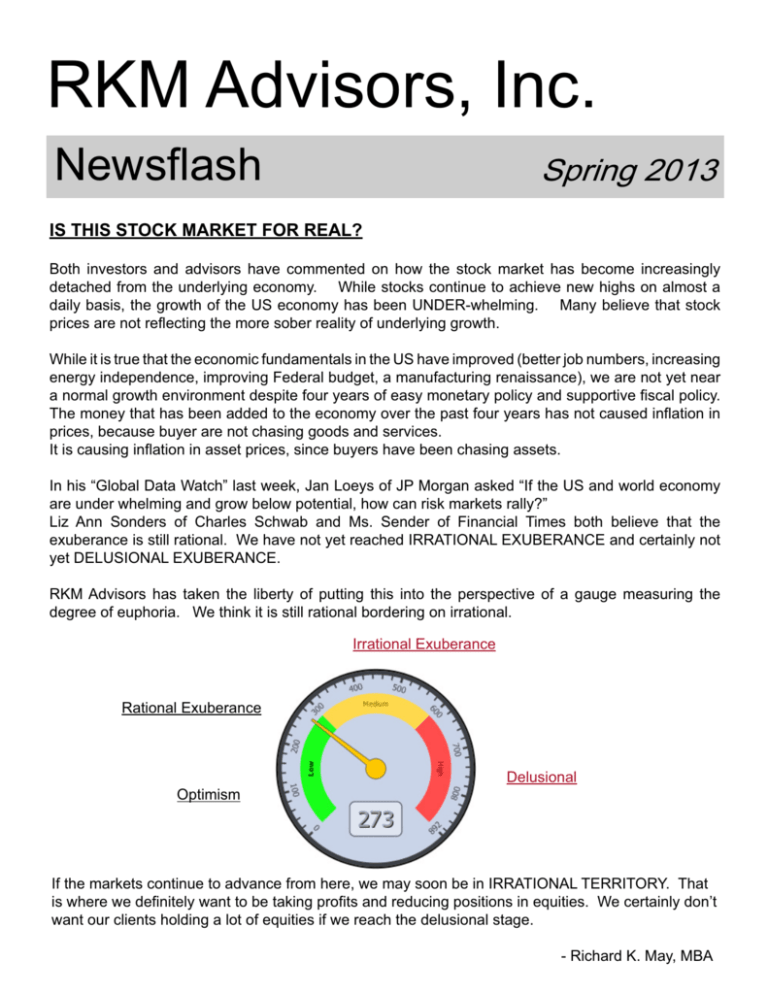

RKM Advisors, Inc. Newsflash Spring 2013 IS THIS STOCK MARKET FOR REAL? Both investors and advisors have commented on how the stock market has become increasingly detached from the underlying economy. While stocks continue to achieve new highs on almost a daily basis, the growth of the US economy has been UNDER-whelming. Many believe that stock prices are not reflecting the more sober reality of underlying growth. While it is true that the economic fundamentals in the US have improved (better job numbers, increasing energy independence, improving Federal budget, a manufacturing renaissance), we are not yet near a normal growth environment despite four years of easy monetary policy and supportive fiscal policy. The money that has been added to the economy over the past four years has not caused inflation in prices, because buyer are not chasing goods and services. It is causing inflation in asset prices, since buyers have been chasing assets. In his “Global Data Watch” last week, Jan Loeys of JP Morgan asked “If the US and world economy are under whelming and grow below potential, how can risk markets rally?” Liz Ann Sonders of Charles Schwab and Ms. Sender of Financial Times both believe that the exuberance is still rational. We have not yet reached IRRATIONAL EXUBERANCE and certainly not yet DELUSIONAL EXUBERANCE. RKM Advisors has taken the liberty of putting this into the perspective of a gauge measuring the degree of euphoria. We think it is still rational bordering on irrational. Irrational Exuberance Rational Exuberance Delusional Optimism If the markets continue to advance from here, we may soon be in IRRATIONAL TERRITORY. That is where we definitely want to be taking profits and reducing positions in equities. We certainly don’t want our clients holding a lot of equities if we reach the delusional stage. - Richard K. May, MBA RKM Advisors, Inc. 121 North Walnut Street, Suite 320 West Chester, PA 19380 Phone (610) 696-3689 Fax (610) 696-6161 www.rkmadvisors.com THE REAL MCCOY? As the stock market continues to set record new highs on a daily basis, we are starting to field more phone calls with the BIG question…IS THIS RALLY FOR REAL? The short answer seems to be yes, it is for real. This doesn’t mean the stock market will continue to head due north unabated. We do expect some normal, healthy consolidation along the way, likely a 5% to 7% pullback, but enough of the economic stars are aligning so we think this stock market rally has legs. The following chart is very encouraging. Stocks are indeed at all-time highs, but valuations are still fairly attractive. This gives us confidence in our forecast of even higher stock prices at year end. Market is still not “expensive” despite new highs. With the streak of positive returns now into its fifth year, the stock market is starting to entice small investors, even those with a massive portfolio hangover who swore they would never invest again after the 2008/9 market debacle. This new ardor for stocks has been display since January, and retail investors have pumped $66 billion of new money into equity mutual funds. Interestingly, they’ve boosted bond holdings as well, all at the expense of money market funds which have experienced outflows so far this year of over $100 billion. 121 North Walnut Street, Suite 320 West Chester, PA 19380 Phone (610) 696-3689 Fax (610) 696-6161 www.rkmadvisors.com RKM Advisors, Inc. THE REAL MCCOY?, CONTINUED In a recent commentary, David Darst, chief investment strategist with Morgan Stanley, wrote about the six boxes on his “bear market checklist”, and none of them are filled in yet. So when he looks at the current bull market, he certainly sees danger that conditions could change, particularly in the case of policy mistakes. But the current trajectory is higher. His checklist: 1. Is the Federal Reserve tightening monetary policy? 2. Are stock price valuations stretched? 3. Is investor euphoria present? 4. Are bond spreads widening? 5. Is there a recession looming? 6. Are transportation stocks, small caps and bank stocks retreating? “Right now we are 0-for-6 in the bear market checklist,” Darst said. In spite of the seemingly easy path to gains for the stock market, which is up more than 20 percent from its low in November, there is still plenty of fear in the market. Despite this nervousness, this year has seen the first consistent inflows to stock mutual funds since the financial crisis began, but investors are still cautious and pouring just as much cash into bond funds. “Nobody is buying stocks, and they will someday,” Darst said. “There will be a coil-spring reaction.” While stocks extend their run, bonds are poised to unwind their own secular bull market that began back when Barack Obama was a college kid. Bonds have rallied since September, 1981, the last leg of the rally being supported by the easy money policy from the Fed, which has kept interest rates artificially low to help the economy repair from the recent housing bubble. Now that the economy is on steadier footing, how does the Fed take away the punch bowl? Debate has been raging on this topic among the Fed Governors for months, with a few of the more hawkish Fed members publicly calling for the Fed to start throttling back on its easy money policy. Deutsche Bank recently weighed in on this issue, with their economist writing “we expect the Fed to downshift and eventually end its asset purchases during the second half of 2013. We expect a sharp backup in Treasury yields as these events unfold.” - Gary S. Hess, CFA RKM Advisors, Inc. 121 North Walnut Street, Suite 320 West Chester, PA 19380 Phone (610) 696-3689 Fax (610) 696-6161 www.rkmadvisors.com TAX BREAKS FOR INVESTORS MAY END BY 2015 - Kiplinger According to the Kiplinger Tax Letter and other reasonably reliable sources, there will be tax reform in 2014. If as expected, the new tax rules are prospective, they will not take effect until 2015. The good news is that 2015 is still more than eighteen months from now. The bad news is that it is ONLY eighteen months from now. This tax reform, according to Kiplinger, is likely to significantly reduce if not eliminate any preferential tax rates for qualified dividends and capital gains. Currently, long term capital gains and qualified dividends are taxed at a maximum rate of 15% for most investors with a 20% maximum. This could change to a 28% top rate, for which there is some history, but if gains and dividend income is instead taxed at ordinary tax rates, the top rate changes to 39.6% (maybe even higher). Most would pay 25% to 28%. If this were to happen, taxes on gains and dividends would increase by 66% to 86% for most investors. This tax cost for investors would be substantial. But consider also the possibility of the investment cost. The relative advantages and disadvantages of components in your portfolio may need reevaluating. Dividend paying stocks would lose their tax-favored status if dividends are taxed at ordinary income rates. (Kiplinger Web Site) There will also be less tax advantage in holding growth stocks. If by then interest rates have returned to more normal levels, CD’s and bond returns would be competitive with stocks. This could in turn reduce the long term demand for equities, muting the returns from equity investments over the long term. IMPLICATIONS If this happens, you should consider harvesting some long term gains before 2015. You should also consider shifting where you hold your stock and where you hold your fixed income investments. And you might consider the implication of lower investment returns over time. WE ARE ALWAYS PLEASED TO ACCEPT NEW CLIENTS. Investment and tax professionals rely primarily on referrals from existing clients to grow their businesses. At RKM, we have signed over 30 new advisory relationships since the start of the year. We consider a referral a high form of compliment, a validation of our mission, which has always been to provide the best tax and investment advisory services we can at a reasonable cost. This level of endorsement means that we have earned your respect, and it pleases us that you are comfortable giving the name of RKM Advisors to your friends and family. We have been in growth mode this year and are encouraged by our progress so far and are poised to accept your continued referrals. Thank you for your long standing support! FOR YOUR INFORMATION Pursuant to SEC Rule 204-3(c) of the Investment Advisors Act, we offer our clients a copy of our ADV Brochure. Any clients who wish to receive a copy of this filing by mail should call our office to request one. ******************************************************************************************************************* Past performance success is no guarantee of future success. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. Any statistics contained herein have been obtained from sources believed to be reliable, but the accuracy of this information cannot be guaranteed. The SEC requires that we advise our clients that trades placed through “clientselected” brokerage firms, as opposed to the RKM Advisers, Inc. selected firm of Charles Schwab & Co., may incur higher transaction fees or less favorable net prices.